Parex Resources Achieves Record Production of 18,000 bopd

January 09 2014 - 3:45PM

Marketwired Canada

NOT FOR DISTRIBUTION OR FOR DISSEMINATION IN THE UNITED STATES

Parex Resources Inc. ("Parex" or the "Company") (TSX:PXT), a company focused on

Colombian oil exploration and production, is pleased to provide an operational

update.

Production: Average production for the periods below was approximately:

-- October 1-December 31, 2013 (Q4): 17,285 bopd, an increase of 35% over

the fourth quarter of 2012 and 7% greater than the prior quarter

production;

-- December 1-December 31: 18,000 bopd with the addition of Tigana-1,

Tigana Sur-1 and La Casona-2 test volumes; and

-- Full year 2013: 15,850 bopd, an increase of 39% over the full year of

2012; and

-- Preliminary analysis indicates that crude oil inventory remained

relatively flat from the prior quarter to December 31, 2013. Accordingly

we expect Q4 crude oil sales to be in-line with Q4 crude oil production.

Tigana & Tigana-Sur (Non-Operated, Block LLA-34, WI 45%): On December 11, 2013

Parex reported the initial Tigana-1 test rates from the Guadalupe Formation as

approximately 1,600 bopd of 15 degrees API oil with a water-cut of 0.8%, prior

to shutting the well in for pressure build-up.

The service rig was moved to the Tigana Sur-1 well, located 1,200 meters

southwest of Tigana-1, to test the Guadalupe Formation. Tigana Sur-1 commenced

production with an Electric Submersible Pump (ESP) on December 13, 2013 and was

produced for a period of 144 hours prior to shut in for a 10 day build-up test.

A total of 7,800 barrels of oil was recovered during the test at an average rate

of 1,300 bopd. On December 30, 2013 the well resumed production and was tested

at peak rates in excess of 2,800 bopd with final measured water-cut of 0.5%.

The service rig was then moved back to the Tigana-1 well to test one of five

potential zones in the Mirador Formation. Using an ESP, the well was tested for

141 hours and a total of 14,554 barrels of oil was recovered for an average test

rate of 2,477 bopd of field measured 20 degrees API oil. The final measured

water-cut in the well was 0.1% prior to shut-in for pressure build-up. The

Tigana Sur-1 well is also prospective in four potential zones in the Mirador

Formation and we plan to test these zones in 2014.

The drilling rig is currently drilling a delineation well at Tua-6. Following

rig release, the rig will return to the Tigana/Tigana Sur pad to drill one or

two delineation wells, while waiting on the construction of new pads that will

enable additional delineation of the Tigana-1 and Tigana Sur-1 discoveries.

Akira (Operated, Cabrestero Block, WI 100%): The Akira-5 well was drilled 1,300

meters west of the Akira-2 well and 150 feet below the lowest known oil as

defined by the Akira-2 well. Parex is currently testing the Akira-5 well. As

previously reported, the Akira-6 well was cased and will be completed to

coincide with the commissioning of the oil treatment plant in March 2014.

Adalia (Operated, Block LLA-30, WI 100%): The Adalia-3 well was drilled

approximately 600 meters west of the Adalia-1 location and encountered pay in

the C5 interval. A limited swab test was conducted with the drilling rig on

location and the final rate from the well was 250 bopd of 38 API oil at a 1%

watercut with a total of 43 barrels of oil recovered during the test. Bottom

hole pressure recorders indicated that the swabbing operation resulted in a

drawdown of only a few percent and analysis of the pressure recorder data

indicates that the well has capability in excess of 1,000 bopd at moderate

producing drawdown. An ESP pump is being installed in the well to allow for

continuous testing of the well which will be produced into the existing Adalia

facilities. The drilling rig will move off of the location after initial testing

of Adalia-3 and a service rig will be moved to location to test the Adalia-2

well which was cased for potential C5 Formation pay.

La Casona (Operated, El Eden Block, WI 60%): The La Casona-2 well was drilled

approximately 700 meters northeast of the La Casona-1 well. The well was

completed in the Mirador Formation and over a 7 day test, a total of 3,903

barrels of 47 degrees API condensate and 25.5 MMCF of gas was recovered at an

average flowing pressure of 2,800 psi, equating to a daily rate of 545 bopd and

3.6 MMSCFD. Final measured water-cut from the test was 1.9%. Parex plans to

produce the La Casona- 2 well into the same production facility as the La

Casona-1 well. Total field sales are governed by a facility-restricted amount of

approximately 2.5 MMCFD of compressed gas. After analyzing the pressure build-up

of La Casona-2, the gas compression facility may be upgraded.

