Quebecor Inc. ("Quebecor" or the "Corporation")

(TSX:QBR.A)(TSX:QBR.B) today reported its consolidated financial

results for the second quarter of 2012. Quebecor consolidates the

financial results of its Quebecor Media Inc. ("Quebecor Media")

subsidiary, in which it holds a 54.7% interest.

Second quarter 2012 highlights

-- Revenues: $1.09 billion, up $33.0 million (3.1%) from the second quarter

of 2011.

-- Operating income:(1) down $0.7 million (-0.2%) to $357.8 million.

-- Net income attributable to shareholders: $67.0 million ($1.05 per basic

share), up $11.8 million ($0.19 per basic share) from $55.2 million

($0.86 per basic share) in the second quarter of 2011.

-- Adjusted income from continuing operations:(2) $48.7 million ($0.77 per

basic share), down $11.3 million ($0.16 per basic share) from $60.0

million ($0.93 per basic share) in the second quarter of 2011.

-- Revenue increases for all the core services of Videotron Ltd.

("Videotron"): Internet access ($20.4 million or 11.9%), cable

television ($15.4 million or 6.1%), mobile telephony service ($14.8

million or 56.9%), and cable telephony service ($4.9 million or 4.5%).

-- Telecommunications segment's operating income: up $27.5 million (10.0%).

"Quebecor's revenues rose by 3.1% in the second quarter of 2012,

mainly because of sustained growth in Videotron's sales," said

Pierre Karl Peladeau, President and Chief Executive Officer of

Quebecor. "Our second quarter results were marked by the

Telecommunications segment's excellent results while our News Media

segment's results declined from the same period of 2011, mainly

because of significant investments in, among other things, the

distribution network and the publishing of community newspapers.

However, the newspaper publishing and printing operations posted

the highest operating margins, expressed as a percentage of

revenues, of all the major industry players in the second quarter

of 2012. We also made major investments in expanding the specialty

services of TVA Group Inc. ("TVA Group"), so that their financial

performance will no longer be entirely dependent on the

conventional television network's results.

"Videotron continued to grow despite the fiercely competitive

environment. The mobile telephony service attracted new customers

and generated additional revenue streams. We continued our business

strategy, which is based on bundling services into attractive

packages, coupled with superior product quality and outstanding

customer service. Revenues from Videotron's core services were all

up significantly, boosting the Telecommunications segment's

operating income by $27.5 million, a 10.0% increase from the same

quarter of 2011. Videotron also posted a net increase of 31,100

revenue generating units(3) during the second quarter of 2012. The

illico TV new generation service was rolled out across all of

Videotron's service area during the quarter and more than six

million Quebecers now have access to the new cable television

service, which is distinguished by its user-friendliness and

superior interfaces. Videotron also launched Ultimate Speed

Internet 200, an Internet access service that sets a new standard

for speed.

(1) See "Operating income" under "Definitions."

(2) See "Adjusted income from continuing operations" under "Definitions."

(3) Revenue generating units are the sum of cable television, cable and

wireless Internet access, and cable telephony service subscriptions,

plus subscriber connections to the mobile telephony service.

"The News Media segment was busy during the second quarter of

2012, acquiring Pub Extra magazine and the weekly L'Impact de

Drummondville, and launching L'Echo de Victoriaville. Quebecor

Media's Quebec community newspapers network now has a combined

weekly circulation of over 2.5 million copies.

"To offer its customers expanded media exposure and broaden its

convergence strategy, Quebecor Media has entered an entirely new

media platform. Quebecor Media was chosen through a call for

tenders to install, maintain and advertise on Societe de transport

de Montreal (STM) bus shelters for the next 20 years. For us, this

is a promising move into a line of business that is experiencing

significant technological change.

"In the field of electronic media, Quebecor Media announced a

partnership with ReadBooks SAS, a Franco-Quebec company

specializing in ebooks. The partnership will support the

development of new software for Archambault Group Inc.

("Archambault Group") and Librairie Paragraphe Bookstore that will

allow them to increase their offerings and enhance their customers'

reading experience.

"Finally, on another front, Quebecor Media welcomed with great

satisfaction the Quebec Superior Court judgements of July 23, 2012

ordering Bell TV (formerly Bell ExpressVu) to compensate Videotron

and TVA Group. The court found that Bell TV committed serious

misconduct by not taking the appropriate measures at the opportune

time to prevent the illegal decoding of its satellite television

signals, even though it knew the extent of the piracy of its system

and had the required technology at its disposal to end it. We were

glad to see Superior Court rule against Bell for resorting to

illegal means that weaken its competitors and for having failed to

meet its obligations to protect rather than undermine the integrity

of the Quebec and Canadian broadcasting industry.

