MRC Global Announces Sale of Canada Business

December 16 2024 - 6:30AM

MRC Global Inc. (NYSE: MRC), announced today that its subsidiary,

MRC Global (Canada) ULC, has entered into a definitive agreement to

sell its Canada operations to Emco Corporation.

Rob Saltiel, MRC Global President & CEO

stated, “This divestiture will reposition our strategic focus and

future capital investment decisions on our core geographies and

product offerings that provide the strongest growth and profit

potential. The sale of our Canada business is expected to be

accretive to our total company adjusted gross margins and adjusted

EBITDA margins.

“I would like to express my appreciation to our

Canada team members who have consistently provided exceptional

value to our customers. We believe we have found the right home for

the Canada business and that Emco Corporation is well equipped to

maintain success for our employees and customers into the future,"

Mr. Saltiel added.

As a result of the expected sale, a pre-tax,

non-cash loss on discontinued operations of approximately US

$25 million is expected to be recorded in the fourth quarter

of 2024. The sale is anticipated to close in the first half of 2025

following customary closing conditions and required Canadian

regulatory approval. The company plans to use the proceeds for

reduction of debt.

Canadian Imperial Bank of Commerce (CIBC) acted

as financial advisor to MRC Global. Norton Rose Fulbright acted as

legal counsel to MRC Global; and McCarthy Tétrault LLP acted as

legal advisor to Emco.

About MRC Global Inc.

Headquartered in Houston, Texas, MRC Global

(NYSE: MRC) is the leading global distributor of pipe,

valves, fittings (PVF) and other infrastructure products

and services to diversified end-markets including the gas

utilities, downstream, industrial and energy transition, and

production and transmission sectors. With over 100 years of

experience, MRC Global has provided customers with innovative

supply chain solutions, technical product expertise and a robust

digital platform from a worldwide network of over 200 locations

including valve and engineering centers. The company’s unmatched

quality assurance program offers over 300,000 SKUs from over 8,500

suppliers, simplifying the supply chain for

approximately 10,000 customers. Find out more at

www.mrcglobal.com.

This news release contains forward-looking

statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. Words such

as “will,” “expect,” “expected,” and similar expressions are

intended to identify forward-looking statements.

Statements about the company’s business,

including the company’s expectations that the transactions

described in this release as being accretive to both cash

generation and earnings per share in 2025 and beyond, are not

guarantees of future performance. These statements are based on

management’s expectations that involve a number of business risks

and uncertainties, any of which could cause actual results to

differ materially from those expressed in or implied by the

forward-looking statements. These statements involve known and

unknown risks, uncertainties and other factors, most of which are

difficult to predict and many of which are beyond MRC Global’s

control, including the factors described in the

company’s SEC filings that may cause the company’s actual

results and performance to be materially different from any future

results or performance expressed or implied by these

forward-looking statements.

These risks and uncertainties include (among

others) decreases in capital and other expenditure levels in

the industries that the company serves; U.S. and

international general economic conditions; geopolitical events;

decreases in oil and natural gas prices; unexpected supply

shortages; loss of third-party transportation providers; cost

increases by the company’s suppliers and transportation providers;

increases in steel prices, which the company may be unable to pass

along to its customers which could significantly lower the

company’s profit; the company’s lack of long-term contracts with

most of its suppliers; suppliers’ price reductions of products

that the company sells, which could cause the value of its

inventory to decline; decreases in steel prices, which could

significantly lower the company’s profit; a decline in demand for

certain of the products the company distributes if tariffs and

duties on these products are imposed or lifted; holding more

inventory than can be sold in a commercial time frame; significant

substitution of renewables and low-carbon fuels for oil and gas,

impacting demand for the company’s products; risks related to

adverse weather events or natural disasters; environmental, health

and safety laws and regulations and the interpretation or

implementation thereof; changes in the company’s customer and

product mix; the risk that manufacturers of the products that the

company distributes will sell a substantial amount of goods

directly to end users in the industry sectors that the company

serves; failure to operate the company’s business in an efficient

or optimized manner; the company’s ability to compete successfully

with other companies; the company’s lack of long-term

contracts with many of its customers and the company’s lack of

contracts with customers that require minimum purchase volumes;

inability to attract and retain employees or the potential loss of

key personnel; adverse health events, such as a pandemic;

interruption in the proper functioning of the company’s information

systems; the occurrence of cybersecurity incidents; risks related

to the company’s customers’ creditworthiness; the success of

acquisition strategies; the potential adverse effects associated

with integrating acquisitions and whether these acquisitions will

yield their intended benefits; impairment of the company’s goodwill

or other intangible assets; adverse changes in political or

economic conditions in the countries in which the company operates;

the company’s significant indebtedness; the dependence on the

company’s subsidiaries for cash to meet parent company obligations;

changes in the company’s credit profile; potential inability to

obtain necessary capital; the sufficiency of the company’s

insurance policies to cover losses, including liabilities arising

from litigation; product liability claims against the company;

pending or future asbestos-related claims against the company;

exposure to U.S. and international laws and regulations,

regulating corruption, limiting imports or exports or imposing

economic sanctions; risks relating to ongoing evaluations of

internal controls required by Section 404 of the Sarbanes-Oxley

Act; risks related to changing laws and regulations including trade

policies and tariffs; and the potential share price volatility and

costs incurred in response to any shareholder activism

campaigns.

For a discussion of key risk factors, please see

the risk factors disclosed in the company’s SEC filings,

which are available on the SEC’s website

at www.sec.gov and on the company’s

website, www.mrcglobal.com. MRC Global’s filings and other

important information are also available on the Investors page

of the company’s website at www.mrcglobal.com.

Undue reliance should not be placed on the

company’s forward-looking statements. Although forward-looking

statements reflect the company’s good faith beliefs, reliance

should not be placed on forward-looking statements because they

involve known and unknown risks, uncertainties and other factors,

which may cause the company’s actual results, performance or

achievements or future events to differ materially from anticipated

future results, performance or achievements or future events

expressed or implied by such forward-looking statements. The

company undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events, changed circumstances or otherwise, except to the

extent required by law.

Contact:Monica BroughtonVP, Investor Relations

& TreasuryMRC Global

Inc.Monica.Broughton@mrcglobal.com832-308-2847

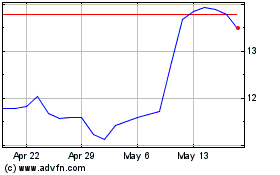

MRC Global (NYSE:MRC)

Historical Stock Chart

From Nov 2024 to Dec 2024

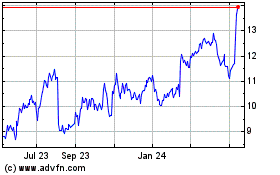

MRC Global (NYSE:MRC)

Historical Stock Chart

From Dec 2023 to Dec 2024