0000095029

false

0000095029

2023-08-03

2023-08-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 3, 2023

STURM, RUGER & COMPANY, INC.

(Exact Name of Registrant as Specified in its

Charter)

|

Delaware

(State or Other Jurisdiction of Incorporation) |

001-10435

(Commission File Number) |

06-0633559

(IRS Employer Identification Number) |

| One Lacey Place, Southport, Connecticut |

06890 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(203) 259-7843

Registrant’s telephone number, including

area code

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

RGR |

NYSE |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure |

On August 3, 2023, the Company hosted its post-earnings

release conference call and webcast to discuss our second quarter 2023 financial results. The transcript of the conference call and webcast

is included as Exhibit 99.1 to this Report on Form 8-K.

The information in this Report on Form 8-K (including

the exhibit) is furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This Report on Form 8-K will not

be deemed an admission as to the materiality of any information in the Report that is required to be disclosed solely by Regulation FD.

The text included with this Report on Form 8-K and

the replay of the conference call and webcast on August 3, 2023, is available on our website located at Ruger.com/corporate, although

we reserve the right to discontinue that availability at any time.

Certain statements contained in this Report

on Form 8-K (including the exhibit) may be deemed to be forward-looking statements under federal securities laws, and we intend that

such forward-looking statements be subject to the safe harbor created thereby. Such forward-looking statements include, but are not limited

to, statements regarding market demand, sales levels of firearms, anticipated castings sales and earnings, the need for external financing

for operations or capital expenditures, the results of pending litigation against the Company, the impact of future firearms control

and environmental legislation, and accounting estimates. Readers are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date made. The Company undertakes no obligation to publish revised forward-looking statements to reflect events

or circumstances after the date such forward-looking statements are made or to reflect the occurrence of subsequent unanticipated events.

| Item 9.01 | Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

STURM, RUGER & COMPANY, INC. |

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

/S/ THOMAS A. DINEEN |

| |

|

Name: |

Thomas A. Dineen |

| |

|

Title: |

Principal Financial Officer, |

| |

|

|

Principal Accounting Officer, |

| |

|

|

Senior Vice President, Treasurer and |

| |

|

|

Chief Financial Officer |

Dated: August 4, 2023

AUGUST 03, 2023 / 1:00PM GMT,

Q2 2023 Sturm Ruger & Company Inc Earnings Call

|

REFINITIV STREETEVENTS

EDITED TRANSCRIPT

Q2

2023 Sturm Ruger & Company Inc Earnings Call

EVENT DATE/TIME: AUGUST

03, 2023 / 1:00PM GMT

|

AUGUST 03, 2023 / 1:00PM GMT, Q2 2023 Sturm Ruger & Company Inc Earnings Call

CORPORATE PARTICIPANTS

Christopher J. Killoy Sturm, Ruger & Company, Inc.

- President, CEO & Director

Kevin B. Reid Sturm, Ruger & Company, Inc. - VP, General

Counsel & Corporate Secretary

Thomas A. Dineen Sturm, Ruger & Company, Inc. - Principal

Accounting Officer, Senior VP, Treasurer & CFO

CONFERENCE CALL PARTICIPANTS

Alex Sturnieks -

Rommel Tolentino Dionisio Aegis Capital Corporation, Research

Division - Head of Consumer Products and Special Situations

PRESENTATION

Christopher J. Killoy Sturm, Ruger & Company, Inc. - President,

CEO & Director

I'll ask Kevin Reid, our General Counsel, to read our caution on

forward-looking statements. Then Tom Dineen, our Chief Financial Officer, will give an overview of the second quarter 2023 financial results,

and then I will discuss our operations and the current market. After that, we'll get to your questions. Kevin?

