UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

| ☐ |

|

Preliminary Proxy Statement |

|

|

|

| ☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

| ☐ |

|

Definitive Proxy Statement |

|

|

|

| ☒ |

|

Definitive Additional Materials |

|

|

|

| ☐ |

|

Soliciting Material under §240.14a-12 |

SOUTHWEST GAS HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

|

|

|

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

On April 19, 2022, Southwest Gas Holdings, Inc. (the “Company”) released a presentation

with respect to the Board of Directors’ Strategy to Maximize Value for All Stockholders:

Support SWX’s Strategy to Maximize

Value for All Stockholders April 19, 2022

Safe Harbor Statements Please refer to

Slide 72 for important information regarding forward looking statements contained in this presentation and the use of non-GAAP financial measures. |

Executive Summary

Executive Summary | Icahn waging proxy

contest either to facilitate takeover of SWX at inadequate price or to simply take control of SWX Board in furtherance of his “fire sale” agenda Following thorough review with assistance from financial and legal advisors, Board

unanimously determined that Icahn’s $82.50 tender offer is inadequate, structurally coercive, highly conditional and not in best interests of stockholders Board recently received indication of interest well in excess of Icahn’s $82.50

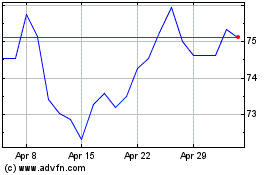

offer Icahn’s offer lacks any semblance of control premium – it reflects mere 7.9% over $76.45, VWAP since Centuri separation announcement, and Southwest Gas is trading higher than $82.50 as of April 14 Confident that alternatives

process will maximize value for Southwest Gas stockholders Southwest Gas Strategy to Maximize Value for Stockholders Icahn's Tender Offer is Inadequate and Not in the Best Interest of ALL Stockholders Executive Summary 1 2 Note: Market data as of

April 14, 2022. The Board has authorized the review of a full range of strategic alternatives to maximize stockholder value Regulated and unregulated businesses now at scale (via organic growth and acquisitions) Company considering a range of

alternatives including, among other things, a sale of the whole Company, a separate sale of its business units and/or pursuing the previously disclosed spin-off of Centuri Successfully completed broadly-marketed public equity offering that fully

satisfied equity portion of permanent financing for MountainWest (with equity portion ~50% lower than anticipated) Value created by separation announcement seen in ~20% SWX share price appreciation

Southwest Gas Has the Right Board to

Maximize Value for Stockholders Icahn’s Claims Have No Basis in Fact Executive Summary (cont’d) | Icahn makes numerous bad faith arguments using misrepresentations and distorted analyses meant to distract attention from goal of taking

control of Board in order to buy the Company for an inadequate price and execute “fire sale” strategy In particular, Icahn’s statements about our performance and returns, the accretive acquisition of MountainWest, subsequent

successful equity offering and G&A expenditures are false and misleading Highly qualified, independent and diverse Board Board includes leaders that work and live in Southwest Gas’ service jurisdictions, which is important to Southwest

Gas’ regulators Significant recent refreshment, with four new Directors added since 2019 (40% refreshment), all of whom bring skills and experience of critical importance to the Company, and all of whom contribute gender and/or ethnic

diversity Based on Icahn’s own statements, Icahn’s control slate was assembled to clear the path for completion of inadequate tender offer Icahn’s nominees include Icahn deputies who would simply rubberstamp Icahn’s takeover

agenda, in some cases have concerning track records, and in some cases run afoul of Southwest Gas’ mandatory retirement age policy Icahn’s nominees do not bring any additional skills or experience not already represented on the Board,

and lack ties to Southwest Gas’ service jurisdictions Icahn did not permit his control slate to be interviewed by Nominating and Corporate Governance Committee Executive Summary 3 4

Southwest Gas Strategy to Maximize Value

for Stockholders

Exploration of Strategic Alternatives to

Maximize Value Southwest Gas Board authorized review of full range of strategic alternatives to maximize stockholder value Company has received indication of interest well in excess of Icahn’s $82.50 Offer Board will consider alternatives

including, among other things, sale of whole Company, separate sale of its business units and/or pursuing previously disclosed spin-off of Centuri Mr. Icahn is invited to participate in the sale process Plan to move forward expeditiously | Clear

Strategy for Delivering Value 1 Southwest Gas Board is the Right Board to Oversee Strategic Alternatives Process to Maximize Value for All Stockholders

Southwest Gas’ Strategic

Transformation | Fast growing but subscale unregulated utility services leader Complementary footprint with scale in a new geography Enhances service offerings Provides opportunities in wind, electric, 5G and renewables Efficient equity financing

Opportunities for operational and financial enhancements Pending alternatives process, Southwest Gas expects dividend payout ratio of 55% – 65% of consolidated earnings per share Plan to increase payout ratio to at least levels competitive

with pure-play utilities following a spin-off Dividend maintained pursuant to this payout ratio and no reduction in the overall dividend payment Strategic Challenges Transformative Acquisitions Unlocking Value Announced Exploration of Strategic

Alternatives to Maximize Value Clear Strategy for Delivering Value Fast growing, but capital-intensive regulated business operating in challenging and primarily historic test period jurisdictions Strong, stable cash flows and favorable regulatory

environment Diversifies rate base Lowers cost of capital Supports Southwest Gas’ capital needs and dividend growth 2020 2021 2022 1 Separation of Centuri to unlock significant value for stockholders Centuri’s attractive customer base of

investment grade regulated utilities, and track record of significant EBITDA growth, position Centuri as strong standalone company

Focused on Thoughtful Long-Term Strategic

Planning Our Board and management team have been deeply focused on developing the optimal strategy to create value for all stockholders Centuri is established as a holding company, enters Canadian market with acquisition of Link-Line Group, and

exceeds $1 billion in revenue Expands geographical reach to New England with acquisition of New England Utility Constructors (Neuco) Grows electric T&D services and expands geographic reach to U.S. Gulf Coast with acquisition of Linetec Services

Expands geographic reach in Northeast and Mid-Atlantic and enables new service offerings with acquisition of Riggs Distler Southwest Gas Holdings announces plans to spin-off Centuri John Hester appointed CEO Completes reorganization into holding

company structure (separating regulated and unregulated businesses) Surpasses $2.5 billion in authorized rate base and 2 million customers served Ranked #1 among natural gas utilities in West region for residential customer satisfaction(1) Engages

top-tier consulting firm to assist in a deep-dive review of strategy Achieves 10%+ authorized rate base CAGR over 2017 – 2021 Acquires MountainWest Pipelines, contributing regulatory diversification and strong, stable cash flows 2020 Gas

Utility Residential Customer Study conducted by global leader in consumer insights. Southwest Gas Holdings Southwest Gas Corp. Centuri 2015 2022 2015 2017 2017 2017 2021 2021 2021 2015 2017 2018 2021 2022 Clear Strategy for Delivering Value 1 Record

investment in capital expenditures of $779 million 2019 Operating margin exceeds $1 billion 2020 Surpasses $4 billion in authorized rate base 2022 |

Committed to Providing Stockholders with

Strong TSR Initiatives to Drive Value Creation: Clear Strategy for Delivering Value 1 Confident that Strategic Alternatives Process will Maximize Value for Stockholders Efficient financing of MountainWest with less equity than previously expected,

yielding higher-than-expected accretion to EPS Favorable results of recent sizable rate cases in our jurisdictions Full review of range of strategic alternatives, including potential sale of Company, to maximize stockholder value In the event of a

spin-off of Centuri, strong pro forma dividend policy across Centuri and Southwest Gas would ensure that stockholders continue to receive value as part of the spin-off Recent significant rate base investments to be reflected in P&L Enhanced

quality of capital allocation across regulated utilities to reduce lag and improve ROE Continued proactive effort to improve stakeholder compact and improve treatment of utilities in jurisdictions Incremental value identified with respect to

