Rio Alto Mining Limited: Positive Gold Sampling Comparison La Arena Gold Oxide Project

August 18 2009 - 9:30AM

Marketwired Canada

Rio Alto Mining Limited ("Rio Alto") (TSX VENTURE:RIO)(WKN:A0MSLE) is pleased to

announce positive results of a channel and bulk sampling program completed on a

representative selection of the current shallow oxide resource in the La Arena

Gold Oxide Project. The gold grades of the channel and bulk samples are

generally significantly higher than the gold grades of the original HQ diamond

drill (DDH) assays.

Gold in the oxide resource at La Arena is preferentially situated within

numerous fractures within the sandstone, quartzite and brecciated material that

hosts the oxide resource. During diamond drilling and core cutting, water is

utilised to cool and lubricate the diamond bits and this water can wash the fine

friable material out of the fractures in the rock. Since gold mineralization is

located within these fractures the resulting core used for analysis can

underestimate total gold content.

La Arena S.A. completed a channel and bulk sampling program over a 3 month

period in 2009. 10 pits were excavated to a maximum depth of 10 metres. The pits

were located to provide a representative distribution of the oxide resource and

were excavated on the existing HQ diamond holes utilised in the current La Arena

Resource estimate.

Channel samples weighing approximately 10kg each were taken 20cm parallel to the

existing drillhole on two meter intervals (equivalent to the diamond drill

sample length and spatial position). Bulk samples were also taken at 2 metre

intervals from the 1.5 metre by 1 metre pit then dried, homogenised and a total

of 10 representative 10kg samples were taken for analysis from each bulk sample.

The results of the sampling and the original HQ diamond drill hole grades are

outlined in the table below. In summary the gold grades in the channel samples

were on average 96% higher than comparative samples from the diamond drill holes

and the gold grades in the bulk samples were on average 40% higher.