Kevin B. Reid Sturm, Ruger & Company, Inc. - VP, General

Counsel & Corporate Secretary

Thanks, Chris. As usual, we want to remind everyone that statements

made in the course of this meeting that state the company's or management's intentions, hopes, beliefs, expectations or predictions of

the future are forward-looking statements. It is important to note that the company's actual results could differ materially from those

projected in such forward-looking statements. Additional information concerning factors that could cause actual results to differ materially

from those in the forward-looking statements is contained from time to time in the company's SEC filings, including but not limited to,

of course, the company's reports on the Form 10-K for the year ended December 31, 2022, and on the Form 10-Qs for the first and second

quarters of 2023, the latter of which we filed last night. Company these documents may be obtained by contacting the company or the SEC

or on the company website at ruger.com/corporate or the SEC website at sec.gov. We do reference non-GAAP EBITDA.

Please note that the reconciliation of net -- excuse me, GAAP net

income to non-GAAP EBITDA can be found in our Form 10-K for the year ended December 31, 2022, and our Form 10-Qs for the first and second

quarters of 2023, all of which are posted to our website. Furthermore, the company disclaims all responsibility to update forward-looking

statements. Chris?

Christopher J. Killoy Sturm, Ruger & Company, Inc. - President,

CEO & Director

Thanks, Kevin. And now Tom will discuss the company's second quarter

2023 results. Tom?

Thomas A. Dineen Sturm, Ruger & Company, Inc. - Principal

Accounting Officer, Senior VP, Treasurer & CFO

Thanks, Chris. For the second quarter of 2023, net sales were $142.8

million and diluted earnings were $0.91 per share. For the corresponding period in 2022, net sales were $140.7 million and diluted earnings

were $1.17 per share. For the 6 months ended July 1, 2023, net sales were $292.3 million and diluted earnings were $1.72 per share. For

the corresponding period in 2022, net sales were $307.2 million and diluted earnings were $2.87 per share.

AUGUST 03, 2023 / 1:00PM GMT, Q2 2023 Sturm Ruger & Company Inc Earnings Call

Our profitability declined in the second quarter of 2023 from the

second quarter of 2022 as our gross margin decreased from 31% to 27%. The lower margin was driven by a product mix shift toward products

with relatively lower margins that remain in stronger demand, inflationary cost increases in materials, commodities, services, energy

and fuel, unfavorable deleveraging of fixed costs resulting from decreased production and increased sales promotional costs.

While down from the prior quarter, we are pleased that our profitability

this quarter improved from the first quarter of 2023 on essentially flat sales. Our continued focus on financial discipline and long-term

shareholder value is evident in our strong debt-free balance sheet. At July 1, 2023, our cash and short-term investments totaled $138

million. Our short-term investments are invested in the United States Treasury bills and in a money market fund that invests exclusively

in United States Treasury instruments, which mature within 1 year.

At July 1, 2023, our current ratio was 4.5:1, and we had no debt.

Stockholders' equity was $333.2 million, which equates to a book value of $18.80 per share, of which $7.77 was cash and short-term investments.

In the first half of 2023, we generated $21.8 million of cash from operations. We reinvested $4.9 million of that back into the company

in the form of capital expenditures. We expect our 2023 capital expenditures will total approximately $20 million related to new product

introductions, upgrades to our manufacturing equipment and improvements to our facilities.

In the first quarter of 2023, we returned $101.4 million to our

shareholders through the payment of our quarterly dividends and a $5 per share special dividend paid in January of 2023. Our Board of

Directors declared a $0.36 per share quarterly dividend for shareholders of record as of August 15, 2023, payable on August 30, 2023.

As a reminder, our quarterly dividend is approximately 40% of net income and, therefore, varies quarter-to-quarter. That's the financial

update for the second quarter. Chris?

Christopher J. Killoy Sturm, Ruger & Company, Inc. - President,

CEO & Director

Thanks, Tom. Our second quarter sales were essentially flat compared

to last year despite the softening demand in some product categories, including polymer pistols, bolt action rifles and modern sporting

rifles. The estimated sell-through of our products from the independent distributors to retailers in the first half of 2023 decreased

7% compared to the prior year period. Comparatively, NICS background checks, as adjusted by the National Shooting Sports Foundation,

decreased 4% from the first half of 2022.

