Kane Biotech Announces First Quarter 2023 Financial Results

May 25 2023 - 4:05PM

Kane Biotech Inc. (TSX- V:KNE; OTCQB:KNBIF) (the “Company” or “Kane

Biotech”), a biotechnology company engaged in the research,

development and commercialization of technologies and products that

prevent and remove microbial biofilms, today announced its first

quarter 2023 financial results.

First Quarter Financial

Highlights:

- Total revenue for the three months ended March 31, 2023, was

$677,617, an increase of 20% compared to $565,433 in the three

months ended March 31, 2022.

- License and royalty revenue for the three months ended March

31, 2023 was $138,180, an increase of 66% compared to $83,349 in

the three months ended March 31, 2022.

- Revenue from product and services sales for the three months

ended March 31, 2023 was $539,437, an increase of 12% from $482,084

in the three months ended March 31, 2022.

- Gross profit for the first quarter of 2023 was $345,047, an

increase of 88% compared to $183,621 for the quarter ended March

31, 2022.

- Total operating expenses for the three months ended March 31,

2023, were $1,360,793, a decrease of 4% compared to $1,420,097 for

the three months ended March 31, 2022.

- Loss for the first quarter of 2022 was ($1,244,684) an increase

of 8% compared to ($1,152,164) for the quarter ended March 31,

2022. This increase is primarily attributable to higher financing

costs in the current period and a higher non-cash fair value

adjustment on government loan advances in the comparative

period.

Detailed financial information about Kane

Biotech can be found in its March 31, 2023. Financial Statements

and Management Discussion and Analysis on SEDAR and the Company’s

website.

“To date, 2023 has seen Kane achieve three

important milestones in the commercialization of its technologies.

First, the licensing of Kane’s clinically proven pet dental care

line to Skout’s Honor Pet Supply Co. (“Skout’s Honor”) will greatly

accelerate expansion into the U.S. pet retail market. Skout’s Honor

have built an enviable network of retailers across North America

and it is expected that their new dental line will reach the

shelves of the majority of US retailers, both big and small, by the

end of this year.” said Marc Edwards, Kane’s President and CEO.

“Second, distribution agreements for our coactiv+™ Antimicrobial

Wound Gel were signed earlier this year with ProgenaCare Global LLC

(“ProgenaCare”) in the United States bringing our effective,

differentiated and accessible product to the annual USD $200

million U.S. wound gel market and with Salud Pharma S.A (“Salud

Pharma”) covering Colombia, Panama and Costa Rica representing our

first global distribution agreement in wound care. Finally, the

510(k) clearance from the United States Food and Drug

Administration (“FDA”) that we just announced today will not only

open the door to multiple additional markets throughout the world,

but will also allow Kane to use this first product clearance as a

predicate product for additional 510(k) devices.”

Recent Corporate

Developments:

- On May

25, 2023, the Company announced that it had received 510(k)

clearance of its coactiv+™ Antimicrobial Wound Gel from the FDA for

the management of ulcers (including diabetic foot and leg ulcers

and pressure ulcers), 1st and 2nd degree burns, partial & full

thickness wounds, large surface area wounds and surgical incisions

for adult populations.

- On April 20, 2023 the Company

announced that it had signed a distribution agreement with

ProgenaCare for its coactiv+™ Antimicrobial Wound Gel in the United

States wound care market. ProgenaCare will have exclusive

distribution rights in the United States wound care market for

Kane’s coactiv+™ Antimicrobial Wound Gel and Kane will receive a

$500,000 USD upfront payment from ProgenaCare once it obtains

510(k) clearance from the FDA.

- On April 18, 2023, the Company

announced that it had signed a licensing agreement with Skout’s

Honor for its patented coactiv+™ technology in pet oral care

applications. Skout’s Honor has been granted a ten-year license for

the non-exclusive use of Kane’s coactiv+™ technology under their

own brand in North America while STEM will continue to

commercialize its bluestem™ line of pet oral care products. STEM

will receive a $500,000 USD licensing fee from Skout’s Honor to be

paid over the course of the agreement as well as an ongoing royalty

on all Skout’s Honor’s sales of products that use the coactiv+™

technology. The Company also announced that Kevin Cole, STEM’s

President and CEO, will be departing the company.

- On March 2, 2023, the Company

announced that it had entered into a formal agreement with Pivot

Financial I Limited Partnership (“Pivot”) to amend the terms of the

credit facility stated in the amended and restated credit agreement

between Pivot and the Company dated August 31, 2021 by increasing

the size of the Credit Facility from $4 million to $5 million,

increasing the interest rate from 14% to 15% and extending the

maturity date from February 28, 2023 to August 31, 2023.

- On Jan 4, 2023, the Company

announced that it had signed a distribution agreement with Salud

Pharma for its coactiv+™ Antimicrobial Wound Gel wound care and

DermaKB™ scalp care products. Once Kane obtains 510(k) approval

from the FDA, Salud Pharma through its distribution partners will

register and commercialize Kane’s coactiv+™ Antimicrobial wound gel

throughout Colombia, Panama, and Costa Rica via wound care centers

and pharmacies and will also import and distribute Kane’s DermaKB™

(www.dermaKB.com) line of scalp detoxifier and shampoos.

Kane Biotech is pleased to invite all interested parties to

participate in a conference call on Thursday, May 25, 2023 at

4:30pm ET during which time the results will be discussed.

Conference Call

Kane Biotech is pleased to invite all interested

parties to participate in a conference call on Thursday, May 25,

2023 at 4:30pm ET to review the financial results and discuss

business developments in the period.