Rumi (Operated, El Eden Block WI 60%): The Rumi-1 exploration well was drilled

to a total depth of 14,620 feet. A total of 26 feet of reservoir was perforated

in four separate sands in the Une Formation. The top three sands were initially

swab tested at a rate of approximately 350 bopd, based on the average of the

last 12 hours of swabbing, with a final watercut of 1%. All four zones were then

tested under natural flowing conditions at an average rate of 740 bopd, with

peak rates of 1,000 bopd achieved, during the 31 hour test prior to shutting in

the well for buildup. The final measured watercut during the test was 32% and a

total of 968 bbls of oil was recovered during the test. The measured API from

both tests was 15 degrees API based on field measurements. An ESP pump is being

installed in the well to continue the short term test.

Aruco (Non-Operated, Block LLA-34, WI 45%): The Aruco-1 well was drilled to a

total depth of 10,705 feet and cased for testing. It was drilled from the same

pad as the Tua-6 well which is currently drilling. Aruco-1 testing operations

will commence after the drilling rig has been moved off location.

2013 Reserve Report Release Date

We expect to release our 2013 year-end independent reserves evaluation on

February 12, 2014.

This news release does not constitute an offer to sell securities, nor is it a

solicitation of an offer to buy securities, in any jurisdiction.

Advisory on Forward Looking Statements

Certain information regarding Parex set forth in this document contains forward-

looking statements that involve substantial known and unknown risks and

uncertainties. The use of any of the words "plan", "expect", "prospective",

"project", "intend", "believe", "should", "anticipate", "estimate" or other

similar words, or statements that certain events or conditions "may" or "will"

occur are intended to identify forward-looking statements. Such statements

represent Parex's internal projections, estimates or beliefs concerning, among

other things, future growth, results of operations, production, future capital

and other expenditures (including the amount, nature and sources of funding

thereof), competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These statements

are only predictions and actual events or results may differ materially.

Although the Company's management believes that the expectations reflected in

the forward-looking statements are reasonable, it cannot guarantee future

results, levels of activity, performance or achievement since such expectations

are inherently subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could cause Parex'

actual results to differ materially from those expressed or implied in any

forward- looking statements made by, or on behalf of, Parex.

In particular, forward-looking statements contained in this document include,

but are not limited to, expected impairment of exploration and evaluation assets

to be recognized in Parex' third quarter financial statements; the focus of the

Company's operations in Colombia; financial and business prospects; and

activities and capital expenditures to be undertaken in various areas.

Additional information on these and other factors that could effect Parex's

operations and financial results are included in reports on file with Canadian

securities regulatory authorities and may be accessed through the SEDAR website

(www.sedar.com).

Although the forward-looking statements contained in this document are based

upon assumptions which Management believes to be reasonable, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking statements contained

in this document, Parex has made assumptions regarding: current commodity prices

and royalty regimes; availability of skilled labour; timing and amount of

capital expenditures; future exchange rates; the price of oil; the impact of

increasing competition; conditions in general economic and financial markets;

availability of drilling and related equipment; effects of regulation by

governmental agencies; royalty rates, future operating costs; that the Company

will have sufficient cash flow, debt or equity sources or other financial

resources required to fund its capital and operating expenditures and

requirements as needed; that the Company's conduct and results of operations

will be consistent with its expectations; that the Company will have the ability

to develop the Company's oil properties in the manner currently contemplated;

that the estimates of the Company's reserves volumes and the assumptions related

thereto (including commodity prices and development costs) are accurate in all

material respects; and other matters.

Management has included the above summary of assumptions and risks related to

forward-looking information provided in this document in order to provide

shareholders with a more complete perspective on Parex's current and future

operations and such information may not be appropriate for other purposes.

Parex's actual results, performance or achievement could differ materially from

those expressed in, or implied by, these forward-looking statements and,

accordingly, no assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are made as of the

date of this document and Parex disclaims any intent or obligation to update

publicly any forward-looking statements, whether as a result of new information,

future events or results or otherwise, other than as required by applicable

securities laws.

Any references in this press release to test production rates are useful in

confirming the presence of hydrocarbons, however, such rates are not

determinative of the rates at which such wells will commence production and

decline thereafter. These test results are not necessarily indicative of

long-term performance or ultimate recovery. Readers are cautioned not to place

reliance on such rates in calculating the aggregate production for the Company.

The TSX has not received and does not accept responsibility for the adequacy or

accuracy of this news release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Parex Resources Inc.

Mike Kruchten

Vice President, Corporate Planning & Investor Relations

(403) 517-1733

Investor.relations@parexresources.com

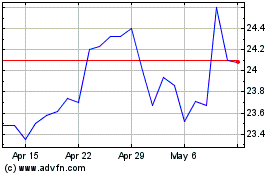

Parex Resources (TSX:PXT)

Historical Stock Chart

From May 2024 to Jun 2024

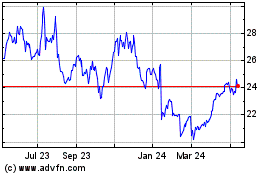

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jun 2023 to Jun 2024