"In the first half of 2012, Quebecor actively pursued its

customer, product and business development strategies, combined

with vigorous operating cost-control initiatives, in order to

achieve its long-term growth and profitability targets."

Table 1

Quebecor second quarter financial highlights, 2008 to 2012

(in millions of Canadian dollars, except per share data)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012(1) 2011(1) 2010(1) 2009(2) 2008(2)

----------------------------------------------------------------------------

Revenues $ 1,086.4 $ 1,053.4 $ 994.0 $ 946.4 $ 949.9

Operating

income(3) 357.8 358.5 351.9 315.9 276.9

Net income

attributable to

shareholders 67.0 55.2 60.8 76.8 57.5

Adjusted income

from continuing

operations(4) 48.7 60.0 62.9 56.3 41.5

Per basic share:

Net income

attributable

to

shareholders 1.05 0.86 0.95 1.19 0.90

Adjusted

income from

continuing

operations(4) 0.77 0.93 0.98 0.88 0.61

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Financial figures for the second quarters of years 2010 to 2012 are

presented in accordance with International Financial Reporting

Standards ("IFRS").

(2) Financial figures for the second quarters of years 2008 and 2009 are

presented in accordance with Canadian Generally Accepted Accounting

Principles ("GAAP").

(3) See "Operating income" under "Definitions."

(4) See "Adjusted income from continuing operations" under "Definitions."

2012/2011 second quarter comparison

Revenues: $1.09 billion, an increase of $33.0 million

(3.1%).

-- Revenues increased in Telecommunications ($50.7 million or 8.4% of

segment revenues) and Interactive Technologies and Communications ($11.2

million or 39.7%).

-- Revenues decreased in News Media ($12.7 million or -4.7%), Leisure and

Entertainment ($8.6 million or -12.0%) and Broadcasting ($2.1 million or

-1.8%).

Operating income: $357.8 million, a decrease of $0.7 million

(-0.2%).

-- Operating income decreased in News Media ($9.3 million or -20.4% of

segment operating income), Leisure and Entertainment ($7.4 million),

Broadcasting ($2.6 million or -11.7%), and Head Office ($10.6 million).

The decrease at Head Office was caused mainly by the unfavourable

variation in the fair value of stock options, as well as higher

operating expenses, including the donations and sponsorships expense.

-- Operating income increased in Telecommunications ($27.5 million or

10.0%) and Interactive Technologies and Communications ($1.7 million or

130.8%).

-- The change in the fair value of Quebecor Media stock options resulted in

a $5.0 million unfavourable variance in the stock-based compensation

charge in the second quarter of 2012 compared with the same period of

2011. The change in the fair value of Quebecor stock options resulted in

a $7.8 million unfavourable variance in the Corporation's stock-based

compensation charge in the second quarter of 2012.

Net income attributable to shareholders: $67.0 million ($1.05

per basic share) compared with $55.2 million ($0.86 per basic

share) in the second quarter of 2011, an increase of $11.8 million

($0.19 per basic share).

-- The increase was due mainly to:

-- $45.9 million favourable variance in gain on valuation and

translation of financial instruments;

-- $18.6 million favourable variance in charge for restructuring of

operations, impairment of assets and other special items.

-- Offset by:

-- $22.7 million increase in amortization charge.

Adjusted income from continuing operations: $48.7 million in the

second quarter of 2012 ($0.77 per basic share) compared with $60.0

million ($0.93 per basic share) in the same period of 2011, a

decrease of $11.3 million ($0.16 per basic share).

2012/2011 year-to-date comparison

Revenues: $2.15 billion, an increase of $106.5 million

(5.2%).

-- Revenues increased in Telecommunications ($113.3 million or 9.6% of

segment revenues), Interactive Technologies and Communications ($21.0

million or 38.2%) and Broadcasting ($8.6 million or 3.8%).

-- Revenues decreased in News Media ($19.7 million or -3.9%) and Leisure

and Entertainment ($2.9 million or -2.2%).

Operating income: $680.0 million, an increase of $27.2 million

(4.2%).

-- Operating income increased in Telecommunications ($76.0 million or 14.4%

of segment operating income) and Interactive Technologies and

Communications ($3.8 million or 172.7%).

-- Operating income decreased in News Media ($21.0 million or -28.4%),

Broadcasting ($13.0 million or -48.3%), Leisure and Entertainment ($8.3

million), and Head Office ($10.3 million). The decrease at Head Office

was caused mainly by the unfavourable variance in the fair value of

stock options.

