Current Report Filing (8-k)

October 16 2019 - 6:08AM

Edgar (US Regulatory)

DE false 0000789570 0000789570 2019-10-15 2019-10-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 15, 2019

MGM RESORTS INTERNATIONAL

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

DELAWARE

|

|

001-10362

|

|

88-0215232

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

file number)

|

|

(I.R.S. employer

identification no.)

|

|

|

|

|

|

3600 Las Vegas Boulevard South,

Las Vegas, Nevada

|

|

89109

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

(702) 693-7120

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common stock (Par Value $0.01)

|

|

MGM

|

|

New York Stock Exchange (NYSE)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 §CRF 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On October 15, 2019, MGM Resorts International (the “Company”) entered into a Master Transaction Agreement (the “MTA”) with Bellagio, LLC (“Tenant”) and BCORE Paradise Parent LLC (the “Sponsor”), a subsidiary of Blackstone Real Estate Income Trust, Inc., which provides for, among other things, the transfer of the real estate assets (the “Property”) related to Bellagio from the Tenant to its wholly-owned subsidiary (“PropCo” or the “Landlord”), followed by a transfer of 100% of the interests in PropCo to a newly formed subsidiary of the Sponsor (the “Joint Venture”). The Tenant will lease the Property from the Landlord and continue to operate Bellagio.

Upon the terms and subject to the conditions set forth in the MTA, the Joint Venture will acquire PropCo for total consideration of $4.25 billion, which will consist of (i) approximately $4.2 billion in gross cash proceeds and (ii) a 5% equity interest in the Joint Venture; provided that the purchase price (and rent) will be adjusted to the extent the Property’s Closing EBITDA (as defined in the MTA) is less than $461 million. In connection with the transaction, the Company will also provide a guaranty of the debt of the Joint Venture, which is expected to be approximately $3.0 billion. The transaction is expected to close in the fourth quarter of 2019, subject to certain closing conditions.

Pursuant to the terms of the MTA, the Property will be leased by the Landlord to the Tenant pursuant to a lease (the “Lease”) with an initial base rent of $245 million (the “Rent”) for a term of thirty years with two ten-year renewal options. The Rent will escalate annually throughout the term of the lease at a rate of 2% per annum for the first ten years and thereafter equal to the greater of 2% and the CPI increase during the prior year subject to a cap of 3% during the 11th through 20th years and 4% thereafter. In addition, the Lease will require that the Tenant be obligated to spend a specified percentage of net revenues at the property on capital expenditures and for the Tenant and Company to comply with certain financial covenants, which, if not met, will require the Tenant to maintain cash security or a letter of credit in favor of the Landlord in an amount equal to rent for the succeeding two year period. The Company will provide a guarantee of Tenant’s obligations under the Lease.

The representations, warranties and covenants contained in the MTA were made only for purposes of the MTA and as of the specific date (or dates) set forth therein and were solely for the benefit of the parties to such agreement and are subject to certain limitations as agreed upon by the contracting parties. In addition, the representations, warranties and covenants contained in the MTA may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries of the MTA and should not rely on the representations, warranties and covenants contained therein, or any descriptions thereof, as characterizations of the actual state of facts or conditions of the Company.

This description of the MTA is qualified in its entirety by reference to the full text of the MTA attached hereto as Exhibit 2.1. Exhibits and schedules that have been excluded from the text of the MTA attached hereto will be supplementally furnished to the Commission upon request.

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 16, 2019

|

|

|

|

|

MGM Resorts International

|

|

|

|

|

|

By:

|

|

/s/ Andrew Hagopian III

|

|

Name:

|

|

Andrew Hagopian III

|

|

Title:

|

|

Chief Corporate Counsel and Assistant Secretary

|

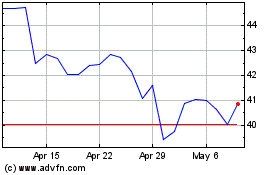

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

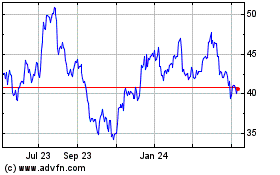

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Apr 2023 to Apr 2024