SilverBow Resources, Inc. (NYSE: SBOW) (“SilverBow” or the

“Company”) today announced operating and financial results for the

second quarter of 2020. Highlights include:

- Net production averaged approximately 142 million cubic feet of

natural gas equivalent per day (“MMcfe/d”), above the high end of

guidance

- Returned approximately 50 MMcfe/d of previously curtailed net

production to sales in June; approximately 50 MMcfe/d of net

production remains shut-in

- Closed divestiture of non-core Wyoming assets for approximately

$5 million of total proceeds

- Reported a net loss of $306 million primarily due to a $260

million non-cash impairment write-down on a pre-tax basis, Adjusted

EBITDA of $26 million and free cash flow ("FCF") of $14 million1.

Adjusted EBITDA and FCF are non-GAAP measures defined and

reconciled in the tables included with today's news release

- Anticipate $40-$50 million of FCF (a non-GAAP measure) for full

year 2020, inclusive of a gas development program planned for the

fourth quarter

- $20 million reduction in revolver borrowings compared to prior

quarter; leverage ratio2 of 2.4x and liquidity of $67 million at

quarter-end

- Active hedging program to combat price volatility; primed for

gas development in late 2020

MANAGEMENT COMMENTS

Sean Woolverton, SilverBow’s Chief Executive Officer, commented,

"Over the course of the second quarter, the SilverBow team was

focused on production management, cost reduction initiatives and

optimizing multiple playbooks for various commodity price

scenarios. The second quarter will mark the low point in our

production profile for 2020. Looking forward to the remainder of

the year, we will be returning the remainder of our curtailed

volumes to sales and are currently in the process of bringing

online our inventory of drilled but uncompleted wells ("DUCs") in

the third quarter. Our plan is to restart our drilling program

during the fourth quarter of 2020, targeting the development of our

high rate of return gas projects. Over the next 18 months, our goal

remains to maximize our free cash flow generation and protect our

balance sheet. We are on track to achieve our stated objective of

$40-$50 million of free cash flow for full year 2020, inclusive of

the additional gas development expenditures we have allocated to

our capital budget. The planned increase in capital expenditures in

the fourth quarter of 2020 bolsters our preliminary 2021 free cash

flow target of $20-$40 million at current strip prices, with

potential tailwinds from higher gas prices this winter and through

next year. Our visibility into cash flows over the near-term is

supported by our hedged position on oil, which covers a substantial

portion of our forecasted oil production through year-end 2021, as

well as our gas hedging strategy, which has utilized a heavier

weighting of two-way collars next year and intentionally preserves

meaningful upside exposure to any improvement in 2021 gas strip

from current levels. Additionally, at the midpoint of our

production guidance, we would reach quarterly highs on our oil

production combined with rising gas production rates as we exit the

year. Moving into 2021, we have the flexibility to allocate capital

across a well-balanced portfolio of gas and liquids development

locations."

Mr. Woolverton commented further, "I want to thank our

employees, contractors and vendors who continue to find innovative

solutions to drive value amidst ongoing disruptions to our daily

lives. As I have stated before, our employees are our greatest

asset. We have an established track record of executing on our

goals, and continue to deploy a winning strategy that is

returns-focused and risk-mitigated. As the economy starts to find

equal footing, we expect natural gas prices to increase. Our

business strategy remains the same. Specifically, we focus on

owning high-quality assets with proximity to premium markets,

maintaining a balanced commodity mix, and driving shareholder

returns through our strong margins and low-cost structure.

Proactive balance sheet management and operational agility will

remain critical in managing the near term. We believe that our

success in identifying attractive acquisition and divestiture

opportunities and locking in returns through our active hedging

program will continue to differentiate SilverBow from its peers. We

are well positioned to capitalize on an expanding merger and

acquisition landscape over the next several years, creating a

favorable risk-reward for stakeholders with the ultimate goal of

sustainable growth in shareholder returns.”

OPERATIONS HIGHLIGHTS

During the second quarter of 2020, SilverBow had essentially no

drilling and completion ("D&C") activity as a result of

releasing its super spec rig at the beginning of April. In addition

to temporarily suspending its D&C program, the Company

curtailed an average of 57 million cubic feet per day ("MMcf/d") of

net natural gas and 1,930 barrels per day ("Bbls/d") of net oil

production during the quarter. SilverBow commenced voluntary well

shut-ins in March, and increased the amount of shut-in production

in April. Working with our midstream partners, approximately 2,750

Bbls/d of curtailed net oil production was returned to sales ahead

of schedule in June, driving oil and natural gas liquids ("NGL")

volumes above the second quarter guidance range. As the year

unfolds, the Company will continue assessing optimal production

timing in response to the evolving commodity price environment.

