Stella-Jones Inc. (TSX: SJ)

-- Sales of $99.4 million compared with $112.0 million last year

-- Net earnings of $5.8 million compared with $7.7 million last year

-- Diluted EPS of $0.46 versus $0.61 in 2009

-- Further debt reduction prior to the completion of the Tangent

acquisition

Stella-Jones Inc. (TSX: SJ) today announced financial results

for its first quarter ended March 31, 2010.

-------------------------------------------------------------

Financial highlights Quarters ended March 31,

(in thousands of dollars, except per

share data)(unaudited) 2010 2009

-------------------------------------------------------------

Sales 99,360 111,954

Gross profit 18,163 22,519

Cash flow from operations(1) 8,528 11,321

Net earnings for the period 5,814 7,687

Per share - basic ($) 0.46 0.61

Per share - diluted ($) 0.46 0.61

Weighted average shares outstanding

(basic, in '000s) 12,688 12,566

-------------------------------------------------------------

(1) Before changes in non-cash working capital components.

FIRST-QUARTER RESULTS

Sales were $99.4 million, a decrease of $12.6 million, or 11.2%

from last year's sales of $112.0 million. Changes in the value of

the Canadian dollar, Stella-Jones' reporting currency, versus the

U.S. dollar, decreased the value of U.S. dollar denominated sales

by about $8.9 million when compared with the same period a year

earlier. Adjusting for year-over-year currency fluctuations, sales

decreased approximately 3.0% versus last year's first quarter,

reflecting reduced railcar availability resulting from severe

winter weather in the eastern United States at the beginning of the

quarter, and, to a lesser extent, weaker demand and softer pricing

for the Company's core products.

Railway tie sales amounted to $48.2 million, down 21.5% from

last year (or approximately 11.0% net of year-over-year currency

translation effect), as a result of reduced railcar availability

and slightly weaker industry demand in North America in comparison

with the year earlier period. Utility pole sales totalled $36.5

million, a decrease of 2.2% from a year ago (or an increase of

approximately 2.0% net of year-over-year currency translation

effect). Industrial lumber sales declined marginally to $10.1

million, as solid demand for marine applications in Canada were

offset by lower sales in the United States. Finally, sales of

consumer lumber rose 65.6% to $4.5 million, largely due to

favourable weather conditions at the end of the quarter in most of

the Company's markets.

"We are pleased with these results in light of difficulties in

securing railcars to ship products, as well as adverse

year-over-year currency movements," said Brian McManus, President

and Chief Executive Officer of Stella-Jones. "More importantly, we

started to see greater sales momentum in our core railway tie

product category towards the end of the period."

Gross profit was $18.2 million or 18.3% of sales, compared with

$22.5 million or 20.1% of sales last year. The reduction in gross

profit, as a percentage of sales, essentially stems from softer

pricing in most product categories as well as a different product

mix in the railway tie category.

"The decrease in gross profit dollars also results from a

significant reduction in the year-over-year average rate applied to

convert gross profit from U.S. dollar denominated sales.

Furthermore, first quarter results include approximately $1.8

million in general and administrative expenses directly related to

the Tangent Rail Corporation ("Tangent") acquisition," added George

Labelle, Senior Vice-President and Chief Financial Officer.

Net earnings for the period stood at $5.8 million or $0.46 per

share, fully diluted, compared with $7.7 million or $0.61 per

share, fully diluted, last year. Cash flow from operating

activities before changes in non-cash working capital components

reached $8.5 million, versus $11.3 million in the same period a

year ago.

Stella-Jones' balance sheet as at March 31, 2010 reflects the

financing components for the Tangent acquisition, which was

successfully completed subsequent to the end of the period on April

1, 2010. Such components include long-term borrowings of US$65.0

million (Cdn$66.0 million) and net proceeds of $76.9 million from

the issuance of subscription receipts. Conversely, current assets

included restricted cash of $142.9 million, which was disbursed on

April 1, 2010. Excluding these components, the Company's long-term

debt, including the current portion, amounted to $83.0 million,

representing a ratio of total long-term debt to shareholders'

equity of 0.46:1, down from 0.48:1 three months earlier. In

addition, a solid cash flow generation and better working capital

resulted in a $6.3 million decrease in short-term bank

indebtedness, which stood at $49.9 million as at March 31,

2010.

OUTLOOK

"The acquisition of Tangent has considerably enhanced

Stella-Jones' position as a continent-wide producer. A successful

integration will be a major performance driver in 2010 and beyond,

as we gradually achieve all potential synergies. While our

expectation for the year ahead is for demand levels to remain

similar to those of last year, our aim will be to reap all the

benefits that our newly enlarged network can provide. Our ongoing

focus on network optimization and cost control should increase both

our efficiencies and our margins as the economic recovery gains

further momentum," concluded Mr. McManus.

CONFERENCE CALL

Stella-Jones will hold a conference call to discuss these

results on Tuesday, May 4, 2010, at 1:00 PM Eastern Time.

Interested parties can join the call by dialling 647-427-7452

(Toronto or overseas) or 1-888-231-8191 (elsewhere in North

America). Parties unable to call in at this time may access a tape

recording of the meeting by calling 1-800-642-1687 and entering the

passcode 67872162. This tape recording will be available on

Tuesday, May 4, 2010 as of 3:00 PM Eastern Time until 11:59 PM

Eastern Time on Tuesday, May 11, 2010.

NON-GAAP MEASURE

Cash flow from operations is a financial measure not prescribed

by Canadian generally accepted accounting principles ("GAAP") and

is not likely to be comparable to similar measures presented by

other issuers. Management considers it to be useful information to

assist knowledgeable investors in evaluating the cash generating

capabilities of the Company.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX: SJ) is a leading producer and marketer

of pressure treated wood products. The Company supplies North

America's railroad operators with railway ties, timbers and

recycling services; and the continent's electrical utilities and

telecommunications companies with utility poles. Stella-Jones also

provides industrial lumber and services for construction and marine

applications, as well as consumer lumber to retailers and

wholesalers for outdoor applications. The Company's common shares

are listed on the Toronto Stock Exchange.

Except for historical information provided herein, this press

release may contain information and statements of a forward-looking

nature concerning the future performance of the Company. These

statements are based on suppositions and uncertainties as well as

on management's best possible evaluation of future events. Such

factors may include, without excluding other considerations,

fluctuations in quarterly results, evolution in customer demand for

the Company's products and services, the impact of price pressures

exerted by competitors, the ability of the Company to raise the

capital required for acquisitions, and general market trends or

economic changes. As a result, readers are advised that actual

results may differ from expected results.

Note to readers: Complete unaudited first-quarter financial

statements are available on Stella-Jones' website at

www.stella-jones.com

Contacts: Source: Stella-Jones Inc. Stella-Jones Inc. George T.

Labelle, CA Senior Vice-President and Chief Financial Officer

514-934-8665 glabelle@stella-jones.com MaisonBrison Martin Goulet,

CFA 514-731-0000 martin@maisonbrison.com

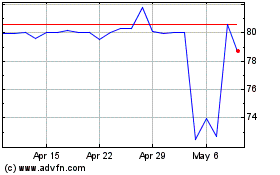

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jul 2023 to Jul 2024