Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

January 06 2022 - 12:54PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of January,

2022

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified

in its charter)

Nu Holdings Ltd.

(Translation of Registrant's

name into English)

Campbells Corporate Services

Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes No (X)

Nu Holdings Ltd. Announces Exercise of

the Underwriters’ Option to Purchase Additional Shares

São Paulo, Brazil, January 6, 2022 –

Nu Holdings Ltd. (NYSE: NU | B3: NUBR33), (“Nu”), one of the world’s largest digital banking platforms and one

of the leading technology companies in the world, today announced that it has closed the sale of 27,555,298 Class A ordinary shares as

a result of the partial exercise of the underwriters’ option to purchase additional shares granted to them in connection with the

initial public offering, pursuant to a registration statement on Form F-1 filed with the U.S. Securities and Exchange Commission (“SEC”)

at the public offering price of $9.00 per Class A ordinary share.

Nu intends to use

the net proceeds from the offering for general corporate purposes, including working capital, operating expenses, and capital expenditures.

Additionally, Nu may use a portion of the net proceeds to acquire or invest in businesses, products, services, or technologies.

The offering was made through an underwriting

group led by Morgan Stanley & Co. LLC, Goldman Sachs & Co. LLC, Citigroup Global Markets Inc. and Nu Invest Corretora de Valores

S.A..

Copies of the final prospectus may be obtained

by contacting: Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, New York 10014;

Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, New York 10282, or by telephone at (866) 471-2526;

or Citigroup Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, or by telephone

at (800) 831-9146.

A registration statement on Form F-1 relating

to these securities has been filed with, and declared effective by, the SEC. Copies of the registration statement can be accessed through

the SEC’s website at www.sec.gov. This press release does not constitute an offer to sell or a solicitation of an offer to

buy the securities described herein, nor will there be any sale of these securities in any state or jurisdiction in which such an offer,

solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Contacts:

Investor Contact:

Federico Sandler

ir@nubank.com.br

Media Contact:

Leila Suwwan

press@nubank.com.br

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Nu Holdings Ltd.

|

|

|

|

|

|

By:

|

/s/ Guilherme Lago

|

|

|

|

Guilherme Lago

Chief Financial Officer

|

Date: January

6, 2022

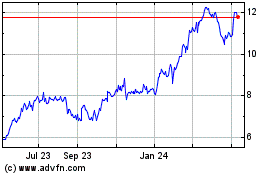

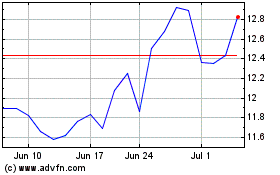

Nu (NYSE:NU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Nu (NYSE:NU)

Historical Stock Chart

From Nov 2023 to Nov 2024