The wells that have been returned to production to-date have not

experienced degradation and have exhibited higher production rates

compared to pre-shut-in levels. The Company is analyzing the

performance of these wells in real-time to optimize choke

management strategy and maximize production profiles and estimated

ultimate recoveries.

On the expense management front, SilverBow is actively engaging

in further cost savings initiatives, primarily related to

chemicals, rentals and other ancillary services. The Company values

its strong vendor relationships and is working together with them

to ensure mutual success. As it pertains to SilverBow's recent

acquisition, the Company has already identified a number of cost

saving measures primarily through the use of existing

infrastructure. SilverBow continues to analyze the subsurface

characteristics of the new acreage to plan for future capital

investment.

Consistent with the Company's strategy to align production start

dates with higher prices, SilverBow intends to bring eight wells in

the McMullen Oil area online over the second half of 2020. The

Company secured favorable service pricing for the five wells it

intends to complete in the third quarter, driving down capital

costs by approximately 30% compared to initial estimates.

SilverBow's procurement initiatives are laying the groundwork for

the resumption of the Company's drilling program in the fourth

quarter.

PRODUCTION VOLUMES, OPERATING COSTS AND REALIZED

PRICES

SilverBow's total net production for the second quarter averaged

approximately 142 MMcfe/d. Production mix for the second quarter

consisted of approximately 82% natural gas, 10% oil and 8% NGL.

Natural gas comprised 73% of total oil and gas sales for the second

quarter, compared to 59% in the first quarter of 2020.

Lease operating expenses ("LOE") were $0.39 per Mcfe for the

second quarter. After deducting $1.2 million of non-cash

compensation expense, cash general and administrative costs were

$5.0 million for the second quarter, with a per unit cash cost of

$0.39 per Mcfe. Transportation and processing expenses ("T&P")

came in at $0.35 per Mcfe and production and ad valorem taxes were

8.2% of oil and gas revenue for the second quarter. Total

production expenses, which include LOE, T&P and production

taxes, were $0.90 per Mcfe for the quarter. The Company's all-in

cash operating expenses for the quarter, which includes cash

general and administrative costs, were $1.29 per Mcfe.

SilverBow continues to benefit from strong basis pricing in the

Eagle Ford, while recent conditions have impacted historical oil

averages. Crude oil and natural gas realizations in the second

quarter were 86% of West Texas Intermediate ("WTI") and 99% of

Henry Hub, respectively, excluding hedging. The Company’s average

realized natural gas price, excluding the effect of hedging, was

$1.70 per thousand cubic feet of natural gas ("Mcf") compared to

$2.66 per Mcf in the second quarter of 2019. The average realized

crude oil selling price, excluding the effect of hedging, was

$23.82 per barrel compared to $61.60 per barrel in the second

quarter of 2019. The average realized NGL selling price in the

quarter was $9.49 per barrel (34% of WTI benchmark) compared to

$14.53 per barrel (24% of WTI benchmark) in the second quarter of

2019.

FINANCIAL RESULTS

SilverBow reported total oil and gas sales of $24.8 million for

the second quarter. On a GAAP basis, the Company reported a net

loss of $306.0 million for the second quarter. Due to the effects

of pricing and timing of projects, SilverBow reported a non-cash

impairment write-down, on a pre-tax basis, of $260.3 million on the

Company's oil and natural gas properties in the second quarter.

Additionally, included in the second quarter’s net loss is an

unrealized loss on the value of the SilverBow's derivative

contracts of $26.5 million and a $22.4 million net tax

provision.

For the second quarter, SilverBow generated Adjusted EBITDA (a

non-GAAP measure) of $26.0 million and FCF (a non-GAAP measure) of

$14.0 million.

At quarter-end, the Company's net debt was $463.4 million,

calculated as total long-term debt of $470.0 million less $6.6

million of cash, a $14.3 million reduction compared to year-end

2019.

Capital expenditures during the second quarter, excluding

acquisition and divestiture activity, totaled $4.8 million on an

accrual basis.