----------------------------------------------------------------------------

Average

bulk

Original Channel sample

From To Recovery grade DDH in pit from pit Channel Pit vs

Hole (m) (m) in DDH (%) (Au ppb) (Au ppb) (Au ppb) vs DDH DDH

----------------------------------------------------------------------------

96D-LA-045 2 4 no data 33 25 13 -24% -60%

----------------------------------------------------------------------------

96D-LA-045 4 6 no data 25 1.506 1.023 5924% 3991%

----------------------------------------------------------------------------

96D-LA-045 6 8 no data 1.180 881 4.523 -25% 283%

----------------------------------------------------------------------------

96D-LA-045 8 10 no data 460 2.197 989 378% 115%

----------------------------------------------------------------------------

98D-LA-058 0 2 57.5 1.000 1.424 2.032 42% 103%

----------------------------------------------------------------------------

98D-LA-058 2 4 60 360 1.021 550 184% 53%

----------------------------------------------------------------------------

98D-LA-058 4 6 70 180 196 253 9% 41%

----------------------------------------------------------------------------

98D-LA-068 0 2 75 510 2.157 851 323% 67%

----------------------------------------------------------------------------

98D-LA-068 2 4 85 770 2.754 912 258% 18%

----------------------------------------------------------------------------

98D-LA-068 4 6 100 930 3.687 1.629 296% 75%

----------------------------------------------------------------------------

98D-LA-068 6 8 100 2.700 5.643 2.343 109% -13%

----------------------------------------------------------------------------

98D-LA-068 8 10 100 3.770 6.394 3.541 70% -6%

----------------------------------------------------------------------------

98D-LA-075 0 2 89 570 883 649 55% 14%

----------------------------------------------------------------------------

98D-LA-075 2 4 80 440 1.273 515 189% 17%

----------------------------------------------------------------------------

98D-LA-075 4 6 78 42 274 369 552% 780%

----------------------------------------------------------------------------

98D-LA-075 6 8 75 350 108 413 -69% 18%

----------------------------------------------------------------------------

98D-LA-077 0 2 80 270 156 72 -42% -73%

----------------------------------------------------------------------------

98D-LA-077 2 4 82.5 92 1.565 1.442 1601% 1468%

----------------------------------------------------------------------------

98D-LA-077 4 6 84 2.010 2.138 3.798 6% 89%

----------------------------------------------------------------------------

98D-LA-077 6 8 98 6.940 2.614 3.394 -62% -51%

----------------------------------------------------------------------------

98D-LA-087 0 2 55 1.240 789 1.260 -36% 2%

----------------------------------------------------------------------------

98D-LA-087 2 4 67.5 1.380 4.340 1.529 214% 11%

----------------------------------------------------------------------------

98D-LA-087 4 6 55 11.100 21.160 5.073 91% -54%

----------------------------------------------------------------------------

98D-LA-087 6 8 57.5 1.640 4.634 4.212 183% 157%

----------------------------------------------------------------------------

98D-LA-087 8 10 60 1.680 5.092 7.259 203% 332%

----------------------------------------------------------------------------

98D-LA-123 0 2 99 239 296 190 24% -20%

----------------------------------------------------------------------------

98D-LA-123 2 4 97.5 517 575 458 11% -12%

----------------------------------------------------------------------------

98D-LA-123 4 6 95 659 2.791 1.959 324% 197%

----------------------------------------------------------------------------

98D-LA-123 6 8 92.5 2.079 1.917 1.275 -8% -39%

----------------------------------------------------------------------------

98D-LA-123 8 10 95 89 2.119 622 2281% 599%

----------------------------------------------------------------------------

05D-LA-146 0 2 80 1.105 5.355 6.685 385% 505%

----------------------------------------------------------------------------

DDH-LA-245 0 2 91.5 1.000 2.127 1.351 113% 35%

----------------------------------------------------------------------------

DDH-LA-245 2 4 97.5 534 3.472 1.065 550% 99%

----------------------------------------------------------------------------

DDH-LA-245 4 6 97.5 1.475 1.815 1.071 23% -27%

----------------------------------------------------------------------------

DDH-LA-253 0 2 32.5 1.155 2.363 999 105% -13%

----------------------------------------------------------------------------

DDH-LA-253 2 4 28.5 254 851 1.160 235% 356%

----------------------------------------------------------------------------

DDH-LA-253 4 6 37.5 526 809 1.541 54% 193%

----------------------------------------------------------------------------

DDH-LA-253 6 8 50 388 1.384 3.308 257% 752%

----------------------------------------------------------------------------

DDH-LA-253 8 10 95 2.320 3.142 2.645 35% 14%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

AVERAGE 1.334 2.614 1.871 96% 40%

----------------------------------------------------------------------------

The results from this comparative study, although representative of only 39

samples in the La Arena oxide resource, demonstrates that in the case of both

the bulk sample and the channel samples taken, the gold grade, in the majority

of cases, tends to be significantly higher than the grades achieved by diamond

drilling.

Rio Alto anticipates that these results will be confirmed in early 2010 as part

of the ongoing development program for the La Arena Gold Oxide Project.

QA/QC applied during the channel and bulk sampling program at La Arena consisted

of including 2 standards and 2 blanks in each batch of 70 samples submitted for

assay. The primary laboratory selected was CIMM Peru which also provided the

results of 4 internal standards, 4 pulp lab duplicates, 1 duplicate from sample

coarse reject and 2 blanks, as part of their procedures. 21 pulp samples, 47

coarse reject samples and granulometric control samples were sent to a second

laboratory, ALS Peru. Both laboratories assayed for gold by fire assay using a

50g pulp and an Atomic Absorption Spectrometry (AAS) finish. Gold results

greater than 10g/t au were analysed using a gravimetric finish. A multi-element

suite was analyzed by aqua regia with an ICP finish. This represents the same

method of analysis used in the original diamond drilling.

The contents of this press release have been reviewed and verified by Mr. Beau

Nicholls, Coffey Mining Pty Ltd, a member of the Australasian Institute of

Geoscientists and graduate of Western Australian School of Mines and holder of a

Bachelor of Science in Mineral Exploration and Mining Geology (1994). Mr.

