Solid H1 financial performance; No change to 2024 and 2025

guidance; Beyond 2025, expect to grow at mid-single digits with

expanding adjusted operating margins

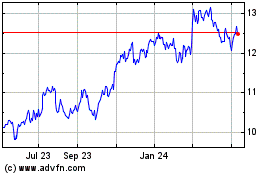

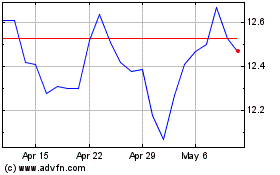

Pearson (FTSE: PSON.L):

Financial Highlights

£m

H1 2024

H1 2023

£m

H1 2024

H1 2023

Business performance

Statutory results

Sales

1,754

1,879

Sales

1,754

1,879

Adjusted operating profit

250

250

Operating profit

219

219

Operating cash flow

129

79

Profit for the period

158

187

Free cash flow

27

(50)

Net cash generated from

operations

185

106

Adjusted earnings per share

25.6p

25.6p

Basic earnings per share

23.1p

26.1p

Highlights

- Underlying Group sales growth1 of 2%, excluding OPM2 and the

Strategic Review3 businesses with each segment performing broadly

in line with our expectations.

- Underlying adjusted operating profit growth1 of 4% to

£250m.

- Strong free cash flow performance up £77m to £27m.

- £500m share buyback substantially complete and raised

interim dividend by 6%, while balance sheet remains

robust.

- Remain on track to deliver on FY24 expectations and

reiterate guidance out to 2025.

- Beyond 2025, Pearson is positioned to deliver mid-single

digit underlying sales CAGR and sustained margin improvement that

will equate to an average increase of 40 basis points per annum by

continuing to drive performance in the core business, executing

synergies and expanding into adjacent markets.

Omar Abbosh, Pearson’s Chief Executive, said:

“Since joining Pearson at the start of the year, I have led a

comprehensive review of our business and the markets in which we

operate. This process has only reinforced my conviction in the

potential of Pearson and the vital role we play in helping people

realise the life they imagine through learning. Significant

demographic shifts and rapid advances in AI will be important

drivers of growth in education and work over the coming years, and

this plays to Pearson’s strengths as a trusted provider of learning

and assessment services.

We are implementing plans across all of our businesses that will

see us deliver better products & services with greater

efficiency. We’re also focusing on opportunities to progressively

build our presence in materially larger and higher growth markets

in which we are well positioned to succeed, with a particular focus

on early careers and enterprise skilling.

“Our good strategic and financial performance in the first half

of the year sets us up to achieve our guidance for the current year

and for 2025, and we expect thereafter to continue to deliver

attractive growth with progressive improvements in our margins

alongside consistently strong cash generation.”

Underlying sales growth1 of 2%, excluding OPM2 and Strategic

Review3 businesses; 1% in aggregate

- Assessment & Qualifications sales grew 2%, with growth

across Pearson VUE, Clinical, and UK & International

Qualifications partially offset by an expected, small decline in US

Student Assessments.

- Virtual Schools sales declined 1%, reflecting the previously

announced contract losses for the current academic year. Virtual

Learning sales declined 8% mostly attributable to the final portion

of the OPM ASU contract in the first half of 2023.

- Higher Education sales were down 2%, in line with our phasing

guidance. We are seeing encouraging signs of progress in the

business with Spring adoption data indicating small market share

gains.

- English Language Learning sales increased 11% due to strong

growth in Institutional as well as growth in Mondly, partially

offset by a sales decline in PTE given market dynamics. The

Argentina FX impact discussed at Q1 has reduced as expected, and

will be immaterial in a full year context.

- Workforce Skills sales grew 6%, with strong performances in

Vocational Qualifications, GED and Credly.

Adjusted operating profit1 up 4% on an underlying basis to

£250m

- Performance driven by trading alongside net cost phasing and

savings, partially offset by inflation and restructuring charges in

Higher Education, which were weighted to the first half. First half

adjusted profit margin grew to 14% (H1 2023: 13%).

- Headline growth was flat reflecting underlying performance,

portfolio changes and currency movements.

- Adjusted earnings per share was flat at 25.6p (H1 2023: 25.6p)

with higher net interest costs offset by the reduction in issued

shares, both due to the share buyback.

Strong free cash flow with robust balance sheet enabling

continued investment and driving increased shareholder

returns

- Operating cash flow was again strong, up £50m to £129m (H1

2023: £79m) with good underlying fundamentals, as well as some

phasing and FX benefits.

- Free cash flow was also strong, up £77m to £27m (H1 2023:

(£50)m) given the operating cash performance and no reorganisation

costs this year.

- Our balance sheet remains robust with net debt of £1.2bn (H1

2023: £0.9bn), the year on year increase being due to the £500m

share buyback and dividends, partially offset by free cash

flow.

- Proposed interim dividend of 7.4p (H1 2023: 7.0p) represents an

increase of 6%.

- The previously announced buyback extension to repurchase £200m

of shares continued. As at 30th June 2024 £163m of shares had been

repurchased at an average price of 994p per share, representing 81%

of the total programme.

Continued operational progress

Operational progress continued across each of our

businesses

- In Assessment & Qualifications, Pearson VUE renewed and won

a number of key contracts, which will support future growth.

Pearson VUE wins included university entrance tests in the UK and

the teacher licence contract in Georgia, and it renewed key

contracts with the National Council of State Boards of Nursing, the

Project Management Institute, and the American Registry of

Radiologic Technologists. PDRI also saw good growth, with strong

volumes across both the TSA and United States Airforce

contracts.

- In Virtual Schools, we have already announced the opening of 3

new schools this year and a further 19 career programmes. This

brings our total number of schools to 40, with 24 career

programmes, across 30 states for the 2024/25 academic year.

- In Higher Education, recent Spring semester market data

indicates a small gain in adoption share, while we also saw 3%

growth in core text units, 2% growth in US digital subscriptions

and Inclusive Access growth of 25%. Pearson+ continued to perform

well with 5.0m cumulative registered users and paid subscriptions

for the full academic year increasing 18% to 1.1m. We are seeing

good engagement with our AI study tools, and are on track to extend

to a further c.80 titles for Fall back to school. Pearson will also

be launching AI tools for instructors for the Fall 2024 semester in

25 of our best-selling titles across business, math, science, and

nursing in the US.

- In English Language Learning, PTE continued to gain market

share, despite a market which has declined given tightening of

policies around international study and migration across Australia,

Canada and the UK. Given these market dynamics, we expect PTE sales

to be flat to down for the year. Our market share gains in PTE, and

the ramp up for Canada, mean we are well placed for English high

stakes testing market growth, which we expect in the medium term

given demographic projections.

- In Workforce Skills, Vishaal Gupta joined Pearson on April 15th

to lead the division, and play a critical role in executing our

enterprise skills strategy.

- Dave Treat joined Pearson as Chief Technology Officer on 2nd

July 2024. Dave will report to CEO, Omar Abbosh, and work in close

partnership with Pearson’s Chief Product and Chief Information

Officers. He will lead technology innovation and architecture

across the company.

