0001854139false00018541392023-07-242023-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): July 24, 2023

ZEVIA PBC

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-40630 |

86-2862492 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

15821 Ventura Blvd., Suite 135, Encino, CA |

|

91436 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(855) 469-3842

(Registrant’s Telephone Number, Including Area Code)

Former Name or Former Address, if Changed Since Last Report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A common stock, par value $0.001 per share |

|

ZVIA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 24, 2023, Zevia PBC (the "Company") issued a press release announcing selected preliminary unaudited financial results for its second fiscal quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information furnished in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be deemed incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

1

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

ZEVIA PBC |

|

|

|

Date: July 24, 2023 |

|

/s/ LORNA R. SIMMS |

|

|

Name: |

Lorna R. Simms |

|

|

Title: |

SVP, General Counsel and Corporate Secretary |

3

Exhibit 99.1

Zevia Announces Preliminary Net Sales for the Second Quarter of 2023

Supply chain transition challenges disrupt service levels while customer demand remains strong

Company to announce second quarter 2023 results on Tuesday, August 8, 2023

LOS ANGELES – July 24, 2023 (BUSINESS WIRE) – Zevia PBC (“Zevia” or the “Company”) (NYSE: ZVIA), today announced preliminary unaudited net sales results for the second quarter ended June 30, 2023.

Second quarter net sales are expected to be approximately $42 million versus prior outlook of a range of $48 million to $51 million, driven entirely by disruption of supply chain service levels amid an operations transition. Demand remained strong following a Q2 price increase and the refreshed brand design has supported accelerated in-store presence, but short-term supply chain logistics challenges hindered fulfillment and impacted net sales results in the quarter.

“Second quarter net sales were below estimates due to unexpected supply chain interruptions that negatively impacted service levels,” said Amy Taylor, President and Chief Executive Officer. “Customer demand continued at or above expectations as reflected in our order book. Customer fulfillment rates, however, fell sharply in the second half of the quarter and did not keep pace with strong customer demand. We have implemented aggressive measures, including changes in supply chain leadership and pausing some components of our supply chain transition to restore service levels. We expect these issues to be resolved by the end of 2023. In the meantime, a strong execution of our Q2 price increase and favorable aluminum pricing contributed some positive indicators in the quarter.”

These preliminary results presented herein for the second quarter of 2023 are an estimate, based on information available to management as of the date of this release, and are subject to further changes upon completion of the Company’s quarter-end closing procedures. This press release does not present all necessary information for an understanding of the Company's financial condition as of the date of this release, or its results of operations for the second quarter of 2023.

2023 Guidance

The Company is updating its guidance for the full year of 2023 to reflect recent results, management's revised near-term outlook, and the current environment. Net sales for 2023 are now expected to be in the range of $163 million to $168 million compared to prior guidance of $180 million to $190 million.

Conference Call and Webcast Information

Zevia will release its final results for the second quarter ended June 30, 2023 before the market opens on Tuesday, August 8, 2023 followed by a conference call at 8:30 a.m. Eastern Time to discuss the results.

Investors and other interested parties may listen to the webcast of the conference call by logging on via the Investor Relations section of Zevia’s website at https://investors.zevia.com/.

A replay of the webcast will be available for approximately thirty (30) days following the call at Zevia’s website at https://investors.zevia.com/. A copy of the earnings press release and supplemental financial disclosures will also be available on Zevia’s website at https://investors.zevia.com/.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain words such as “on track,” “guidance,” “outlook,” “believe,” “anticipate,” “expect,” “consider,” “contemplate,” “continue,” “would,” “could,’” “may,” “potential,” “estimate,” “intend,” “project,” “plan,” “seek,” “pursue,” “will,” or words or phrases with similar meaning. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements contained in this press release relate to, among other things, statements regarding 2023 Guidance and anticipated growth, supply chain service levels, strategic direction, branding, operating environment, distribution, velocity, pricing and costs. Forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties, including, but not limited to, the ability to develop and maintain our brand, our ability to successfully execute on our rebranding strategy and cost reduction initiatives, our ability to restore supply chain service levels on the anticipated timeline, product demand, change in consumer preferences, pricing factors, the impact of inflation on our sales growth and cost structure such as increased commodity, packaging, transportation and freight, warehouse, labor and other input costs and other economic, competitive and governmental factors outside of our control, such as pandemics or epidemics, including the impact of the effects of the COVID-19 pandemic, and adverse global macroeconomic conditions, including rising interest rates, instability in financial institutions and a recessionary environment, and geopolitical events or conflicts, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. We do not intend and undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable law. Investors are referred to our filings with the U.S. Securities and Exchange Commission for additional information regarding the risks and uncertainties that may cause actual results to differ materially from those expressed in any forward-looking statement.

About Zevia

Zevia PBC, a Delaware public benefit corporation designated as a “Certified B Corporation,” is focused on addressing the global health challenges resulting from excess sugar consumption by offering a broad portfolio of zero sugar, zero calorie, naturally sweetened beverages. All Zevia® beverages are made with a handful of simple, plant-based ingredients, contain no artificial sweeteners, and are Non-GMO Project verified, gluten-free, Kosher, vegan and zero sodium. Zevia is distributed in more than 32,000 retail locations in the U.S. and Canada through a diverse network of major retailers in the food, drug, warehouse club, mass, natural and ecommerce channels.

(ZEVIA-F)

Contacts

Media

Annie Thompson

Edelman Smithfield

713-299-4115

Annie.Thompson@edelmansmithfield.com

Investors

Reed Anderson

ICR

646-277-1260

Reed.Anderson@icrinc.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

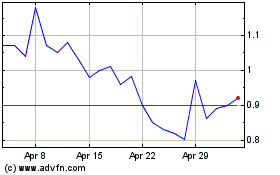

Zevia PBC (NYSE:ZVIA)

Historical Stock Chart

From Apr 2024 to May 2024

Zevia PBC (NYSE:ZVIA)

Historical Stock Chart

From May 2023 to May 2024