MountainWest |

Southwest Gas Board and Management Team

Committed to Continued Value Creation Our Commitments to Stockholders Enhancing Growth and Value Creation: Ongoing Execution of Strategic Initiatives ROE improvement to 8% in 2023 and beyond Optimization of capital expenditures to enhance ROE

performance Continued optimization of existing rate case processes and working closely with regulators and legislators to enhance existing processes to minimize regulatory lag In the event of a Centuri spin-off, continued dividend growth and peer

group payout ratio leadership immediately following Centuri separation Delivering on the energy transition through continued partnerships with stakeholders and customers to invest in RNG, carbon offsets, research and development of hydrogen creation

and blending, and exploring opportunities for CO2 transportation and sequestration Southwest Gas LDC: Continued customer growth of 40,000+/year Five-year CAGR for rate base growth of 5% – 7%; gross capital expenditures of $2.5 – $3.5

billion Five-year CAGR for O&M per customer growth of less than 1% MountainWest: Revenues of $240 – $245 million in 2022 with a run rate EBITDA margin of 68% – 72% Up to $110 million in new project expansion opportunities over next

three years Clear Strategy for Delivering Value 1 |

Southwest Gas: Positioned for

Accelerated Value Creation Under the stewardship of the Board, Southwest Gas has become a leading regulated natural gas operator providing reliable, affordable, clean energy across service territories and is positioned for accelerated value creation

driven by rate base growth Attractive rate base growth Diversified, fully regulated business mix Favorable demand dynamics in diversified geographic footprint Positive rate case outcomes demonstrate constructive regulatory relationships Positioned

for the energy transition High customer satisfaction Clear Strategy for Delivering Value 1 |

MountainWest: A Complementary Platform

MountainWest’s 2,000 miles of highly contracted, FERC-regulated interstate natural gas pipelines in the Rocky Mountain region make it a unique, structurally advantaged asset that could not be replicated today Accretion is now expected to be

even greater given the efficient equity financing secured to fund the acquisition(1) Attractive business, purchased at a fair price, below historical trading multiples and recent transaction multiples, that provides scale and stability to further

allow for the planned spin-off of Centuri Provides improved rate base and regulatory diversification, as well as strong, stable cash flows Virtually impossible to replicate and uniquely positioned to serve location-specific transportation and

storage demand MountainWest was a non-core asset for its multiple previous owners; MountainWest represents an opportunity to unlock further value through more focused management as a core strategic component of Southwest Gas Adjacent energy

transition opportunities in RNG/RSG, hydrogen and CO2 transportation Original estimate included $900 – $1,000 million in equity and equity-linked securities, now limited to the ~$460 million common equity issuance that occurred on March 28,

2022. Clear Strategy for Delivering Value 1 |

Efficient Equity Financing for

MountainWest Acquisition No additional equity financing anticipated for MountainWest acquisition Multiple times oversubscribed; broad distribution to well over 100 current and new investors; modest price discount; stock has performed strongly

subsequent to issuance Company expects to achieve EPS uplift of $0.26 – $0.34 (or 6% – 8%) in 2022 compared to consensus EPS estimates as of Q2 2021 (i.e., prior to the announcement of the Riggs Distler acquisition) Following the

Board’s announcement of the Centuri spin-off, the Company successfully reduced the equity portion of MountainWest financing by ~50% at better prices than initially projected In $ millions Permission to use quote neither sought nor obtained.

The Company is not endorsing or adopting the contents of the report, and it is not incorporated into this presentation. Accretion from MountainWest acquisition expected to increase further as a result of modified financing structure “Upgrade

to Buy: Positive Risk/Reward; Equity Overhang Cleared w/ Upside From Here” “In our view, the offering satisfies the equity portion of the permanent financing of the Questar Pipelines acquisition and is decreased from our initial

expectations of $900 – $1,000 million when the deal was announced to equity needs given increased latitude on the credit metrics with a lower business risk profile likely to be assigned by the ratings agencies following the pending separation

of Southwest Gas’ utility infrastructure services business, Centuri. As a result of the reduced equity needs we are raising our 2022E by 3% and a 6% revision on our 2023E based on our initial calculations, as we see upside to EPS from the

issuance and ability for shares to re-rate off of the clearing of the overhang. We believe the accretion of the 2021 acquisitions is underappreciated in the current share price and see the discount to the group as too steep (3x on updated numbers or

nearly 17%). We see the potential for upside on our valuation with the spin of the Infrastructure Services business in Q1 2023.” , March 30, 2022(1) — Clear Strategy for Delivering Value 1 |

Diversified, Fully Regulated Business

Mix | Fully Regulated Business Mix and Attractive Business Profile Regulated returns across gas LDC, Great Basin and MountainWest Pipelines Regulatory diversification across three states and FERC Collaborative and constructive regulatory

relationships Predictable cash flows, including support from MountainWest Strong credit metrics and attractive financial profile Incremental investment opportunities across businesses, including in the energy transition Improved Rate Base

Diversification AZ NV CA FERC $3.8B $4.9B (1) Increased exposure to attractive FERC regulation More balanced exposure to individual jurisdictions MWP rate base twelve months ended Sept. 2021. MountainWest Pipelines rate base understates true

earnings power due to value associated with Rockies Express Pipeline lease. Clear Strategy for Delivering Value 1

Favorable Demand Dynamics Across

Diversified Geographic Footprint | Clear Strategy for Delivering Value 1 SWX’s Diverse Geographic Footprint Southwest Gas Holdings has assembled a portfolio of gas delivery assets positioned to benefit from strong organic and inorganic growth

opportunities Strong Regional Demand Dynamics Driving Consistent Growth Strong Regional Pop. Growth (’20 to ’21 national growth rankings) Utah: 2nd Strong Regional GDP Growth (2021 YOY % change – trailing 5-year average) Arizona:

4th Nevada: 9th Sources: United States Census Bureau, Bureau of Economic Analysis. SWGC Net Customer Additions Continue to Grow (in thousands) CA NV AZ WY UT CO Driving Future Returns by Investing to Support Demographic Growth

Attractive Rate Base Growth | Successful

Rate Base Growth Plan to Increase ROE to 8% in 2023 and Beyond Rate base has nearly doubled in last 5 years Growth driven by: Capital investment Constructive rate case outcomes Supportive regulatory mechanisms MountainWest acquisition Continue to

work collaboratively with regulators to enhance and expand existing suite of regulatory mechanisms designed to minimize regulatory lag Optimization of capital expenditure planning to improve alignment with timing of expenditures and recovery in

rates Timely rate cases and regulatory rate case process improvements designed to minimize regulatory lag MountainWest provides accretive regulatory earnings performance (1) MWP rate base twelve months ended Sept. 2021. MountainWest Pipelines rate

base understates true earnings power due to value associated with Rockies Express Pipeline lease. Clear Strategy for Delivering Value 1 10%+ Authorized Rate Base CAGR over 2017 – 2021

Regulatory Lag – Closing the Gap

Combination of increasing annual capex from 2016 – 2019 and unusually longer than normal regulatory lag contributed to larger than normal difference between authorized rate base and actual rate base While the ACC temporary suspension of

COYL/VSP surcharge revenue also contributed to this regulatory lag from 2018 – 2020, the Company worked with the ACC and ultimately received approval to record 100% of the $86 million ($12 million included in 2021 rate case and $74 million as

part of separate filing in 2021) outstanding surcharge revenue that had been suspended and deferred Moving forward, we expect the difference between authorized and actual rate base will continue to close to a more normal level of approximately 20%,

resulting in an improved earned ROE Clear Strategy for Delivering Value Note:Market data as of April 14, 2022. Share price performance and TSR performance reflect share prices on the final trading day of each quarter. 1 ($ in millions) |

(1)

Positioned for the Energy Transition |

Steadfast in delivering on responsibility to create sustainable future for customers and communities CA NV AZ WY UT CO A Variety of Clean Energy Projects Well Underway RNG Hydrogen Other Victor Valley Wastewater Reclamation Authority Pima County

Regional Wastewater Reclamation Milky Way Dairy | Butterfield Dairy | Paloma Dairy RTC of Southern NV Northern NV maintenance enhancements through methane release avoidance Central AZ maintenance enhancements through methane release avoidance NV

Move2Zero Carbon Offset Program Hydrogen blending and creation pilot with UNLV Hydrogen blending pilot with ASU Reducing the Carbon Footprint Planned blowdown reductions Pilot air compressor project Voluntary leak detection and repair (LDAR) High

bleed conversions ILI pigging ZEVAC Well workovers flaring Operating tight system by further reducing leaks Proactively advancing sustainable energy projects Establishing regulatory frameworks supporting sustainability initiatives Helping make RNG

available to market by connecting sources to end users and investing in infrastructure Developing unique partnerships to study and develop standards for hydrogen creation and blending Exploring opportunities for CO2 transportation and sequestration

Continuing to work with transportation partners to reduce GHG emissions with CNG and RNG Implementing emissions reductions technology as part of operations procedures Strategic Focus “… investments in existing infrastructure can support

a pathway toward wider storage and delivery of cleaner and increasingly zero-carbon gases while lowering the overall cost of the transition and ensuring reliability across the energy system… the natural gas grid should be viewed as a way to

enable increasingly low-carbon molecules to be transported.” ̶ Columbia University Center on Global Energy Policy (1) MountainWest Broadens Southwest Gas’ Participation in Energy Transition Excerpt is sourced from the article

