H&R Real Estate Investment Trust Announces $100MM Senior Unsecured Debenture Financing

October 27 2011 - 4:14PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A

VIOLATION OF U.S. SECURITIES LAW.

H&R Real Estate Investment Trust ("H&R")

(TSX:HR.UN)(TSX:HR.DB)(TSX:HR.DB.B)(TSX:HR.DB.C)(TSX:HR.DB.D) is pleased to

announce it has entered into an agreement to sell on a bought deal basis, to a

syndicate of underwriters co-led by CIBC and RBC Capital Markets $100 million

principal amount of senior unsecured debentures (the "Series E Debentures"). The

Series E Debentures will bear interest at a rate of 4.900% and will mature on

February 2, 2018.

The net proceeds from the offering of the Series E Debentures will be utilized

by the REIT to repay bank indebtedness, fund future property acquisitions, and

for general trust purposes.

DBRS Limited has provided H&R with a provisional credit rating of BBB with a

stable trend relating to the Series E Debentures. Closing is expected to occur

on or about November 3, 2011.

The offering of the Series E Debentures is being made under H&R's existing short

form base shelf prospectus dated March 31, 2011, as amended. The terms of the

offering of the Series E Debentures will be described in a prospectus supplement

to be filed with Canadian securities regulators.

Forward-looking Statements

Certain information in this news release contains forward-looking information

within the meaning of applicable securities laws (also known as forward-looking

statements) including, among others, statements relating to the objectives of

H&R REIT and H&R Finance Trust (together, "H&R"), strategies to achieve those

objectives, H&R's beliefs, plans, estimates, and intentions, and similar

statements concerning anticipated future events, results, circumstances,

performance or expectations that are not historical facts including, in

particular, H&R REIT's expectation regarding the closing of the offering of

Series D Debentures and future acquisition of properties. Forward-looking

statements generally can be identified by words such as "outlook", "objective",

"may", "will", "expect", "intend", "estimate", "anticipate", "believe",

"should", "plans", "project", "budget" or "continue" or similar expressions

suggesting future outcomes or events. Such forward-looking statements reflect

H&R's current beliefs and are based on information currently available to

management. These statements are not guarantees of future performance and are

based on H&R's estimates and assumptions that are subject to risk and

uncertainties, including those discussed in H&R's materials filed with the

Canadian securities regulatory authorities from time to time, which could cause

the actual results and performance of H&R to differ materially from the

forward-looking statements contained in this news release. Those risks and

uncertainties include, among other things, risks related to: prices and market

value of securities of H&R; availability of cash for distributions; development

and financing relating to The Bow development; restrictions pursuant to the

terms of indebtedness; liquidity; credit risk and tenant concentration;

interest rate and other debt related risk; tax risk; ability to access capital

markets; dilution; lease rollover risk; construction risks; currency risk;

unitholder liability; co-ownership interest in properties; competition for real

property investments; environmental matters; reliance on one corporation for

management of substantially all H&R REIT's properties; changes in legislation

and indebtedness of H&R. Material factors or assumptions that were applied in

drawing a conclusion or making an estimate set out in the forward-looking

statements include that the general economy is stable; local real estate

conditions are stable; interest rates are relatively stable; and equity and debt

markets continue to provide access to capital. H&R cautions that this list of

factors is not exhaustive. Although the forward-looking statements contained in

this news release are based upon what H&R believes is reasonable assumptions,

there can be no assurance that actual results will be consistent with these

forward-looking statements. All forward-looking statements in this news release

are qualified by these cautionary statements. These forward-looking statements

are made as of today and H&R, except as required by applicable law, assumes no

obligation to update or revise them to reflect new information or the occurrence

of future events or circumstances.

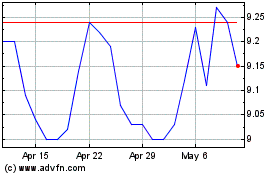

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

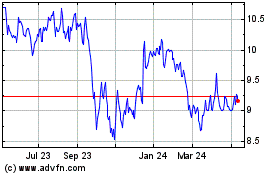

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024