Current Report Filing (8-k)

December 20 2021 - 5:08PM

Edgar (US Regulatory)

0000791963false00007919632021-12-152021-12-15

As filed with the Securities and Exchange Commission on December 20, 2021

___________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 15, 2021

OPPENHEIMER HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Commission File Number 1-12043

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

98-0080034

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

85 Broad Street

New York, New York 10004

(Address of principal executive offices) (Zip Code)

(212) 668-8000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock

|

OPY

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 5 -- Corporate Governance and Management

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Oppenheimer & Co. Inc. (“Oppenheimer”) adopted the Oppenheimer & Co. Inc. Investment Banking and Capital Markets Deferred Compensation Plan (the “Plan”) effective December 15, 2021. An employee is eligible to participate in the Plan if the employee (i) is an Investment Banking Division employee of Oppenheimer with a title of Associate or above, or (ii) is a professional working in the Oppenheimer Capital Markets Division (but not the Investment Banking Division) who is designated by Oppenheimer (in its sole discretion) as eligible to participate in the Plan. This would include the Senior Managing Directors and head of the Investment Banking and, at the discretion of the Plan Administrator, heads of other Capital Markets businesses. An employee is eligible to participate in the mandatory deferral portion of the Plan if the sum of such employee’s prior year’s Base Salary and Bonus (each as defined in the Plan) equals or exceeds $200,000. The amount of compensation subject to mandatory deferral is based on a schedule maintained by the Plan Administrator from time to time. Amounts deferred on a mandatory basis vest ratably over a period of three years and are distributed upon vesting. An employee is eligible to participate in the elective deferral portion of the Plan if the employee’s annual Base Salary and Bonus (each as defined in the Plan) equals or exceeds $500,000. For the elective deferral portion, an employee may defer a portion of their Bonus in an amount up to 50% of the aggregate of the employee’s Base Salary and Bonus (up to a maximum of $2.5 million). Elective deferrals vest immediately and the employee will receive a lump sum distribution on, at the option of the employee, either the fifth or tenth year anniversary of the deferral. Oppenheimer will contribute an amount equal to ten percent (10%) of an employee’s elective deferral to the extent that the employee remains employed by Oppenheimer for a period of either five or ten years from the date of the deferral.

SECTION 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

|

|

|

|

|

|

|

|

Exhibit Number

|

Exhibit

|

|

99.1

|

Oppenheimer & Co. Inc. Investment Banking and Capital Markets

Deferred Compensation Plan effective December 15, 2021

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Oppenheimer Holdings Inc.

|

|

|

|

|

Date: December 20, 2021

By: /s/ Jeffrey J. Alfano

---------------------------------

Name: Jeffrey J. Alfano

Title: Chief Financial Officer

(Duly Authorized Officer)

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

|

|

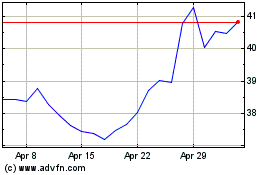

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jul 2023 to Jul 2024