- Ginny Cartwright Ziegler joined Pearson, today, 29 July 2024 as

Chief Marketing Officer. Ginny will report to CEO Omar Abbosh and

will lead the next generation of our work in marketing, brand and

communications. Ginny is succeeding Lynne Frank, who has stepped

down from her dual role as Chief Marketing Officer and

Co-President, Direct to Consumer.

Positioning Pearson for sustained growth with continued

higher margins

Through an extensive examination of the business and the

markets in which we operate, we have identified a targeted market

expansion opportunity for Pearson and have updated our strategy to

drive higher performance in the core business and unlock new

synergies

- Pearson is in a strong position today. We are the world’s

lifelong learning company, where we are trusted to help individuals

realise the life they imagine through learning. Our five businesses

have clear lines of accountability and improving financial

performance, with particular strength in assessments and

verification.

- We are leaders today in a c.$15bn subsegment of the U.S.

learning market, and are well positioned to play in a larger, and

faster growing c.$80bn addressable market.

- The opportunity for Pearson will be supported by two key

secular trends foreseen over the coming years: shifts in

demographic trends and the rapid growth in the power of AI. The

demographic shift will see the baby boomer generation leave the

workforce, resulting in heightened pressure on talent sourcing, and

the rapid development of increasingly powerful AI models will

significantly change the world of work and skills requirements.

Employers will need to find new pools of talent and continuously

develop and verify the skills of their workforces to keep pace with

and benefit from technology and AI advancements.

- To realise the growth opportunity for Pearson we will:

- Drive further performance from our existing five core

businesses to deliver an improved customer proposition, growth and

efficiencies. We have identified a number of technology enabled

initiatives, which we expect to unlock tens of millions of savings

over the medium term. Initially these savings will be offset by

restructuring costs, but as these pay back they will enable us to

further invest in growth opportunities.

- Unlock execution-based synergies across the business units from

product & service bundling, a modern approach to software and

product development, and a focus on strategic partnerships.

- We will allocate our investment where we see the best

opportunities for growth and returns: firstly assessments and

verifications; then enterprise skills and early careers.

- We will maintain net debt to EBITDA of around 2x, on average

over time, though in the short term we intend to remain below this

level to maintain some investment optionality. Our dividend policy

is progressive and sustainable. At present, we do not plan to

extend our share buyback programme, but are committed to regularly

reviewing this.

Outlook

2024 Outlook reaffirmed4 Group underlying sales growth,

adjusted operating profit and tax outlook for 2024 remain in line

with market expectations. As guided, interest will be c.£45m and

free cash flow conversion 95-100%.

In terms of divisional guidance and phasing:

- Expect improved growth momentum in the second half of 2024 with

the growth of Higher Education and normalised comparators for the

assessments businesses.

- In Assessment & Qualifications, we continue to expect low

to mid-single digit sales growth for the year, with sales growth

weighted to H2.

- In Virtual Schools, we continue to expect sales to decline at a

similar rate to 2023, given the previously cited loss of a larger

partner school for the 2024/25 academic year. We expect Virtual

Schools to return to growth in 2025 and beyond.

- In Higher Education, we remain confident we will return to

growth in the second half and for the full year. Growth in digital

sales will continue to shift revenue recognition from Q3 to

Q4.

- In English Language Learning, we continue to expect high single

digit sales growth and growth weighted to the second half given the

outstanding performance in the first half of 2023. The growth will

be driven mainly by Institutional, with PTE being flat to

down.

- In Workforce Skills, we expect to achieve high single digit

sales growth.

- Every 1c movement in £:$ rate equates to approximately £5m

adjusted operating profit impact.

2025 Outlook We continue to expect the Group to achieve

mid-single digit underlying sales 3-year CAGR from 2022 to 2025,

excluding OPM and Strategic Review businesses, and remain on track

to achieve our 16-17% adjusted operating profit margin

guidance.

Medium Term Outlook Our future growth and investment

focus will lead to mid-single digit underlying sales CAGR. Through

continued operational improvements, we also expect to deliver

sustained margin improvement that will equate to an average

increase of 40 basis points per annum beyond 2025. We will maintain

free cash flow conversion in the region of 90-100% on average

across the period.

Contacts

Investor Relations

Jo Russell

Alex Shore

+44 (0) 7785 451 266

+44 (0) 7720 947 853

Gemma Terry

Brennan Matthews

+44 (0) 7841 363 216

+1 (332) 238-8785

Media

Teneo

Ed Cropley

+44 (0) 7492 949 346

Pearson

Laura Ewart

+44 (0) 7798 846 805

Results event

Pearson’s Interim Results presentation will be held today at

both 09:30 and 14:00 (BST). If you would like to attend the

in-person session at 09:30, please email amy.plavecky@pearson.com.

Register to join either session virtually here

https://pearson.connectid.cloud/register

Notes Forward looking statements: Except for the

historical information contained herein, the matters discussed in

this statement include forward-looking statements. In particular,

all statements that express forecasts, expectations and projections

with respect to future matters, including trends in results of

operations, margins, growth rates, overall market trends, the

impact of interest or exchange rates, the availability of

financing, anticipated cost savings and synergies and the execution

of Pearson’s strategy, are forward-looking statements. By their

nature, forward-looking statements involve risks and uncertainties

because they relate to events and depend on circumstances that will

occur in future. They are based on numerous assumptions regarding

Pearson’s present and future business strategies and the

environment in which it will operate in the future. There are a

number of factors which could cause actual results and developments

to differ materially from those expressed or implied by these

forward-looking statements, including a number of factors outside

Pearson’s control. These include international, national and local

conditions, as well as competition. They also include other risks

detailed from time to time in Pearson’s publicly-filed documents

and you are advised to read, in particular, the risk factors set

out in Pearson’s latest annual report and accounts, which can be

found on its website (www.pearsonplc.com). Any forward-looking

statements speak only as of the date they are made, and Pearson

gives no undertaking to update forward-looking statements to

reflect any changes in its expectations with regard thereto or any

changes to events, conditions or circumstances on which any such

statement is based. Readers are cautioned not to place undue

reliance on such forward-looking statements.

KPIs

KPI

Objective

KPI Measure

H1 2024

H1 2023

Digital Growth

Drive digital sales growth

OnVUE volumes

1.2m

1.5m*

Higher Education US digital

subscriptions

4.5m

4.4m+

PTE volume

546k

606k

Consumer Engagement

Create engaging and personalised consumer

experiences

NPS for Connections Academy

+67

+67

NPS for PTE

+57

+56

Pearson+ registered users

5.0m

4.7m

Mondly paid subscriptions

532k

473k

Workforce Skills registered users

5.4m

5.3m

Product Effectiveness

Improve the effectiveness of our products

to deliver better outcomes

PTE speed of score return

1.1 days

1.1 days

VUE test volumes

10.9m

10.8m*

VUE partner retention

99.7%

98.0%

Workforce Skills number of enterprise

customers

1,487

1,556

Higher Education product usage – text

units

2.1m

2.0m

*H1 2023 figures have been restated for adjustments made in H2

2023.

+H1 2023 US digital subscriptions restated

from 4.5m to 4.4m due to removal of non-paying subscribers.

