Current Report Filing (8-k)

September 16 2019 - 4:16PM

Edgar (US Regulatory)

WATERS CORP /DE/ false 0001000697 0001000697 2019-09-12 2019-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) September 12, 2019

WATERS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

01-14010

|

|

13-3668640

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

34 Maple Street

Milford, Massachusetts 01757

(Address of principal executive offices) (Zip Code)

(508) 478-2000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

WAT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On September 12, 2019, Waters Corporation (the “Company”) entered into a Note Purchase Agreement among the Company and the institutional accredited investors named therein (the “Agreement”) pursuant to which the Company issued and sold in a private placement, notes (the “Senior Notes”) in the aggregate principal amount of $500 million. Certain domestic subsidiaries of the Company entered into a Subsidiary Guarantee Agreement pursuant to which such subsidiaries agreed to jointly and severally guarantee the Company’s monetary obligations under the Agreement. The Company issued and sold the following Senior Notes pursuant to the Agreement:

|

|

•

|

Series L Senior Notes in the aggregate principal amount of $200 million bearing interest at a fixed rate of 3.31% and maturing on September 12, 2026;

|

|

|

•

|

Series M Senior Notes in the aggregate principal amount of $300 million bearing interest at a fixed rate of 3.53% and maturing on September 12, 2029;

|

The Company intends to use the proceeds from the issuance of the Senior Notes to repay other outstanding debt and for general corporate purposes.

Interest on the Series L and M Senior Notes is payable semi-annually on March 12 and September 12 of each year. The Company may prepay some or all of the Senior Notes at any time in an amount not less than 10% of the aggregate principal amount of the Senior Notes then outstanding, plus the applicable make-whole amount for Series L and M Senior Notes, in each case, upon no more than 60 nor less than 30 days’ written notice to the holders of the Senior Notes. In the event of a change in control (as defined in the Agreement) of the Company, the Company may be required to prepay the Senior Notes at a price equal to 100% of the principal amount thereof, plus accrued and unpaid interest.

Pursuant to the Agreement, the Company is subject to certain covenants that require it to maintain certain financial ratios, including (i) an interest coverage ratio (as determined pursuant to the Agreement) as of the end of each fiscal quarter and calculated for the period of the four consecutive preceding fiscal quarters of no less than 3.50:1, and (ii) a leverage ratio (as determined pursuant to the Agreement) as of the end of each fiscal quarter of no more than 3.50:1. Following the completion of a material acquisition of $400 million or more, the Company may elect to increase the maximum leverage ratio to 4:1 at the end of and for the fiscal quarter during which such material acquisition occurred and for each of the following three consecutive fiscal quarters. During the period of time where the leverage ratio exceeds 3.50:1, the interest payable on the Senior Notes shall increase by 0.50%. In addition, the Senior Notes include negative covenants that are similar to the covenants to which the Company is subject pursuant to its existing bank credit agreement and other existing senior notes. The Senior Notes also contain certain customary representations and warranties, affirmative covenants and events of default.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 10.1

|

|

|

Note Purchase Agreement.

|

|

|

|

|

|

|

|

|

Exhibit 104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

WATERS CORPORATION

|

|

|

|

|

|

|

|

|

|

Date: September 16, 2019

|

|

|

|

By:

|

|

/s/ Sherry Buck

|

|

|

|

|

|

Name:

|

|

Sherry Buck

|

|

|

|

|

|

Title:

|

|

Senior Vice President and Chief Financial Officer

|

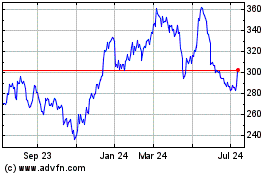

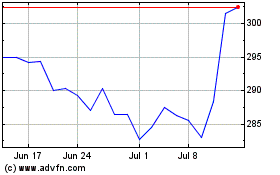

Waters (NYSE:WAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Waters (NYSE:WAT)

Historical Stock Chart

From Apr 2023 to Apr 2024