“Investing in the US Natural Gas Pipeline System to Support Net-Zero Targets” published in April 2021 by the Columbia University Center on Global Energy Policy. Clear Strategy for Delivering Value 1

High Customer Satisfaction and Employee

Safety | 91% Customers prefer the choice of natural gas(1) 95% Customer Satisfaction(2) CSO50 Award A top 50 company recognition for security initiatives that demonstrate outstanding business value and thought leadership(3) 2021 In May 2021,

launched Project Horizon, the single largest digital transformation in Company history; brought project in on time and under budget #1 For 2 years in a row, ranked #1 among natural gas utilities in the West region for business customers satisfaction

in 2021(4) Ranked #1 among natural gas utilities in the West region for residential customer satisfaction in 2020(5) #1 Ranked #1 among natural gas utilities in the West region for Utility Digital Experience in 2021(6) #1 2019 Top 10 OH Predictive

Insights (December 2019) - Natural Gas Customer Survey. Monthly Customer Satisfaction Survey conducted by MDC Research. IDG 2021 CSO50 Award. 2021 Gas Utility Business Customer Satisfaction Study conducted by global leader in consumer insights. 2020

Gas Utility Residential Customer Study conducted by global leader in consumer insights. 2021 Utility Digital Experience Study conducted by global leader in consumer insights. PHMSA -

https://www.phmsa.dot.gov/data-and-statistics/pipeline/gas-distribution-gas-gathering-gas-transmission-hazardous-liquids. Clear Strategy for Delivering Value 2021 Gold Shovel 1 States SWGC operates in are ranked in the Top 10 of major investor-owned

utilities in terms of lowest number of gas distribution damages per 10,000 services(7) In 2021, SWGC achieved a record performance in damages per 1,000 line locations of .91, a 21% improvement from prior year Member of Gold Shovel Standard since

2018, committed to improving workforce and public safety while maintaining the integrity of buried infrastructure. First utility to be certified in pre-excavation metrics. Foundational in the development and deployment of pre-excavation

certification and metrics

Centuri Under stewardship of Board,

Centuri has achieved scale in attractive end markets with experienced leadership and a high-quality business model Centuri’s attractive customer base, consisting of investment grade regulated utilities, and track record of significant EBITDA

growth, position Centuri as strong standalone company Diversified, well-tenured blue chip customer base Scaled player with leading market share in utility infrastructure services Strong growth outlook supported by multi-decade mega-trends Recurring

and visible revenue profile that is utility services focused, MSA-driven and T&M / unit price-oriented small project work Highly skilled craft labor installed base across a national footprint Acquiror of choice in a highly fragmented but

consolidating market Clear Strategy for Delivering Value 1 Highly attractive financial profile Best-in-class, public company ready management team |

A Timeline of Successful Business Growth

Toward Spin-Off | Over 25 years, Southwest Gas has injected $266 million of equity into Centuri, received back $186 million in dividends and created a scaled utility infrastructure services leader worth billions in equity value today With a 100-year

vision for growth and diversification, Centuri is established as a holding company and enters the Canadian market with acquisition of Link-Line Group of Companies Revenue exceeds $1 billion in first full year of combined company (2015) Centuri is

ranked #12 in ENR’s Top 600 Specialty Contractors Centuri grows electric T&D services and expands geographic reach into the U.S. Gulf Coast region with the acquisition of Linetec Services, LLC Strategic Alliances Strategic Growth Neuco

Acquisition Industry Leadership Record Achievements Transformational Acquisition Record Growth Acquisition by Southwest Gas Transition to Spin-Off from NPL becomes a wholly-owned subsidiary of Southwest Gas Corporation, following completion of a $24

million acquisition Centuri expands its geographical reach in the U.S. to include New England with the acquisition of New England Utility Constructors, Inc. (Neuco) Company-wide record safety performance Annual revenue increases to $1.95 billion.

Net Income $75 million (2020) The addition of Riggs Distler provides Centuri with a strong union electric platform enabling new service offerings to combination utility customers and expands geographic reach in the Northeast and Mid-Atlantic

Strategic Alliances developed with key customers to meet the changing needs to support capital spend growth with a consistent and qualified workforce Revenue reaches $500 million as a result of increased investment in regulatory-driven utility

infrastructure programs Centuri Advisory Board formed $98 $163 $606 $1,009 $1,246 $1,522 $1,948 $2,466(1) Revenue $13 $21 $65 $110 $100 $142 $213 $252(2) Adj. EBITDA(3) (in millions) Includes $307 million of revenue earned by Riggs Distler prior to

acquisition. Pro forma including $38 million of adjusted EBITDA earned by Riggs Distler prior to acquisition. See appendix for EBITDA reconciliation. Clear Strategy for Delivering Value 1 2022 1996 2000 2012 2014/15 2017 2018 2019/20 2021

Announced Spin-Off of Centuri to Unlock

Value for Stockholders | Unlock Value Unlock value for stockholders and enhance transparency through more direct comparability to pure-play industry peers Reduced Equity Needs Meaningfully reduces future equity financing needs – equity

required to finance MountainWest reduced by ~50% Attractive Financial Profile Compelling financial profiles that more accurately reflect the strengths and opportunities of each business and, as a result, both companies will be able to more

efficiently finance themselves while providing a more targeted investment opportunity for stockholders Capital and Strategic Flexibility Improved capital allocation efficiency and strategic flexibility (including in view of consolidation trends)

based on the specific business initiatives and objectives of each business Growth Opportunities Distinct and expanding market opportunities and specific customer bases with enhanced potential for customer base expansion and growth Dividend

Structured so that stockholders of Southwest Gas will benefit from the same overall dividend payment as immediately before the separation Southwest Gas’ payout ratio to increase to levels competitive with pure-play utilities following Centuri

spin-off Tax Efficient A spin-off of Centuri is expected to be tax free Credit Benefits “Southwest Gas Holdings Inc. Ratings Placed On CreditWatch Positive On Announced Spin-Off Of Centuri Group Inc. … We believe a spin-off of this

higher-risk business will improve consolidated business risk.” ̶ S&P, April 1, 2022(1) In the event of a spin-off of Centuri, which is expected to be tax-free, stockholders would own two attractively positioned securities poised to

deliver upside well in excess of Icahn’s $82.50 offer Clear Strategy for Delivering Value Permission to use quote neither sought nor obtained. The Company is not endorsing or adopting the contents of the report, and it is not incorporated into

this presentation. 1 The upside from each separate security would belong to all stockholders, not just Mr. Icahn

Strategic Utility Infrastructure

Services Leader | With resources and capabilities to thrive on its own, Centuri’s diversified platform enhances growth avenues while reducing risk High-Quality Utility Customer Base GAS GROUP POWER GROUP CANADA GROUP Gas Combination Electric

Clear Strategy for Delivering Value 1 #3 largest U.S. utility infrastructure services provider 42 EBITDA CAGR over 2012 – 2021 states of operations (and 2 Canadian provinces) 16.2% -year weighted average customer life 10,500 employees

supporting North American gas and electric utilities 23 master service agreement-driven contract profile 77%

Long-Term Utility Customer Contracts

Bolster Cash Flow Quality and Growth Potential | Fixed Price 12% Unit Price 64% Time and Materials 24% RISK Diverse Infrastructure Service Offerings(1) Contract Pricing Type Contract Structure Type Gas Infra Instructure Electric Instructure Other

Instructure PA 3% Bid Contract 23% Master Services Agreement 77% Attractive and Low Risk Contract Mix(1) Revenues by segment, gross profit by segment, revenues by geography, contract pricing type and contract structure type represent percent of 2021

revenues. Clear Strategy for Delivering Value 1

Strong Tailwinds Across Infrastructure

End Markets Support Long-Term Growth | Electric Utility Distribution Gas Utility Distribution 5G Datacom Energy Transition Near end of useful life At end of useful life Within useful life Distribution Infrastructure Aging Electric Infrastructure(1)

Distribution infrastructure age relative to useful lifespan Growing CapEx Spend(2) North American Distribution Capex Construction Spend on Distribution(2) Aging Gas Infrastructure(3) Gas Distribution Pipelines Constructed (By decade) Strong growth

for new and replacement Nearly 45% of gas distribution infrastructure is near or at the end of its useful life of 40 years 1950s 1990s 1940s 1980s 1960s Pre-1940s 1970s 2000s Global Small Cell New Deployments by Environment(2) (Units in millions)

