Multitude SE with continued strong growth at the start of 2024: EBIT increases by 31 percent to EUR 11.6 million

May 16 2024 - 1:30AM

Multitude SE with continued strong growth at the start of 2024:

EBIT increases by 31 percent to EUR 11.6 million

Multitude SE with continued strong growth at the start

of 2024: EBIT increases by 31 percent to EUR 11.6 million

Key takeaways:

- Significant EBIT growth of 31.0% to

EUR 11.6 million compared to the same period of the previous

year

- Revenue increases by 18.3% to EUR

64.2 million

- Consolidated net profit increases by

13.0% to EUR 2.6 million, EPS by 48.8% to EUR 0.07

- Multitude SE strengthens market

position with the acquisition of Omniveta's business

- On track to achieve EBIT forecast of

EUR 67.5 million in 2024

Helsinki, 16 May 2024 – Multitude SE, a listed

European FinTech company, offering digital lending and online

banking services to consumers, small and medium-sized businesses,

and other FinTechs (ISIN: FI4000106299, WKN: A1W9NS) (“Multitude”,

“Company” or “Group”) has published its quarterly figures for Q1

2024, which show a continued positive development in all business

units Consumer banking (Ferratum), SME banking (CapitalBox) and

Wholesale banking (Multitude Bank).

|

Key figures, EUR million |

Q1 2024 |

Q1 2023* |

% change |

|

Interest income |

64.2 |

54.2 |

+18.3 |

|

Net interest Income |

55.6 |

50.3 |

+10.5 |

|

Profit before interest expense and taxes (EBIT) |

11.6 |

8.9 |

+31.0 |

|

Profit for the period |

2.6 |

2.3 |

+13.0 |

*numbers are restated as of Q1 2023

Strong growth

continues

In the first quarter of the new year, the Group

continued to show solid financial development and managed to

accelerate growth compared to the same period of the previous year.

Revenue increased by 18.3% to EUR 64.2 million (Q1 2023: EUR 54.2

million), being one of the strongest growth quarters of the

company. Multitude's EBIT increased by 31.0% to EUR 11.6 million

compared to the same period of the previous year (Q1 2023: EUR 8.9

million). Net AR increased significantly by 23.1% from EUR 543.3

million to EUR 657.6 million in a 12-month comparison. This

resulted in a 10.5% increase in net interest income from EUR 50.3

million to EUR 55.6 million. At EUR 2.6 million, profit for the

period was 13% higher than the previous year's figure of EUR 2.3

million despite elevated credit losses in parts of the business

during Q1 2024.

Further sharpening of the strategic

focus and expansion of the range of services

At the beginning of 2024, Multitude's new

business unit, Wholesale banking, officially commenced operations

as a separate segment. Wholesale banking provides customers with

two new, distinct products: Secured Debt and Payment Solutions.

Previously, the business was reported under the title Warehouse

Lending as part of SweepBank segment. The growth in volume of

179.8% over twelve months to EUR 69.2 million shows how successful

Multitude is with its growth ambitions. In addition, the new

business unit is already profitable and achieved an EBIT of EUR 1.0

million in the first quarter of 2024. The rest of SweepBank's

service offering have been integrated into the existing Ferratum

and CapitalBox business units and are available to all Multitude

clients as part of the existing growth platform.

In addition to the new business unit, Multitude

also acquired the business of invoice purchasing specialist

Omniveta Finance in the first quarter, which will operate under

CapitalBox and strengthen CapitalBox's factoring offering in the

future. The transaction strengthens Multitude's market position in

the SME business and demonstrates its ambition to strengthen its

market position as an alternative lender alongside banks and to

further expand its business model through continuous organic

growth, partnerships and acquisitions.

Continued stable balance sheet quality

and efficient risk management

Following significant growth in 2023, the

Group's total assets fell slightly from EUR 990.9 million to EUR

960.3 million (-3.1%). The decline is primarily due to a planned

20.7% decrease in cash and cash equivalents to EUR 225.0 million.

The Group experienced elevated credit losses in parts of the

business, and correcting underwriting measures have been done.

Impairment losses remain at a low average of around 4%, reaching

4.2% in the first quarter of 2024. The Group's equity increased to

EUR 185.2 million, which corresponds to an equity ratio of 19.2%.

The net equity ratio remained de facto stable at 25.2% in the first

quarter of 2024.

Outlook for 2024 confirmed: Further EBIT

growth of 50% targeted

With the publication of its Q1 figures,

Multitude is on track to achieve its EBIT guidance of EUR 67.5

million for 2024, which corresponds to an increase in EBIT of

around 50% compared to 2023. Furthermore, the company has set

itself the guidance of increasing consolidated profit (after tax)

to EUR 30 million by the end of 2026. In addition to its already

established high resilience through the diversification of its

business activities, Multitude's strategic focus remains on the

financial stability of its business model and the reduction of

risks.

Contact:

Lasse Mäkelä Chief Strategy and IR OfficerPhone: +41 79 371

34 17E-Mail: Lasse.makela@multitude.com

About Multitude SE:

Multitude is a listed European FinTech company, offering digital

lending and online banking services to consumers, small and

medium-sized businesses, and other FinTechs overlooked by

traditional banks. The services are provided through three

independent business units, which are served by our internal

Banking-as-a-Service Growth Platform. Multitude’s business units

are consumer banking (Ferratum), SME banking (CapitalBox) and

wholesale banking (Multitude Bank). Multitude Group employs over

700 people in 25 countries and offers services in 16 countries,

achieving a combined turnover of 230 million euros in 2023.

Multitude was founded in Finland in 2005 and is listed on the Prime

Standard segment of the Frankfurt Stock Exchange under the symbol

'FRU'.

- Multitude SE_Q1 2024 Report

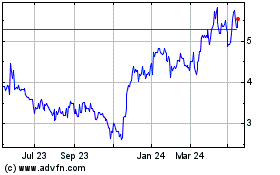

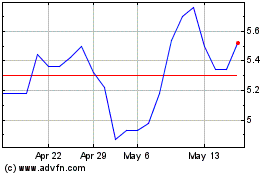

Multitude (TG:FRU)

Historical Stock Chart

From Apr 2024 to May 2024

Multitude (TG:FRU)

Historical Stock Chart

From May 2023 to May 2024