Compass Gold Corp. (TSX-V: CVB) (Compass or

the Company) is pleased to provide an update on

the latest exploration drilling at the Boumban South and Boumban

Central prospects, located on the Company’s Sikasso Property in

Southern Mali (

Figure 1).

Highlights

- Additional drilling at Boumban Central (3 RC holes, 640

m) identified high-grade gold mineralization adjacent to the

Siekorole Fault and coincident with a strong shallow soil

anomaly

- Best interval was 1 m @ 50.56 grams per tonne (g/t)

gold (Au), within 4 m @ 14.93 g/t Au (from 63 m)

- Drilling at Boumban South (5 RC holes, 781 m)

intersected several zones of mineralization, including 8 m @ 0.67

g/t Au (from 21 m)

- A 2,000-m air core drill program has commenced

on four target areas on the Sankarani and Kourou

permits

Compass CEO, Larry Phillips,

said, “As drilling is about to start on our high-priority targets

at Sankarani and Kourou, we continue to receive encouraging results

on our Farabakoura Trend prospects. Based on the

early-December drill results from Boumban Central, we drilled three

additional holes to extend one of our fences. This led to the

discovery of a high-grade gold intercept, which supports our

interpretation that the Siekeroli Fault is a controlling feature in

the permit area.

Our aim continues to be the drill testing of the

principal targets along the length of the 15 km long Farabakoura

Trend, where we continue to find pockets of strong gold

mineralization. We have several more untested targets that need to

be drilled.

I am also excited about the pending start of

drilling on the Sankarani permit, located immediately to the east

of our current drilling. This will be the first ever drilling

on this set of targets that lie on a 40-km-long north-northeast

trend of artisanal gold workings and geochemical gold anomalism

associated with a crustal-scale fault. We eagerly await the assay

results of this promising area.”

Technical Review

Boumban Central

Three holes (360 m) were completed at Boumban

Central in mid-January (Figure 1) to follow-up on

gold mineralization noted in OURC56 on the prospect during drilling

in December 2019 (see Compass press release, January 14,

2019). OURC56 intercepted 10 m @ 0.57 g/t Au (from 31 m),

including 3 m @ 1.33 g/t Au. Holes OURC93 to OURC95 were

added to the northwest end of the previously drilled NW-trending

fence into a shallow soil geochemistry and deep overburden gold

anomaly (Figure 1). Drilling was performed

by Capital Drilling, and collected samples were assayed at SGS

(Bamako, Mali) by fire assay.

Figure 1 accompanying this announcement is

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/eb820e37-5c50-44ac-b9f3-946ebe513cf2

The holes were drilled to the southeast at dips

of 55° and depths of 120 m. OURC94 contained the

highest-grade interval, with 1 m @ 50.56 g/t Au

(from 64 m) within 4 m @ 14.93 g/t Au (Table 1). OURC94 also

contained the longest interval of mineralization, 6 m @ 0.56 g/t Au

(from 103 m). The mineralized veins are thought to correspond

to east-west structures determined from the ground magnetic

study. Drill holes OURC93 and OURC95 were weakly mineralized

in comparison to OURC94, with several zones varying from 1 to 3 m

containing less than 0.3 g/t Au (Table 1). The mineralization

encountered during drilling is likely responsible for the soil

anomalism noted in the shallow soil and deep overburden sampling

programs.

Table 1. Assays (>0.2

g/t Au) identified during recent drilling at Boumban South

(OURC87-92) and Boumban Central (OURC93-95)

|

Hole ID |

From (m) |

To (m) |

1, 2 Interval (m) |

Au (g/t) |

|

OURC87 |

No intercept > 0.2 g/t Au |

|

OURC88 |

No intercept > 0.2 g/t Au |

|

OURC89 |

51 |

54 |

3 |

0.21 |

|

OURC90 |

35 |

36 |

1 |

0.36 |

|

OURC91 |

72 |

73 |

1 |

0.28 |

|

OURC92 |

46 |

47 |

1 |

0.35 |

|

OURC93 |

47 |

50 |

3 |

0.37 |

|

OURC94 |

47 |

50 |

3 |

0.37 |

|

OURC94 |

63 |

67 |

4 |

14.93 |

|

inc. |

64 |

65 |

1 |

50.56 |

|

OURC94 |

75 |

76 |

1 |

0.44 |

|

OURC94 |

103 |

109 |

6 |

0.56 |

|

inc. |

108 |

109 |

1 |

1.49 |

|

OURC95 |

5 |

6 |

1 |

0.39 |

|

OURC95 |

24 |

29 |

5 |

0.28 |

1True thicknesses are interpreted as 60-90% of

stated intervals2 Intervals use a 0.2-gram-per-tonne gold cut-off

value

Boumban South Reverse Circulation

Drilling Results In late-January, the Company completed

781 m of reverse circulation (RC) drilling in six drill holes

(OURC87 to 92) over selected geophysical and geochemical targets on

the Boumban South prospect (Figure

1). All holes were drilled on an azimuth of 045° (to

the northeast), at dips of 50°, and lengths varying from 91 to 150

m.