The above table is a subset of our full

list of strategic KPIs, which will be reported on alongside full

year results.

For a full list of KPI measure

definitions, please refer to:

https://plc.pearson.com/en-GB/purpose/our-targets-kpis

Operational review

£m

H1 2024

H1 2023

Headline

growth

CER

Growth1

Underlying

growth1

Sales

Assessment & Qualifications

811

796

2%

4%

2%

Virtual Learning

254

373

(32%)

(31%)

(8%)

Higher Education

358

379

(6%)

(4%)

(2%)

English Language Learning

188

184

2%

11%

11%

Workforce Skills

143

140

2%

3%

6%

Strategic review3

-

7

(100%)

(100%)

(100%)

Total

1,754

1,879

(7%)

(4%)

1%

Total, excluding OPM2 and Strategic

Review3

2%

Adjusted operating profit/loss

Assessment & Qualifications

187

174

7%

10%

7%

Virtual Learning

31

47

(34%)

(32%)

(32%)

Higher Education

(1)

(1)

0%

100%

100%

English Language Learning

4

8

(50%)

38%

38%

Workforce Skills

29

21

38%

33%

27%

Strategic review3

-

1

(100%)

(100%)

(100%)

Total

250

250

0%

5%

4%

1

Throughout this announcement: a) Growth

rates are stated on an underlying basis unless otherwise stated.

Underlying growth rates exclude currency movements, and portfolio

changes. b) The ‘business performance’ measures are non-GAAP

measures and reconciliations to the equivalent statutory heading

under IFRS are included in notes to the attached condensed

consolidated financial statements 2, 3, 4, 6, 7 and 14. c) Constant

exchange rates are calculated by assuming the average FX in the

prior period prevailed through the current period.

2

In 2023, we completed the sale of the POLS

business and as such have removed from underlying measures

throughout. Within this specific measure we exclude our entire OPM

business (POLS and ASU) to aid comparison to guidance. As expected,

there are no sales in the OPM business in 2024.

3

Strategic Review is sales in international

courseware local publishing businesses which have been wound down.

As expected, there are no sales in these businesses in 2024.

4

2024 consensus on the Pearson website as

at 22nd November 2023; organic CER sales growth of 3.7%, median

adjusted operating profit of £621m at £:$ 1.22, tax rate 24%.

Assessment & Qualifications In Assessment &

Qualifications, sales increased 2% on an underlying basis and 2% on

a headline basis. Adjusted operating profit increased 7% in

underlying terms due to operating leverage on sales growth, and

cost phasing and savings partially offset by inflation and 7% in

headline terms due to this, PDRI profit and currency movements.

Pearson VUE sales were up 4% in underlying terms driven by

favorable mix and value-added services. Test volumes increased

versus the same period last year to 10.9m. PDRI also saw good

growth with strong volumes.

In US Student Assessment, sales decreased 3% in underlying terms

due to reduced scope and phasing of some contracts which will

normalise in the second half.

In Clinical Assessment, sales increased 1% in underlying terms

supported by pricing, digital product growth and a new product

release.

In UK and International Qualifications, sales increased 7% in

underlying terms driven by volume, pricing and strong International

growth.

Virtual Learning Virtual Schools sales were down 1% on an

underlying basis, given the previously cited loss of a larger

partner school in the 2023/24 academic year. In Virtual Learning,

sales decreased 8% on an underlying basis mostly attributable to

the final portion of the OPM ASU contract in the first half of 2023

and 32% on a headline basis due to currency movements and the

disposal of the OPM business. Adjusted operating profit declined

32% in underlying terms, as the prior year comparator benefited

from the ASU contract, and decreased 34% in headline terms due to

this and currency movements.

Higher Education In Higher Education, sales

declined 2% on an underlying basis, in line with our phasing

guidance, and decreased 6% on a headline basis due to this,

currency movements and portfolio changes. Adjusted operating profit

increased in underlying terms driven by cost savings partially

offset by restructuring costs and trading and was flat in headline

terms due to this offset by currency movements and portfolio

changes.

We also saw a strong performance in K-12 with sales growth of

12%, given strong adoption cycle fundamentals in this market this

year.

English Language Learning In English Language Learning,

sales were up 11% on an underlying basis due to strong growth in

Institutional (including hyperinflationary pricing in Argentina) as

well as growth in Mondly, and 2% on a headline basis due to this

offset by currency movements. Adjusted operating profit increased

by 38% in underlying terms due to increased operating leverage on

sales partially offset by increased investment and decreased 50% in

headline terms due to this and currency movements.

PTE volumes were down 10%, due to declines in the English High

Stakes testing market due to tightening of policies around

international study and migration. PTE has continued to see market

share gains, particularly in India and China, while it also

continues to benefit in the ramp up for Canada.

Within Institutional, performance was strong, with particularly

good growth in Latin America and the Middle East.

Our Online Self-Study business, Mondly, performed well with paid

subscriptions increasing 12% versus the prior period driven by new

enterprise contracts and DTC users.

Workforce Skills In Workforce Skills, sales were up 6% on

an underlying basis and 2% on a headline basis. Adjusted operating

profit increased by 27% in underlying terms due to trading and cost

savings and increased 38% in headline terms due to this, currency

movements and portfolio changes.

Both the Vocational Qualifications and the Workforce Solutions

businesses grew by 6% in underlying terms.

FINANCIAL REVIEW

Operating result Sales for the six months to 30 June 2024

decreased on a headline basis by £125m or 7% from £1,879m for the

six months to 30 June 2023 to £1,754m for the same period in 2024

and adjusted operating profit remained at £250m in the first half

of 2024 compared to £250m in the first half of 2023 (for a

reconciliation of this measure see note 2 to the condensed

consolidated financial statements).

The headline basis simply compares the reported results for the

six months to 30 June 2024 with those for the equivalent period in

the prior year. We also present sales and profits on an underlying

basis which excludes the effects of exchange, the effect of

portfolio changes arising from acquisitions and disposals and the

impact of adopting new accounting standards that are not

retrospectively applied, when relevant. Our portfolio change is

calculated by excluding sales and profits made by businesses

disposed in 2023 or 2024 and by ensuring the contribution from

acquisitions is comparable year on year. For prior year

acquisitions, the corresponding pre-acquisition period is excluded

from the current year. Portfolio changes mainly relate to the

disposals of the Group’s interest in POLS, Pearson College and our

international courseware local publishing business in India and

businesses within Higher Education in 2023, and the acquisition of

PDRI in 2023.

On an underlying basis, sales increased by 1% in the first six

months of 2024 compared to the equivalent period in 2023 and

adjusted operating profit increased by 4%. Currency movements

decreased sales by £45m and adjusted operating profit by £12m, and

portfolio changes decreased sales by £93m and increased adjusted

operating profit by £1m. There were no new accounting standards

adopted in the first half of 2024 that impacted sales or

profits.

