Indigo Exploration Inc. (TSX VENTURE: IXI) reports that it has

entered into a non-binding Letter of Intent (the "LOI") to acquire

(the "Acquisition") all of the issued and outstanding shares of

Sanu Resources Burkina Faso SARL, ("Sanu Burkina") an indirectly

owned subsidiary of NGEx Resources Inc. NGEx is a mineral

exploration company listed on the TSX and which trades under the

symbol "NGQ". The primary assets of Sanu Burkina consist of four

gold mineral exploration permits in the Republic of Burkina Faso,

West Africa. The consideration for the Acquisition is Cdn$65,000

and 3,000,000 common shares of Indigo at a deemed price of $0.15

per share, of which $30,000 was paid on signing of the LOI. The

remaining $35,000 and the 3,000,000 common shares are due on

execution of a definitive agreement and closing, respectively, of

the Acquisition. The number of shares to be issued at closing will

be subject to readjustment if the market price of the shares is

less than $450,000, based on the 10 day average closing market

price of Indigo's shares on the TSX Venture Exchange (the

"Exchange"). The proposed Acquisition will be subject to, among

other things, the parties entering into a definitive agreement and

to the acceptance of the Exchange.

The Burkina Faso property package consists of four exploration

permits in greenstone belts that contain significant gold

discoveries: Kodyel, Tordo, Lati and Loto. The four permits held by

Sanu Burkina are government granted licenses. The following

description of the four permits is summarized from the NGEx

Resources Inc. Annual Information Form filed under the NGEx SEDAR

profile.

Kodyel Exploration Permit

The Kodyel permit lies close to the Niger border approximately

300km east of Ouagadougou. Access is by paved road as far as Fada

N'gourma about 200km east of Ouagadougou and thence by gravel

roads.The Kodyel permit covers an extension of the Sirba greenstone

belt that hosts the Samira Hill gold mine just across the border in

Niger. The geology consists of meta-volcanics associated with

meta-sediments which are affected by NE-SW shearing. Several

artisanal workings occur within the permit, with the most

significant being the Kodyel 1, CFA workings and Tounganga. Here a

multiple, massive, quartz veins 1-5m wide cropping out over more

than 400m have been worked by local miners since 1984 to a depth of

over 7m. Highlights of grab samples of quartz from artisanal gold

mining sites on veining, and alteration, within intermediate tuffs

and highly altered, sheared and kaolinized felsic volcanics include

7 gpt Au and 9 gpt Au. A large part of the permit including the

major Tounganga artisanal mining site remains unexplored.

The permit was held from 1995-1997 by SEMAFO who drilled over

493 RAB, 26 RC and 12 DD holes into the CFA prospect and outlined a

small resource. The best intersection was Hole 196 with 43m of 4.3

gpt Au.

The permit is 100% owned by Sanu Burkina.

Tordo Exploration Permit

The 143 sq. km Tordo permit lies about 150km northeast of

Ouagadougou and is 100% owned by Sanu Burkina. The permit covers a

portion of the Fada N'gourma greenstone belt which consists of

meta-tuff, meta-sediment and mafic metavolcanic rocks. A dilational

fault splay is focused near the contact of the greenstone belt and

enclosing granites. A number of artisanal gold workings and lag

quartz-float debris fields are associated with these structures.

The area had never been previously explored. A regional and locally

detailed soil geochemistry program has defined a 1300 x 300m soil

gold anomaly in saprolite with peak values to 3000 ppb gold.

Lati Exploration Permit

The 246 sq. km Lati Permit, located in the Boromo greenstone

belt, covers a major north-south shear zone and a number of known

but under-explored prospects as well as an active artisanal mining

area. The Lati permit is about 150 km by road, of which about 100

km is paved, west of Ouagadougou. Lati was previously explored by

the UNDP (United Nations Development Program) and BUMIGEB (Burkina

Faso Office of Mines and Geology) for volcanic-hosted massive

sulfides (VHMS) similar to the Perkoa zinc deposit, as well as by

Carlin Resources and Incanore Resources.

Prior exploration included airborne geophysics, soil

geochemistry, trenching, and drilling. Several anomalous areas that

were not followed up include a gold-in-soil anomaly (1000m by 200m)

in the northern part of the permit in which three samples yielded

over 1 gpt Au with a peak value of 6.5 gpt Au; a UNDP prospect that

reported 12m of 2.45 gpt Au in a diamond drill hole; and the

Kwademen artisanal mining area where reported gold mineralization

over an area of 1250m x 250m with isolated values up to 65 gpt Au

occurs in quartz veins and veinlets in a sheared granites and

felsic volcanics.

Sanu Burkina has completed a detailed mapping and soil and

trench sampling program to verify and better understand the extent

of the reported gold anomalies before embarking on a program of RC

drilling in the most prospective areas of the permit. The

preliminary results show a significant gold and base metal anomaly

approximately 1.5km x 300m near a sediment volcanic contact in the

Kwademen prospect.

Work has concentrated on relocating previously discovered

anomalies since there appeared to significant positional errors in

the earlier work. Current work has confirmed a strong gold and

base-metal anomaly with peak gold values to 1480 ppb near a felsic

volcanic-shale contact and suggests that previous work did not test

the gold anomaly adequately.

Loto Exploration Permit

The 93 sq. km Loto exploration permit is located in the Boromo

greenstone belt. The Loto permit lies near the town of Diebougou,

approximately 270km by road from Ouagadougou of which 250km is

paved. The area is intensely farmed and it has taken time to

establish a working relationship with the local community.

