Franklin Templeton Closed-End Funds Announce Share Repurchases for the Second Quarter of 2024

July 16 2024 - 8:00AM

Business Wire

The following Funds announced today their share repurchase

activity during the second quarter of 2024.

Ticker

Fund Name

Share Repurchases

(4/1/24 - 6/30/24)

Share Repurchases

Since

Inception of Each

Fund’s

Repurchase Program

PMM

Putnam Managed Municipal Income Trust

830,197

16,054,054

PIM

Putnam Master Intermediate Income

Trust

99,262

32,218,485

PMO

Putnam Municipal Opportunities Trust

678,351

14,514,165

PPT

Putnam Premier Income Trust

598,186

83,959,861

EMF

Templeton Emerging Markets Fund

115,388

2,778,490

MMU

Western Asset Managed Municipals Fund

Inc.

92,881

141,787

The Funds seek to enhance shareholder value by repurchasing

their common shares when trading at a discount to the Fund’s net

asset value (“NAV”) per share. All repurchased shares are canceled

and the difference between the purchase price and NAV results in

incremental accretion to the Fund’s NAV for all common

shareholders.

Each Fund’s Board of Directors/Trustees has authorized each Fund

to repurchase shares when they are trading at a discount to NAV.

Each Fund's repurchase activity will be disclosed in its

shareholder report for the relevant fiscal period.

About Franklin Templeton

Franklin Resources, Inc. is a global investment management

organization with subsidiaries operating as Franklin Templeton.

For more information about the Funds, please call 1-888-777-0102

or consult the Funds’ website at

www.franklintempleton.com/investments/options/closed-end-funds or

www.putnam.com/individual/mutual-funds/closed-end-funds/, with

respect to the Putnam Funds. Hard copies of the Funds’ complete

audited financial statements are available free of charge upon

request.

Data and commentary provided in this press release are for

informational purposes only.

The Funds’ shares are traded on the New York Stock Exchange.

Similar to stocks, Fund share prices fluctuate with market

conditions and, at the time of sale, may be worth more or less than

the original investment. Shares of closed-end funds often trade at

a discount to their net asset value, and can increase an investor’s

risk of loss. All investments are subject to risk, including the

risk of loss.

This press release contains "forward-looking statements" as

defined under the U.S. federal securities laws. Generally, the

words "believe," "expect," "intend," "estimate," "anticipate,"

"project," "will," and similar expressions identify forward looking

statements, which generally are not historical in nature.

Forward-looking statements are subject to certain risks and

uncertainties that could cause actual future results to differ

significantly from each Fund’s present expectations or projections

indicated in any forward-looking statements. These risks include,

but are not limited to, changes in economic and political

conditions; regulatory and legal changes; leverage risk; valuation

risk; interest rate risk; tax risk; disruption to investment

advisory, administration and other service arrangements; and other

risks discussed in the Fund’s filings with the Securities and

Exchange Commission. You should not place undue reliance on

forward-looking statements, which speak only as of the date they

are made. The Fund undertakes no obligation to publicly update or

revise any forward-looking statements made herein. There is no

assurance that the Fund’s investment objectives will be

attained.

INVESTMENT PRODUCTS: NOT FDIC INSURED | NO BANK GUARANTEE | MAY

LOSE VALUE

Category: Corporate Action

Source: Franklin Resources, Inc.

Source: Legg Mason Closed End Funds

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240716348538/en/

Investor: Fund Investor Services 1-888-777-0102 Media: Fund

Investor Services-1-888-777-0102

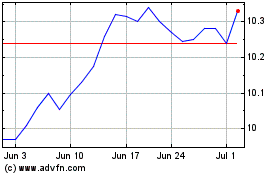

Westerm Asset Managed Mu... (NYSE:MMU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Westerm Asset Managed Mu... (NYSE:MMU)

Historical Stock Chart

From Dec 2023 to Dec 2024