MCK Stock: is This S&P 500 Company a Buy, Sell, or Hold?

October 16 2023 - 8:54AM

Finscreener.org

Investing in low-beta stocks

might not be the most thrilling journey for investors, given their

characteristically low volatility. They may not promise rapid

growth but offer a significant level of stability, often becoming

the cornerstone of an investment portfolio.

Consider the case of

McCormick & Company (NYSE:

MCK), a spice

manufacturer exemplifying the nature of low-beta stocks. Typically,

itU+02019s a steadfast performer and a consistent dividend

provider. However, it has recently experienced an uncharacteristic

downturn, plummeting over 30% from its peak in the past

year.

Is this a sign of a foundational

crack in McCormick’s steady performance, or is it an unexpected

opportunity for potential investors to buy at a lower price? Let’s

see.

Is MCK stock undervalued in 2023?

McCormick enjoys a leadership

position in the spice sector, surprising investors with its 33%

drop from its peak in the last 12 months. Despite the pullback, the

renowned S&P 500 dividend stock continues to add zest to the

global culinary landscape.

MCK operates under two primary

segments. Its consumer business accounts for 59% of sales, while

flavor solutions contribute 41%. A small addition of

McCormickU+02019s products significantly enhances mealsU+02019

flavor without substantially adding to the cost.

The consumer segment is more than

just the well-known McCormick brand of spices and seasonings. It

also boasts leading brands like:

- FrenchU+02019s

mustard

- Seasoning blends from Old Bay,

Lawry’s, and McCormick

- FrankU+02019s RedHot and Cholula

hot sauces

- ZatarainU+02019s Cajun seasoning

blends

- Club House, Kamis, and Ducros

spices and seasonings

Approximately two-thirds of the

company’s consumer sales stem from these spices, seasonings,

condiments, and sauces, giving McCormick control over 40% of the

U.S. market dedicated to enhancing food flavor.

In the flavor solutions segment,

McCormick extends its expertise, offering culinary research to food

manufacturers, with Pepsi (NASDAQ: PEP)

being a notable client. The company plays a pivotal role in

flavoring various products, including snacks, beverages, baked

goods, savory items, and health and wellness products like vitamins

and gummies.

Inflation impacts McCormick’s sales and

profits

So, whatU+02019s behind the

notable decline in McCormick’s stock? The answer lies in the

companyU+02019s recent third-quarter results. Although sales saw a

commendable 6% increase, the net profit margin took a hit, dropping

from 14% in 2022 to 10% this year. This decline also affected the

earnings per share (EPS), which fell by 23%, leading to a

corresponding dip in the stock value.

The rampant inflation affecting economies

globally is the primary culprit behind this downward trend. The

company’s gross profit

margin has suffered as inflation rates soared in 2022. However, for

prospective investors, this dip could represent a ripe opportunity,

as McCormickU+02019s foundational strength and market dominance

remain intact.

For instance, a scenario where

McCormick elevates its net profit margin from the prevailing 9.8%

to its 2020 pinnacle of 13% positions it at 19x earnings. This

presents a substantial value proposition compared to the S&P

500’s average price-to-earnings (P/E) ratio of 23x. ItU+02019s a

particularly compelling prospect considering McCormick’s track

record of stability and security in investment, barring the past

quarter.

The enhanced appeal is not just

for those eyeing capital appreciation but also for investors

inclined toward passive income streams. The decline in stock price

has inadvertently amplified the dividend yield to 2.5%, a peak not

witnessed since 2010. With the dividend distribution accounting for

a mere 64% of its net income, the prospect of McCormick continuing

its illustrious 36-year run of consistent dividend raises appears

promising.

What next for MCK stock?

The company’s entrenched

leadership in the spice industry, anticipated to witness a 6%

annual growth through 2030, further accentuates its appeal. As

McCormick navigates the path to profitability restoration, the

stock is envisaged to revert to its historical stability. In this

trajectory of financial recovery, shareholders are poised to reap

both appreciation in stock value and consistent

dividends.

In essence, the current scenario

paints a promising picture for potential investors. The combination

of a discounted stock price, an elevated dividend yield, and the

company’s unyielding dominance in a growth-oriented spice industry

underlines a conducive environment for investment.

Shareholders can reasonably

anticipate a blend of capital appreciation and a reliable income

stream as McCormick embarks on its journey of financial and

operational resurgence.

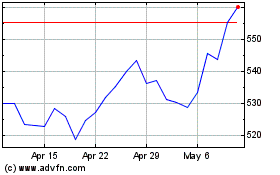

McKesson (NYSE:MCK)

Historical Stock Chart

From Oct 2024 to Nov 2024

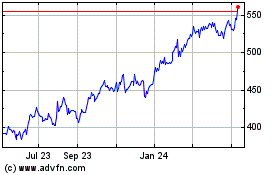

McKesson (NYSE:MCK)

Historical Stock Chart

From Nov 2023 to Nov 2024