-- The change in the fair value of Quebecor Media stock options resulted in

a $9.7 million unfavourable variance in the stock-based compensation

charge in the first half of 2012 compared with the same period of 2011.

The change in the fair value of Quebecor stock options resulted in a

$14.3 million unfavourable variance in the Corporation's stock-based

compensation charge in the first half of 2012.

Net income attributable to shareholders: $139.9 million ($2.20

per basic share) compared with $89.5 million ($1.39 per basic

share) in the first half of 2011, an increase of $50.4 million

($0.81 per basic share).

-- The increase was due mainly to:

-- $117.3 million favourable variance in gain on valuation and

translation of financial instruments;

-- $27.2 million increase in operating income;

-- $27.0 million favourable variance in charge for restructuring of

operations, impairment of assets and other special items.

-- Partially offset by:

-- $43.2 million increase in amortization charge;

-- $14.5 million goodwill impairment charge recognized in the first

half of 2012.

Adjusted income from continuing operations: $88.0 million in the

first half of 2012 ($1.39 per basic share) compared with $95.9

million ($1.49 per basic share) in the same period of 2011, a

decrease of $7.9 million ($0.10 per basic share).

Dividends

On August 8, 2012, the Board of Directors of Quebecor declared a

quarterly dividend of $0.05 per share on Class A Multiple Voting

Shares ("Class A shares") and Class B Subordinate Voting Shares

("Class B shares") payable on September 18, 2012 to shareholders of

record at the close of business on August 24, 2012. This dividend

is designated to be an eligible dividend, as provided under

subsection 89(14) of the Canadian Income Tax Act and its provincial

counterpart.

Normal course issuer bid

The Board of Directors of Quebecor has authorized a normal

course issuer bid for a maximum of 980,357 Class A shares,

representing approximately 5% of the issued and outstanding Class A

shares, and for a maximum of 4,351,276 Class B shares, representing

approximately 10% of the public float for the Class B shares as of

July 31, 2012.

The purchases will be made from August 13, 2012 to August 12,

2013, at prevailing market prices, on the open market through the

facilities of the Toronto Stock Exchange and will be made in

accordance with the requirements of said Exchange. All shares

purchased will be cancelled. As of July 31, 2012, 19,607,151 Class

A Shares and 43,725,831 Class Bshares were issued and

outstanding.

The average daily trading volume of the Class A shares and the

Class B shares of the Corporation from February 1, 2012 to July 31,

2012 has been 979 Class A shares and 110,324 Class B shares.

Consequently, the Corporation will be authorized to purchase a

maximum of 1,000 Class A shares and of 27,581 Class B shares during

the same trading day pursuant to its normal course issued bid.

The Corporation believes that the repurchase of these shares,

pursuant to this normal course issuer bid, is in the best interest

of the Corporation and its shareholders.

Within the past twelve months, the Corporation has not

repurchased any outstanding Class A shares and has repurchased

1,121,500 Class B Shares at a volume weighted average price of

$33.2596 per share.

Shareholders may obtain a copy of the Notice filed with the

Toronto Stock Exchange, without charge, by contacting the

Secretary's office of the Corporation at (514) 380-1994.

Detailed financial information

For a detailed analysis of Quebecor's second quarter 2012

results, please refer to the Management Discussion and Analysis and

consolidated financial statements of Quebecor, available on the

Corporation's website at:

http://www.quebecor.com/en/quarterly_doc_quebecor_inc or from the

SEDAR filing service at www.sedar.com.

Conference call for investors and webcast

Quebecor will hold a conference call to discuss its second

quarter 2012 results on August 9, 2012, at 11 a.m. EDT. There will

be a question period reserved for financial analysts. To access the

conference call, please dial 1 877 293-8052, access code for

participants 58308#. A tape recording of the call will be available

from August 9 to November 9, 2012 by dialling 1 877 293-8133,

conference number 801836#, access code for participants 58308#. The

conference call will also be broadcast live on Quebecor's website

at www.quebecor.com/en/content/conference-call. It is advisable to

ensure the appropriate software is installed before accessing the

call. Instructions and links to free player downloads are available

at the Internet address shown above.

Cautionary statement regarding forward-looking statements

The statements in this press release that are not historical

facts are forward-looking statements and are subject to significant

known and unknown risks, uncertainties and assumptions that could

cause Quebecor's actual results for future periods to differ

materially from those set forth in the forward-looking statements.