Accelerating U.S. Capacity and Investment(3) (Units in gigawatts; $ in billions) 2021E 2022E 2023E 2024E 2025E 2025E 2030E 2035E 2020A 2020A 2019A 2018A 2017A Department of Energy. The C Three Group, LLC. American Gas Association. Clear Strategy for

Delivering Value 1

Centuri’s Stable Earnings Profile

| Centuri compares favorably to its core peer group in business profile and income volatility Double-breasted workforce Gas distribution construction

No cross-country pipeline projects Electric distribution construction No cross-country electric transmission projects Competitive

Position Highest Growth and Least Volatility Volatility rankings based on Standard Error of the Regression (SER) statistics for 10 years ended 12/31/2020. Compound Annual Growth Rate (CAGR) rankings based on change from 12/31/2010 to 12/31/2020. 10Y

EBITDA CAGR RANK 1 2 4 3 5 Least volatile Highest growth 10Y EBITDA VOLATILITY 10Y NET INCOME CAGR RANK 1 2 4 3 5 Least volatile Highest growth 10Y NET INCOME VOLATILITY X Note: Based on company filings. EBITDA and Net Income data from S&P

Capital IQ. Clear Strategy for Delivering Value X X X X X X X 1

Highly Experienced, Public Company Ready

Management Team | Paul Daily President & Chief Executive Officer Kevin Neill Executive Vice President, Chief Financial Officer & Treasurer Richard Delaney Executive Vice President, Chief Operating Officer Rob Lyons President, Centuri Power

Group James Connell, Jr. Executive Vice President, Chief Customer Officer Steve Adams Senior Vice President, Centuri Power Group 35+ years of experience across senior leadership of infrastructure engineering and construction companies Joined Centuri

in 2016 as CEO 30+ years of experience across financial reporting, accounting, investor relations and M&A Joined Centuri in 2012 as CFO of NPL Construction 34+ years of experience across operations and management Joined Centuri in 2002 as

President & COO of NPL Canada 40+ years of experience across operations and senior leadership of utility services companies Joined Centuri in 2018 as EVP of Electrical Transmission and Distribution 25+ years of experience across various

executive leadership roles driving customer and market development Joined Centuri in 2006 as Director of Supply Chain & Asset Mgmt. for NPL Construction 35+ years of experience of operational leadership across the electric T&D industry

(including President of PAR Electric, a >$1.6B business) Joined Centuri in 2019 Executive Leadership Experience Prior Companies Michael Cicchella, Jr. President, Centuri Services Group & Chief Administrative Officer 20+ years of experience in

utility services companies managing M&A, IT, Safety, Fleet, Supply Chain and HR Joined Centuri in 2016 as SVP & CAO Strong Management Team & Advisory Board Since 2018 Clear Strategy for Delivering Value 1

Icahn’s Tender Offer is Inadequate

and Not in the Best Interest of ALL Stockholders

The Board Unanimously Rejected

Icahn’s Tender Offer Your Board carefully studied a wide range of factors relating to Icahn’s Offer and took into consideration, among other things: Icahn’s Inadequate Offer 2 The Company’s compelling prospects for continued

growth and the ongoing creation of sustainable, long-term stockholder value The Company’s plan for value creation through expected growth in the public utility business, the recent acquisition of MountainWest and (more recently) the Centuri

spin-off The inadequacy opinions from each of its financial advisors, Lazard and Moelis The lack of protections provided by the Offer for stockholders who do not tender Mr. Icahn’s track record of failing to close tender offers in similar

situations The significant number and nature of the conditions to the Offer – many of which Mr. Icahn can use in his sole discretion to not close the Offer – make it unlikely that stockholders will receive any consideration That Mr.

Icahn is refusing to obtain required state regulatory approvals The Offer’s possible effect on the Company’s credit agreements and what that might mean in terms of funding any potential liabilities Receipt of proposal well in excess of

Icahn’s $82.50 Offer affirms Board’s unanimous rejection |

Icahn’s Tender Offer is Inadequate

Board recently received indication of interest well in excess of Icahn’s $82.50 offer Icahn is waging proxy contest solely to facilitate takeover of SWX at a price that significantly undervalues the Company Icahn’s offer lacks any

semblance of a control premium at a mere 7.9% over $76.45, our VWAP since we announced the separation of Centuri, and Southwest Gas is trading higher than $82.50 as of April 14 Confident that alternatives process will maximize value for Southwest

Gas stockholders X Icahn’s Inadequate Offer 2 Note: Market data as of April 14, 2022. | X X

Icahn Slate Assembled Solely to Take

Control at an Inadequate Price The true purpose of Icahn’s control slate is to remove the stockholder rights plan and acquire SWX at an inadequate price “The tender offer will be conditioned upon the elimination of the recently announced

poison pill and the waiver of the application of Article 7(A) of Southwest Gas’ certificate of incorporation. … Icahn Enterprises also intends to commence a proxy contest to elect a full slate of directors at the 2022 annual meeting of

Southwest Gas stockholders in an effort to ensure that these obstacles will be removed if the Southwest Gas Holdings Board obstinately refuses to do so.” ̶ Icahn’s Tender Offer Statement on Schedule TO, October 14, 2021 “At

the very least, a majority of the Board needs to change in order to allow for the tender offer to be completed…” ̶ Icahn’s Definitive Proxy Statement, March 28, 2022 Icahn’s Inadequate Offer 2 |

Icahn’s Offer is Highly

Conditional and Subject to Significant Regulatory Hurdles Icahn is attempting to circumvent the regulatory approval process Icahn does not have and has not applied for the state regulatory approvals to proceed with his Offer State regulatory

approval is required for Icahn to acquire more than 25% of Southwest Gas’ outstanding shares (well below the 35% that Icahn has indicated he needs if he is to extend his Offer) Successfully clearing regulatory hurdles to close a regulated

utility acquisition is extremely difficult and could take up to 18 months, even for the most experienced utility acquirors Instead of seeking state regulatory approval, Icahn has structured his tender offer to employ an untested trust structure in a

blatant attempt to circumvent regulatory approval Evading regulatory oversight and authority is not a winning strategy for a regulated company – Icahn’s gamesmanship with regulatory supervision could seriously harm Southwest Gas’

constructive relationships with its regulators Icahn’s tender offer is highly conditional Icahn’s tender offer will only proceed if he wins control of Southwest Gas’ Board Further reinforces that Icahn slate assembled with the sole

goal of facilitating Icahn's effort to take control of Southwest Gas without paying an adequate control premium Icahn’s tender offer contingent upon satisfaction of a long list of ambiguous conditions: No Injunction Condition No External

Events Condition No Challenge Condition No Events Outside of the Ordinary Course Condition No Competing Offer Condition Rights Plan Condition Dominant Stockholder Condition Equity Condition (incapable of being satisfied due to the recent equity

offering, which gives Icahn the ability to walk at any time) X X X X X Icahn’s Inadequate Offer 2 |

Southwest Gas Has the Right Board to

Maximize Value for Stockholders

Southwest Gas Has the Right Board to

Maximize Value for Stockholders Highly qualified, independent and diverse Board Significant Board refreshment, with four new Directors added since 2019, all of whom contribute gender and/or ethnic diversity Recent refreshment of leadership

positions, with Bob Boughner assuming role of Board Chair and Jane Lewis-Raymond appointed Chair of Compensation Committee Diverse perspectives and robust experience in key areas including strategy, operations, finance, cyber, ESG and

legal/regulatory matters Strong corporate governance framework with a commitment to being best-in-class Right Board to Lead the Company 3 Independent Board Focused on Maximizing Value for All Stockholders |

Southwest Gas’ Highly Qualified

Board of Directors As previously announced, Robert Boughner will be appointed Chair of the Board effective at the 2022 AGM. Independent according to ISS classifications. Measured as of 2022 AGM, pro forma for the retirement of Michael Melarkey and

Stephen Comer. Southwest Gas’ Directors are well prepared to oversee the Company’s growth strategy, manage risk and maximize stockholder value John Hester (President & CEO) President and Chief Executive Officer, Southwest Gas

Southwest Gas Holdings, Inc. Director Since: 2015 Carlos Ruisanchez Co-founder, Sorelle Capital and Sorelle Hospitality Director Since: 2022 Committees: Audit Nominating and Corporate Governance Leslie Thornton Former Executive, WGL Holdings, Inc.

