Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

June 28 2023 - 6:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2023

Commission File Number 001-33098

Mizuho Financial Group, Inc.

(Translation of registrant’s name into English)

5-5, Otemachi 1-chome

Chiyoda-ku, Tokyo 100-8176

Japan

(Address of

principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE PROSPECTUS FORMING A PART

OF MIZUHO FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-266555) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY

FILED OR FURNISHED.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

| Date: June 28, 2023 |

|

| Mizuho Financial Group, Inc. |

|

|

| By: |

|

/s/ Takefumi Yonezawa |

|

|

|

| Name: |

|

Takefumi Yonezawa |

| Title: |

|

Senior Executive Officer / Group CFO |

June 28, 2023

To whom it may concern:

Mizuho Financial Group,

Inc.

Filing of Extraordinary Report

Mizuho Financial Group, Inc. (“Mizuho Financial Group”) hereby announces that it filed today an extraordinary report concerning the results of the

exercise of voting rights at the ordinary general meeting of shareholders of Mizuho Financial Group.

1. Reason for filing

Given that the proposal was adopted at the 21st Ordinary General Meeting of Shareholders of Mizuho Financial Group held on June 23, 2023,

Mizuho Financial Group filed the extraordinary report pursuant to Article 24-5, Paragraph 4 of the Financial Instruments and Exchange Act and Article 19, Paragraph 2, Item 9-2 of the Cabinet Office Ordinance on Disclosure of Corporate Affairs.

2. Description of report

| (1) |

Date on which the ordinary general meeting of shareholders was held |

| (2) |

Matters to be resolved |

|

|

|

|

|

|

|

Company proposal |

|

|

|

|

|

Proposal 1: |

|

Appointment of fourteen (14) directors |

|

|

|

| |

|

|

|

It was proposed that Mr. Yoshimitsu Kobayashi, Mr. Ryoji Sato, Mr. Takashi Tsukioka, Mr. Kotaro Ohno, Mr. Hiromichi Shinohara, Mr. Masami Yamamoto, Ms. Izumi Kobayashi, Ms. Yumiko Noda,

Mr. Seiji Imai, Mr. Hisaaki Hirama, Mr. Masahiro Kihara, Mr. Makoto Umemiya, Mr. Motonori Wakabayashi and Mr. Nobuhiro Kaminoyama, fourteen (14) in total, be appointed to assume the office of director. |

|

|

|

|

Shareholder proposal |

|

|

|

|

|

Proposal 2: |

|

Partial amendment to the Articles of Incorporation (issuing and disclosing a transition plan to align lending and investment portfolios with the Paris Agreement’s 1.5 degree goal requiring net zero emissions by 2050) |

1

| (3) |

Number of voting rights for approval, disapproval and abstention for the matters to be resolved, and the

requirement for adoption and voting results thereof |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Matters to be resolved |

|

Number of

approval

(units) |

|

|

Number of

disapproval

(units) |

|

|

Number of

abstention

(units) |

|

|

Approval

rate (%) |

|

|

Voting

result |

|

| Proposal 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Yoshimitsu Kobayashi |

|

|

17,296,632 |

|

|

|

300,425 |

|

|

|

6,029 |

|

|

|

97 |

|

|

|

Adopted |

|

| Ryoji Sato |

|

|

17,458,803 |

|

|

|

138,265 |

|

|

|

6,029 |

|

|

|

98 |

|

|

|

Adopted |

|

| Takashi Tsukioka |

|

|

17,461,803 |

|

|

|

135,262 |

|

|

|

6,029 |

|

|

|

98 |

|

|

|

Adopted |

|

| Kotaro Ohno |

|

|

17,489,070 |

|

|

|

107,997 |

|

|

|

6,029 |

|

|

|

98 |

|

|

|

Adopted |

|

| Hiromichi Shinohara |

|

|

17,507,095 |

|

|

|

89,972 |

|

|

|

6,029 |

|

|

|

98 |

|

|

|

Adopted |

|

| Masami Yamamoto |

|

|

17,428,041 |

|

|

|

169,022 |

|

|

|

6,029 |

|

|

|

98 |

|

|

|

Adopted |

|

| Izumi Kobayashi |

|

|

17,431,579 |

|

|

|

165,485 |

|

|

|

6,029 |

|

|

|

98 |

|

|

|

Adopted |

|

| Yumiko Noda |

|

|

17,519,737 |

|

|

|

77,329 |

|

|

|

6,029 |

|

|

|

98 |

|

|

|

Adopted |

|

| Seiji Imai |

|

|

15,487,155 |

|

|

|

2,109,879 |

|

|

|

6,029 |

|

|

|

87 |

|

|

|

Adopted |

|

| Hisaaki Hirama |

|

|

16,798,372 |

|

|

|

798,664 |

|

|

|

6,029 |

|

|

|

94 |

|

|

|

Adopted |

|

| Masahiro Kihara |

|

|

15,380,987 |

|

|

|

2,216,050 |

|

|

|

6,029 |

|

|

|

86 |

|

|

|

Adopted |

|

| Makoto Umemiya |

|

|

17,251,916 |

|

|

|

345,148 |

|

|

|

6,029 |

|

|

|

97 |

|

|

|

Adopted |

|

| Motonori Wakabayashi |

|

|

17,434,397 |

|

|

|

162,667 |

|

|

|

6,029 |

|

|

|

98 |

|

|

|

Adopted |

|

| Nobuhiro Kaminoyama |

|

|

17,469,059 |

|

|

|

128,005 |

|

|

|

6,029 |

|

|

|

98 |

|

|

|

Adopted |

|

| Proposal 2 |

|

|

3,501,778 |

|

|

|

14,019,285 |

|

|

|

117,084 |

|

|

|

19 |

|

|

|

Rejected |

|

Note: The requirement for adoption of the proposal is as follows:

| |

• |

|

Approval of a majority of the voting rights held by the shareholders present at the meeting who hold in aggregate

not less than one-third (1/3) of the voting rights of the shareholders entitled to exercise their voting rights is required for the adoption of Proposal 1. |

| |

• |

|

Approval of not less than two-thirds (2/3) of the voting rights held by the shareholders present at the meeting

who hold in aggregate not less than one-third (1/3) of the voting rights of the shareholders entitled to exercise their voting rights is required for the adoption of Proposal 2. |

Although a motion was submitted against Proposal 1 to replace Mr. Yoshimitsu Kobayashi, Mr. Takashi Tsukioka, Mr. Masami Yamamoto and Ms. Izumi

Kobayashi with other candidates, the motion was rejected by obtaining the disapproval of the majority of the voting rights held by the shareholders present at the meeting because the original proposal was lawfully adopted in respect of all

directors, as shown in the above table.

| (4) |

Reason for not counting a portion of the voting rights of the shareholders present at the ordinary general

meeting of shareholders |

Since the adoption or rejection of all the proposals was conclusively decided by the

exercise of the voting rights prior to the date of this general meeting and the number of voting rights of shareholders in attendance at this general meeting, whose approval or disapproval Mizuho Financial Group was able to confirm, the number of

voting rights for approval, disapproval and abstention shown in the above table does not include a portion of those of the shareholders present at the general meeting.

-End-

2

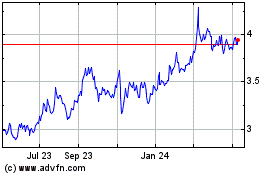

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Dec 2024 to Jan 2025

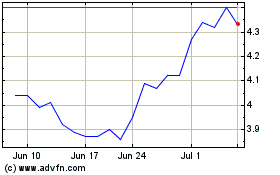

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jan 2024 to Jan 2025