Former Oppenheimer Adviser Charged in Insider-Trading Case

June 03 2016 - 3:40PM

Dow Jones News

A former financial adviser at Oppenheimer & Co. Inc. was

charged on Friday with participating for six years in an

insider-trading scheme with his close childhood friend, a former

Pfizer Inc. employee.

David Hobson, 47 years old, was arrested Friday morning at his

home in Providence, R.I.

Prosecutors say Mr. Hobson orchestrated a yearslong

insider-trading scheme with his childhood friend Michael Maciocio,

46, a former Pfizer employee. Mr. Maciocio pleaded guilty to

conspiracy and securities fraud charges two weeks ago, according to

a spokeswoman for the Manhattan U.S. attorney's office.

A lawyer for Mr. Maciocio didn't respond to a request for

comment. A lawyer for Mr. Hobson couldn't immediately be

identified.

The charges Friday were filed by Manhattan federal prosecutors

and by the Securities and Exchange Commission. Authorities didn't

name the employers for Messrs. Hobson and Maciocio, but

representatives for Oppenheimer and Pfizer confirmed that they were

former employees.

Both companies said they were cooperating with the

government.

A Pfizer spokeswoman said in a statement that the company

terminated Mr. Maciocio's employment in 2014 "after identifying the

potential improper conduct."

An Oppenheimer spokeswoman said the company became aware of this

issue "some time ago."

Prosecutors allege Mr. Maciocio earned more than $116,000 in

illegal profits from the scheme. Mr. Hobson allegedly made at least

$187,000 for himself and at least $145,000 for his customers.

Messrs. Maciocio and Hobson grew up together in Rhode Island,

where they played Little League baseball and attended the same high

school, authorities said.

Mr. Maciocio's role at his employer was to evaluate the

company's capacity to manufacture certain drug compounds, according

to authorities. Since 2008, Mr. Maciocio allegedly began sending

Mr. Hobson inside tips about potential deal activity between Pfizer

and companies that included Medivation Inc., Ardea Biosciences Inc.

and Furiex Pharmaceuticals Inc.

Pfizer had considered acquiring Ardea in 2010 and 2011, and

renewed its interest in 2012. Pfizer ended up abandoning the

consideration. Ardea was acquired in 2012 by AstraZeneca PLC.

In 2014, Pfizer was in discussions over a potential acquisition

of Furiex. Pfizer decided to abandon the transaction. Furiex was

acquired later that year by Forest Labs Inc.

In exchange for the tips, authorities said Mr. Maciocio received

"personal benefits," including investment advice.

Mr. Maciocio often wasn't told the name of a potential

acquisition target, but using clues and through his own research,

he would figure out the companies' identities and ask Mr. Hobson to

make trades based off the information, authorities said.

For instance, Mr. Maciocio allegedly learned in May 2008 that

Pfizer was pursuing a potential deal with a company code-named

"Madeline." A Pfizer director shared select details about the deal

with Mr. Maciocio so that Mr. Maciocio could help determine

Pfizer's ability to manufacture a particular drug, according to the

SEC complaint.

Mr. Maciocio figured out that "Madeline" was Medivation and

allegedly tipped off Mr. Hobson, according to the complaint. They

both allegedly began accumulating Medivation shares as the deal

progressed. On the day Pfizer and Medivation publicly announced the

deal in September 2008, Medivation shares opened up 30% from the

previous day. In total, Mr. Hobson made more than $200,000 for

himself and his clients off the announcement, prosecutors said.

Write to Nicole Hong at nicole.hong@wsj.com

(END) Dow Jones Newswires

June 03, 2016 15:25 ET (19:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

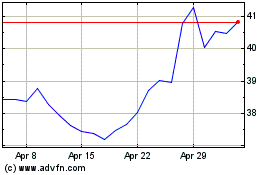

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Jul 2023 to Jul 2024