Nicholls is Rio Alto's Qualified Person as defined by NI 43-101. For additional

information regarding the La Arena Project, please refer to the technical report

(the "Report") entitled "La Arena Project, Huamachuco District, Peru" dated

March 31, 2008 (the "La Arena Report") prepared by Linton Kirk, BE (Mining),

FAusIMM, Jan de Visser, PhD (Geol), MSC (Geol), MAusIMM, and Chris Witt, BSc

(Met), MAusIMM of Coffey Mining Pty Ltd. The Report was prepared in accordance

with NI 43-101 and a copy is available under Rio Alto's SEDAR profile at

www.sedar.com.

Commenting, Director & COO, Alex Black said, "We are delighted to see that this

comparison study demonstrated the potential for higher gold grades at the La

Arena Gold Oxide Project. Like a number of other gold oxide projects in Peru, it

is possible that Rio Alto will achieve positive grade reconciliations during

mining. We expect that further work during the development program will

demonstrate higher mine head grades are achievable."

Rio Alto Mining Limited (TSX VENTURE:RIO)(WKN:A0MSLE) is focused on developing

the La Arena Gold Oxide Project in Peru within the next 20 months and exploring

for silver on three former silver producing properties in north eastern Mexico.

The principal objective of Rio Alto Mining Limited is to become the next company

in Peru to bring a gold project into production and to use cash flow from

production to further develop its assets in Peru and Mexico. To learn more about

Rio Alto Mining Limited, please visit: www.mexicansilvermines.com. Financial

information and other information can also be found at www.sedar.com.

Forward Looking Information

This press release may contain "forward-looking information" within the meaning

of applicable Canadian securities legislation. All statements, other than

statements of historical fact, included herein may be forward-looking

information. Generally, forward-looking information may be identified by the use

of forward-looking terminology such as "plans", "expects" or "does not expect",

"proposed", "is expected", "budgets", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes", or variations

of such words and phrases, or by the use of words or phrases which state that

certain actions, events or results may, could, would, or might occur or be

achieved. More particularly, and without limitation, this news release contains

forward-looking information regarding the gold grade of the La Arena Gold Oxide

Project. This forward-looking information reflects Rio Alto's current beliefs

and is based on information currently available to Rio Alto and on assumptions

Rio Alto believes are reasonable. These assumptions include, but are not limited

to, the expectations and beliefs of management, the assumed long-term prices of

mineral commodities; that Rio Alto can access financing, appropriate equipment

and sufficient labour and that the political environment where Rio Alto operates

will continue to support the development and operation of mining projects and

the grade and tonnage of actual ore being equivalent to or better than estimated

results in technical reports or prior exploration results.

Forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of activity,

performance or achievements of Rio Alto to be materially different from those

expressed or implied by such forward-looking information. Such risks and other

factors may include, but are not limited to: risks and uncertainties relating to

foreign currency fluctuations; risks inherent in mining including environmental

hazards, industrial accidents, unusual or unexpected geological formations,

ground control problems and flooding; risks associated with the estimation of

mineral resources and reserves and the geology, grade and continuity of mineral

deposits; the possibility that future exploration, development or mining results

will not be consistent with Rio Alto's expectations; the potential for and

effects of labour disputes or other unanticipated difficulties with or shortages

of labour or interruptions in production; actual ore mined varying from

estimates of grade, tonnage, dilution and metallurgical and other

characteristics; the inherent uncertainty of production and cost estimates and

the potential for unexpected costs and expenses, commodity price fluctuations;

uncertain political and economic environments; changes in laws or policies,

changes in tax laws, delays or the inability to obtain necessary governmental

permits; and other risks and uncertainties. Although Rio Alto has attempted to

identify important factors that could cause actual results to differ materially

from those contained in forward-looking information, there may be other factors

that cause results not to be as anticipated, estimated or intended. Accordingly,

readers should not place undue reliance on forward-looking information. Rio Alto

does not undertake to update any forward-looking information, except in

accordance with applicable securities laws.

ON BEHALF OF THE BOARD OF RIO ALTO MINING LIMITED

Alex Black, Director and Chief Operating Officer

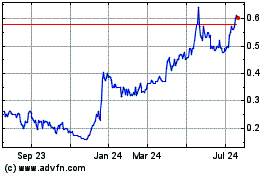

Rio2 (TSXV:RIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rio2 (TSXV:RIO)

Historical Stock Chart

From Jul 2023 to Jul 2024