2020 GUIDANCE AND OUTLOOK

Third Quarter:

The third quarter marks the return to sales of the majority of

the previously curtailed volumes and the completion of five DUCs.

For the third quarter, SilverBow is guiding for estimated

production of 173-180 MMcfe/d, with natural gas volumes expected to

comprise 125-130 MMcf/d, although additional curtailments

necessitated by storage constraints, commodity prices or other

impacts from the COVID-19 pandemic could result in lower third

quarter production. Regardless of commodity prices, the Company

carefully considers the production economics and the net benefit to

its borrowing base and its financials before committing to future

capital investment.

Full Year:

For the full year 2020, SilverBow increased the midpoint of its

2020 capital budget by $12.5 million, with a revised range of

$95-$105 million. The Company plans to add a rig in the fourth

quarter and commence a nine-well gas development program in Webb

County. For the full year, SilverBow is guiding to a production

range of 176-184 MMcfe/d with natural gas volumes expected to

comprise 135-140 MMcf/d. Additional curtailments necessitated by

storage constraints, commodity prices or other impacts from the

COVID-19 pandemic could result in lower full year production and

adversely affect the Company's ability to achieve FCF and other

guidance. SilverBow is reaffirming its FCF target of $40-$50

million for the full year, inclusive of the additional D&C

activity planned for the fourth quarter. This gas development

project in late 2020 accelerates the Company's ability to generate

approximately $20-$40 million of free cash flow3 in 2021 while

maintaining upside to higher gas prices by utilizing more two-way

collars in its hedge strategy.

Additional detail concerning SilverBow's third quarter and full

year 2020 guidance can be found in the table included with today’s

news release and the Corporate Presentation uploaded to the

Investor Relations section of the Company’s website.

HEDGING UPDATE

Hedging continues to be an important element of SilverBow's

strategy to protect cash flow. The Company's active hedging program

provides greater predictability of cash flows and preserves

exposure to higher commodity prices. In conjunction with unwinding

oil derivative contracts in 2020 and 2021, SilverBow is amortizing

the $38 million of cash inflow it received in discreet amounts for

each month over the same time period. The amortized hedge gains

will factor into the Company's calculation of Adjusted EBITDA for

covenant compliance purposes through the end of 2021.

As of July 31, 2020, the Company had 67% of total estimated

production volumes hedged for the remainder of 2020, using the

midpoint of production guidance. For the remainder of 2020,

SilverBow has 87 MMcf/d hedged at an average price of $2.60 per

million British thermal units ("MMBtu") and 4,811 Bbls/d of oil

hedged at an average price of $45.34 per barrel. For 2021, the

Company has 67 MMcf/d hedged at an average price of $2.34 per MMBtu

and 3,364 Bbls/d of oil hedged at an average price of $45.19 per

barrel. Notably, SilverBow's hedges are a combination of swaps and

collars with the weighted average price factoring in the floor. As

of July 31, 2020, the Company's mark-to-market value of its hedge

portfolio was $11.8 million.

Please see SilverBow's Form 10-Q filing for the second quarter

of 2020, which the Company expects to file on Wednesday, August 5,

2020, for a detailed summary of its derivative contracts.

CAPITAL STRUCTURE AND LIQUIDITY

As of June 30, 2020, SilverBow's liquidity position was $66.6

million, consisting of $6.6 million of cash and $60.0 million of

availability under the Company’s credit facility. SilverBow’s net

debt was $463.4 million, calculated as total long-term debt of

$470.0 million less $6.6 million of cash, a 3% decrease from

December 31, 2019. As of July 31, 2020, SilverBow had 11.9 million

total common shares outstanding.

CONFERENCE CALL AND UPDATED INVESTOR PRESENTATION

SilverBow will host a conference call for investors on

Wednesday, August 5, 2020, at 9:00 a.m. Central Time (10:00 a.m.

Eastern Time). Investors and participants can register for the call

in advance by visiting

http://www.directeventreg.com/registration/event/7269448. After

registering, instructions and dial-in information will be provided

on how to join the call.

A simultaneous webcast of the call may be accessed over the

internet by visiting SilverBow's website at www.sbow.com, clicking

on “Investor Relations” and “Events and Presentations” and then

clicking on the “Second Quarter 2020 Earnings Conference Call”

link. The webcast will be archived for replay on the Company's

website for 14 days. Additionally, an updated Corporate

Presentation will be uploaded to the Investor Relations section of

SilverBow's website before the conference call.

