VAALCO Energy Inc. (NYSE: EGY; LSE: EGY) ("

VAALCO"

or the "

Company") declared its quarterly cash

dividend of $0.0325 per share of common stock for the fourth

quarter of 2022 ($0.13 annualized), which is payable December 22,

2022, to stockholders of record at the close of business on

November 22, 2022. Future declarations of quarterly dividends and

the establishment of future record and payment dates are subject to

approval by the Board of Directors.

George Maxwell, VAALCO’s Chief Executive

Officer, commented, "We continue to return value to shareholders

and we believe that it is important for E&P companies to

deliver sustainable shareholder returns. We closed on our strategic

combination with TransGlobe Energy, Inc. on October 13, 2022 and

remain committed to nearly doubling our target annualized dividend

to $0.25 per share beginning in the first quarter of 2023, the

first quarter immediately following the closing of the transaction.

The combination of VAALCO and TransGlobe is expected to generate

robust cash flow in 2023 and beyond, enabling us to significantly

increase our dividend. We have premier assets in Gabon, Egypt and

Canada generating strong operational results, which coupled with

strong pricing, allows us to return meaningful cash to our

shareholders through dividends, share buybacks and potentially

through special distributions in the future.”

About VAALCO

VAALCO, founded in 1985 and incorporated under

the laws of Delaware, is a Houston, USA based, independent energy

company with production, development and exploration assets in

Africa and Canada.

Following its business combination with

TransGlobe in October 2022, VAALCO owns a diverse portfolio of

operated production, development and exploration assets across

Gabon, Egypt, Equatorial Guinea and Canada.

For Further Information

| |

|

| VAALCO Energy, Inc.

(General and Investor Enquiries) |

+00 1 713 623 0801 |

| Website: |

www.vaalco.com |

| |

|

| |

|

| Al Petrie Advisors (US

Investor Relations) |

+00 1 713 543 3422 |

| Al Petrie / Chris Delange |

|

| |

|

| Buchanan (UK Financial

PR) |

+44 (0) 207 466 5000 |

| Ben Romney / Jon Krinks |

VAALCO@buchanan.uk.com |

Forward Looking Statements

This document includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

historical facts, included in this document that address

activities, events, plans, expectations, objectives or developments

that VAALCO expects, believes or anticipates will or may occur in

the future are forward-looking statements. These statements may

include statements related to the impact of the COVID-19 pandemic,

including the recent sharp decline in the global demand for and

resulting global oversupply of crude oil and the resulting steep

decline in oil prices, production quotas imposed by Gabon,

disruptions in global supply chains, quarantines of our workforce

or workforce reductions and other matters related to the pandemic,

well results, wells anticipated to be drilled and placed on

production, future levels of drilling and operational activity and

associated expectations, the implementation of the Company’s

business plans and strategy, prospect evaluations, prospective

resources and reserve growth, its activities in Equatorial Guinea,

expected sources of and potential difficulties in obtaining future

capital funding and future liquidity, its ability to restore

production in non-producing wells, our ability to find a

replacement for the FPSO or to renew the FPSO charter, future

operating losses, future changes in crude oil and natural gas

prices, future strategic alternatives, future and pending

acquisitions, capital expenditures, future drilling plans,

acquisition and interpretation of seismic data and costs thereof,

negotiations with governments and third parties, timing of the

settlement of Gabon income taxes, and expectations regarding

processing facilities, production, sales and financial projections.

These statements are based on assumptions made by VAALCO based on

its experience and perception of historical trends, current

conditions, expected future developments and other factors it

believes are appropriate in the circumstances. Such statements are

subject to a number of assumptions, risks and uncertainties, many

of which are beyond VAALCO’s control. These risks include, but are

not limited to, crude oil and natural gas price volatility, the

impact of production quotas imposed by Gabon in response to

production cuts agreed to as a member of OPEC, inflation, general

economic conditions, the outbreak of COVID-19, the Company’s

success in discovering, developing and producing reserves,

production and sales differences due to timing of liftings,

decisions by future lenders, the risks associated with liquidity,

lack of availability of goods, services and capital, environmental

risks, drilling risks, foreign regulatory and operational risks,

and regulatory changes.

The declaration and payment of future dividends

remains at the discretion of the Board of Directors of VAALCO and

will be determined based on VAALCO’s financial results, balance

sheet strength, cash and liquidity requirements, future prospects,

crude oil and natural gas prices, and other factors deemed relevant

by the Board of Directors of VAALCO. The Board of Directors of

VAALCO reserves all powers related to the declaration and payment

of dividends. Consequently, in determining the dividend to be

declared and paid on VAALCO common stock, the Board of Directors of

VAALCO may revise or terminate the payment level at any time

without prior notice.

Investors are cautioned that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

in the forward-looking statements. VAALCO disclaims any intention

or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise.

Inside Information

This announcement contains inside information as defined in

Regulation (EU) No. 596/2014 on market abuse which is part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

(“MAR”) and is made in accordance with the Company’s obligations

under article 17 of MAR.

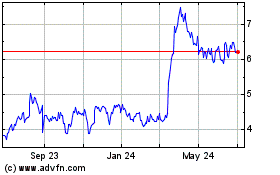

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

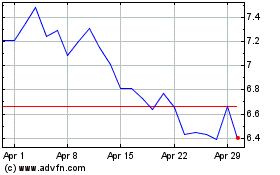

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Apr 2023 to Apr 2024