We continually review independent distributor sell-through data

and inventory trends and channel inventories of several of our product families remain below desired levels. We continue to adjust our

level of production and the product mix to better align our output with current and expected consumer demand as we strive to capitalize

on these opportunities and to better satisfy demand. Distributor inventories of several product categories are below pre-pandemic levels,

including virtually all of our single-action revolvers, most of our double-action revolvers and several of our rifles, the Mini-14 and

the Hawkeye product family in particular.

AUGUST 03, 2023 / 1:00PM GMT, Q2 2023 Sturm Ruger & Company Inc Earnings Call

In addition to these legacy families, new products consistently

help drive demand. We had several new product introductions in the first half of the year. Most notably, we launched 2 new additions

to the Marlin lever-action rifle family, the Model 336 Classic, chambered in 30-30 Winchester and a model 1894 Classic, chambered and

44 Magnum. These products have been received with great excitement by our customers and Marlin has continue to be the most talked about

and requested products in our lineup. In April, we launched a Super Wrangler steel frame single-action revolver, which comes with 2 cylinders,

one for the inexpensive 22 Long Rifle ammunition and one for the more powerful 22 Magnum ammunition.

The moderately-priced Wrangler family has remained popular since

its introduction in 2019. New product sales, which include only major new products that were introduced in the past 2 years, like the

Marlins and the Super Wranglers I just mentioned, totaled $63.3 million or 23% of firearms sales in the first half of 2023. This includes

the MAX-9 pistol, the LCP MAX pistol, the 1895 Marlin lever-action rifle, the LC Carbine, Small-Frame Autoloading Rifle, the Security-380

pistol, and the previously mentioned Marlin 336 Classic and the 1894 Classic lever-action rifles and the Super Wrangler revolver.

In the second quarter, we were also excited to introduce new pistols

into California for the first time in 2014 due to some changes to the requirements for pistols to be sold in the state of California.

Now our customers in California are able to purchase a Mark IV pistol, the SR22 pistol and the LCP pistol, all of which have been added

to the California roster certified handguns. We hope to add more in the second half of the year. Those are the highlights of the second

quarter of 2023. Operator, may we have the first question

QUESTIONS AND ANSWERS

Operator

(Operator Instructions) And our first question comes from the line

of Mark Smith with Lake Street Capital Markets.

Alex Sturnieks -

This is Alex Sturnieks on the line for Mark Smith today.

Just firstly, can you guys talk about your current comfort levels

with the channel inventory?

Christopher J. Killoy Sturm, Ruger & Company, Inc. - President,

CEO & Director

Yes. Alex, this is Chris. One of the things when we look at our

channel inventories, we don't look at it just in terms of the aggregate amount. We also look at it by product family. And there are certain

product families that we're still, frankly, working very hard to catch up. And there are others who are satisfied with what's out there

and what we have in the inventory. And right now, when we look at our churns that our independent distributors have, they're just about

6 times a year, so we're comfortable with that. And again, we think inventory is okay where it is right now. Of course, we'd always like

to see that inventory move into retail and move on across the dealer's counter to the consumer. But right now, we're okay with where things

are at.

AUGUST 03, 2023 / 1:00PM GMT, Q2 2023 Sturm Ruger & Company Inc Earnings Call

Alex Sturnieks -

That's great. My follow-up here is, so you kind of see the industry

seems to have dialed back from some promotions. Do you expect to have the promotional holiday season? And then if so, are you planning

on participating in promotions with it?

Christopher J. Killoy Sturm, Ruger & Company, Inc. - President,

CEO & Director

Good question, Alex. Well, actually, right now, if you look at what's

going on in the industry, there are a lot of promotions out there. There's a lot of rebates. I was just looking at a couple of websites

with a number of rebates, it is pretty strong right now from a variety of manufacturers. I suspect that's going to continue as we go forward

as we get closer to the periods like Black Friday and holiday selling season. So again, too early to tell as far as -- we don't comment

on forward-looking statements, but it is getting to be a much more traditional and a little more promotional-based activity out there

than we've seen in a couple of years.