Forward-looking statements may be identified by the use of the

conditional or by forward-looking terminology such as the terms

"plans," "expects," "may," "anticipates," "intends," "estimates,"

"projects," "seeks," "believes," or similar terms, variations of

such terms or the negative of such terms. Certain factors that may

cause actual results to differ from current expectations include

seasonality (including seasonal fluctuations in customer orders),

operating risk (including fluctuations in demand for Quebecor's

products and pricing actions by competitors), insurance risk, risks

associated with capital investment (including risks related to

technological development and equipment availability and

breakdown), environmental risks, risks associated with labour

agreements, risks associated with commodities and energy prices

(including fluctuations in the cost and availability of raw

materials), credit risk, financial risks, debt risks, risks related

to interest rate fluctuations, foreign exchange risks, risks

associated with government acts and regulations, risks related to

changes in tax legislation, and changes in the general political

and economic environment. Investors and others are cautioned that

the foregoing list of factors that may affect future results is not

exhaustive and that undue reliance should not be placed on any

forward-looking statements. For more information on the risks,

uncertainties and assumptions that could cause Quebecor's actual

results to differ from current expectations, please refer to

Quebecor's public filings available at www.sedar.com and

www.quebecor.com including, in particular, the "Risks and

Uncertainties" section of Quebecor's Management Discussion and

Analysis for the year ended December 31, 2011.

The forward-looking statements in this press release reflect

Quebecor's expectations as of August 9, 2012, and are subject to

change after that date. Quebecor expressly disclaims any obligation

or intention to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by applicable securities laws.

The Corporation

Quebecor Inc. (TSX:QBR.A)(TSX:QBR.B) is a holding company with a

54.7% interest in Quebecor Media Inc., one of Canada's largest

media groups, with more than 16,000 employees. Quebecor Media Inc.,

through its subsidiary Videotron Ltd., is an integrated

communications company engaged in cable television, interactive

multimedia development, Internet access services, cable telephony,

and mobile telephony. Through Sun Media Corporation, Quebecor Media

Inc. is the largest publisher of newspapers in Canada. It also

operates Canoe.ca and its network of English- and French-language

Internet properties in Canada. In the broadcasting sector, Quebecor

Media Inc. operates, through TVA Group Inc., the number one

French-language general-interest television network in Quebec, a

number of specialty channels and the SUN News English-language

channel. Another subsidiary of Quebecor Media Inc., Nurun Inc., is

a major interactive technologies and communications agency with

offices in Canada, the United States, Europe and Asia. Quebecor

Media Inc. is also active in magazine publishing (TVA Publishing

Inc.), video game development (BlooBuzz Studios Holding, L.P.),

book publishing and distribution (Sogides Group Inc. and CEC

Publishing Inc.), the production, distribution and retailing of

cultural products (Archambault Group Inc. and TVA Films), DVD,

Blu-ray disc and videogame rental and retailing (Le SuperClub

Videotron ltee), the printing and distribution of regional

newspapers and flyers (Quebecor Media Printing Inc. and Quebecor

Media Network Inc.), news content production and distribution (QMI

Agency), multiplatform advertising solutions (QMI Sales), and the

publishing of printed and online directories, through Quebecor

MediaPages(TM).

DEFINITIONS

Operating income

In its analysis of operating results, the Corporation defines

operating income, as reconciled to net income under IFRS, as net

income before amortization, financial expenses, gain (loss) on

valuation and translation of financial instruments, charge for

restructuring of operations, impairment of assets and other special

items, impairment of goodwill, loss on debt refinancing, and income

tax. Operating income as defined above is not a measure of results

that is consistent with IFRS. It is not intended to be regarded as

an alternative to other financial operating performance measures or

to the statement of cash flows as a measure of liquidity. It should

not be considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. The Corporation uses

operating income in order to assess the performance of its

investment in Quebecor Media. The Corporation's management and

Board of Directors use this measure in evaluating its consolidated

results as well as the results of the Corporation's operating

segments. This measure eliminates the significant level of

depreciation and amortization of tangible and intangible assets and

is unaffected by the capital structure or investment activities of

the Corporation and its segments. Operating income is also relevant

because it is a significant component of the Corporation's annual

incentive compensation programs. A limitation of this measure,

however, is that it does not reflect the periodic costs of tangible

and intangible assets used in generating revenues in the

Corporation's segments. The Corporation also uses other measures

that do reflect such costs, such as cash flows from segment

operations and free cash flows from operations. In addition,

measures like operating income are commonly used by the investment

community to analyze and compare the performance of companies in

the industries in which the Corporation is engaged. The

Corporation's definition of operating income may not be the same as

similarly titled measures reported by other companies.