ABOUT SILVERBOW RESOURCES, INC.

SilverBow Resources, Inc. (NYSE: SBOW) is a Houston-based energy

company actively engaged in the exploration, development, and

production of oil and gas in the Eagle Ford Shale in South Texas.

With over 30 years of history operating in South Texas, the Company

possesses a significant understanding of regional reservoirs which

it leverages to assemble high quality drilling inventory while

continuously enhancing its operations to maximize returns on

capital invested. For more information, please visit

www.sbow.com.

FORWARD-LOOKING STATEMENTS

This release includes “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements represent management's

expectations or beliefs concerning future events, and it is

possible that the results described in this release will not be

achieved. These forward-looking statements are subject to a number

of risks and uncertainties, many of which are beyond our control,

which could cause actual results to differ materially from the

results discussed in the forward-looking statements, including

among other things: the severity and duration of world health

events, including the COVID-19 pandemic, related economic

repercussions and the resulting severe disruption in the oil and

gas industry and negative impact on demand for oil and gas, which

is negatively impacting our business; the current significant

surplus in the supply of crude oil and actions by the members of

the Organization of the Petroleum Exporting Countries (“OPEC”) and

Russia (together with OPEC and other allied producing countries,

“OPEC+”) with respect to oil production levels and announcements of

potential changes in such levels, including the ability of the

OPEC+ countries to agree on and comply with supply limitations;

operational challenges relating to the COVID-19 pandemic and

efforts to mitigate the spread of the virus, including logistical

challenges, protecting the health and well-being of our employees,

remote work arrangements, performance of contracts and supply chain

disruptions; shut-in or curtailment of production due to decreases

in available storage capacity or other factors; oil and natural gas

price levels and volatility; our ability to satisfy our short- or

long-term liquidity needs; our ability to execute our business

strategy, including the success of our drilling and development

efforts; timing, cost and amount of future production of oil and

natural gas; expectations regarding future free cash flow; and

other factors discussed in the Company’s reports filed with the

Securities and Exchange Commission ("SEC"), including its Annual

Report on Form 10-K for the year ended December 31, 2019 and

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K

filed thereafter. All statements, other than historical facts

included in this press release, regarding our strategy, future

operations, financial position, future cash flows, estimated

production levels, expected oil and natural gas pricing, estimated

oil and natural gas reserves or the present value thereof, reserve

increases, capital expenditures, budget, projected costs,

prospects, plans and objectives of management are forward-looking

statements.

All forward-looking statements speak only as of the date of this

news release. You should not place undue reliance on these

forward-looking statements. Although we believe that our plans,

intentions and expectations reflected in or suggested by the

forward-looking statements we make in this release are reasonable,

we can give no assurance that these plans, intentions or

expectations will be achieved. The risk factors and other factors

noted herein and in the Company's SEC filings could cause its

actual results to differ materially from those contained in any

forward-looking statement. These cautionary statements qualify all

forward-looking statements attributable to us or persons acting on

our behalf.

All subsequent written and oral forward-looking statements

attributable to us or to persons acting on our behalf are expressly

qualified in their entirety by the foregoing. We undertake no

obligation to publicly release the results of any revisions to any

such statements that may be made to reflect events or circumstances

after the date of this release or to reflect the occurrence of

unanticipated events. New factors emerge from time to time, and it

is not possible for us to predict all such factors.

(Footnotes)

1 Free cash flow ("FCF") is a non-GAAP financial measure.

Definitions of non-GAAP financial measures and reconciliations of

non-GAAP financial measures to the closest GAAP-based financial

measures appear at the end of this release.

2 Leverage ratio is defined as total long-term debt, before

unamortized discounts, divided by Adjusted EBITDA for Leverage

Ratio (a non-GAAP measure defined and reconciled in the tables

included with today’s news release) for the trailing twelve-month

period.

3 A forward-looking estimate of net income (loss) is not

provided with the forward-looking estimate of FCF (a non-GAAP

measure) because the items necessary to estimate net income (loss)

are not accessible or estimable at this time.