& Washington Gas Light Director Since: 2019 Committees: Audit Nominating and Corporate Governance Renae Conley CEO, ER Solutions, LLC Director Since: 2022 Committees: Audit Compensation Jane Lewis-Raymond Principal, Hilltop Strategies, LLC;

Former Executive, Piedmont Natural Gas Director Since: 2019 Committees: Audit Compensation* A. Randall Thoman Principal, Thoman International; Former Partner, Deloitte & Touche LLP Director Since: 2010 Committees: Audit* Compensation José

Cárdenas SVP and General Counsel, Arizona State University Director Since: 2011 Committees: Compensation Nominating and Corporate Governance* Anne Mariucci Former President, Del Webb Corporation Director Since: 2006 Committees: Compensation

Nominating and Corporate Governance Thomas Thomas Managing Partner, Thomas & Mack Co. LLC Director Since: 2008 Committees: Audit Nominating and Corporate Governance Robert Boughner Investor, Hospitality and Gaming Executive Director Since: 2008

Committees: Audit Nominating and Corporate Governance CE I * Committee Chair Chair-Elect(1) CE Added Since 2019 Independent Director(2) I I I I I I I I I 60% Gender or Ethnically Diverse Board Diversity(3) 90% Independent Board Independence(2) (3)

Average Tenure(3) ~8 Years Right Board to Lead the Company 3 Refreshment in Last 3 Years 40% |

Robert Boughner Skills Contributed:

Public Board Experience Executive Leadership Ties to Service Territories Banking expertise Carlos Ruisanchez Skills Contributed: Public Board Experience Executive Leadership Capital Markets Experience and Expertise M&A Expertise E. Renae Conley

Skills Contributed: Utility Expertise Public Board Experience Executive Leadership M&A Expertise Jane Lewis-Raymond Skills Contributed: Utility Expertise Sustainability Background Legal / Regulatory Background M&A Expertise Southwest Gas is

Committed to Proactive Board Refreshment 2019 2022 Jane Lewis-Raymond appointed Chair of the Compensation Committee in May 2021 Appointed Chair of the Board effective at the 2022 AGM Leslie Thornton Skills Contributed: Utility Expertise Public Board

Experience Legal / Regulatory Background Cybersecurity expertise M&A Expertise Through this process, we have refreshed 40% of our Board in the last three years, adding four highly qualified Directors to our Board since 2019, three of whom are

seasoned leaders in our industry Appointed to the Board Appointed to the Board Appointed to the Board Appointed to the Board Southwest Gas has a robust and ongoing Board refreshment process to ensure the Board is comprised of individuals with

varied, complementary backgrounds, who possess certain core competencies that enhance our oversight and support our strategy Right Board to Lead the Company 3 |

Recent Board Refreshment E. Renae Conley

Chief Executive Officer of ER Solutions Independent Director of US Ecology and PNM Resources Former Chairman, CEO and President of Entergy Louisiana and Gulf States Louisiana; previously served as EVP, Human Resources and Administration and Chief

Diversity Officer, Entergy Corporation Carlos A. Ruisanchez Co-founder of Sorelle Capital and Sorelle Hospitality Independent Director of Cedar Fair Entertainment Company Former President, CFO and Director of Pinnacle Entertainment Former Senior

Managing Director at Bear Stearns Skills and Expertise Renae Conley has more than 30 years of executive experience in the energy industry, including significant leadership positions in operations, finance and human resources Southwest Gas will

benefit from Conley’s extensive experience in regulated industries Conley also brings to Southwest Gas significant sustainability experience from her tenure at PNM Resources and U.S. Ecology Skills and Expertise Carlos Ruisanchez is a seasoned

executive with more than 25 years of strategy, finance, M&A and senior management experience Ruisanchez’s extensive finance experience will help support Southwest Gas’ strategy of diversified, profitable growth The Board undertook a

six-month long search process to identify qualified candidates whose skills and experiences would enhance the Board's oversight; following this process, Southwest Gas announced on November 9, 2021 that E. Renae Conley and Carlos A. Ruisanchez would

join the Board effective January 1, 2022 Right Board to Lead the Company 3 |

New Board Chair and Chair of

Compensation Committee Robert L. Boughner Significant leadership experience in highly regulated industries including Banking, Gaming, Hospitality and Financial Services Clear understanding of the Nevada market from over 30 years of leadership in the

region enhances Southwest Gas’ ability to operate with strategic insight relating to new market expansion, profit margin growth and optimization of business processes Appointment as Chair of the Board signifies deep commitment to Board

refreshment and an understanding of Southwest Gas’ unique business needs Jane Lewis-Raymond Joined Board in 2019, bringing 30 years of experience in natural gas industry as an attorney and executive As former CLO and Corporate Secretary for

highly regarded natural gas utility, a recognized expert in natural gas federal and state regulatory law and a corporate governance, compliance and risk expert, Uniquely experienced to lead prudent Board oversight for Southwest Gas’

Compensation practices Naming Ms. Lewis-Raymond as Chair of the Compensation Committee reflects Southwest Gas’ dedication to incorporating fresh insight into key leadership positions on the Board Robert L. Boughner appointed Chair of the Board

effective at Company's 2022 Annual Meeting; Jane Lewis-Raymond recently assumed the role of Chair of Compensation Committee in 2021 Right Board to Lead the Company 3 |

Depth and Breadth of Director Skills and

Experience High quality executives with extensive energy and public company experience Legal and regulatory expertise to lead Southwest Gas through industry’s complex landscape Finance experience allows Board to properly oversee

Company’s growth strategy Technology / cybersecurity experience enhances Board oversight of cybersecurity risks Relevant sustainability and operational experience to guide Southwest Gas in mission to be industry leader in sustainability and

safety Experience or Expertise Number of Directors(1) Energy Utilities Experience Public Company Board Service Public Company Executive Officer Legal / Regulatory Finance / Accounting Technology / Cybersecurity Sustainability / Environmental

Experience Operations Responsibility The Southwest Gas Board is focused on maximizing value for all stockholders — Directors’ skills and experience enhance the Board’s ability to make decisions that further this objective Measured

as of 2022 AGM, pro forma for the retirement of Michael Melarkey and Stephen Comer. Right Board to Lead the Company 3 |

Southwest Gas’ Governance

Framework is Aligned with Stockholder Interests Southwest Gas has strong corporate governance and is committed to being best-in-class Governance Best Practices Compensation Best Practices ü Independent Chairman ü Annual election of

Directors ü Majority voting policy in uncontested elections ü Stockholders may act by written consent ü Stockholders able to call special meetings ü Regular, thoughtful evaluation of Board composition and succession planning

ü Stock ownership requirements for executives and directors ü Caps on annual and long-term incentive program payouts ü Strong anti-pledging and anti-hedging policies ü Annual risk assessment of compensation policies ü

Double-trigger change in control provisions ü No dividends paid on unvested stock-based awards ü Clawback policy Right Board to Lead the Company 3 | Committed to Not Extend Rights Plan Without Stockholder Approval

Icahn’s Nominees Have Concerning

Track Records and Lack Relevant Expertise Lynn Teno Sharma Joshi Frisby Linginfelter Evans Brownell Edwards Higgins No operational experience in utility industry X X X X X No ties to key geographic service territories X X X X X X X X No public Board

experience X X Presided over poor company performance in prior leadership/Board roles X X X X X Served on Boards of companies implicated in significant legal controversies X X Exceed or will soon exceed Southwest Gas’ mandatory retirement age

X X X Icahn insiders that would act as his rubberstamps X X Right Board to Lead the Company 3 |

Presided over poor company performance

in prior leadership/Board roles Nora Brownell: PG&E’s share price declined 25% during her brief tenure as Chair of the PG&E Board Marcie Edwards: despite serving on the CIM Commercial Trust’s Board for just over one year, the

Company’s stock price has lost ~41% of its value since her appointment; at the LADPW Marcie Edwards failed to respond to the needs of ratepayers, with LADPW remaining the lowest ranked of all Western power providers by J.D. Power during her

tenure as General Manager Andrew Evans: AGL Resources underperformed the S&P 500 by 32% during Evans’ tenure as CFO through announcement of acquisition by Southern Co.; During his time as CFO of Southern Co., company underperformed the

S&P 500 by 15% H. Russell Frisby, Jr.: during his tenure on PEPCO Holdings’ Board, PEPCO’s share price dropped ~47% Walter Higgins: during his tenure on Just Energy’s Board, Just Energy’s share price decreased by over

90%; while he was CEO of Sierra Pacific Resources/NV Energy, the company’s stock price lost 34% of its value Served on Boards of companies implicated in significant legal controversies Nora Brownell: Under Brownell’s oversight as Chair,

PG&E pleaded guilty to charges relating to the California Camp Fire wildfire Walter Higgins: Just Energy filed for bankruptcy protection and was investigated for possible securities fraud shortly after he left the Board Abruptly resigned from

Puerto Rico’s Electric Power Authority amid its bankruptcy, following controversies related to perceived inappropriate compensation and third-party contracts Icahn’s Nominees Are Unreliable Stewards of Value X X X X X X X Right Board to

Lead the Company 3 | Sources: BoardEx, Broward Daily Business Review, FactSet, Los Angeles Times, and public company filings. Note: Market data as of April 14, 2022.