Table 2 below provides a reconciliation of operating income to

net income, as disclosed in Quebecor's condensed consolidated

financial statements.

Table 2

Reconciliation of the operating income measure used in this press release to

the net income measure used in the condensed consolidated financial

statements

(in millions of Canadian dollars)

Three months ended June 30 Six months ended June 30

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

Operating income

(loss):

Telecommunications $ 301.7 $ 274.2 $ 604.7 $ 528.7

News Media 36.4 45.7 53.0 74.0

Broadcasting 19.7 22.3 13.9 26.9

Leisure and

Entertainment (1.1) 6.3 (0.8) 7.5

Interactive

Technologies and

Communications 3.0 1.3 6.0 2.2

Head Office (1.9) 8.7 3.2 13.5

----------------------------------------------------------------------------

357.8 358.5 680.0 652.8

Amortization (144.2) (121.5) (286.2) (243.0)

Financial expenses (79.1) (80.4) (162.3) (161.8)

Gain (loss) on

valuation and

translation of

financial

instruments 41.9 (4.0) 123.8 6.5

Restructuring of

operations,

impairment of

assets and other

special items 12.0 (6.6) 10.9 (16.1)

Impairment of

goodwill - - (14.5) -

Loss on debt

refinancing - - (7.3) (9.3)

Income taxes (52.0) (40.0) (91.8) (59.8)

----------------------------------------------------------------------------

Net income $ 136.4 $ 106.0 $ 252.6 $ 169.3

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Adjusted income from continuing operations

The Corporation defines adjusted income from continuing

operations, as reconciled to net income attributable to

shareholders under IFRS, as net income attributable to shareholders

before gain (loss) on valuation and translation of financial

instruments, charge for restructuring of operations, impairment of

assets and other special items, impairment of goodwill and loss on

debt refinancing, net of income tax and net income attributable to

non-controlling interests. Adjusted income from continuing

operations, as defined above, is not a measure of results that is

consistent with IFRS. It should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS. The Corporation's definition of adjusted income from

continuing operating activities may not be identical to similarly

titled measures reported by other companies.

Table 3 provides a reconciliation of adjusted income from

continuing operations to the net income attributable to

shareholders measure used in Quebecor's condensed consolidated

financial statements.

Table 3

Reconciliation of the adjusted income from continuing operations measure

used in this press release to the net income attributable to shareholders

measure used in the condensed consolidated financial statements

(in millions of Canadian dollars)

Three months ended June 30 Six months ended June 30

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

Adjusted income from

continuing

operations $ 48.7 $ 60.0 $ 88.0 $ 95.9

Gain (loss) on

valuation and

translation of

financial

instruments 41.9 (4.0) 123.8 6.5

Restructuring of

operations,

impairment of

assets and other

special items 12.0 (6.6) 10.9 (16.1)

Impairment of

goodwill - - (14.5) -

Loss on debt

refinancing - - (7.3) (9.3)

Income taxes related

to adjustments(1) (13.2) 1.7 (26.5) 6.1

Net income

attributable to

non-controlling

interest related to

adjustments (22.4) 4.1 (34.5) 6.4

----------------------------------------------------------------------------

Net income

attributable to

shareholders $ 67.0 $ 55.2 $ 139.9 $ 89.5

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Includes the impact of fluctuations in tax rates applicable to

adjusted items, either for statutory reasons or in connection with tax

transactions.

Average Monthly Revenue per User

Average monthly revenue per user ("ARPU") is an industry metric

that the Corporation uses to measure its monthly cable television,

Internet access, cable telephony and mobile telephony revenues per

average basic cable customer. ARPU is not a measurement that is

consistent with IFRS and the Corporation's definition and

calculation of ARPU may not be the same as identically titled

measurements reported by other companies. The Corporation

calculates ARPU by dividing its combined cable television, Internet

access, cable telephony and mobile telephony revenues by the

average number of basic customers during the applicable period, and

then dividing the resulting amount by the number of months in the

applicable period.