Adjusted operating profit includes the results from discontinued

operations when relevant but excludes charges for acquired

intangible amortisation and impairment, acquisition related costs,

gains and losses arising from disposals, the cost of major

reorganisation, when relevant, property charges and one off-costs

related to the UK pension scheme. A summary of these adjustments is

included below and in note 2 to the condensed consolidated

financial statements.

all figures in £ millions

2024

2023

2023

half year

half year

full year

Operating profit

219

219

498

Add back: Intangible charges

20

24

48

Add back: UK pension discretionary

increase

5

-

-

Add back: Other net gains and losses

6

7

16

Add back: Property charges

-

-

11

Adjusted operating profit

250

250

573

Intangible amortisation charges to the end of June 2024 were

£20m compared to a charge of £24m in the equivalent period in 2023.

This is due to increased amortisation from recent acquisitions

which is more than offset by a reduction in amortisation from

intangible assets at the end of their useful life and recent

disposals.

UK pension discretionary increases in 2024 relate to one-off

pension increases awarded to certain cohorts of pensioners in

response to the cost of living crisis.

Other net gains and losses in 2024 relate to costs related to

prior year acquisitions and disposals, partially offset by a gain

on the partial disposal of our investment in an associate. Other

net gains and losses in 2023 relate largely to the gain on disposal

of the POLS business and a gain resulting from the release of a

provision related to a previous disposal, offset by losses on the

disposal of Pearson College and costs related to disposals and

acquisitions.

Property charges of £11m in the second half of 2023 relate to

impairments of property assets arising from the impact of updates

in 2023 to assumptions initially made during the 2022 and 2021

reorganisation programmes. There are no such charges in the first

half of 2024.

The reported operating profit of £219m in the first half of 2024

compares to a profit of £219m in the first half of 2023, with the

disposal of POLS and other businesses in 2023 reducing sales but

having minimal impact on profit, and unfavourable FX movements and

inflation costs being offset by operating leverage on sales and

cost phasing and savings.

Due to seasonal bias in some of the Group’s businesses, Pearson

typically makes a higher proportion of its profits and operating

cash flows in the second half of the year.

Net finance costs Net finance income decreased on a

headline basis from income of £17m in the first half of 2023 to an

expense of £7m in the same period in 2024. The decrease is

primarily due to losses on investments held at fair value through

profit and loss (FVTPL) compared to gains in 2023, a reduction in

foreign exchange gains, increased borrowings and a reduction in

returns on cash deposits.

Net interest payable reflected in adjusted earnings to 30 June

2024 was £21m, compared to a payable of £12m in the first half of

2023. The increase is primarily due to increased borrowings and a

reduction in returns on cash deposits.

Net finance income relating to retirement benefits has been

excluded from our adjusted earnings as we believe the income

statement presentation does not reflect the economic substance of

the underlying assets and liabilities. Also included in the net

finance costs (but not in our adjusted measure) are interest costs

relating to acquisition or disposal transactions, fair value

movements on investments classified as FVTPL foreign exchange and

other gains and losses on derivatives. Interest relating to

acquisition or disposal transactions is excluded from adjusted

earnings as it is considered part of the acquisition cost or

disposal proceeds rather than being reflective of the underlying

financing costs of the Group. Foreign exchange, fair value

movements and other gains and losses are excluded from adjusted

earnings as they represent short-term fluctuations in market value

and are subject to significant volatility. Other gains and losses

may not be realised in due course as it is normally the intention

to hold the related instruments to maturity. Interest on certain

tax provisions is excluded from our adjusted measure in order to

mirror the treatment of the underlying tax item.

In the period to 30 June 2024, the total of these items excluded

from adjusted earnings was net income of £14m compared to net

income of £29m in the first half of 2023. Net finance income

relating to retirement benefits decreased from £13m in the first

half of 2023 to £11m in 2024 reflecting the comparative funding

position of the plans at the beginning of each year offset by

higher prevailing discount rates. Fair value movements on

investments in unlisted securities are a loss of £8m in the first

half of 2024 compared to a gain of £5m in 2023. For a

reconciliation of the adjusted measure see note 3 to the condensed

consolidated financial statements.

Taxation The reported tax on statutory earnings for the

six months to 30 June 2024 was a charge of £54m compared to a

charge of £49m in the period to 30 June 2023. This equates to an

effective tax rate of 25.5% (2023: 20.8%). The higher effective tax

rate compared to the prior period is primarily due to a tax credit

being recognised on the disposal of the POLS business in 2023 which

is not recurring in 2024.

The total adjusted tax charge for the period was £54m (2023:

£54m), corresponding to an effective tax rate on adjusted profit

before tax of 23.6% (2023: 22.7%). For a reconciliation of the

adjusted measure see note 4 to the condensed consolidated financial

statements.

In the first half of 2024, there was a net tax payment of £69m

(2023: £59m), principally relating to the US and the UK.

Other comprehensive income Included in other

comprehensive income are the net exchange differences on

translation of foreign operations. The loss on translation of £9m

at 30 June 2024 compares to a loss at 30 June 2023 of £166m. The

loss in 2024 arises from an overall weakening of the majority of

currencies to which the Group is exposed, partially offset by a

slight strengthening of the US dollar. A significant proportion of

the Group’s operations are based in the US and the US dollar

closing rate at 30 June 2024 was £1:$1.26 compared to the opening

rate of £1:$1.27. At the end of June 2023, the US dollar rate was

£1:$1.27 compared to the opening rate of £1:$1.21.

Also included in other comprehensive income at 30 June 2024 is

an actuarial gain of £1m in relation to retirement benefit

obligations. The gain arises largely from losses on assets and

experience losses, offset by a decrease in liabilities driven by

higher discount rates. The gain in 2024 compares to an actuarial

loss at 30 June 2023 of £27m.

Fair value losses of £4m (2023: gains of £2m) have been

recognised in other comprehensive income and relate to movements in

the value of investments in unlisted securities held at fair value

through other comprehensive income (FVOCI).

In 2023, a gain of £122m was recycled from the currency

translation reserve to the income statement in relation to the

disposal of the POLS business.

Cash flow and working capital Our operating cash flow

measure is used to align cash flows with our adjusted profit

measures (see note 14 to the condensed consolidated financial

statements). Operating cash flow increased on a headline basis by

£50m from an inflow of £79m in the first half of 2023 to an inflow

of £129m in the first half of 2024. The increase is largely

explained by reduced capital expenditure on product development,

property, plant, equipment and software and FX as well as

favourable working capital movements, some of which arise from

portfolio changes.

The equivalent statutory measure, net cash generated from

operations, was an inflow of £185m in 2024 compared to an inflow of

£106m in 2023. Compared to operating cash flow, this measure

includes reorganisation costs but does not include regular

dividends from associates. It also excludes capital expenditure on

property, plant, equipment and software, and additions to right of

use assets as well as disposal proceeds from the sale of property,

plant, equipment and right of use assets (including the impacts of

transfers to/from investment in finance lease receivable). In the

first half of 2024, reorganisation cash outflow was £5m compared to

£46m in the same period in 2023.