Little to No Relevant Qualifications

Additional Concerns Jesse Lynn General Counsel, Icahn Enterprises No relevant operational industry experience Only public company experience has been through Directorships granted by Icahn, not by Lynn’s own merit or qualifications Would be

sitting on four public company Boards if elected, in addition to his classification as an Icahn Executive Officer by ISS guidelines Currently serves as Icahn’s representative on three Boards Has presided over significant destruction of

stockholder value while seated on the Board of Conduent (Conduent’s share price has declined more than 56% since Lynn’s appointment) Has been employed by Icahn Enterprises since 2004; has close ties to Mr. Icahn Andrew Teno Portfolio

Manager, Icahn Capital No relevant operational industry experience Professional experience largely limited to junior roles within activist hedge funds Has joined three Boards since mid-February 2022, each at the behest of Icahn Would be sitting on

four public company Boards if elected, in addition to his classification as an Icahn Executive Officer by ISS guidelines Currently serves as Icahn’s representative on three Boards Icahn’s Insiders on His Control Slate are Underqualified,

Overcommitted and Would Rubberstamp Icahn’s Tender Offer Jesse Lynn and Andrew Teno are Icahn employees whose presence on the control slate serves no purpose other than to facilitate Icahn’s effort to take control of Southwest Gas

without paying control premium X X X X X X X X X Right Board to Lead the Company 3 | Note: Market data as of April 14, 2022.

% of Slate Experience Icahn / Public

Company Executive Officer 20% vs. 70% Legal / Regulatory 50% vs. 70% Finance / Accounting 40% vs. 60% Technology / Cybersecurity 20% vs. 40% Sustainability / Environmental Experience 20% vs. 50% Operations Responsibility 30% vs. 70% Ties to Key

Geographic Territories 20% vs. 70% Power & Utilities Industry 50% vs. 40% Public Company Board Service 80% vs. 80% Southwest Gas Board is comprised of seasoned executives, while Icahn’s nominees lack critical leadership experience

Southwest Gas Board brings decades of experience in key areas including management, legal / regulatory, finance, technology, ESG and operations – all areas of relative deficiency in Icahn’s slate Southwest Gas Board includes leaders that

work and live in our service territories, which is important to our regulators; only two of Icahn’s ten nominees have any ties to Southwest Gas’ service territories The newly refreshed and independent members of Southwest Gas Board have

a combined 70 years of relevant industry experience, as well as deep public company and finance experience Icahn’s Slate Compares Poorly to Southwest Gas’ Board Compared to the Southwest Gas Board, Icahn’s nominees are clearly

deficient in key skills and only contribute experience in areas already represented on the Southwest Gas Board Right Board to Lead the Company 3 |

Icahn’s Claims Have No Basis in

Fact

Icahn’s Claims Have No Basis in

Fact The Facts Icahn’s False Allegations ü SWX has performed in line with its peers on a TSR basis over the last twelve months and is taking proactive steps to drive future total returns û “SWX has underperformed as compared to

its natural gas utility peers” ü SWX paid a multiple for Questar Pipelines that is below both average precedent transactions multiples and current trading multiples, and SWX has identified incremental value to be extracted û

“SWX overpaid massively for Questar Pipelines” ü In prior years SWX has publicly expressed multiple times an openness to an eventual separation of Centuri and now is separating Centuri û SWX has a “highly unprofitable and

value-destructive record of overspending and empire building” ü SWX’s much higher rate base growth vs. its regional peers accounts for its lower earned ROE – growth that will drive long-term earnings growth and value.

Moreover, Icahn’s selected peers are not directly comparable to SWX û “SWX has the lowest ROE of utilities in Arizona and Nevada. There is no justification except for management” ü SWX issued $460 million of equity in a

broadly-marketed offering to 100+ new and current investors û “Hester is therefore seeking to issue ~$1 billion of equity to friendly parties” ü Growth in O&M has actually slowed (and has declined on a per-customer basis)

since Hester’s appointment û “G&A has grown 42% since Hester became CEO. This seems high!” ü The Nevada PUC has accepted SWX’s pipeline safety programs û SWX “unilaterally disobey[ed] a commission

order to remove certain plastic pipe” ü The Nevada PUC has approved SWX’s expenses in recent proceedings as reasonable û “SWX was trying to pass on [inappropriate expenses] to customers” ü Icahn’s

calculations are wrong – Overthrust earned a healthy ROE in the low teens û “Overthrust earned a 30% ROE – far in excess of allowed rates” ü SWX’s compensation program aligns with best practices, is

competitive vs. our peers and consistently receives robust ‘say-on-pay’ stockholder support (3-year average of 98%+) û “Named Executive Officer compensation increased…while the company underperformed the S&P

Utilities Index” The FACTS X X X X X X X X X X |

Southwest Gas – TSR in Context 1

June 28, 2021 Riggs Distler Acquisition Announcement October 4, 2021 Questar Pipelines Acquisition Announcement March 1, 2022 Centuri Separation Announcement March 28, 2022 $460 Million Common Equity Offering 2 3 4 1 2 3 4 Icahn’s

“Regulated Gas LDC Peers” consist of Atmos, ONE Gas and NiSource. Southwest Gas’ Natural Gas Peers consist of Atmos Energy, Chesapeake Utilities, MDU Resources, New Jersey Resources, NW Natural, ONE Gas, Spire and UGI. South Jersey

Industries has been excluded. Southwest Gas’ Diversified Peers consist of Chesapeake Utilities, MDU Resources, New Jersey Resources, Spire and UGI. South Jersey Industries has been excluded. Indexed Share Price Performance – Last 12

Months The FACTS 4 Southwest Gas has outperformed its Natural Gas Peers and Diversified Peers over the last twelve months by pursuing a clear strategy to build and unlock value We are poised to realize the benefits of the high levels of investment

made in recent years – the upside from these investments should accrue to all stockholders, not just Icahn Icahn misleadingly omits from his “Regulated Gas LDC Peers” a number of gas LDCs such as New Jersey Resources, NW Natural

and Spire, plus includes NiSource, which is in material part an electric utility as well – this so called “peer universe” is not an appropriate basis for comparison | Source: FactSet. Note: Market data as of April 14,

2022.

Southwest Gas – TSR in Context

(cont’d) We recognize TSR has lagged our peers in certain periods. We are committed to providing our stockholders the TSR they expect. Southwest Gas has delivered share price and TSR performance above its peers over the last twelve months by

pursuing a clear strategy to build and unlock value We operate the business for the long term, not quarter to quarter – while total stockholder returns vary depending upon the chosen time period, we remain confident our investments will bear

fruit and result in attractive risk-adjusted returns For example, Southwest Gas has injected a total of just $266 million of equity into Centuri since 1996, received back $186 million in dividends and created a business worth billions in equity

value today Centuri has achieved scale, via organic and inorganic growth (e.g., the 2021 acquisition of Riggs Distler, etc.), and it can now thrive as a standalone public company should the Company pursue a spin-off Five years ago, the Southwest Gas

Board made a commitment to growing Centuri – though this came at the expense of short-term TSR underperformance (due in part to Centuri’s industry trading at low multiples), ultimately, we would expect to unlock outsized stockholder

returns upon the spin-off of Centuri or consummation of some other strategic alternative This was not a matter of luck – we had the foresight to recognize that an increased pace of infrastructure spending was required to facilitate the ongoing

energy transition and address the aging energy infrastructure problem, which has become a political and market imperative that directly benefits Centuri Accordingly, in recent quarters, Centuri’s peers’ trading EV/EBITDA multiples have

surpassed their last five-year average,(1) validating Southwest Gas’ prudent decision to retain Centuri to maximize value(2) Southwest Gas’ transformation into a pure-play regulated business consisting of SWGC and MountainWest would

unlock fit-and-focus benefits. In the event of a spin-off, the Company’s payout ratio is expected to increase to levels at least competitive with pure-play utilities,(3) leading to an enhanced long-term TSR proposition Share Price Performance

TSR See appendix for details. Maximizing value will require thoughtful planning around tax considerations and use of proceeds. Icahn’s planned sale of Centuri that uses after-tax proceeds to pay down HoldCo debt would be meaningfully dilutive

to Southwest Gas’ EPS and destroy value. The dividend would be maintained pursuant to this payout ratio, and Southwest Gas stockholders should not expect any reduction in the overall dividend payment that exists at Southwest Gas before a

spin-off. Share Price and TSR Performance The FACTS 4 | Source: FactSet. Note: Market data as of April 14, 2022.