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(in millions of Canadian

dollars, except for

earnings per share data)

Three months ended Six months ended

(unaudited) June 30 June 30

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

Revenues

Telecommunications $ 651.8 $ 601.1 $ 1,297.6 $ 1,184.3

News Media 254.8 267.5 487.9 507.6

Broadcasting 115.4 117.5 233.2 224.6

Leisure and Entertainment 62.9 71.5 130.0 132.9

Interactive Technologies

and Communications 39.4 28.2 76.0 55.0

Inter-segment (37.9) (32.4) (74.3) (60.5)

------------------------------------------------

1,086.4 1,053.4 2,150.4 2,043.9

Cost of sales, selling and

administrative expenses 728.6 694.9 1,470.4 1,391.1

Amortization 144.2 121.5 286.2 243.0

Financial expenses 79.1 80.4 162.3 161.8

(Gain) loss on valuation and

translation of financial

instruments (41.9) 4.0 (123.8) (6.5)

Restructuring of operations,

impairment of assets and

other special items (12.0) 6.6 (10.9) 16.1

Impairment of goodwill - - 14.5 -

Loss on debt refinancing - - 7.3 9.3

------------------------------------------------

Income before income taxes 188.4 146.0 344.4 229.1

Income taxes:

Current 20.3 (5.5) 25.8 (5.1)

Deferred 31.7 45.5 66.0 64.9

------------------------------------------------

52.0 40.0 91.8 59.8

------------------------------------------------

Net income $ 136.4 $ 106.0 $ 252.6 $ 169.3

------------------------------------------------

------------------------------------------------

Net income attributable to:

Shareholders $ 67.0 $ 55.2 $ 139.9 $ 89.5

Non-controlling interests 69.4 50.8 112.7 79.8

------------------------------------------------

------------------------------------------------

Earnings per share

attributable to

shareholders

Basic $ 1.05 $ 0.86 $ 2.20 $ 1.39

Diluted 1.05 0.85 2.19 1.37

------------------------------------------------

------------------------------------------------

Weighted average number of

shares outstanding (in

millions) 63.5 64.3 63.5 64.3

Weighted average number of

diluted shares (in

millions) 63.6 65.0 63.6 65.0

------------------------------------------------

------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in millions of Canadian

dollars)

Three months ended Six months ended

(unaudited) June 30 June 30

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

Net income $ 136.4 $ 106.0 $ 252.6 $ 169.3

Other comprehensive income

(loss) :

(Loss) gain on translation

of net investments in

foreign operations (0.4) 0.3 (0.8) 0.8

Cash flow hedges:

Gain (loss) on valuation

of derivative financial

instruments 6.5 (6.8) 25.4 (6.0)

Deferred income taxes (3.2) 0.7 (0.9) 2.9

Defined benefit plans:

Net change in asset

limit or in minimum

funding liability - (0.1) - (0.2)

Deferred income taxes - 0.1 - 0.1

Reclassification to

income:

Other comprehensive

income related to cash

flow hedges - - (3.3) -

Deferred income taxes - - (1.2) -

------------------------------------------------

2.9 (5.8) 19.2 (2.4)

------------------------------------------------

Comprehensive income $ 139.3 $ 100.2 $ 271.8 $ 166.9

------------------------------------------------

------------------------------------------------

Attributable to:

Shareholders $ 68.6 $ 51.8 $ 150.4 $ 88.0

Non-controlling interests 70.7 48.4 121.4 78.9

------------------------------------------------

------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

SEGMENTED INFORMATION

(in millions of Canadian

dollars)