(Financial Highlights to Follow)

Condensed Consolidated Balance Sheets

(Unaudited)

SilverBow Resources, Inc. and Subsidiaries

(in thousands, except share amounts)

June 30, 2020

December 31, 2019

ASSETS

Current Assets:

Cash and cash equivalents

$

6,610

$

1,358

Accounts receivable, net

23,572

36,996

Fair value of commodity derivatives

20,822

12,833

Other current assets

3,028

2,121

Total Current Assets

54,032

53,308

Property and Equipment:

Property and equipment, full cost method,

including $30,043 and $41,201, respectively, of unproved property

costs not being amortized at the end of each period

1,303,551

1,247,717

Less – Accumulated depreciation,

depletion, amortization & impairment

(773,836

)

(380,728

)

Property and Equipment, Net

529,715

866,989

Right of Use Assets

7,586

9,374

Fair Value of Long-Term Commodity

Derivatives

4,679

3,854

Deferred Tax Asset

—

22,669

Other Long-Term Assets

2,022

3,622

Total Assets

$

598,034

$

959,816

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current Liabilities:

Accounts payable and accrued

liabilities

$

15,800

$

39,343

Fair value of commodity derivatives

4,248

6,644

Accrued capital costs

5,436

17,889

Accrued interest

1,257

1,397

Current lease liability

5,972

6,707

Undistributed oil and gas revenues

5,916

9,166

Total Current Liabilities

38,629

81,146

Long-Term Debt, Net

464,390

472,900

Non-Current Lease Liability

1,778

2,813

Deferred Tax Liabilities

—

1,582

Asset Retirement Obligations

4,312

4,055

Fair Value of Long-Term Commodity

Derivatives

2,412

1,613

Other Long-Term Liabilities

162

—

Commitments and Contingencies

Stockholders' Equity:

Preferred stock, $0.01 par value,

10,000,000 shares authorized, none issued

—

—

Common stock, $0.01 par value, 40,000,000

shares authorized, 12,049,810 and 11,895,032 shares issued,

respectively, and 11,933,684 and 11,806,679 shares outstanding,

respectively

120

119

Additional paid-in capital

295,479

292,916

Treasury stock, held at cost, 116,126 and

88,353 shares, respectively

(2,368

)

(2,282

)

(Accumulated deficit) Retained

earnings

(206,880

)

104,954

Total Stockholders’ Equity

86,351

395,707

Total Liabilities and Stockholders’

Equity

$

598,034

$

959,816

Condensed Consolidated Statements of

Operations (Unaudited)

SilverBow Resources, Inc. and Subsidiaries

(in thousands, except per-share amounts)

Three Months Ended June 30,

2020

Three Months Ended June 30,

2019

Revenues:

Oil and gas sales

$

24,846

$

74,703

Operating Expenses:

General and administrative, net

6,180

6,624

Depreciation, depletion, and

amortization

13,716

24,029

Accretion of asset retirement

obligations

88

86

Lease operating costs

5,000

5,035

Workovers

—

(127

)

Transportation and gas processing

4,554

6,728

Severance and other taxes

2,037

3,950

Write-down of oil and gas properties

260,342

—

Total Operating Expenses

291,917

46,325

Operating Income (Loss)

(267,071

)

28,378

Non-Operating Income (Expense)

Gain (loss) on commodity derivatives,

net

(8,458

)

24,925

Interest expense, net

(8,026

)

(9,306

)

Other income (expense), net

(1

)

(28

)

Income (Loss) Before Income Taxes

(283,556

)

43,969

Provision (Benefit) for Income Taxes

22,420

(20,735

)

Net Income (Loss)

$

(305,976

)

$

64,704

Per Share Amounts

Basic: Net Income (Loss)

$

(25.69

)

$

5.51

Diluted: Net Income (Loss)

$

(25.69

)

$

5.49

Weighted-Average Shares Outstanding -

Basic

11,910

11,746

Weighted-Average Shares Outstanding -

Diluted

11,910

11,780

Condensed Consolidated Statements of

Operations (Unaudited)

SilverBow Resources, Inc. and Subsidiaries

(in thousands, except per-share amounts)

Six Months Ended June 30,

2020

Six Months Ended June 30,

2019

Revenues:

Oil and gas sales

$

78,222

$

146,768

Operating Expenses:

General and administrative, net

12,093

12,900

Depreciation, depletion, and

amortization

37,156

45,834

Accretion of asset retirement

obligations

173

168

Lease operating costs

10,812

9,567

Workovers

—

519

Transportation and gas processing

11,197

13,135

Severance and other taxes

5,001

7,266

Write-down of oil and gas properties

355,948

—

Total Operating Expenses

432,380

89,389

Operating Income (Loss)