Operator

And our next question comes from Rommel Dionisio with Aegis Capital.

Rommel Tolentino Dionisio Aegis Capital Corporation, Research

Division - Head of Consumer Products and Special Situations

I want to ask -- prior as we look back over the last couple of decades,

we've definitely seen some spikes in demand in election years. And I just wanted 2 questions there. One is, are you starting to hear any

of that in the channel in terms of an anticipation of that increased demand? And second, you've enacted a lot of supply chain infrastructure

investments over the last several years. And I wonder if you could just talk about, Chris, your ability to flex up in the next sort of

part of the demand cycle?

Christopher J. Killoy Sturm, Ruger & Company, Inc. - President,

CEO & Director

Thanks, Rommel. Good questions. First part, as far as any upcoming

election increase in demand, certainly not seeing that right now. What we are seeing, I'd say, traditionally, in our business, we see

kind of as things hit the main time period, they typically slow down as retail traffic at the gun shops decrease. So we saw some of that

beginning in May. We're optimistic that we're going to see a decent hunting season. We're excited with our bolt offering -- our bolt

action rifle offerings, and I think we're well positioned to capitalize on that. But again, when it comes to the fall hunting season,

probably too early to predict.

AUGUST 03, 2023 / 1:00PM GMT, Q2 2023 Sturm Ruger & Company Inc Earnings Call

And your second question, as far as the -- our ability to flex up,

we've got 3 major gun plants as well as our metal injection molding facility in Earth City, Missouri. And we built over 2 million units

just a few years ago on an annualized basis. And I think we've demonstrated our ability to flex up, but we're also able to, with our strong

balance sheet, maintain a decent amount of inventory in certain product categories where we know it takes us a longer time to ramp up.

So if it does flex up, again, we've been through these cycles many times, we're ready to go. And -- but I think at this point in time,

we're not seeing any indications of kind of that artificial stimulus from a political season. We're just not seeing that certainly at

this point.

Operator

(Operator Instructions) And I'm currently showing no further questions

at this time. I'd like to hand the conference back over to Mr. Killoy for closing comments.

Christopher J. Killoy Sturm, Ruger & Company, Inc. - President,

CEO & Director

Thanks, operator. I'd like to thank all of you for attending this

call, especially our shareholders. And I'd also like to thank our loyal customers and our 1,900 hard-working members of the Ruger team

who design, build and sell rugged, reliable firearms. And finally, just a reminder that August is National Shooting Sports month, I encourage

all of you to get outside or go to your favorite indoor range and safely enjoy (inaudible) associates make and enjoy those with your friends

and family. Thank you.

Operator

Thank you. This concludes today's conference call. Thank you for

your participation. You may now disconnect. Everyone, have a wonderful day.

DISCLAIMER

Refinitiv reserves the right to make changes to documents, content,

or other information on this web site without obligation to notify any person of such changes

In the conference calls upon which Event Briefs are based, companies

may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon

current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking

statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings.

Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of

the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking

statements will be realized.

THE INFORMATION CONTAINED IN EVENT BRIEFS REFLECTS REFINITIV'S SUBJECTIVE

CONDENSED PARAPHRASE OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING

OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES REFINITIV OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT

OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT BRIEF. USERS ARE ADVISED TO REVIEW THE APPLICABLE

COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2023 Refinitiv. All Rights Reserved.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

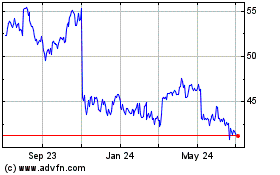

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

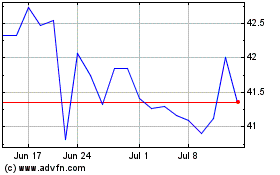

Sturm Ruger (NYSE:RGR)

Historical Stock Chart

From Jul 2023 to Jul 2024