Attention was first drawn to this area by outcrops of strongly

anomalous (1-2 gpt Au) quartz vein swarms in intermediate to mafic

volcanics. Sanu Burkina has covered the areas of quartz veining by

regional 400 x 100m soil geochemistry, rock chip and lag sampling

and geological mapping. Results are pending.

Indigo plans programs of concurrent soil geochemistry and air

core drilling on the Lati and Tordo permits and a program of

concurrent soil geochemistry and reverse circulation drilling on

the Kodyel permit.

About Burkina Faso

The property package lies in the West African nation of Burkina

Faso. West Africa is underlain by the Birimian Greenstone Belt, one

of the most prolific gold producing areas in the world. A number of

the world's major gold companies are active in West Africa, several

with producing mines, including: IAMGOLD Corporation, AngloGold

Ashanti Limited, Randgold Resources Limited, Gold Fields Limited

and Newmont Mining Corporation. Burkina Faso is considered to be

relatively stable, both politically and economically and relies

primarily on farming and mining as it main sources of revenue.

Concurrent Financing

In connection with the Acquisition, Indigo intends to conduct a

private placement of up to 5,000,000 subscription receipts (the

"Subscription Receipts") at a price of $0.20 per subscription

receipt for gross proceeds of up to $1,000,000 (the "Offering").

Each Subscription Receipt will entitle the holder to acquire, for

no additional consideration, one common share of Indigo (a "Share")

and one share purchase warrant (a "Warrant") entitling the holder

to purchase one additional share of Indigo at a price of $0.30 per

share for a period of one year from the date the Subscription

Receipts are issued. If during the exercise period of the Warrants

the closing price of Indigo's shares is $0.45 per share or higher

for 20 consecutive trading days, Indigo may accelerate the expiry

time of the Warrants to 20 calendar days from the date written

notice of same is provided to the holders.

On the closing of the Offering, the gross proceeds will be

placed into escrow pursuant to the terms of a subscription receipts

agreement (the "SRA") to be entered into between Indigo and

Computershare Trust Company of Canada (the "Escrow Agent"). Under

the terms of the SRA, the Subscription Receipts will automatically

convert into Shares and Warrants on that date (the "Conversion

Date") on which Indigo provides notice to the Escrow Agent

that:

(a) Indigo has entered into a definitive agreement that replaces

the LOI;

(b) the Exchange has approved or accepted filing of

documentation respecting the Acquisition; and

(c) the Acquisition has closed.

On the Conversion Date, the Escrow Agent will release the

proceeds from the Offering to Indigo. The Shares and any shares

issued upon exercise of the Warrants will be subject to a hold

period of 4 months and one day from the date of Closing of the

Offering. If the Conversion Date does not occur on or before 4:00

p.m. (Vancouver Time) on May 31, 2010, all Subscription Receipts

will be automatically cancelled and be null and void and the

subscription proceeds held by the Escrow Agent from the Offering

will be returned to the purchasers.

Finders' fees may be payable in connection with the

Offering.

The proceeds of the Offering will be used to conduct exploration

activities on Indigo's properties in Burkina Faso and for working

capital.

On Behalf of the Board of Directors,

R. Tim Henneberry, P.Geo., President and CEO

R. Tim Henneberry, P.Geo., President and Director of Indigo

Exploration Inc., is the Qualified Person as defined in National

Instrument 43-101, who has reviewed and approved the technical

content of this news release.

Forward-Looking Statements

This press release contains forward-looking statements. All

statements, other than statements of historical fact, constitute

"forward-looking statements" and include any information that

addresses activities, events or developments that Indigo believes,

expects or anticipates will or may occur in the future including

Indigo's strategy, plans or future financial or operating

performance and other statements that express management's

expectations or estimates of future performance.

Forward-looking statements are generally identifiable by the use

of the words "may", "will", "should", "continue", "expect",

"anticipate", "estimate", "believe", "intend", "plan" or "project"

or the negative of these words or other variations on these words

or comparable terminology. All such forward-looking information and

statements are based on certain assumptions and analyses made by

Indigo's management in light of their experience and perception of

historical trends, current conditions and expected future

developments, as well as other factors management believes are

appropriate in the circumstances. These statements, however, are

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, performance

or achievements of Indigo to be materially different from those

expressed, implied by or projected in the forward-looking

information or statements. Important factors that could cause

actual results to differ from these forward-looking statements

include but are not limited to: inability to enter into a final

binding agreement with respect to Sanu Burkina, risks related to

the exploration and potential development of Indigo's projects,

risks related to international operations, the conclusions of

economic evaluations, changes in project parameters as plans

continue to be refined, future prices of gold, as well as risk

factors discussed in certain of Indigo's continuous disclosure

documents filed on SEDAR.

There can be no assurance that any forward-looking statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements.

Accordingly, the reader should not place any undue reliance on

forward-looking information or statements. Except as required by

law, Indigo does not intend to revise or update these

forward-looking statements after the date of this document or to

revise them to reflect the occurrence of future unanticipated

events.

Neither the TSX Venture Exchange nor its Regulations Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accept responsibility for the adequacy or

accuracy of this release.

Contacts: Indigo Exploration Inc. Tim Henneberry (604)

681-3422

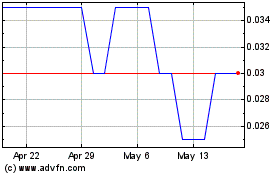

Indigo Explorations (TSXV:IXI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Indigo Explorations (TSXV:IXI)

Historical Stock Chart

From Jan 2024 to Jan 2025