(354,158

)

57,379

Non-Operating Income (Expense)

Gain (loss) on commodity derivatives,

net

79,829

20,903

Interest expense, net

(16,433

)

(18,065

)

Other income (expense), net

107

37

Income (Loss) Before Income Taxes

(290,655

)

60,254

Provision (Benefit) for Income Taxes

21,179

(20,503

)

Net Income (Loss)

$

(311,834

)

$

80,757

Per Share Amounts

Basic: Net Income (Loss)

$

(26.28

)

$

6.89

Diluted: Net Income (Loss)

$

(26.28

)

$

6.85

Weighted-Average Shares Outstanding -

Basic

11,868

11,727

Weighted-Average Shares Outstanding -

Diluted

11,868

11,786

Condensed Consolidated Statements of

Cash Flows (Unaudited)

SilverBow Resources, Inc. and Subsidiaries

(in thousands)

Six Months Ended June 30,

2020

Six Months Ended June 30,

2019

Cash Flows from Operating Activities:

Net income (loss)

$

(311,834

)

$

80,757

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities

Depreciation, depletion, and

amortization

37,156

45,834

Write-down of oil and gas properties

355,948

—

Accretion of asset retirement

obligations

173

168

Deferred income taxes

21,087

(20,732

)

Share-based compensation

2,437

3,339

(Gain) Loss on derivatives, net

(79,829

)

(20,903

)

Cash settlement (paid) received on

derivatives

67,496

4,381

Settlements of asset retirement

obligations

(15

)

(47

)

Write down of debt issuance cost

459

—

Other

1,814

1,160

Change in operating assets and

liabilities

(Increase) decrease in accounts receivable

and other current assets

14,293

13,411

Increase (decrease) in accounts payable

and accrued liabilities

(10,137

)

(6,928

)

Increase (decrease) in income taxes

payable

92

—

Increase (decrease) in accrued

interest

(140

)

(180

)

Net Cash Provided by (Used in) Operating

Activities

99,000

100,260

Cash Flows from Investing Activities:

Additions to property and equipment

(85,594

)

(174,138

)

Acquisition of oil and gas properties

(3,394

)

—

Proceeds from the sale of property and

equipment

4,752

(96

)

Payments on property sale obligations

(426

)

(2,840

)

Net Cash Provided by (Used in) Investing

Activities

(84,662

)

(177,074

)

Cash Flows from Financing Activities:

Proceeds from bank borrowings

50,000

227,000

Payments of bank borrowings

(59,000

)

(149,000

)

Purchase of treasury shares

(86

)

(318

)

Net Cash Provided by (Used in) Financing

Activities

(9,086

)

77,682

Net Increase (Decrease) in Cash and Cash

Equivalents

5,252

868

Cash and Cash Equivalents at Beginning of

Period

1,358

2,465

Cash and Cash Equivalents at End of

Period

$

6,610

$

3,333

Supplemental Disclosures of Cash Flow

Information:

Cash paid during period for interest, net

of amounts capitalized

$

15,006

$

17,128

Changes in capital accounts payable and

capital accruals

$

(28,618

)

$

(16,521

)

Definition of Non-GAAP Measures as Calculated by the Company

(Unaudited)

The following non-GAAP measures are presented in addition to

financial statements as SilverBow believes these metrics and

performance measures are widely used by the investment community,

including investors, research analysts and others, to evaluate and

useful in comparing investments among upstream oil and gas

companies in making investment decisions or recommendations. These

measures, as presented, may have differing calculations among

companies and investment professionals and may not be directly

comparable to the same measures provided by others. A non-GAAP

measure should not be considered in isolation or as a substitute

for the related GAAP measure or any other measure of a company's

financial or operating performance presented in accordance with

GAAP. A reconciliation of each of these non-GAAP measures to the

most directly comparable GAAP measure or measures is presented

below. These measures may not be comparable to similarly titled

measures of other companies.