In the first half of 2024, there was an overall increase of £23m

in cash and cash equivalents from £309m at the end of 2023 to £332m

at 30 June 2024. The increase in 2024 is primarily due to the cash

inflow from operations of £185m and proceeds from borrowings of

£495m offset by payments for the acquisition of subsidiaries of

£38m, share buyback programme of £278m, dividends paid of £107m,

own share purchases of £37m, tax paid of £69m, net interest

payments of £28m, capital expenditure on property, plant, equipment

and software of £58m and payments of lease liabilities of £39m.

The movement on trade and other liabilities is driven by the

payment of deferred consideration relating to previous

acquisitions, the net movement on the accrual for share buyback

programmes as well as movements in working capital balances.

Liquidity and capital resources The Group’s net debt

increased from £744m at the end of 2023 to £1,177m at the end of

June 2024. The increase is largely due to free cash flow which is

more than offset by the share buyback programme and dividend

payments.

At 30 June 2024, the Group had drawn £495m on its Revolving

Credit Facility.

At 30 June 2024, the Group had approximately £0.5bn in total

liquidity immediately available from cash and its Revolving Credit

Facility maturing February 2027. In assessing the Group’s ability

to continue as a going concern for the period until 31 December

2025, the Board analysed a variety of downside scenarios, including

a severe but plausible scenario, where the Group is impacted by a

combination of all principal risks from H2 2024, as well as reverse

stress testing to identify what would be required to either breach

covenants or run out of liquidity. The severe but plausible

scenario modelled a severe reduction in revenue, profit and

operating cash flow from risks continuing throughout 2025. During

the period under evaluation, the Group has a €300m bond (converted

to c£260m) due for repayment in May 2025 and the model assumes that

this is refinanced with a similar sized bond in 2024. In all

scenarios, the Group would maintain comfortable liquidity headroom

and sufficient headroom against covenant requirements during the

period under assessment even before modelling the mitigating effect

of actions that management would take in the event that these

downside risks were to crystallise.

Post-retirement benefits Pearson operates a variety of

pension and post-retirement plans. The UK Group pension plan has by

far the largest defined benefit section. This plan has a strong

funding position and a surplus with a very substantially de-risked

investment portfolio including approximately 50% of the assets in

buy-in contracts. We have some smaller defined benefit sections in

the US and Canada but, outside the UK, most of the companies

operate defined contribution plans.

The charge to profit in respect of worldwide pensions and

retirement benefits amounted to £30m in the period to 30 June 2024

(30 June 2023: £23m) of which a charge of £41m (30 June 2023: £36m)

was reported in operating profit and income of £11m (30 June 2023:

£13m) was reported against other net finance costs. In the period

to 30 June 2024, a charge of £5m (30 June 2023: nil) related to

one-off discretionary pension increases has been excluded from

adjusted operating profit.

The overall surplus on UK Group pension plans of £491m at the

end of 2023 has decreased to a surplus of £485m at the end of June

2024. The decrease has arisen principally due to asset returns

being lower than expected, an increase in long-term inflation

expectations, and inflation over the period being slightly higher

than was expected at the beginning of the year. In total, our

worldwide net position in respect of pensions and other

post-retirement benefits decreased from a net asset of £455m at the

end of 2023 to a net asset of £449m at the end of June 2024.

Businesses acquired The Group made no acquisitions of

subsidiaries in H1 2024. The cash outflow in H1 2024 relating to

acquisitions of subsidiaries was £38m, arising from the payment of

deferred consideration in respect of prior year acquisitions,

mainly Credly and Mondly, which were acquired in 2022. In addition,

there was a cash outflow relating to investments of £7m.

The cash outflow in the first half of 2023 relating to

acquisitions of subsidiaries was £173m arising primarily from the

acquisition of PDRI. In addition, there was a cash outflow relating

to the acquisition of associates of £5m and investments of £6m.

Businesses disposed The Group made no disposals of

subsidiaries in H1 2024. In 2024, the cash outflow relating to

costs paid in relation to the disposal of businesses in prior years

was £6m. The cash outflow in the first half of 2023 relating to the

disposal of businesses was £19m mainly relating to the disposal of

POLS and Pearson College.

In addition, the Group sold part of its investment in its

associate, Academy of Pop, for £4m (which has not yet been paid),

resulting in a gain of £2m. The remaining stake is now classified

as a financial investment.

Dividends The dividend accounted for in the six months to

30 June 2024 is the final dividend in respect of 2023 of 15.7p. An

interim dividend for 2024 of 7.4p was declared by the Board in July

2024 and will be accounted for in the second half of 2024.

The interim dividend will be paid on 16 September 2024 to

shareholders who are on the register of members at close of

business on 9 August 2024 (the Record Date). Shareholders may elect

to reinvest their dividend in the Dividend Reinvestment Plan

(DRIP). The last date for receipt of DRIP elections and revocations

will be 23 August 2024. A Dividend Reinvestment Plan (DRIP) is

provided by our Registrar, Computershare Investor Services. The

DRIP enables the Company's shareholders to elect to have their cash

dividend payments used to purchase the Company's shares. More

information can be found at www.computershare.com/Investor

Share buyback On 20 September 2023, the Board approved a

£300m share buyback programme in order to return capital to

shareholders, with a further £200m extension being announced by the

Group on 1 March 2024. In the first half of 2024, c28m shares have

been bought back at a cash cost of £278m. The £300m programme

completed in March 2024 and as at 30 June 2024 the £200m programme

was c80% complete. A £40m liability for the remainder of the £200m

programme plus related costs has been accrued as at 30 June 2024.

At 31 December 2023, a liability of £118m was accrued in relation

to the £300m share buyback programme. The nominal value of the

cancelled shares of £7m has been transferred to the capital

redemption reserve. In the period from 1 to 26 July 2024, an

additional c2m of shares have been repurchased.

Principal risks and uncertainties In the 2023 Annual

Report and Accounts, we set out our assessment of the principal

risk issues that face the business under the categories:

accreditation risk, artificial intelligence, content and channel

risks, capability risk, competitive marketplace, customer

expectations, portfolio change, and reputation and

responsibility.

We also noted in our 2023 Annual Report and Accounts that the

Group continues to closely monitor significant near-term and

emerging risks which have been identified as climate transition,

inflation and interest rates, recession, supply chain, tax and

sanctions and geopolitics.

The principal risks and uncertainties are summarised below. The

selection of principal risks will be reviewed in the second half of

the year alongside the Group’s long-term strategic planning

process. However, these risks have not changed materially from

those detailed in the 2023 Annual Report.

Accreditation Risk

Termination or modification of accreditation due to policy

changes or failure to maintain the accreditation of our courses and

assessments by states, countries, and professional associations,

reducing their eligibility for funding or attractiveness to

learners.

Artificial Intelligence, Content and Channel Risk

The risk that Pearson’s intellectual property is harder to

protect as a result of increased content generation through

artificial intelligence and that Pearson’s content and method of

delivery (channel) is, or is perceived to be, insufficiently

differentiated in terms of outcomes or learner experience.

Capability Risk

Inability to meet our contractual obligations or to transform as

required by our strategy due to infrastructure, system or

organisational challenges.

