Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

September 15 2022 - 5:04PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of September,

2022

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified

in its charter)

Nu Holdings Ltd.

(Translation of Registrant's

name into English)

Campbells Corporate Services

Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes No (X)

MATERIAL FACT

Grand

Cayman, Cayman Islands, September 15, 2022 – Nu Holdings Ltd. (NYSE: NU, B3: NUBR33) ("Nu" or the "Company"),

a publicly-held company registered with the Brazilian Securities Commission ("CVM") as a foreign issuer of class "A"

securities and sponsor of the Level III Brazilian Depositary Receipts program, each of which represents one-sixth of a class A ordinary

share of its issuance ("Level III BDRs" and "Level III BDR Program"), hereby informs holders of Level

III BDRs and the market in general that, on this date, its Board of Directors, decided to start the process for discontinuation of its

Level III BDR Program, having approved the following for the implementation of such process:

- an application

for registration as sponsor of a Level I BDR program ("BDR Level I"), pursuant to CVM Instruction nº 332, of April

4, 2009 ("CVM Instruction 332") and CVM Resolution nº 80, of March 29, 2022 ("CVM Resolution 80"),

which will be part of the steps necessary for the Discontinuance of the Level III BDR Program, as defined below;

- the plan

for the voluntary discontinuance of the Level III BDR Program, pursuant to the procedure established in the Issuer's Manual of B3 S.A.

- Brasil, Bolsa, Balcão ("B3", "Manual" and "Discontinuance of the Level III BDR Program",

respectively), with its subsequent cancellation with the CVM, pursuant to CVM Instruction 332 and CVM Resolution 80; and

- after the

Discontinuance of the Level III BDR Program is concluded, the necessary steps be taken for the cancellation of the Company's registration

with the CVM as a foreign public issuer of category "A" securities, under the terms of article 53 of CVM Resolution 80.

The proposal

for the Discontinuance of the Level III BDR Program aims to maximize efficiency and minimize redundancies resulting from a publicly traded

company in more than one jurisdiction. The Company's management affirms that this resolution does not affect the Company's long-term commitment

to Brazil, nor to the Brazilian capital markets.

The plan

for the Discontinuance of the Level III BDR Program, designed by the Company, will be submitted to B3 for approval and, if approved in

the proposed format, will offer the Company's Level III BDR holders the following options:

| i. | remain as Company's shareholder, through the receipt of class A ordinary shares traded on NYSE ("Class

A Ordinary Shares"), in the proportion of Level III BDRs held by each holder, with each Level III BDR representing one-sixth

(1/6) of a Class A Ordinary Share ("Receipt of Class A Ordinary Shares"). Please note that for a holder of Level III

BDRs to be able to choose this option, such investor must hold a sufficient number of Level III BDRs to make up 6 or more Level III BDRs

and an active account with a brokerage house in the United States of America; |

| ii. | remain as holders of the Company's BDRs by receiving Level I BDRs, in the proportion of 1:1 for the Level

III BDRs held by each holder, with each Level III BDR having the same composition as the Level I BDRs and being certain, furthermore,

that the participants in the NuSócios Client Program will receive their Level I BDRs through the Comissario Mercantil, under the

same terms and conditions currently applied to the ownership of Level III BDRs ("Receiving Level I BDRs"); or |

| iii. | carry out the sale of the BDRs or underlying assets held by the investor, on a Brazilian or US stock exchange,

depending on the approval by B3 and CVM, in a facilitated sales process to be instituted by the Company ("Sale Facility"). |

The Company

will keep the market, its shareholders and the NuSócios Client Program informed about the subject of this material fact, and following

the approval by B3 will disclose to BDR holders the details of the procedures for the Discontinuance of the Level III BDRs Program, which

will include an initial period of 30 days, during which all holders of Level III

BDRs, including NuSócios Client Program participants, will be given the opportunity to decide on the option that best suits them.

2

Investor Relations

Guilherme Lago

investors@nubank.com.br

Media Relations

Leila Suwwan

press@nubank.com.br

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nu Holdings Ltd. |

| |

|

| |

By: |

/s/ Guilherme Lago |

| |

|

Guilherme Lago

Chief Financial Officer |

Date: September

15, 2022

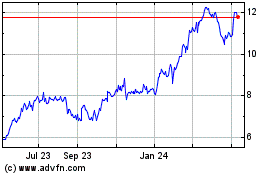

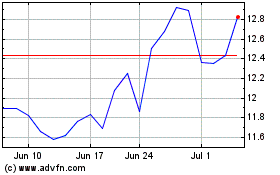

Nu (NYSE:NU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Nu (NYSE:NU)

Historical Stock Chart

From Nov 2023 to Nov 2024