Excelsior Announces North Sea Corporate Restructuring

April 08 2008 - 10:21PM

Marketwired Canada

Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or the "Company")

announces it has recently completed a transaction whereby it has sold the shares

of its wholly owned subsidiary, Excelsior Energy North Sea Limited, to an

Alberta private company ("NorthseaCo"). NorthseaCo is presently a wholly-owned

subsidiary of Excelsior. Excelsior will manage NorthseaCo pursuant to a services

agreement. NorthseaCo will manage and fund the work program in the 100% owned

License P.1500, Blocks 16/1a and 16/6c, and intends to pursue near term

production and development opportunities in the North Sea through acquisitions

and participation in licensing rounds. In connection with the restructuring,

NorthseaCo intends to issue up to 25% of its common shares on a non-brokered

private placement basis for gross proceeds of $1,000,000.

The private placement will be comprised of 4,000,000 units (the "Units") issued

at a subscription price of $0.25 per Unit. Each unit will consist of one common

share in the capital of the NorthseaCo (a "Common Share") and one half of a

common share purchase warrant (each whole warrant a "Warrant") of NorthseaCo.

Each whole Warrant will entitle the holder thereof to acquire one Common Share

at a price of $0.60 per Common Share. The Warrants will expire two years from

the date of the closing of the private placement. It is presently anticipated

that certain insiders of the Company, including management and directors will

participate in the private placement to a maximum level of 50% of the Units

being sold. The private placement is expected to close on or about April 21,

2008 and will be subject to applicable hold periods under applicable securities

laws. The proceeds will be used to fund ongoing technical work and business

development activities of NorthseaCo. On completion of the private placement

NorthseaCo will have 16,000,000 shares issued and outstanding (18,000,000 shares

on a fully diluted basis).

"This transaction gives us the structure and opportunity to execute an

aggressive international strategy and add shareholder value from assets which we

believe are currently undervalued within Excelsior," said David Winter,

President and CEO of Excelsior. "We look forward to applying our extensive

international experience and expertise to expand the asset base of NorthseaCo

and build a successful junior oil company active in the North Sea."

Block 16/1a and 16/6c were awarded to Excelsior in April 2007 and are located

within Quadrant 16 of the Central North Sea a few kilometres North West of the

West Brae Field. A number of leads and prospects have been identified and mapped

in Eocene and Palaeocene aged sand reservoirs which are productive in the

neighbouring West Brae Field. The primary prospect lies up-dip from a well

drilled in 1992 which penetrated a 15 meter thick oil column in the target

reservoir sands. An independent evaluation of the prospect by PGL Consultants

estimated a range of oil in place of between 50 and 220 million barrels of oil

in place. The company is currently reprocessing just over 300 square kilometres

of 3D seismic data to better image the reservoir sands and to define a drilling

location to test the prospect. NorthseaCo has until April 2009 to make a drill

or drop decision. If a successful discovery is made the location is several

kilometres from existing infrastructure with spare capacity.

About Excelsior Energy

Excelsior is active in oil sands exploration and appraisal in the Hangingstone

and West Surmont areas near Fort McMurray, Alberta and will hold a 75% working

interest in 58 contiguous sections on completion of its farm-in obligations. The

Company also indirectly holds a 100% working interest in Blocks 16/1a and 16/6c

in the UK North Sea and a minor interest in gas production in Alberta.

Excelsior's strategy is to capture oil and gas appraisal and development

opportunities where we can leverage Management's diverse international

experience and field development expertise. This includes heavy oil reservoir

engineering and development of complex fields.

Forward-Looking Statements: This news release contains statements about future

events that are forward looking in nature and, as a result, are subject to

certain risks and uncertainties such as changes in plans or the occurrence of

unexpected events. Actual results may differ from the estimates provided by

management. Readers are cautioned not to place undue reliance on these

statements.

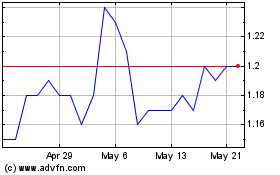

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2024 to Jul 2024

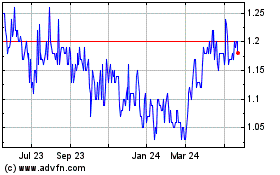

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jul 2023 to Jul 2024