Total Cash Operating Expenses: Total Cash Operating

Expenses is calculated as lease operating expenses plus

transportation and processing expenses plus production taxes plus

cash general and administrative expenses. Cash general and

administrative expenses is a non-GAAP measure calculated as net

general and administrative costs less share-based compensation

Adjusted EBITDA: Adjusted EBITDA is calculated as net

income (loss) plus (less) depreciation, depletion and amortization,

accretion of asset retirement obligations, interest expense,

impairment of oil and natural gas properties, net losses (gains) on

commodity derivative contracts, amounts collected (paid) for

commodity derivative contracts held to settlement, income tax

expense (benefit); and share-based compensation expense. Adjusted

EBITDA excludes certain items that the Company believes affect the

comparability of operating results, including items that are

generally non-recurring in nature or whose timing and/or amount

cannot be reasonably estimated. Adjusted EBITDA is also important

as it is considered among the financial covenants under SilverBow's

First Amended and Restated Senior Secured Revolving Credit

Agreement with JPMorgan Chase Bank, National Association, as

administrative agent, and certain lenders party thereto (as

amended, the “Credit Agreement”), a material source of liquidity

for the Company. Please reference the SilverBow's 2019 Form 10-K

and second quarter 2020 Form 10-Q for discussion of the Credit

Agreement and its covenants.

Adjusted EBITDA for Leverage Ratio: Adjusted EBITDA for

Leverage Ratio is calculated as Adjusted EBITDA (defined above)

plus amortization of derivative contracts, in accordance with the

covenant compliance calculations under the Credit Agreement.

Adjusted EBITDA Margin: Adjusted EBITDA Margin is

calculated as Adjusted EBITDA (defined above) divided by oil and

gas sales plus amounts collected (paid) for commodity derivative

contracts held to settlement.

Free cash flow ("FCF"): Free cash flow is calculated as

Adjusted EBITDA (defined above) plus (less) monetized derivative

contracts, cash interest expense, capital expenditures and current

income tax (expense) benefit.

Net debt: Net debt is calculated as the total principal

amount of second lien notes plus borrowings on the Company’s credit

facility less cash and cash equivalents.

Reconciliation of Net Income (GAAP) to Adjusted EBITDA to

Free Cash Flow (Non-GAAP) (Unaudited)

SilverBow presents Adjusted EBITDA attributable to common

stockholders and Adjusted EBITDA Margin in addition to reported net

income (loss) in accordance with GAAP. Both metrics are non-GAAP

measures that are used by SilverBow's management and by external

users of the Company's financial statements, such as investors,

commercial banks and others, to assess SilverBow's operating

performance as compared to that of other companies, without regard

to financing methods, capital structure or historical cost basis.

It is also used to assess the Company's ability to incur and

service debt and fund capital expenditures.

SilverBow defines Adjusted EBITDA as net income (loss):

Plus (Less):

- Depreciation, depletion and amortization;

- Accretion of asset retirement obligations;

- Interest expense;

- Impairment of oil and natural gas properties;

- Net losses (gains) on commodity derivative contracts;

- Amounts collected (paid) for commodity derivative contracts

held to settlement;

- Income tax expense (benefit); and

- Share-based compensation expense

Adjusted EBITDA for Leverage Ratio is defined as Adjusted EBITDA

plus amortization of derivative contracts.

SilverBow defines Free Cash Flow as Adjusted EBITDA:

Plus (Less):

- Monetized derivative contracts

- Cash interest expense, net;

- Capital expenditures; and

- Current income tax (expense) benefit

SilverBow defines Adjusted EBITDA Margin as Adjusted EBITDA

divided by the sum of oil and gas sales and derivative cash

settlements collected or paid. The Company's Adjusted EBITDA and

Adjusted EBITDA Margin should not be considered alternatives to net

income (loss), operating income (loss), cash flows provided by

(used in) operating activities or any other measure of financial

performance or liquidity presented in accordance with GAAP.

SilverBow's Adjusted EBITDA and Adjusted EBITDA Margin may not be

comparable to similarly titled measures of another company because

all companies may not calculate Adjusted EBITDA and Adjusted EBITDA

Margin in the same manner.

Calculation of Adjusted EBITDA, Free

Cash Flow and Adjusted EBITDA Margin (Unaudited)

SilverBow Resources, Inc. and Subsidiaries

(in thousands, except share amounts)

The below tables provide the calculation

of Adjusted EBITDA, Free Cash Flow and Adjusted EBITDA Margin for

the following periods (in thousands).