Competitive Marketplace

Significant changes in our target markets could make those

markets less attractive. This could be due to significant changes

in demand or in supply which impact the addressable market, market

share and margins (e.g. changes in enrolments, in-sourcing of

learning and assessment by customers, open educational resources, a

shift from in person to virtual or vice versa or innovations in

areas such as generative AI).

Customer Expectations

Rising end-user expectations increase the need to offer

differentiated value propositions, risking margin pressure to meet

these expectations and potential loss of sales if not

successful.

Portfolio Change

Failure to effectively execute desired or required portfolio

changes to promote scale or capability and increase focus on key

divisional and geographic markets, due to either execution failures

or inability to secure transactions at appropriate valuations.

Reputation and Responsibility

The risk of serious reputational harm through failure to meet

obligations to key stakeholders. These include legal and regulatory

requirements, the possibility of serious unethical behaviour and

serious breaches of customer trust.

CONDENSED CONSOLIDATED INCOME STATEMENT for the period ended

30 June 2024

all figures in £ millions

note

2024

2023

2023

half year

half year

full year

Continuing operations

Sales

2

1,754

1,879

3,674

Cost of goods sold

(875

)

(960

)

(1,839

)

Gross profit

879

919

1,835

Operating expenses

(654

)

(688

)

(1,322

)

Other net gains and losses

2

(6

)

(7

)

(16

)

Share of results of joint ventures and

associates

-

(5

)

1

Operating profit

2

219

219

498

Finance costs

3

(57

)

(36

)

(81

)

Finance income

3

50

53

76

Profit before tax

212

236

493

Income tax

4

(54

)

(49

)

(113

)

Profit for the period

158

187

380

Attributable to:

Equity holders of the company

157

186

378

Non-controlling interest

1

1

2

Earnings per share from continuing

operations (in pence per share)

Basic

5

23.1

p

26.1

p

53.1

p

Diluted

5

22.8

p

25.9

p

52.7

p

The accompanying notes to the condensed consolidated financial

statements form an integral part of the financial information.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME for

the period ended 30 June 2024

all figures in £ millions

2024

2023

2023

half year

half year

full year

Profit for the period

158

187

380

Items that may be reclassified to the

income statement

Net exchange differences on translation of

foreign operations

(9

)

(166

)

(177

)

Currency translation adjustment on

disposals

-

(122

)

(122

)

Attributable tax

-

1

-

Items that are not reclassified to the

income statement

Fair value gain on other financial

assets

(4

)

2

1

Attributable tax

-

-

-

Remeasurement of retirement benefit

obligations

1

(27

)

(85

)

Attributable tax

-

7

20

Other comprehensive expense

(12

)

(305

)

(363

)

Total comprehensive income /

(expense)

146

(118

)

17

Attributable to:

Equity holders of the company

145

(118

)

16

Non-controlling interest

1

-

1

CONDENSED CONSOLIDATED BALANCE SHEET as at 30 June

2024

all figures in £ millions

note

2024

2023

2023

half year

half year

full year

Property, plant and equipment

207

226

217

Investment property

75

60

79

Intangible assets

9

3,050

3,126

3,091

Investments in joint ventures and

associates

11

17

22

Deferred income tax assets

34

27

35

Financial assets – derivative financial

instruments

4

41

32

Retirement benefit assets

491

554

499

Other financial assets

141

138

143

Income tax assets

41

41

41

Trade and other receivables

134

138

135

Non-current assets

4,188

4,368

4,294

Intangible assets – product

development

941

947

947

Inventories

89

110

91

Trade and other receivables

1,081

1,060

1,050

Financial assets – derivative financial

instruments

55

17

16

Current income tax assets

23

10

15

Cash and cash equivalents (excluding

overdrafts)

332

355

312

Current assets

2,521

2,499

2,431

Assets classified as held for sale

-

15

2

Total assets

6,709

6,882

6,727

Financial liabilities – borrowings

(1,300

)

(1,308

)

(1,094

)

Financial liabilities – derivative

financial instruments

(3

)

(43

)

(38

)

Deferred income tax liabilities

(56

)

(31

)

(46

)

Retirement benefit obligations

(42

)

(54

)

(44

)

Provisions for other liabilities and

charges

(14

)

(14

)

(15

)

Other liabilities

(65

)

(80

)

(98

)

Non-current liabilities

(1,480

)

(1,530

)

(1,335

)

Trade and other liabilities

(1,036

)

(1,020

)

(1,275

)

Financial liabilities – borrowings

(313

)

(75

)

(67

)

Financial liabilities – derivative

financial instruments

(44

)

(5

)

(5

)

Current income tax liabilities

(15

)

(27

)

(32

)

Provisions for other liabilities and

charges

(10

)

(37

)

(25

)

Current liabilities

(1,418

)

(1,164

)

(1,404

)

Liabilities classified as held for

sale

-

-

-

Total liabilities

(2,898

)

(2,694

)

(2,739

)

Net assets

3,811

4,188

3,988

Share capital

167

179

174

Share premium

2,644

2,635

2,642

Treasury shares

(15

)

(20

)

(19

)

Reserves

1,000

1,381

1,177

Total equity attributable to equity

holders of the company

3,796

4,175

3,974

Non-controlling interest

15

13

14

Total equity

3,811

4,188

3,988

The condensed consolidated financial statements were approved by

the Board on 28 July 2024.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY for the

period ended 30 June 2024

Equity attributable to equity

holders of the company

all figures in £ millions

Share capital

Share

premium

Treasury shares

Capital redemption reserve

Fair value reserve

Translation reserve

Retained earnings

Total

Non-controlling interest

Total equity

2024 half year

At 1 January 2024

174

2,642

(19

)

33

(12

)

411

745

3,974

14

3,988

Profit for the period

-

-

-

-

-

-

157

157

1

158

Other comprehensive income / (expense)

-

-

-

-

(4

)

(9

)

1

(12

)

-

(12

)

Total comprehensive income / (expense)

-

-

-

-

(4

)

(9

)

158

145

1

146

Equity-settled transactions1

-

-

-

-

-

-

16

16

-

16

Issue of ordinary shares

-

2

-

-

-

-

-

2

-

2

Buyback of equity

(7

)

-

-

7

-

-

(204

)

(204

)

-

(204

)

Purchase of treasury shares

-

-

(30

)

-

-

-

-

(30

)

-

(30

)

Release of treasury shares

-

-

34

-

-

-

(34

)

-

-

-

Dividends

-

-

-

-

-

-

(107

)

(107

)

-

(107

)

At 30 June 2024

167

2,644

(15

)

40

(16

)

402

574

3,796

15

3,811

1.

