Pfizer Raises Earnings Projections -- Update

April 30 2019 - 4:00PM

Dow Jones News

By Jared S. Hopkins

Pfizer Inc.'s new portfolio of prescription drugs lifted sales

during the first quarter as the company said it continues to make

progress on growing through its internal pipeline.

Shares of Pfizer rose 3% Tuesday afternoon as the company

reported better-than-expected sales and earnings.

The New York-based drugmaker, the largest in the U.S. by

revenue, is working on a two-year-old plan to get approval by 2022

on 15 new drugs or indications that have the potential to generate

$1 billion in annual sales. Chief Executive Albert Bourla, who

began running the company in January, said Tuesday that he is

encouraged by the success of many drugs currently in clinical

trials, noting that only two trials have been discontinued.

"I'm very happy with the progress," Mr. Bourla said in an

interview.

For example, Tafamidis, which treats patients with a rare

condition that can lead to heart failure, may be approved by U.S.

regulators later this year and reach the market shortly afterward.

There are as many as 500,000 patients world-wide who have the

disease known as transthyretin cardiomyopathy, but fewer than 1%

have been diagnosed.

Pfizer also is looking at possible deals. Chief Business Officer

John Young said on a conference call with analysts that Pfizer is

targeting firms with early- to mid-stage assets. Mr. Young said

such deals are riskier than buying companies with commercial drugs

or ones farther along in development, but they also limit any

potential disruption to the company's pipeline.

He said the value of a bolt-on deal the company would consider

would be "a few billion."

For the first quarter, Pfizer reported a profit of $3.88

billion, or 68 cents a share, compared with a profit of $3.56

billion, or 59 cents a share, a year earlier. Excluding special

items, Pfizer posted adjusted earnings of 85 cents a share. Citing

the first-quarter results, the company also raised its full-year

projections for adjusted per-share earnings by a penny.

Pfizer's sales increased 2% from a year earlier to $13 billion.

Sales in Pfizer's innovative division of new drugs, which includes

prostate cancer treatment Xtandi and blood thinner Eliquis, grew by

3%, led mostly by an increase in its international markets.

Breast-cancer treatment Ibrance led the company's growing

oncology division, with sales up 21% to $1.1 billion. Pfizer

credited strong uptake after the drug hit some markets outside the

U.S., and analysts expect Ibrance to become Pfizer's top-selling

treatment by 2022.

Beyond 2022, the drugmaker expects a new slate of experimental

drugs to complete clinical trials with hopes of eventually filing

for regulatory approval. They include drugs for treating diabetes

and liver ailments as well as gene therapies, cutting-edge

treatments that aim to replace defective genes with healthy ones.

In March, Pfizer made another bet on the space when it said it

would pay for the rights for gene therapies being developed at

French company Vivet Therapeutics.

Mr. Bourla also left open the possibility of separating Pfizer's

segment that makes off-patent and generic prescription drugs,

including cholesterol-controlling Lipitor pills. Mr. Bourla said he

was satisfied with the recent performance of the division, now

called Upjohn, which includes more than 20 drugs.

Sales for the division fell about 1% from the year-ago period to

$3.1 billion. Growth came from emerging markets such as China but

was offset by pricing challenges that have afflicted the

industry.

Pfizer considered splitting into two companies before deciding

against it in 2016. But as the generic pricing pressures continue

to challenge the industry, companies like Mallinckrodt

Pharmaceuticals and Perrigo plan to split off their divisions that

make generic medicines.

Mr. Bourla said he expected low-single-digit revenue growth for

the Upjohn division once it absorbs the expiration of pain medicine

Lyrica's patent protection. In June, Pfizer expects to lose the

protection, and it could begin to face generic competition. Lyrica

posted sales of nearly $5 billion last year.

Pfizer's consumer health-care division, which includes products

like Centrum vitamins and ChapStick lip balm, fell 2% to $858

million. The company plans to combine the division with a similar

one from GlaxoSmithKline PLC, in a deal slated to close in the

second half of this year. The venture eventually will be spun

off.

--Kimberly Chen contributed to this article.

Write to Jared S. Hopkins at jared.hopkins@wsj.com

(END) Dow Jones Newswires

April 30, 2019 15:45 ET (19:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

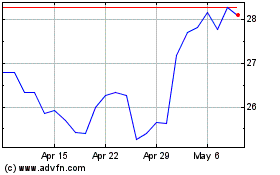

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024