Three Months Ended June 30,

2020

Three Months Ended June 30,

2019

Net Income (Loss)

$

(305,976

)

$

64,704

Plus:

Depreciation, depletion and

amortization

13,716

24,029

Accretion of asset retirement

obligations

88

86

Interest expense

8,026

9,306

Impairment of oil and gas properties

260,342

—

Derivative (gain)/loss

8,458

(24,925

)

Derivative cash settlements

collected/(paid) (1)

17,731

4,319

Income tax expense/(benefit)

22,420

(20,735

)

Share-based compensation expense

1,176

1,648

Adjusted EBITDA

$

25,981

$

58,432

Plus:

Cash interest expense, net

(6,959

)

(8,825

)

Capital expenditures(2)

(4,804

)

(69,640

)

Current income tax (expense)/benefit

(268

)

21,033

Free Cash Flow

$

13,950

$

1,000

Adjusted EBITDA Margin

61

%

74

%

Adjusted EBITDA

$

25,981

$

58,432

Amortization of derivative contracts

6,737

—

Adjusted EBITDA for Leverage Ratio

(3)

$

32,718

$

58,432

(1) Includes accruals for settled

contracts covering commodity deliveries during the period where the

actual cash settlements occur outside of the period.

(2) Excludes proceeds/(payments) related

to the divestiture/(acquisition) of oil and gas properties and

equipment, outside of regular way land and leasing costs.

(3) Adjusted EBITDA includes $6.7 million

of proceeds from the amortization of previously unwound derivative

contracts for the second quarter of 2020. Adjusted EBITDA for

Leverage Ratio for the twelve months ended June 30, 2020 is $199.2

million.

Production Volumes & Pricing

(Unaudited)

SilverBow Resources, Inc. and

Subsidiaries

Three Months Ended June 30,

2020

Three Months Ended June 30,

2019

Production volumes:

Oil (MBbl) (1)

221

405

Natural gas (MMcf)

10,624

16,409

Natural gas liquids (MBbl) (1)

156

424

Total (MMcfe)

12,884

21,385

Oil, natural gas and natural gas liquids

sales (in thousands):

Oil

$

5,265

$

24,940

Natural gas

18,103

43,597

Natural gas liquids

1,478

6,166

Total

$

24,846

$

74,703

Average realized price:

Oil (per Bbl)

$

23.82

$

61.60

Natural gas (per Mcf)

1.70

2.66

Natural gas liquids (per Bbl)

9.49

14.53

Average per Mcfe

$

1.93

$

3.49

Price impact of cash-settled

derivatives:

Oil (per Bbl)

$

49.52

$

(0.01

)

Natural gas (per Mcf)

0.64

0.17

Natural gas liquids (per Bbl)

—

3.78

Average per Mcfe

$

1.38

$

0.20

Average realized price including impact of

cash-settled derivatives:

Oil (per Bbl)

$

73.34

$

61.59

Natural gas (per Mcf)

2.34

2.83

Natural gas liquids (per Bbl)

9.49

18.31

Average per Mcfe

$

3.31

$

3.69

(1) Oil and NGLs are converted at the rate

of one barrel to six Mcfe. MBbl refers to one thousand barrels.

Third Quarter 2020 & Full

Year 2020 Guidance

Guidance

3Q 2020

FY 2020

Production Volumes:

Oil (Bbls/d)

5,150 - 5,350

4,150 - 4,450

Natural Gas (MMcf/d)

125 - 130

135 - 140

NGLs (Bbls/d)

2,900 - 3,000

2,700 - 2,800

Total Reported Production (MMcfe/d)

173 - 180

176 - 184

% Gas

72%

76%

Product Pricing:

Crude Oil NYMEX Differential ($/Bbl)

($5.50) - ($1.50)

N/A

Natural Gas NYMEX Differential ($/Mcf)

($0.05) - ($0.01)

N/A

Natural Gas Liquids (% of WTI)

29% - 35%

N/A

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200804005962/en/

Jeff Magids Director of Finance & Investor Relations (281)

874-2700, (888) 991-SBOW

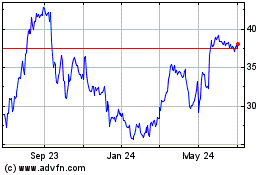

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

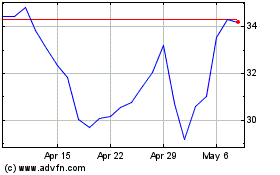

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Apr 2023 to Apr 2024