Participants can access the call using this

link: Q1 2023. A webcast of the call will be

available on the Company's website at kanebiotech.com under

"News/Events" in the Investors section of the Kane Biotech website

at ir.kanebiotech.com.

About Kane Biotech

Kane Biotech is a biotechnology company engaged

in the research, development and commercialization of technologies

and products that prevent and remove microbial biofilms. The

Company has a portfolio of biotechnologies, intellectual property

(80 patents and patents pending, trade secrets and trademarks) and

products developed by the Company's own biofilm research expertise

and acquired from leading research institutions. StrixNB™,

DispersinB®, Aledex™, bluestem™, bluestem®, silkstem™, goldstem™,

coactiv+™, coactiv+®, DermaKB™ and DermaKB Biofilm™ are trademarks

of Kane Biotech Inc. The Company is listed on the TSX Venture

Exchange under the symbol "KNE" and on the OTCQB Venture Market

under the symbol “KNBIF”.

For more information:

| Marc

Edwards |

Ray

Dupuis |

Nicole

Sendey |

| Chief Executive

Officer |

Chief Financial

Officer |

Investor Relations/PR |

| Kane Biotech Inc |

Kane Biotech Inc |

Kane Biotech Inc |

|

medwards@kanebiotech.com |

rdupuis@kanebiotech.com |

nsendey@kanebiotech.com |

| +1 (514)

910-6991 |

+1 (204)

298-2200 |

+1 (204) 453-1301 |

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Caution Regarding Forward-Looking

InformationThis press release contains certain statements regarding

Kane Biotech Inc. that constitute forward-looking information under

applicable securities law. These statements reflect

management’s current beliefs and are based on information currently

available to management. Certain material factors or assumptions

are applied in making forward-looking statements, and actual

results may differ materially from those expressed or implied in

such statements. These risks and uncertainties include, but are not

limited to, risks relating to the Company’s: (a) financial

condition, including lack of significant revenues to date and

reliance on equity and other financing; (b) business, including its

early stage of development, government regulation, market

acceptance for its products, rapid technological change and

dependence on key personnel; (c) intellectual property including

the ability of the Company to protect its intellectual property and

dependence on its strategic partners; and (d) capital structure,

including its lack of dividends on its common shares, volatility of

the market price of its common shares and public company costs.

Further information about these and other risks and uncertainties

can be found in the disclosure documents filed by the Company with

applicable securities regulatory authorities, available

at www.sedar.com. The Company cautions that the foregoing list

of factors that may affect future results is

not exhaustive.

|

KANE BIOTECH INC. |

|

|

Selected Financial Results |

|

| |

|

|

|

|

|

Statement of Comprehensive Loss |

Three months ended March 31, |

|

|

|

2023 |

|

2022 |

|

| |

|

|

|

|

|

Total Revenue |

$ |

677,617 |

|

|

$ |

565,433 |

|

|

| |

|

|

|

|

|

Gross Profit |

|

345,047 |

|

|

|

183,621 |

|

|

| |

|

|

|

|

|

Operating expenses |

|

|

|

| |

|

|

|

|

|

General and administration |

|

1,052,837 |

|

|

|

1,068,248 |

|

|

| |

|

|

|

|

|

Research |

|

307,956 |

|

|

|

351,849 |

|

|

| |

|

|

|

|

|

Total operating expenses |

|

1,360,793 |

|

|

|

1,420,097 |

|

|

| |

|

|

|

|

| Loss

from operations |

$ |

(1,015,746 |

) |

|

$ |

(1,236,476 |

) |

|

| |

|

|

|

|

| Loss

and comprehensive loss for the period |

$ |

(1,244,684 |

) |

|

$ |

(1,152,164 |

) |

|

| |

|

|

|

|

|

Loss and comprehensive loss for the period |

|

|

attibutable to shareholders |

$ |

(1,201,102 |

) |

|

$ |

(1,108,591 |

) |

|

| |

|

|

|

|

|

Basic and diluted loss per share for the

period |

$ |

(0.01 |

) |

|

$ |

(0.01 |

) |

|

| |

|

|

|

|

|

Weighted average shares outstanding - basic |

|

|

and diluted |

|

124,833,906 |

|

|

|

114,817,239 |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

Statement of Financial Position |

March

31, |

|

December 31, |

|

| |

2023 |

|

2022 |

|

| |

|

|

|

|

| Cash

and cash equivalents |

$ |

990,078 |

|

|

$ |

1,104,091 |

|

|

| |

|

|

|

|

|

Other current assets |

|

1,962,979 |

|

|

|

1,992,654 |

|

|

| |

|

|

|

|

|

Non-current assets |

|

2,512,145 |

|

|

|

2,523,090 |

|

|

| |

|

|

|

|

|

Total Assets |

$ |

5,465,202 |

|

|

$ |

5,619,835 |

|

|

| |

|

|

|

|

|

Current liabilities |

$ |

7,589,265 |

|

|

$ |

6,341,562 |

|

|

| |

|

|

|

|

|

Non-current liabilities |

|

3,293,660 |

|

|

|

3,415,984 |

|

|

| |

|

|

|

|

|

Shareholders' equity |

|

(5,417,723 |

) |

|

|

(4,137,711 |

) |

|

| |

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

5,465,202 |

|

|

$ |

5,619,835 |

|

|

| |

|

|

|

|

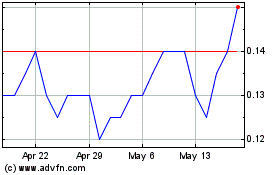

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Jan 2024 to Jan 2025