Nik Singhal Joins ORIX USA as Group Head of Direct Lending

June 25 2024 - 10:30AM

Business Wire

Private Credit Platform Organized into Direct

Lending and Securitized Credit Specializations

ORIX Corporation USA (ORIX USA), announced today the appointment

of Nik Singhal as Managing Director and Group Head of Direct

Lending within its Private Credit business. Mr. Singhal is based in

New York and will report to Jeff Abrams, Group Head of Private

Credit and Real Estate and Member, Executive Committee. Mr. Singhal

will also join ORIX USA’s Management Committee. His start date at

the firm is July 8, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240625586730/en/

Nik Singhal, Managing Director and Group

Head of Direct Lending, ORIX USA (Photo: Business Wire)

Mr. Singhal has over 26 years of credit and lending experience,

and joins ORIX USA after almost 14 years at BlackRock, where he was

most recently Managing Director and Head of Portfolio Management

for BlackRock’s U.S. Private Capital group. In that role, he was a

member of the Management and Operating Committee for its U.S.

direct lending business, and a voting member of the Investment

Committee for various direct lending funds. He also served as

President of BlackRock Capital Investment Corp., a public BDC, as

well as CEO of BlackRock Direct Lending Corp., a private BDC.

In conjunction with this appointment, Mr. Abrams also announced

a focused alignment of its private credit platform into two

verticals, both reporting directly to him:

- Direct Lending, led by Mr. Singhal and comprised of NXT

Capital: lower-middle market direct lending; Growth Capital:

private credit for late-stage growth companies; and Municipal &

Infrastructure: solutions for the high yield municipal market.

- Securitized Credit, led by Raviv Shtaingos, who has been

appointed Group Head of Securitized Credit, comprised of Structured

Credit: commercial and residential mortgage-backed credit and

alternative asset-backed securities; Asset-Based Finance: bespoke

loans backed by hard assets, financial assets, intellectual

property and non-core infrastructure; and GP Solutions: private

equity fund and management company capital solutions.

As Group Head of Direct Lending, Mr. Singhal will work closely

with the relevant business line leaders to expand and grow the

businesses, drive origination and performance, and strategically

leverage the firm’s balance sheet. He will also partner with ORIX

USA’s Asset Management sales and distribution team to continue to

raise third-party capital and broaden the firm’s reach in the

investor community.

“I am pleased to welcome a seasoned leader like Nik to the firm

to lead our direct lending businesses. He will add great value to

our existing bench of strong investment leaders and, along with

Raviv, will be able to deliver our differentiated hybrid strategy

of deploying our balance sheet in alignment with our investor

capital to the market,” said Mr. Abrams. “By organizing our

broad private credit platform into areas of specialization, we

reflect the way investors are assessing private credit

opportunities, specifically in our long-time focus area of the

middle market. With Nik and Raviv’s leadership, the collective

expertise of the investment teams, and our experience through

market cycles, we are poised to scale our private credit business

to the next level.”

Earlier in his career, Mr. Singhal worked at HBK Capital

Management, where he grew and managed a middle market lending

business, and at Lehman Brothers in its principal finance group

focusing on middle-market investments. Mr. Singhal holds a BS in

Computer Science and Engineering from the Indian Institute of

Technology in Delhi and an MBA from the Indian Institute of

Management in Ahmedabad, India. He is also a CFA Charterholder.

“I am thrilled to be joining ORIX USA at this pivotal time for

the firm. While ORIX USA has maintained a relatively low-profile in

the investor community, their platform and potential are world

class,” added Mr. Singhal. “There is currently a lot of global

traction and investor interest in NXT Capital and Growth Lending,

both of which are well established businesses, and I am looking

forward to working with them as well as with the experienced

Municipal and Infrastructure group to invest and raise third-party

capital.”

Signal Peak Capital Management, a private credit business

focused on liquid broadly syndicated loans and CLOs, will continue

to report directly to Mr. Abrams.

About ORIX Corporation USA (ORIX USA)

Established in the U.S. in 1981, ORIX USA has grown organically

and through acquisition into the investment and asset management

firm we are today. With a specialization in private credit, real

estate, and private equity solutions for middle-market focused

borrowers and investors, we combine our robust balance sheet with

funds from third-party investors, providing a strong alignment of

interest. ORIX USA and its subsidiaries — ORIX Advisers, ORIX

Capital Partners, Signal Peak Capital Management, Boston Financial,

Lument, Real Estate Capital and NXT Capital — have approximately

1300 employees across the U.S. and have $85 billion in assets,

which include $26.8 billion of assets under management, $48.6

billion in servicing and administration assets, and approximately

$9.2 billion in proprietary assets, as of March 2024. Our parent

company, ORIX Corporation, is a publicly owned international

financial services company with operations in 30 countries and

regions worldwide. ORIX Corporation is listed on the Tokyo Stock

Exchange (8591) and New York Stock Exchange (IX). For more

information, visit orix.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240625586730/en/

ORIX USA Media Megan O’Brien Megan.obrien@orix.com

Prosek Partners Remy Marin rmarin@prosek.com

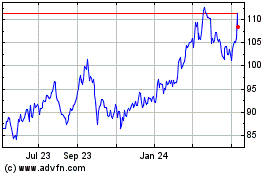

Orix (NYSE:IX)

Historical Stock Chart

From Oct 2024 to Nov 2024

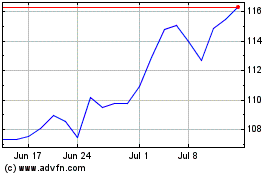

Orix (NYSE:IX)

Historical Stock Chart

From Nov 2023 to Nov 2024