Supreme Court Rejects Puerto Rico Debt-Restructuring Law

June 13 2016 - 1:00PM

Dow Jones News

WASHINGTON—The Supreme Court on Monday struck down Puerto Rico's

effort to restructure its public utility debts, ruling Congress had

precluded the territory from enacting its own bankruptcy

legislation.

The 5-to-2 vote increases pressure on Congress to act to resolve

the island territory's fiscal crisis, since Puerto Rico as a U.S.

territory has no authority to provide for municipal

bankruptcies.

Last week, the U.S. House passed bipartisan legislation to

create a debt-restructuring process for the territory, which would

be overseen by a seven-member federal board. No federal funds would

be spent to bailout the island. It awaits action in the Senate.

The Supreme Court's decision means the pending legislation in

Congress is really the only way to create a mechanism to avoid a

disorderly restructuring of Puerto Rico's debt.

Monday's case involved an effort by Puerto Rico to ease one

element of its pervasive fiscal crisis by restructuring the debt of

its public utilities. But the case highlighted the unusual status

the island holds within the U.S. federal structure, as an

"unincorporated territory" subject to federal control with neither

voting representation in Congress nor the quasi-sovereign powers of

the 50 states.

Congress excluded the territory from authorization it provided

U.S. municipalities to restructure their debts under section 9 of

the federal bankruptcy code. Puerto Rico interpreted its omission

as implicitly providing it with the authority to address the issue

on its own, and the territorial legislature enacted a law allowing

several public agencies and utilities to discharge most of their

debts despite creditors' objections.

Bondholders read the federal law in precisely the opposite way,

seeing it as providing Puerto Rico no authority to restructure debt

either through section 9 or its own statutes. Lower courts

agreed.

Bondholders in the case—Franklin Resources Inc. and Oppenheimer

Holdings Inc.—hold approximately $1.56 billion in bonds issued by

the Puerto Rico Electric Power Authority, a utility covered by the

challenged statute.

"The holders of Prepa bonds have the right to a receiver to

collect the pledged revenues, and the right to compel an increase

in electricity rates so that revenues will be sufficient to repay

the bonds," the Franklin Funds said in a court brief. Rather than

discharge the debt, it called for appointment of a receiver who

"can and will keep the lights on, and who also can increase

revenues, cut costs and collect debts."

Because Puerto Rico bonds are exempts from all state and federal

taxes, Franklin and other funds focused on a particular state's

municipal bonds have filled out their portfolios with Puerto Rico

bonds. The island is about $70 billion in debt and has missed bond

payments.

Justice Clarence Thomas wrote the majority opinion, joined by

Chief Justice John Roberts and Justices Anthony Kennedy, Stephen

Breyer and Elena Kagan.

Justice Sonia Sotomayor dissented, joined by Justice Ruth Bader

Ginsburg.

Justice Samuel Alito recused himself from the case. He gave no

explanation for sitting out the case, as is customary. But his

financial disclosures list numerous mutual funds managed by

Franklin and other companies, including funds focused on tax-free

income.

Last week, the Supreme Court underscored Puerto Rico's dependent

status in ruling that, for criminal prosecution purposes, the

territory is a division of the federal government and lacks an

independent source of sovereignty akin to that claimed by states

and Indian tribes.

The distinction is important for the Constitution's

double-jeopardy clause, which prevents the same "sovereign" from

repeatedly trying a defendant for the same offense, but allows

separate prosecutions by federal, state and tribal authorities.

Write to Jess Bravin at jess.bravin@wsj.com

(END) Dow Jones Newswires

June 13, 2016 12:45 ET (16:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

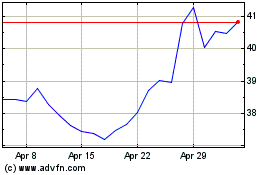

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jul 2023 to Jul 2024