BWR Exploration Inc. Closes First Tranche of Private Placement

September 17 2020 - 9:00AM

BWR Exploration Inc. (TSX.V: BWR) (“

BWR” or the

“

Company”) is pleased to announce the closing of

the first tranche (the “

Closing”) of the

previously announced non-brokered private placement (the

“

Offering”) for aggregate gross proceeds of

$360,000, on September 16, 2020, through the purchase of 7,200,000

Units consisting of 7,200,000 common shares (“

Common

Shares”) plus 3,600,000 warrants, issued in connection

with the Closing.

As previously announced, each Unit consists of 1

Common Share, plus one half of one common share purchase warrant (a

“Warrant”) of the Company. Each Full Warrant will

expire 36 months from the date of issue (the “Full Warrant

Expiry Date”) and will entitle the holder thereof to

purchase one Common Share (a “Full Warrant Share”)

at a price of $0.075 per Full Warrant Share within 24 months from

the date of issue and for the period that is for 24 months plus one

day from the date of issue until the Full Warrant Expiry Date at a

price of $0.10 per Full Warrant Share.

All securities issued have a hold period of 4

months plus one day, which expires on January 17, 2021 pursuant to

the Closing.

The gross proceeds raised were $360,000.

However, as previously announced, the Unit Offering was for

aggregate proceeds of up to $500,000, so the remaining available

Units in the Offering are 2,800,000 Units for aggregate proceeds of

$140,000 which remain open and available. The Company has elected

to complete a further closing on or about September 18, for all or

a portion of the above residual amount.

While the Unit Offering was effected by the

Company on a non-brokered basis, the Company paid finder’s fees to

an arm’s-length third party, Raymond James Ltd. (the

“Broker”), consisting of: $4,800 cash commission

representing 8% of the gross proceeds of the Unit Offering raised

by the Broker; and (ii) 96,000 broker warrants (“Broker

Warrants”) representing an amount up to 8% of the total

number of Units of the Unit Offering raised by the Broker. Each

Broker Warrant will entitle the holder thereof to purchase one

Common Share of the Company at the Exercise Price of $0.075 for 24

months from the date of issue.

Two insiders participated in this financing,

subscribing for 2,400,000 Units for net proceeds to the Company of

$120,000.

The proceeds from the Offering will be used for

general corporate purposes, with a focus on the Little Stull Lake

Gold project located in Northeastern Manitoba.

BWR Exploration Inc. is a public company focused

on exploring for base and precious metals, with its flagship Little

Stull Lake Gold Project in NE Manitoba along with other exploration

projects in Northern Ontario, and Northern Quebec, Canada.

Management of BWR includes an accomplished group of

exploration/mining specialists with many decades of operational

experience in the junior resource sector in Canada and abroad.

Prior to this financing there were 79,502,461 shares issued in BWR;

subsequent to the closing there are 86,702,461 shares issued.

Neither the Toronto Venture Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For more information about BWR please visit our website:

http://www.bwrexploration.com or call/email:Neil Novak, P.Geo.,

President, CEO & Director, BWR Exploration Inc.82 Richmond St.

E Toronto, ON M5C 1P1 Office:

416-848-6866nnovak@bwrexploration.com

For information regarding this financing please contact:Carl

Desjardins, Paradox Investor Services Inc.Cell:

514-618-4477carldesjardins@paradox-pr.ca

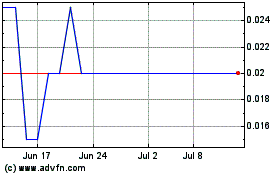

BWR Exploration (TSXV:BWR)

Historical Stock Chart

From Nov 2024 to Dec 2024

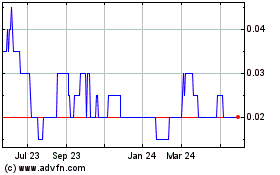

BWR Exploration (TSXV:BWR)

Historical Stock Chart

From Dec 2023 to Dec 2024