Three months ended Six months ended

(unaudited) June 30 June 30

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

Net income before

amortization, financial

expenses, (gain) loss on

valuation and translation of

financial instruments,

restructuring of operations,

impairment of assets and

other special items,

impairment of goodwill, loss

on debt refinancing and

income taxes

Telecommunications $ 301.7 $ 274.2 $ 604.7 $ 528.7

News Media 36.4 45.7 53.0 74.0

Broadcasting 19.7 22.3 13.9 26.9

Leisure and Entertainment (1.1) 6.3 (0.8) 7.5

Interactive Technologies and

Communications 3.0 1.3 6.0 2.2

Head Office (1.9) 8.7 3.2 13.5

----------------------------------------------

$ 357.8 $ 358.5 $ 680.0 $ 652.8

----------------------------------------------

----------------------------------------------

Amortization

Telecommunications $ 119.3 $ 99.6 $ 236.7 $ 199.9

News Media 14.7 13.8 29.2 26.8

Broadcasting 5.3 4.3 10.6 8.4

Leisure and Entertainment 2.6 2.1 5.1 4.4

Interactive Technologies and

Communications 1.4 0.8 2.8 1.6

Head Office 0.9 0.9 1.8 1.9

----------------------------------------------

$ 144.2 $ 121.5 $ 286.2 $ 243.0

----------------------------------------------

----------------------------------------------

Additions to property, plant

and equipment

Telecommunications $ 161.5 $ 160.4 $ 345.0 $ 337.6

News Media 1.6 2.5 3.5 8.4

Broadcasting 6.8 6.5 12.1 15.4

Leisure and Entertainment 0.9 1.2 1.8 1.6

Interactive Technologies and

Communications 1.1 2.2 2.2 3.2

Head Office 0.7 0.3 1.2 0.7

----------------------------------------------

$ 172.6 $ 173.1 $ 365.8 $ 366.9

----------------------------------------------

----------------------------------------------

Additions to intangible assets

Telecommunications $ 14.8 $ 14.8 $ 33.7 $ 31.7

News Media 3.3 3.3 6.1 5.4

Broadcasting 0.7 1.2 1.3 2.0

Leisure and Entertainment 2.1 1.4 2.8 2.6

Inter-segment (0.5) - (1.0) -

----------------------------------------------

$ 20.4 $ 20.7 $ 42.9 $ 41.7

----------------------------------------------

----------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(in millions of Canadian dollars)

(unaudited)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Equity attributable to shareholders

--------------------------------------

Accumu- Equity

lated attri-

other butable

com- to non-

Contri- prehen- control-

Capital buted Retained sive ling Total

stock surplus earnings income interests equity

----------------------------------------------------------------------------

Balance as of

December 31,

2010 $ 346.6 $ 0.9 $ 943.6 $ 13.7 $ 1,346.9 $2,651.7

Net income - - 89.5 - 79.8 169.3

Other

comprehensive

loss - - - (1.5) (0.9) (2.4)

Issuance of

shares of a

subsidiary - - - - 1.0 1.0

Dividends - - (6.4) - (23.8) (30.2)

----------------------------------------------------------------------------

Balance as of

June 30, 2011 346.6 0.9 1,026.7 12.2 1,403.0 2,789.4

Net income - - 111.5 - 102.2 213.7

Other

comprehensive

loss - - (31.5) (3.6) (38.1) (73.2)

Repurchase of

Class B shares (7.1) - (23.1) - - (30.2)

Dividends - - (6.4) - (22.7) (29.1)

----------------------------------------------------------------------------

Balance as of

December 31,

2011 339.5 0.9 1,077.2 8.6 1,444.4 2,870.6

Net income - - 139.9 - 112.7 252.6

Other

comprehensive

income - - - 10.5 8.7 19.2

Issuance of

Class B shares 3.6 1.5 - - - 5.1

Repurchase of

Class B shares (1.1) - (4.2) - - (5.3)

Acquisition of

non-controlling

interests - (0.1) - - 0.1 -

Dividends - - (6.3) - (22.7) (29.0)

----------------------------------------------------------------------------

Balance as of

June 30, 2012 $ 342.0 $ 2.3 $ 1,206.6 $ 19.1 $ 1,543.2 $3,113.2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions of Canadian

dollars)

Three months ended Six months ended

(unaudited) June 30 June 30

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012 2011 2012 2011

----------------------------------------------------------------------------

Cash flows related to

operating activities

Net income $ 136.4 $ 106.0 $ 252.6 $ 169.3

Adjustments for:

Amortization of

property, plant and

equipment 109.7 92.9 218.6 185.9

Amortization of

intangible assets 34.5 28.6 67.6 57.1

(Gain) loss on valuation

and translation of

financial instruments (41.9) 4.0 (123.8) (6.5)

Gain on business

disposals (12.9) - (12.9) -

Impairment of goodwill - - 14.5 -

Loss on debt refinancing - - 7.3 9.3

Amortization of

financing costs and

long-term debt discount 3.6 2.9 7.3 5.9

Deferred income taxes 31.7 45.5 66.0 64.9

Other (1.2) (0.5) 1.7 (0.2)

------------------------------------------------

259.9 279.4 498.9 485.7

Net change in non-cash

balances related to

operating activities (31.8) (137.9) (33.5) (173.5)

------------------------------------------------

Cash flows provided by

operating activities 228.1 141.5 465.4 312.2

------------------------------------------------

Cash flows related to

investing activities

Business acquisitions, net

of cash and cash

equivalents (0.8) (5.0) (0.8) (50.1)

Business disposals, net of

cash and cash equivalents 17.9 - 17.9 -

Additions to property,

plant and equipment (172.6) (173.1) (365.8) (366.9)

Additions to intangible

assets (20.4) (20.7) (42.9) (41.7)

Proceeds from disposals of

assets 1.2 4.0 2.4 5.0

Other (1.0) 0.7 (1.0) 2.8

------------------------------------------------

Cash flows used in investing

activities (175.7) (194.1) (390.2) (450.9)