Icahn’s Misleading Claims

Regarding Under-Earning Reflect Lack of Understanding of Utility Regulatory Frameworks Icahn misleads by focusing on earned ROEs in isolation – boosting earned ROE in the short term by sacrificing long-term growth and earnings potential is not

a winning strategy Excerpt from Icahn Presentation Dated December 15, 2021 Southwest Gas is growing rate base at a faster rate than its peers, so it would naturally have a lower earned ROE. A transitory lower earned ROE is an unavoidable part of

investing for future growth in jurisdictions with structural lag – as we continue to file rate cases, we will see greater earnings and improvement in ROE Notably, Southwest Gas is fully decoupled whereas Icahn’s selected regional

electric utilities are not. The earned ROEs of these regional electric utilities are inflated from off-system power sales and increased load during warmer than normal weather ROE Comparability Assessment vs. Southwest Gas Corp. APS TEP UNS Gas UNS

Electric NV Power Sierra Electric Sierra Gas Gas? û û ü û û û ü Decoupled? Partial(1) Partial(1) Partial(2) Partial(1) û û û Lost fixed cost recovery

(“LFCR”) charge is in place for APS, TEP and UNS Electric and is a mechanism designed to make the company whole for contributions to fixed-cost recovery that are lost due to customer participation in energy efficiency and distributed

generation. The LFCR is not intended to recover fixed costs due to other factors “such as generation, weather, or general economic conditions, and, as such, is not considered a full decoupling mechanism.” UNS Gas has an incentive-based

decoupling mechanism based on meeting commission-defined energy efficiency goals. Icahn’s lack of understanding of the utility regulatory frameworks suggests that he would stunt investment in rate base at the expense of durable long-term

earnings and TSR performance The FACTS 4 |

Contrary to Icahn’s Claims, the

Company Paid a Fair Price for MountainWest We paid a fair price for MountainWest, below historical multiples after accounting for value we received from a tax basis set-up. And multiples have only continued to expand since the acquisition,

underscoring that we bought MountainWest at an attractive valuation The purchase price for MountainWest also implies a transaction multiple that is below the 10.2x median of recent precedents in the Gas Pipeline & Storage sector The transaction,

as it stands, is highly supportive from a value perspective and is supported by sound strategic rationale that aligns with long-term value creation goals Furthermore, the Company has already identified incremental value that can be extracted from

MountainWest (2) EV / Adj. EBITDA (4) (3) (2) Note:Market data as of April 14, 2022. *Indicates related-party transaction. Gas Pipeline & Storage Peers include Cheniere Energy Partners, Enbridge, Energy Transfer, Kinder Morgan, TC Energy and

Williams. Adjusted for tax basis step-up. Assuming Questar Pipelines, which was a part of Dominion’s Gas Transmission & Storage Assets, was attributed $1,730 million of value, the implied transaction multiple would be ~9.5x EBITDA for

Questar Pipelines. Reflects proportional net debt and projected EBITDA pro forma for anticipated contract expirations in 2019. Historical EV Multiples – Gas Pipeline & Storage Peers (1) Precedent Gas Pipeline & Storage M&A

Transactions (Last 5 Years) The FACTS 4 |

Icahn is Wrong about

MountainWest’s Environmental Benefits A natural gas pipeline does not need to be located next to a landfill or dairy farm to transport RNG Citing the total number of potential landfill locations in Wyoming and Utah is a red herring.

MountainWest has four critical interconnection points to the Kern River Gas Terminal and CAISO markets, which means that MountainWest will serve as a key corridor to transport RNG into California from across the country The Rocky Mountain region is

a highly promising area for the development of utility-scale hydrogen, and MountainWest is positioned to serve this emerging market The Governors from Colorado, Wyoming, Utah and New Mexico have signed an agreement to pursue the development of a

regional clean hydrogen hub.(1) The Rocky Mountain region is an excellent location for such a project due to the prevalence of existing natural gas infrastructure suited for utility-scale hydrogen production facilities The Rocky Mountain region has

oilfields, large industrial facilities and power generators that could be strong candidates for carbon capture and sequestration Further, the production of clean hydrogen from natural gas is an ideal use of carbon capture and storage technology

MountainWest Pipeline’s experience with developing natural gas pipelines and storage facilities in the Rocky Mountain region make it ideally suited to construct and operate CO2 sequestration infrastructure “We believe SWX’s Claims

that Questar is “E” Enhancing is Greenwashing” “Renewable Natural Gas: Best sourced from landfills and agricultural waste. The EPA estimates there are a total of nine potential landfill locations in all of Wyoming and Utah.

SWX has far more opportunity in Arizona/California/Nevada which have a total of 49 landfill sites. Arizona and California also have significantly larger dairy farms Hydrogen: SWX does not need to expand into Wyoming and Colorado to invest in green

hydrogen. Stranded solar renewables in Arizona, California and Nevada are plentiful. SWX also fails to mention that a large green hydrogen project is being constructed in central Utah, which entirely bypasses the need to use the Questar Pipeline

system CO2: Lowest cost CO2 capture will be in areas with both extensive industrial emissions (CO2 sources) and storage like the U.S. Gulf Coast (not in the wilderness of Wyoming, Colorado, Utah)” ̶ Icahn Presentation, April 4, 2022

Contrary to Icahn’s claims, the acquisition of MountainWest accelerates and diversifies the Company’s energy transition strategy Colorado, New Mexico, Utah and Wyoming signed a Memorandum of Understanding to coordinate development of a

regional clean hydrogen hub to compete for $8 billion of funds from the 2021 Infrastructure and Jobs Act that are dedicated to developing regional hydrogen hubs. MountainWest Pipelines received the 2021 Environmental Excellence Award from the Utah

Department of Oil, Gas and Mining (“UDOGM”) for its methane emission savings initiatives. MountainWest Pipelines reported 84% methane emissions savings or 150 MMscf saved, via the use of low pressure lines, flaring and portable

compression. Icahn’s Allegations The Facts MountainWest is an ESG leader amongst its peers — MountainWest is the only natural gas pipeline to receive the Environmental Excellence Award from the UDOGM, which recognizes our efforts to

meaningfully reduce methane emissions by over 80%(2) The FACTS 4 |

Icahn Falsely Claimed that Company

Intended to Place Equity with “Friends” Multiple times oversubscribed; broad distribution to 100+ current and new investors; modest price discount; one day execution had minimal, if any, impact on the market price Significantly decreased

the equity portion of the MountainWest financing Accretion from MountainWest acquisition expected to increase – overall, we expect to achieve EPS uplift of $0.26 – $0.34 (or 6% – 8%) in 2022 compared to consensus EPS estimates as

of Q2 2021 (i.e., prior to the announcement of the Riggs Distler acquisition) New shares issued after record date for 2022 annual meeting and therefore cannot vote at 2022 annual meeting Relatively few precedents for U.S.-listed companies, typically

used for companies in distress Often offered at a deep discount to market price to encourage participation, which results in value dilution for stockholders who do not take up their rights (i.e., it is a zero-sum game among stockholders)

Icahn’s offer to backstop provides an avenue for him to obtain control without an appropriate control premium After we announced we had obtained financing in public markets at virtually the same price as Icahn’s proposal, he

disingenuously claimed that he had offered $82.50 for the financing Mr. Icahn continued to advocate for his participation in permanent financing of MountainWest, which we believe was yet another tactic to try to support his tender offer and take

control of the Company at the expense of other stockholders Broadly-Marketed Public Equity Offering Governance provisions are unclear; we asked but Icahn refused to answer Issue full $1 billion equity to Icahn $75.00/share(2) does not reflect an

appropriate control premium for this conveyance of control Results in value transfer from Southwest Gas Holdings stockholders to Icahn Following discussions with our credit rating agencies, we successfully reduced the anticipated equity portion of

the MountainWest financing by ~50% In Millions Despite our outreach to Mr. Icahn, Mr. Icahn has declined to propose any real concrete terms related to such financing. Although Mr. Icahn claims that the financing and his tender offer are unrelated,

when our financial advisor pressed him on the proposed terms of the financing, Mr. Icahn restated his objective to purchase the Company as his priority as compared to providing any financing on its own. Mr. Icahn was initially silent on providing

financing at $82.50 per share, his revised tender offer price. The Company’s Plan Icahn’s “Proposals” (1) Rights Offering Icahn Equity Financing The FACTS 4 |

