Current Report Filing (8-k)

November 02 2022 - 6:02AM

Edgar (US Regulatory)

false

0000894627

0000894627

2022-11-01

2022-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest reported): November 1, 2022

VAALCO Energy, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-32167

|

|

76-0274813

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

9800 Richmond Avenue, Suite 700

Houston, Texas

|

|

77042

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (713) 623-0801

Not Applicable

(Former Name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.10

|

EGY

|

New York Stock Exchange

|

|

Common Stock, par value $0.10

|

EGY

|

London Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On November 1, 2022, VAALCO Energy, Inc. (the “Company”) announced that the Company’s newly-expanded Board of Directors (the “Board”) formally ratified and approved the share buyback program that was announced on August 8, 2022 in conjunction with the Company’s business combination with TransGlobe Energy Corporation, an Alberta corporation. The Board also directed management to implement a Rule 10b5-1 trading plan (the “Plan”) to facilitate share purchases through open market purchases, privately-negotiated transactions, or otherwise in compliance with Rule 10b-18 under the Securities Exchange Act of 1934. The Plan provides for an aggregate purchase of currently outstanding common stock up to $30 million over 20 months. Payment for shares repurchased under the share buyback program will be funded using the Company's cash on hand and cash flow from operations.

The actual timing, number and value of shares repurchased under the share buyback program will depend on a number of factors, including constraints specified in any Rule 10b5-1 trading plans, price, general business and market conditions, and alternative investment opportunities. Under such a trading plan, the Company’s third-party broker, subject to Securities and Exchange Commission regulations regarding certain price, market, volume and timing constraints, would have authority to purchase the Company’s common stock in accordance with the terms of the Plan.

The share buyback program does not obligate the Company to acquire any specific number of shares in any period, and may be expanded, extended, modified or discontinued at any time.

A copy of the Company’s press release announcing the share buyback program is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Cautionary Note Regarding Forward-Looking Statements. This Form 8-K and the press release filed herewith as Exhibit 99.1 contain forward-looking statements, including, for example, statements regarding the Company’s plans to repurchase outstanding shares of its common stock and the timing and ability of the Company to repurchase shares of its common stock. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements, including changes in price and volume and the volatility of the Company’s common stock, adverse developments affecting prices and trading of securities listed on the New York Stock Exchange and the London Stock Exchange generally, and unexpected or otherwise unplanned or alternative requirements with respect to the Company’s capital investments. Please refer to the cautionary note in the press release regarding these forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| |

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

Press Release, dated November 1, 2022

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

| |

VAALCO Energy, Inc.

|

|

| |

(Registrant)

|

|

| |

|

|

|

| |

|

|

|

|

Date: November 1, 2022

|

|

|

|

| |

By:

|

/s/ Jason Doornik

|

|

| |

Name:

|

Jason Doornik

|

|

| |

Title:

|

Chief Accounting Officer and Controller

|

|

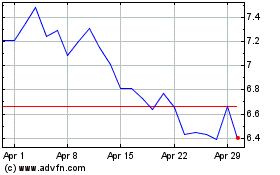

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

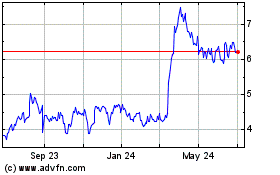

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Apr 2023 to Apr 2024