Dacha Announces Completion of Normal Course Issuer Bid and Provides Corporate Update

January 16 2012 - 9:27AM

Marketwired Canada

Dacha Strategic Metals Inc. ("Dacha" or the "Company") (TSX

VENTURE:DSM)(OTCQX:DCHAF) is pleased to announce that it has completed its

normal course issuer bid ("NCIB"), which was launched in June of 2011.

Dacha has purchased for cancellation a total of 6,747,679 shares of the Company

at an average price of CDN$0.738 per share. Dacha's corporate structure now

consists of approximately 74.8 million common shares issued and outstanding, or

95.2 million common shares issued and outstanding on a fully diluted basis.

In accordance with TSX Venture Exchange rules, a new NCIB may be launched in

June of 2012 on the basis of 10% of the public float of the Company at that

time. Management feels that the NCIB has been highly accretive to Dacha's

shareholders as the Company's current net assets as at December 31st were valued

at $1.47 per share.

Corporate Update

The Rare Earth Market has seen a rocky fourth quarter with demand falling

substantially both domestically and in the international market. By all

estimates approximately 50% of the 2011 quotas will go unused. Chinese export

quotas for the first half of 2012 ("H1") were recently released and for the

first time the export quotas have been dispersed into categories between "Light

rare earths" and "Mid/heavy rare earths". Dacha sources indicate Lanthanum,

Cerium, Neodymium and Praseodymium which will now fall under the Light rare

earths category with all others plus Yttrium falling under the Mid/Heavy rare

earths quota limit.

The recent release of Chinese rare earth element quotas saw only 11 exporters

pass the environmental review and receive their H1 quotas, with the majority of

these approved exporters being state owned enterprises. It appears as though the

quotas were split 86 % light rare earths (La,Ce,Nd,Pr) and 14% for medium to

heavy rare earths. Interestingly, a significant number of northern rare earth

companies were not included in the initial round of the quotas as they did not

pass the environmental review.

Should China maintain the 30,000-tonne export quota for 2012, the implication is

that about 4,000 tonnes of heavy rare earths will be available for export. The

typical southern plant only produces up to 60% of light rare earths so these

companies will not have a balanced portfolio of quotas to production output. Any

one of the main plants in the south can produce upwards of 6,000 tonnes per year

of which at least 40-50% would be heavies so this will likely reduced output

from southern China overall. Last year, southern plants produced approximately

25,000 tonnes of rare earth oxides, on a reduced production schedule, or about

10,000 Tonnes of heavy rare earths (not counting SEG from the north). As such,

one would expect a continued reduction of heavy rare earths produced which would

likely solidify pricing of heaving rare earth in H1 2012.

As the main northern plants did not receive any quotas other than three

State-owned companies (Minmetals, Sinosteel and China Nonferrous), they will

have to ship through these companies or some southern plants with excess light

quotas. It is still undetermined whether this will be approved by the State.

Either way, this recent change in splitting the quotas will likely result in

continued weakness in the light rare earth elemensas Lynas prepares to come to

market later this year. We would expect continued decline in quota value in

2012.

Japan has been relatively inactive in the market over the past six months. Dacha

believes that this will not continue and inventories of rare earths will have to

be restocked in the near term. Production in China has been severely curtailed

since August and as such inventories have not been growing substantially. Dacha

would expect demand and potentially pricing to firm up for Dysprosium and

Terbium in the first half of 2012 as the new split quota system is digested.

Many end-users may not want to risk the lack of heavy quotas being available in

H2 2012 and therefore buying activity may be heavier in H1.

Dacha will continue to seek strategic opportunities for moving its inventory

during this quarter with a view to ensuring its net asset value is reflective of

the value of the Company's holdings.

Dacha's inventory, including market value is updated weekly every Monday morning

and posted to the "Inventory" tab of its website at www.dachametals.com. Dacha

encourages its shareholders and all other interested parties to visit its

website regularly and to monitor the ongoing appreciation of its physical

inventory of Rare Earth Elements.

About Dacha

Dacha Strategic Metals Inc is an investment company focused on the acquisition,

storage and trading of strategic metals with a primary focus on Rare Earth

Elements. Dacha is in the unique position of holding a commercial stockpile of

Physical Rare Earth Elements. Its shares are listed on the TSX Venture Exchange

under the symbol "DSM" and on the OTCQX exchange under the symbol "DCHAF".

Except for statements of historical fact relating to the Company, certain

information contained herein constitutes "forward-looking information" under

Canadian securities legislation. Forward-looking information includes, but is

not limited to, statements with respect to current market conditions and the

Company's expectations for future market conditions, expected quotas, the

Company's ability to trade in rare earth elements, the realization value of

Dacha's physical inventory portfolio, proposed investment strategy of the

Company, and general investment and market trends. Generally, forward-looking

information can be identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or statements that certain

actions, events or results "may", "could", "would", "might" or "will be taken",

"occur" or "be achieved". Forward-looking statements are based on the opinions

and estimates of management as of the date such statements are made.

Forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of activity,

performance or achievements of Dacha to be materially different from those

expressed or implied by such forward-looking information. Although management of

Dacha has attempted to identify important factors that could cause actual

results to differ materially from those contained in forward-looking

information, there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that such

statements will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking information. Dacha

does not undertake to update any forward-looking information, except in

accordance with applicable securities laws.

The market value of the Company's physical inventory is estimated using price

quotes published by two of the largest independent news sources for the metals

industry, namely, Asian Metal (www.asianmetal.com) and Metal-Pages

(www.metal-pages.com). In cases where these websites do not provide a price

quote on the type or quality of metal held in the Company's physical inventory,

the Company relies on a price quote provided by independent third-party industry

participants.

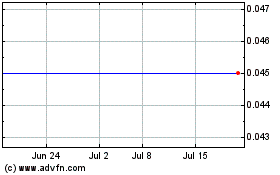

Deep South Resources (TSXV:DSM)

Historical Stock Chart

From Jun 2024 to Jul 2024

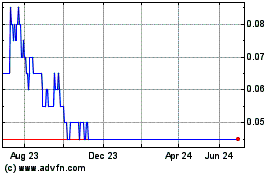

Deep South Resources (TSXV:DSM)

Historical Stock Chart

From Jul 2023 to Jul 2024