The drilling determined the underlying rock is

predominantly granodiorite, which has been cut by

northwest-trending faults. Minor gold mineralization was

identified in narrow, discrete zones in four of the six holes

(Table 1). The highest grade

encountered was 1 m @ 0.36 g/t Au (from 35 m) in OURC90, and

the greatest mineralized interval was 3 m @ 0.21 g/t Au. The

primary target on this fence line was the strong inferred

NW-trending fault, which was predicted to cut OURC89, and

coincidently was the widest mineralized interval. The

distribution of the soil anomalism (Figure 1)

suggests the mineralization is probably concentrated at the margins

of the intrusion closer to the Siekeroli fault. Weathering of

the identified veins might be responsible for the gold anomalism

noted in the shallow soil samples.

Pending Results

Results are pending on a further 1,110 m of

drilling from the Boumban NW (840 m) and Boumban North (270 m)

prospects (Figure 1). A total of 1,168

samples (with QAQC standards and blanks) have been dispatched to

the assay lab, and results will be reported when available.

Next Steps

Compass has prepared drill pads for a 2,000-m

air-core drilling program on three prospects (Tarabala, Yala, and

Sodala), which are characterized by artisanal workings and strong

geochemical anomalism on the Sankarani permit, and one prospect

(Samagouela) on the Kourou permit. Drilling is expected to

begin as soon as the rig can get to the target sites. Each of these

prospects is characterized by bedrock gold mineralization, shallow

soil gold geochemical anomalism, structural targets identified from

geophysics, and the presence of artisanal gold mining.

Additionally, the Tarabala and Yala prospects lie on a 40-km-long

north-northeast trend of 30 artisanal gold workings associated with

a crustal-scale fault.

Field teams have completed geological mapping on

the prospects, and local ground geophysical surveys (magnetic and

induced polarization) are being completed on the prospects prior to

drilling.

About Compass Gold Corp.

Compass, a public company having been

incorporated into Ontario, is a Tier 2 issuer on the TSX- V.

Through the 2017 acquisition of MGE and Malian subsidiaries,

Compass holds gold exploration permits located in Mali that

comprise the Sikasso Property. The exploration permits

are located in three sites in southern Mali with a combined land

holding of 867 km2. The Sikasso Property is

located in the same region as several multi-million-ounce gold

projects, including Morila, Syama, Kalana and Kodiéran. The

Company’s Mali-based technical team, led in the field by Dr.

Madani Diallo and under the supervision of Dr. Sandy Archibald,

P.Geo, is conducting the current exploration program. They are

examining numerous anomalies first noted in Dr. Archibald’s

August 2017 “National Instrument 43-101 Technical Report

on the Sikasso Property, Southern Mali.”

QAQC

All RC samples were collected following industry

best practices, and an appropriate number and type of certified

reference materials (standards), blanks and duplicates were

inserted to ensure an effective QAQC program was carried out.

The 1 m interval samples were prepared and analyzed at SGS SARL

(Bamako, Mali) by fire assay technique FAE505. All standard

and blank results were reviewed to ensure no failures were

detected.

Qualified Person

This news release has been reviewed and approved

by EurGeol. Dr. Sandy Archibald, P.Geo, Compass’s Technical

Director, who is the Qualified Person for the technical information

in this news release under National Instrument 43-101

standards.

Forward‐Looking InformationThis

news release contains "forward‐looking information" within the

meaning of applicable securities laws, including statements

regarding the Company’s planned exploration work and management

appointments. Readers are cautioned not to place undue reliance on

forward‐looking information. Actual results and developments may

differ materially from those contemplated by such information. The

statements in this news release are made as of the date hereof. The

Company undertakes no obligation to update forward‐looking

information except as required by applicable law.

For further information please contact:

|

Compass Gold Corporation |

Compass Gold Corporation |

|

Larry Phillips – Pres. & CEO |

Greg Taylor – Dir. Investor Relations & Corporate

Communications |

|

lphillips@compassgoldcorp.com |

gtaylor@compassgoldcorp.com |

|

T: +1 416-596-0996 X 302 |

T: +1 416-596-0996 X 301 |

Website: www.compassgoldcorp.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

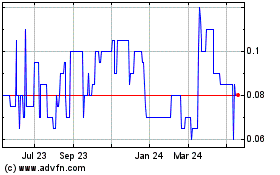

Compass Gold (TSXV:CVB)

Historical Stock Chart

From Dec 2024 to Jan 2025

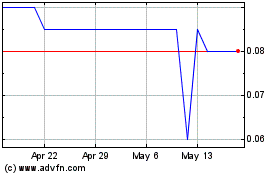

Compass Gold (TSXV:CVB)

Historical Stock Chart

From Jan 2024 to Jan 2025