Icahn’s Unattractive Equity

Financing “Proposal” Icahn’s proposed financing was illegal given his outstanding tender offer Icahn’s offer, whether at $75.00 or $82.50 per share, lacked an appropriate control premium, though it would result in the

transfer of a meaningful level of control Icahn repeatedly declined to propose any governance terms for the financing despite our outreach Icahn’s offer required the elimination of the stockholder rights plan in place, a tool that preserves

the realization of a control premium for all stockholders Icahn’s offer results in value transfer from Southwest Gas Holdings stockholders to Icahn Icahn’s $82.50 offer was made only after the Company announced the commencement of the

public offering – he could have made the offer when he raised his tender offer price to $82.50 but chose to stay silent Icahn claims to have offered $82.50 per share for the equity financing related to MountainWest – but many factors

rendered Icahn’s “proposal” unattractive: The FACTS 4 |

Icahn’s Unfounded Argument

Regarding Southwest Gas’ Costs 2011 – 2014 2015 – 2020 On average over 2011 – 2020, G&A makes up only ~21% of total operating costs per annum, whereas O&M makes up ~61%. Icahn has cherry-picked G&A as a single

metric to portray costs at Southwest Gas growing at an unfavorable rate since John Hester became CEO in 2015 A more holistic view of O&M, O&M per customer and operating costs per customer trends(1) (which includes G&A expenses) shows the

true picture Operating cost reduction has not been at the expense of growth, which has accelerated significantly Disciplined Cost Control and Efficiency (CAGR) Growth in expenses over 2015 – 2020 has actually slowed (and has declined on a

per-customer basis) vs. the five-year period before John Hester’s appointment Improved Earnings Growth (Total Change) | The FACTS 4

Icahn’s Unfounded Argument

Regarding Southwest Gas’ Costs (cont’d) For more information, please see FASB Accounting Standards Update No. 2017-07. The ruling, effective in 2018, precludes companies from capitalizing the non-service component of periodic pension

costs and requires companies to reflect non-service periodic pension costs in a caption below operating income (instead of within O&M expenses such as G&A). FASB allows companies to present retrospective information (i.e., pre-2018) in a

manner that reduces the total amount of non-service costs (including those capitalized) from O&M expenses (for Southwest Gas, G&A reflected the decrease) and reflect the non-service costs in Other Deductions. This significantly reduces the

comparability of G&A between 2015 and 2020. Due to a 2017 change in GAAP related to periodic pension cost presentation, Icahn’s comparison of 2015 G&A expenses to 2020 G&A expenses is not “apples-to-apples”(1) For

periods prior to 2018, the Company reclassified the entirety of its non-service pension costs, including amounts originally capitalized, from G&A to “Other Deductions” Use of this FASB practical expedient results in a greater

deduction to G&A in periods prior to 2018 (e.g., 2015) G&A expense is only about 1/3 of total O&M expenses Comparisons of this metric in isolation are not representative of overall costs Customer growth impacts comparisons on an absolute

dollar basis Total O&M per customer and operating costs per customer reveal a truer picture of trends The FACTS 4 |

Icahn’s Unfounded Argument

Regarding Southwest Gas’ Costs (cont’d) Excerpt from Icahn Proxy Statement Dated April 4, 2022 In reality, Southwest Gas’ broader cost structure as represented by O&M per customer has been maintained at levels well below the

peers selected by Icahn since 2015 Excerpt from Icahn Proxy Statement Dated April 4, 2022 Peer Average: $214/customer Southwest Gas is a cost leader and spends less per customer than the average of its publicly traded peers – Icahn obfuscates

the truth by cherry picking Atmos(1) O&M Per Customer (2015 – 2020 Average) O&M Per Customer (2021) Icahn’s Unfounded Arguments The Facts Atmos is an outlier relative to its peers. Atmos’ average O&M per customer over

2015 – 2021 is $137 vs. $196 for Southwest Gas and $261 for its other peers (New Jersey Resources, South Jersey Industries, NW Natural, Spire and ONE Gas). Icahn further compares Southwest Gas’ G&A and operating expenses per customer

against regional utilities and Atmos in a misleading manner—a fair basis of comparison shows that Southwest Gas exhibits costs in line or lower than its peers | The FACTS 4

Icahn again cites an adversarial third

party rather than the Commission 1) These costs were not disallowed by the Commission and were approved as reasonable expenditures 2) This was a Board of Director dinner expense in the amount of $1,330 (~$66 per person) approved by the Commission 3)

These costs were approved by the Commission, which found these costs reasonable(1) Overthrust’s earned ROE in 2021 was in the low teens, well below 30% Icahn is seemingly, incorrectly including the revenue and cost of service for

Overthrusts’ Rocky Mountain Express (“REX”) lease of pipeline capacity in his calculations The REX lease’s earnings contribution is statutorily not included in the rate setting process and has no bearing on regulatory ROE

Icahn’s Other Bad Faith Arguments “The Nevada PUC filed a report on January 21, 2022 discussing SWX’s decision to unilaterally disobey a commission order to remove certain plastic pipe.” Icahn misquotes rate case proceedings

and attempts to pass off incorrect calculations as the truth Icahn’s Bad Faith Arguments The quotes Icahn cites in support of this statement were lifted from allegations made by an adversarial third party in a contested case and are

incorrectly attributed to the Commission In the case, SWGC addressed the pace that SWGC was proactively replacing certain pipe, NOT that it disobeyed a commission order This issue was successfully resolved with Staff, and the resolution was accepted

by the Commission on March 8, 2022 “As of Q3 2021, Overthrust earned a 30% ROE – far in excess of allowed rates. We expect that when a [ROE] reset happens another $30 million of EBITDA (or 18% of current EBITDA is at risk).” The

Facts “Nevada Staff found that SWX was trying to pass on [inappropriate expenses] to customers.” Icahn quotes: 1) “The Work Order for the purchase of the CEO office furniture…$120,449.71.” 2) “SWGC Senior

Executives incurring a dinner tab in excess of $4,700.” 3) “SWGC should not have performed the remodel in its existing headquarters.” See Nevada PUC Docket No. 20-02023 for more detail, which notes that the Commission agrees with

SWGC that, contrary to Staff’s implication, SWGC is not paying for the same space twice (paragraph 406). The Facts The Facts | The FACTS 4

Reflects a robust pay-for-performance

approach and best market practices Pay magnitude is reasonable and in line with market Pay mix emphasizes pay-for-performance 78% of CEO’s target pay and 71% of other NEOs’ target pay is variable and at risk Payouts for 2017-2019 and

2018-2020 performance RSUs reduced by the relative TSR modifier feature Southwest Gas Executive Compensation Program Aligns with Long-Term Strategy and Supports Stockholder Value Creation Other NEOs include Gregory Peterson, Paul Daily, Karen Haller

and Eric DeBonis. CEO Target Pay Mix Other NEOs Target Pay Mix (1) The FACTS 4 |

Component Format Base Salary Fixed

payments, targeted at 50th percentile of peer group Annual Cash Incentive Compensation Payouts based on rigorous pre-set targets and reflecting important drivers to our business(1): 40% Adjusted Net Income 20% Customer Satisfaction 20% Productivity

20% Safety No annual incentive compensation is awarded unless 80% of target adjusted net income is achieved Long-Term Incentive Payouts based on 3-year rigorous performance targets: 60% EPS or Utility Net Income 40% ROE Utility Segment Payouts

modified by 3-year cumulative relative TSR Introduced a cap to reduce payouts in the event of negative absolute and relative TSR Vest over 3 years 3-Year Average ‘Say-on-Pay’ Support: 98.4% Compensation Program Motivates Value Creation

Rigorous and progressively more challenging year-over-year performance targets Annual performance metrics reflect key factors that drive our performance and support our strategy: net income focuses on profitability, customer satisfaction drives

long-term client commitment, productivity instills effective cost management and safety is linked to regulation, operations, reputation and franchise value drivers Long-term metrics promote sustained value creation and alignment with stockholder

experience In 2021, to further align our executive compensation program with stockholder interests, we adopted the following changes: 2021 – 2023 Long-Term Incentive Program Introduced a cap to reduce payouts in the event of negative absolute

and relative TSR performance Increased negative payout modifier from 15% to 30% Closed Retirement Plan and SERP for new participants Compensation Aligned with Performance Southwest Gas key performance metrics structure applies to John Hester,

Gregory Peterson, Karen Haller and Eric DeBonis. Average ratio of performance and time-based equity awards that includes 2021 equity grants to John Hester, Gregory Peterson, Karen Haller and Eric DeBonis. FY21 NEO Compensation Program Summary The

FACTS 4 ~70% Performance Shares(2) ~30% Time RSUs (2) |