Equity-settled transactions are presented

net of withholding taxes that the Group is obligated to pay on

behalf of employees. The payments to the tax authorities are

accounted for as a deduction

from equity for the shares withheld.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY for the

period ended 30 June 2024

Equity attributable to equity

holders of the company

all figures in £ millions

Share capital

Share premium

Treasury shares

Capital redemption reserve

Fair value reserve

Translation reserve

Retained earnings

Total

Non-controlling interest

Total equity

2023 half year

At 1 January 2023

179

2,633

(15

)

28

(13

)

709

881

4,402

13

4,415

Profit for the period

-

-

-

-

-

-

186

186

1

187

Other comprehensive income / (expense)

-

-

-

-

2

(287

)

(19

)

(304

)

(1

)

(305

)

Total comprehensive income / (expense)

-

-

-

-

2

(287

)

167

(118

)

-

(118

)

Equity-settled transactions

-

-

-

-

-

-

20

20

-

20

Issue of ordinary shares

-

2

-

-

-

-

-

2

-

2

Buyback of equity

-

-

-

-

-

-

-

-

-

-

Purchase of treasury shares

-

-

(25

)

-

-

-

-

(25

)

-

(25

)

Release of treasury shares

-

-

20

-

-

-

(20

)

-

-

-

Dividends

-

-

-

-

-

-

(106

)

(106

)

-

(106

)

At 30 June 2023

179

2,635

(20

)

28

(11

)

422

942

4,175

13

4,188

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY for the

period ended 30 June 2024

Equity attributable to equity

holders of the company

all figures in £ millions

Share capital

Share premium

Treasury shares

Capital redemption reserve

Fair value reserve

Translation reserve

Retained earnings

Total

Non-controlling interest

Total equity

2023 full year

At 1 January 2023

179

2,633

(15

)

28

(13

)

709

881

4,402

13

4,415

Profit for the period

-

-

-

-

-

-

378

378

2

380

Other comprehensive income / (expense)

-

-

-

-

1

(298

)

(65

)

(362

)

(1

)

(363

)

Total comprehensive income / (expense)

-

-

-

-

1

(298

)

313

16

1

17

Equity-settled transactions

-

-

-

-

-

-

40

40

-

40

Tax on equity-settled transactions

-

-

-

-

-

-

1

1

-

1

Issue of ordinary shares

-

9

-

-

-

-

-

9

-

9

Buyback of equity

(5

)

-

-

5

-

-

(304

)

(304

)

-

(304

)

Purchase of treasury shares

-

-

(35

)

-

-

-

-

(35

)

-

(35

)

Release of treasury shares

-

-

31

-

-

-

(31

)

-

-

-

Dividends

-

-

-

-

-

-

(155

)

(155

)

-

(155

)

At 31 December 2023

174

2,642

(19

)

33

(12

)

411

745

3,974

14

3,988

CONDENSED CONSOLIDATED CASH FLOW STATEMENT for the period

ended 30 June 2024

all figures in £ millions

note

2024

2023

2023

half year

half year

full year

Cash flows from operating

activities

Profit before tax

212

236

493

Net finance costs / (income)

7

(17

)

5

Depreciation and impairment – PPE,

investment property and assets held for sale

40

38

90

Amortisation and impairment – software

61

64

123

Amortisation and impairment – acquired

intangible assets

20

24

46

Other net gains and losses

5

7

13

Product development capital

expenditure

(130

)

(144

)

(300

)

Product development amortisation

144

137

284

Share-based payment costs

23

19

40

Change in inventories

1

(9

)

9

Change in trade and other receivables

(34

)

(20

)

(24

)

Change in trade and other liabilities

(164

)

(187

)

(20

)

Change in provisions for other liabilities

and charges

(12

)

(45

)

(61

)

Other movements

12

3

(16

)

Net cash generated from operations

185

106

682

Interest paid

(41

)

(34

)

(60

)

Tax paid

(69

)

(59

)

(97

)

Net cash generated from operating

activities

75

13

525

Cash flows from investing

activities

Acquisition of subsidiaries, net of cash

acquired

10

(38

)

(173

)

(171

)

Acquisition of joint ventures and

associates

-

(5

)

(5

)

Purchase of investments

(7

)

(6

)

(8

)

Purchase of property, plant and

equipment

(18

)

(16

)

(30

)

Purchase of intangible assets

(40

)

(47

)

(96

)

Disposal of subsidiaries, net of cash

disposed

11

(6

)

(19

)

(38

)

Proceeds from sale of investments

-

3

7

Proceeds from sale of property, plant and

equipment

6

1

5

Lease receivables repaid including

disposals

9

8

15

Interest received

13

10

20

Net cash used in investing

activities

(81

)

(244

)

(301

)

Cash flows from financing

activities

Proceeds from issue of ordinary shares

2

2

9

Buyback of equity

(278

)

-

(186

)

Settlement of share based payments

(37

)

(25

)

(35

)

Repayment of borrowings

-

-

(285

)

Proceeds from borrowings

495

220

285

Repayment of lease liabilities

(39

)

(42

)

(84

)

Dividends paid to company’s

shareholders

(107

)

(106

)

(154

)

Net cash generated from / (used in)

financing activities

36

49

(450

)

Effects of exchange rate changes on cash

and cash equivalents

(7

)

(13

)

(8

)

Net increase / (decrease) in cash and

cash equivalents

23

(195

)

(234

)

Cash and cash equivalents at beginning of

period

309

543

543

Cash and cash equivalents at end of

period

332

348

309

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS for

the period ended 30 June 2024

1. Basis of preparation

The condensed consolidated financial statements have been

prepared in accordance with the Disclosure Guidance and

Transparency Rules sourcebook of the UK’s Financial Conduct

Authority and in accordance with UK-adopted IAS 34 ‘Interim

Financial Reporting’. The condensed consolidated financial

statements should be read in conjunction with the annual financial

statements for the year ended 31 December 2023, which were prepared

in accordance with UK-adopted International Accounting Standards

and with the requirements of the Companies Act 2006 and in

accordance with IFRS accounting standards as issued by the

International Accounting Standards Board (IASB). In respect of

accounting standards applicable to the Group, there is no

difference between UK-adopted IASs and IFRS accounting standards as

issued by the IASB.

The condensed consolidated financial statements have also been

prepared in accordance with the accounting policies set out in the

2023 Annual Report and have been prepared under the historical cost

convention as modified by the revaluation of certain financial

assets and liabilities (including derivative financial instruments)

at fair value.

No new standards and interpretations that apply to annual

reporting periods beginning on or after 1 January 2024 have had a

material impact on the financial position of the Group.

In assessing the Group’s ability to continue as a going concern

for the period until 31 December 2025, the Board analysed a variety

of downside scenarios, including a severe but plausible scenario,

where the Group is impacted by a combination of all principal risks

from H2 2024, as well as reverse stress testing to identify what

would be required to either breach covenants or run out of

liquidity. The severe but plausible scenario modelled a severe

reduction in revenue, profit and operating cash flow from risks

continuing throughout 2025. At 30 June 2024, the Group had

available liquidity of c£0.5bn, comprising central cash balances

and the undrawn element of its $1bn Revolving Credit Facility (RCF)

maturing February 2027. During the period under evaluation, the

Group has a €300m bond (converted to c£260m) due for repayment in

May 2025 and the model assumes that this is refinanced with a

similar sized bond in 2024. Even under a severe downside case, the

Group would maintain comfortable liquidity headroom and sufficient

headroom against covenant requirements during the period under

assessment even before modelling the mitigating effect of actions

that management would take in the event that these downside risks

were to crystallise.