------------------------------------------------

Cash flows related to

financing activities

Net change in bank

indebtedness 4.7 0.3 2.1 (2.9)

Net change under revolving

credit facilities (24.2) (2.6) (22.9) (10.9)

Issuance of long-term

debt, net of financing

fees - - 787.6 319.9

Repayment of long-term

debt (190.9) (1.3) (709.0) (226.2)

Settlement of hedging

contracts (3.6) - (44.1) (105.4)

Issuance of Class B shares - - 3.6 -

Repurchase of Class B

shares (4.9) - (5.3) -

Dividends (6.3) (3.2) (6.3) (3.2)

Dividends paid to non-

controlling interests (11.4) (12.5) (22.7) (23.8)

Other - 1.0 - 1.0

------------------------------------------------

Cash flows used in financing

activities (236.6) (18.3) (17.0) (51.5)

------------------------------------------------

Net change in cash and cash

equivalents (184.2) (70.9) 58.2 (190.2)

Effect of exchange rate

changes on cash and cash

equivalents denominated in

foreign currencies (0.2) 0.1 (0.2) 0.3

Cash and cash equivalents at

beginning of period 388.8 123.6 146.4 242.7

------------------------------------------------

Cash and cash equivalents at

end of period $ 204.4 $ 52.8 $ 204.4 $ 52.8

------------------------------------------------

------------------------------------------------

Cash and cash equivalents

consist of

Cash $ 18.4 $ - $ 18.4 $ -

Cash equivalents 186.0 52.8 186.0 52.8

------------------------------------------------

$ 204.4 $ 52.8 $ 204.4 $ 52.8

------------------------------------------------

------------------------------------------------

Interest and taxes reflected

as operating activities

Cash interest payments $ 129.7 $ 127.1 $ 151.1 $ 163.2

Cash income tax payments

(net of refunds) 2.4 6.0 7.5 34.0

------------------------------------------------

------------------------------------------------

QUEBECOR INC. AND ITS SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions of Canadian dollars)

(unaudited) June 30 December 31

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012 2011

----------------------------------------------------------------------------

Assets

Current assets

Cash and cash equivalents $ 204.4 $ 146.4

Accounts receivable 565.3 603.7

Income taxes 13.7 29.0

Inventories 257.8 283.6

Prepaid expenses 53.6 31.3

---------------------------------------

1,094.8 1,094.0

Non-current assets

Property, plant and equipment 3,289.9 3,211.1

Intangible assets 1,007.1 1,041.0

Goodwill 3,529.5 3,543.8

Derivative financial instruments 52.3 34.9

Deferred income taxes 17.8 20.6

Other assets 96.6 93.4

---------------------------------------

7,993.2 7,944.8

---------------------------------------

Total assets $ 9,088.0 $ 9,038.8

---------------------------------------

---------------------------------------

Liabilities and equity

Current liabilities

Bank indebtedness $ 6.3 $ 4.2

Accounts payable and accrued

charges 631.3 776.5

Provisions 23.0 33.7

Deferred revenue 294.5 295.7

Income taxes 4.3 2.7

Derivative financial instruments 24.1 -

Current portion of long-term debt 215.4 114.5

---------------------------------------

1,198.9 1,227.3

Non-current liabilities

Long-term debt 3,536.4 3,688.3

Derivative financial instruments 242.9 315.4

Other liabilities 338.8 344.7

Deferred income taxes 657.8 592.5

---------------------------------------

4,775.9 4,940.9

Equity

Capital stock 342.0 339.5

Contributed surplus 2.3 0.9

Retained earnings 1,206.6 1,077.2

Accumulated other comprehensive

income 19.1 8.6

---------------------------------------

Equity attributable to shareholders 1,570.0 1,426.2

Non-controlling interests 1,543.2 1,444.4

---------------------------------------

3,113.2 2,870.6

---------------------------------------

Total liabilities and equity $ 9,088.0 $ 9,038.8

---------------------------------------

---------------------------------------

Contacts: Jean-Francois Pruneau Chief Financial Officer Quebecor

Inc. and Quebecor Media Inc.jean-francois.pruneau@quebecor.com

(514) 380-4144 J. Serge Sasseville Senior Vice President, Corporate

and Institutional Affairs Quebecor Media

Inc.serge.sasseville@quebecor.com (514) 380-1864

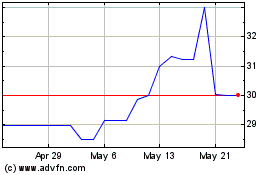

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024