Public Storage Increases Quarterly Common Dividend by 50%

February 05 2023 - 6:01PM

Business Wire

Public Storage (NYSE:PSA) announced today that its Board of

Trustees declared a 50% increase in the Company’s regular common

quarterly dividend from $2.00 to $3.00 per share. The distribution

equates to an annualized increase to the Company’s regular common

dividend from $8.00 to $12.00 per share. The Board also declared

dividends with respect to the Company’s various series of preferred

shares. All the dividends are payable on March 30, 2023 to

shareholders of record as of March 15, 2023.

“We are pleased to announce a 50% common dividend increase as we

continue to deliver strong financial performance,” said Joe

Russell, President and Chief Executive Officer. “Public Storage is

executing on strategic initiatives focused on enhancing our digital

innovation and deepening our operating advantages, driving

significant growth and industry-leading direct operating margins of

approximately 80%. Our growth-oriented balance sheet and strong

retained cash flow provide exceptional capital access to execute on

a wide range of potential opportunities within the evolving macro

environment. We are well positioned for continued growth and value

creation.”

Company Information

Public Storage, a member of the S&P 500 and FT Global 500,

is a REIT that primarily acquires, develops, owns, and operates

self-storage facilities. At September 30, 2022, we had: (i)

interests in 2,836 self-storage facilities located in 40 states

with approximately 202 million net rentable square feet in the

United States and (ii) a 35% common equity interest in Shurgard

Self-Storage SA (Euronext Brussels:SHUR), which owned 259

self-storage facilities located in seven Western European nations

with approximately 14 million net rentable square feet operated

under the Shurgard® brand. Our headquarters are located in

Glendale, California.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements include statements relating

to our dividend policy and expectations, our outlook and all

underlying assumptions, our expected acquisition, disposition,

development and redevelopment activity, our strategic priorities,

and our expectations with respect to financing activities, rental

rates, cap rates and yields, leasing expectations, our credit

ratings, and all other statements other than statements of

historical fact. Such statements are based on management’s beliefs

and assumptions based on information currently available to

management. All statements in this press release, other than

statements of historical fact, are forward-looking statements that

may be identified by the use of the words “outlook,” “guidance,”

“expects,” “believes,” “anticipates,” “should,” “estimates,” and

similar expressions. These forward-looking statements involve known

and unknown risks and uncertainties, which may cause our actual

results and performance to be materially different from those

expressed or implied in the forward-looking statements. Factors and

risks that may impact future results and performance include, but

are not limited to those factors and risks described in Part 1,

Item 1A, “Risk Factors” in our most recent Annual Report on Form

10-K filed with the Securities and Exchange Commission (the “SEC”)

on February 22, 2022 and in our other filings with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230204005020/en/

Ryan Burke (818) 244-8080, Ext. 1141

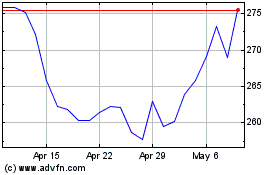

Public Storage (NYSE:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024