The directors have confirmed that they have a reasonable

expectation that the Group has adequate resources to continue in

operational existence and to meet its liabilities as they fall due

for the assessment period to 31 December 2025. The condensed

consolidated financial statements have therefore been prepared on a

going concern basis.

The preparation of condensed consolidated financial statements

requires the use of certain critical accounting assumptions. It

also requires management to exercise its judgement in the process

of applying the Group’s accounting policies. The areas requiring a

higher degree of judgement or complexity, or areas where

assumptions and estimates are significant to the condensed

consolidated financial statements, have been set out in the 2023

Annual Report.

The financial information for the year ended 31 December 2023

does not constitute statutory accounts as defined in section 434 of

the Companies Act 2006. A copy of the statutory accounts for that

year has been delivered to the Registrar of Companies. The

independent auditors' report on the full financial statements for

the year ended 31 December 2023 was unqualified and did not contain

an emphasis of matter paragraph or any statement under section 498

of the Companies Act 2006. The condensed consolidated financial

statements and related notes for the six months to 30 June 2024 are

unaudited but have been reviewed by the auditors and their review

opinion is included at the end of these condensed consolidated

financial statements.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS for

the period ended 30 June 2024

2. Segment information

The Group has five main global business divisions, which are

each considered separate operating segments for management and

reporting purposes. These five divisions are Assessment &

Qualifications, Virtual Learning, English Language Learning, Higher

Education and Workforce Skills. In addition, the International

Courseware local publishing businesses, most of which were disposed

in 2022 with the remainder being wound down in 2023, were being

managed as a separate division, known as Strategic Review. There

are no longer any reported results for the Strategic Review

division.

all figures in £ millions

2024

2023

2023

half year

half year

full year

Sales

Assessment & Qualifications

811

796

1,559

Virtual Learning

254

373

616

English Language Learning

188

184

415

Workforce Skills

143

140

220

Higher Education

358

379

855

Strategic Review

-

7

9

Total sales

1,754

1,879

3,674

Adjusted operating profit

Assessment & Qualifications

187

174

350

Virtual Learning

31

47

76

English Language Learning

4

8

47

Workforce Skills

29

21

(8

)

Higher Education

(1

)

(1

)

110

Strategic Review

-

1

(2

)

Total adjusted operating profit

250

250

573

There were no material inter-segment sales.

The following table reconciles the Group’s measure of segmental

performance, adjusted operating profit, to statutory operating

profit:

all figures in £ millions

2024

2023

2023

half year

half year

full year

Adjusted operating profit

250

250

573

Intangible charges

(20

)

(24

)

(48

)

UK pension discretionary increases

(5

)

-

-

Other net gains and losses

(6

)

(7

)

(16

)

Property charges

-

-

(11

)

Operating profit

219

219

498

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS for

the period ended 30 June 2024

2. Segment information continued

The Group derived revenue from the transfer of goods and

services over time and at a point in time in the following major

product lines:

all figures in £ millions

Assessment

& Qualifications

Virtual Learning

English Language

Learning

Workforce Skills

Higher Education

Strategic Review

Total

2024 half year

Courseware

Products transferred at a point in

time

28

-

60

-

91

-

179

Products and services transferred over

time

9

-

6

-

267

-

282

37

-

66

-

358

-

461

Assessments

Products transferred at a point in

time

93

-

3

3

-

-

99

Products and services transferred over

time

681

-

97

120

-

-

898

774

-

100

123

-

-

997

Services

Products transferred at a point in

time

-

-

12

-

-

-

12

Products and services transferred over

time

-

254

10

20

-

-

284

-

254

22

20

-

-

296

Total sales

811

254

188

143

358

-

1,754

2023 half year

Courseware

Products transferred at a point in

time

30

-

51

1

108

7

197

Products and services transferred over

time

10

-

5

-

268

-

283

40

-

56

1

376

7

480

Assessments

Products transferred at a point in

time

96

-

3

11

-

-

110

Products and services transferred over

time

660

-

103

105

-

-

868

756

-

106

116

-

-

978

Services

Products transferred at a point in

time

-

-

11

-

-

-

11

Products and services transferred over

time

-

373

11

23

3

-

410

-

373

22

23

3

-

421

Total sales

796

373

184

140

379

7

1,879

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS for

the period ended 30 June 2024

2. Segment information continued

all figures in £ millions

Assessment

& Qualifications

Virtual Learning

English Language

Learning

Workforce Skills

Higher Education

Strategic Review

Total

2023 full year

Courseware

Products transferred at a point in

time

57

-

135

2

254

9

457

Products and services transferred over

time

20

-

15

-

595

-

630

77

-

150

2

849

9

1,087

Assessments

Products transferred at a point in

time

198

-

5

5

-

-

208

Products and services transferred over

time

1,284

-

204

170

-

-

1,658

1,482

-

209

175

-

-

1,866

Services

Products transferred at a point in

time

-

-

35

-

-

-

35

Products and services transferred over

time

-

616

21

43

6

-

686

-

616

56

43

6

-

721

Total sales

1,559

616

415

220

855

9

3,674

Adjusted operating profit is one of the Group’s key business

performance measures. The measure includes the operating profit

from the total business but excludes charges for acquired

intangibles amortisation and impairment, acquisition related costs,

gains and losses arising from disposals, the cost of major

reorganisation where relevant, property charges and one-off costs

related to the UK pension scheme.

Intangible charges – These represent charges relating to

intangibles acquired through business combinations. These charges

are excluded as they reflect past acquisition activity and do not

necessarily reflect the current year performance of the Group.

Intangible amortisation charges in the first half of 2024 were £20m

compared to a charge of £24m in the equivalent period in 2023.

UK pension discretionary increases – Charges in 2024 relate to

one-off pension increases awarded to certain cohorts of pensioners

in response to the cost of living crisis.

Other net gains and losses – These represent profits and losses

on the sale of subsidiaries, joint ventures, associates and other

financial assets and are excluded from adjusted operating profit in

order to show the performance of the Group on a more comparable

basis year on year. Other net gains and losses also includes costs

related to business closures and acquisitions. Other net gains and

losses in 2024 relate to costs related to prior year acquisitions

and disposals, partially offset by a gain on the partial disposal

of our investment in an associate. Other net gains and losses in

the first half of 2023 relate largely to the gain on disposal of

the POLS business and a gain related to the release of a provision

related to a historical acquisition, offset by losses on the

disposal of Pearson College and costs related to current and prior

year disposals and acquisitions.

Property charges – In the second half of 2023, charges of £11m

relate to impairments of property assets arising from the impact of

updates in 2023 to assumptions initially made during the 2022 and

2021 reorganisation programmes. There are no such charges in the

first half of 2024.

Adjusted operating profit should not be regarded as a complete

picture of the Group’s financial performance. For example, adjusted

operating profit includes the benefits of major reorganisation

programmes but excludes the significant associated costs, and

adjusted operating profit excludes costs related to acquisitions,

and the amortisation of intangibles acquired in business

combinations, but does not exclude the associated revenues. The

Group’s definition of adjusted operating profit may not be

comparable to other similarly titled measures reported by other

companies.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS for

the period ended 30 June 2024

3. Net finance income / costs

all figures in £ millions

2024

2023

2023