Dacha Reports Assets of US$1.62 Per Share With Inventory Valued at US$121.0 Million as of September 30, 2011 and Provides Com...

October 03 2011 - 5:05PM

Marketwired Canada

Dacha Strategic Metals Inc. ("Dacha" or the "Company") (TSX

VENTURE:DSM)(OTCQX:DCHAF) is pleased to announce the estimated market value of

its Rare Earth metals inventory. As of September 30, 2011, the estimated value

of its metals inventory was US$121.0 million, a decrease of US$14.2 million, or

10.5%, from the estimated value of US$135.2 million at August 31, 2011, as

reported in the Company's September 2, 2011 press release.

Assets include metal inventory, cash and marketable securities. At September 30,

2011, in addition to its metal inventory, which had an estimated fair market

value of US$121.0 million, the Company's equity investments had an estimated

fair market value of approximately US$1.9 million and cash of approximately

US$3.3 million for a total of US$126.2 million, or US$1.62 per share, based on

78.1 million shares outstanding, or, US$1.37 per share on a fully diluted basis

of 98.7 million shares outstanding.

Company Update

Dacha continues to execute under its Normal Course Issuer Bid and has purchased

1.4 million shares for cancellation since its AGM on September 15th, 2011. As of

September 30, 2011, the Company has purchased and cancelled a total of 3,450,000

shares of Dacha at an average price of $0.91 as part of its on-going Normal

Course Issuer Bid.

Dacha notes that the market has reacted strongly to the recent pullback in rare

earth prices, with Dacha's share price dropping approximately 30% while its

inventory value fell only 10% over the same period from the Company's last net

asset value update on August 30th 2011. Dacha believes the severe curtailment of

heavy rare earth mining and separation combined with speculators exiting the

market will have a significant positive influence on heavy rare earth prices in

the next 90 days. Moreover, while Asian buyers have been relatively inactive in

the market since August, the Company has seen a rise in inquiries in the last

two weeks. Dacha maintains its inventory in two London Metal Exchange warehouses

in Korea owned and operated by Pacorini Metals, a Glencore company. The

Company's inventory is physically audited at the end of each quarter and its

auditors were on site on September 30th.

As at September 30, 2011, Dacha's physical inventory portfolio consisted as follows:

----------------------------------------------------------------------------

Metals Inventory Grades(i) Quantity Spot Price/kg Market Value

9/30/2011 (Kg) (US$) (US$millions)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Busan, South Korea

----------------------------------------------------------------------------

Dysprosium Oxide 3N+ 15,000 $2,295 $34.4

----------------------------------------------------------------------------

Dysprosium Fe Santoku 12,000 $2,450 $29.4

----------------------------------------------------------------------------

Gadolinium Oxide 4N5+ 9,950 $265 $2.6

----------------------------------------------------------------------------

Lutetium Oxide 4N+ 2,900 $1,150 $3.3

----------------------------------------------------------------------------

Neodymium Oxide 4N+ 18,000 $276 $5.0

----------------------------------------------------------------------------

Terbium Oxide 4N+ 14,000 $3,153 $44.1

----------------------------------------------------------------------------

Yttrium Oxide 5N 14,000 $153 $2.1

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total: 85,850 $121.0

----------------------------------------------------------------------------

------------------------------

(i)Grades:

4N = 99.99%

4N+ = 99.99+%

5N = 99.999%

4N5+ = 99.99%/99.999+%

------------------------------

Dacha's inventory, including market value, is updated weekly every Monday

morning and posted to the "Inventory" tab of its website at www.dachametals.com.

Dacha encourages its shareholders and all other interested parties to visit its

website regularly and to monitor the ongoing appreciation of its physical

inventory of Rare Earth Elements.

About Dacha

Dacha Strategic Metals Inc is an investment company focused on the acquisition,

storage and trading of strategic metals with a primary focus on Rare Earth

Elements. Dacha is in the unique position of holding a commercial stockpile of

Physical Rare Earth Elements. Its shares are listed on the TSX Venture Exchange

under the symbol "DSM" and on the OTCQX exchange under the symbol "DCHAF".

Except for statements of historical fact relating to the Company, certain

information contained herein constitutes "forward-looking information" under

Canadian securities legislation. Forward-looking information includes, but is

not limited to, statements with respect to the Company's expectations and

observations of the industry and trends, the Company's ability to trade in rare

earth elements, the realization value of Dacha's physical inventory portfolio,

proposed investment strategy of the Company, and general investment and market

trends. Generally, forward-looking information can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates" or "does not anticipate", or "believes", or variations of such

words and phrases or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements are based on the opinions and estimates of management

as of the date such statements are made. Forward- looking information is subject

to known and unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of Dacha to be

materially different from those expressed or implied by such forward-looking

information. Although management of Dacha has attempted to identify important

factors that could cause actual results to differ materially from those

contained in forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can be no

assurance that such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward-looking

information. Dacha does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

The market value of the Company's physical inventory is estimated using price

quotes published by two of the largest independent news sources for the metals

industry, namely, Asian Metal (www.asianmetal.com) and Metal-Pages

(www.metal-pages.com). In cases where these websites do not provide a price

quote on the type or quality of metal held in the Company's physical inventory,

the Company relies on a price quote provided by independent third-party industry

participants.

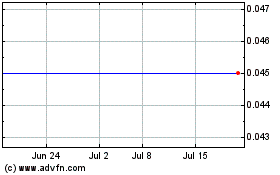

Deep South Resources (TSXV:DSM)

Historical Stock Chart

From Jun 2024 to Jul 2024

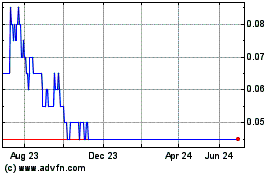

Deep South Resources (TSXV:DSM)

Historical Stock Chart

From Jul 2023 to Jul 2024