Current Report Filing (8-k)

April 06 2022 - 5:20PM

Edgar (US Regulatory)

0000314203

false

0000314203

2022-03-31

2022-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 31, 2022

McEWEN MINING INC.

(Exact name of registrant as specified in

its charter)

Colorado

(State or other jurisdiction of

incorporation or organization) |

|

001-33190

(Commission File

Number) |

|

84-0796160

(I.R.S. Employer

Identification No.) |

150 King Street West, Suite 2800

Toronto, Ontario, Canada M5H 1J9

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number including

area code: (866) 441-0690

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

MUX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry

into a Material Definitive Agreement.

On March 31, 2022, McEwen Mining Inc. (the “Company”) agreed to borrow an additional $15 million from Evanachan Limited

(“Evanachan”), an Ontario corporation and an affiliate of the Company’s Chairman and Chief Executive Officer and the

beneficial owner of more than 5% of its common stock, Robert McEwen. The loan is evidenced by a subordinated promissory note of that date

executed by the Company in favor of Evanachan (the “Note”), a copy of which is filed with this report as Exhibit 10.1.

The principal amount of the loan bears interest at the rate of 8% per annum, payable monthly in arrears. The principal and any accrued

but unpaid interest are due and payable in full on September 30, 2025. The Note is unsecured.

On April 1, 2022,

and, among other reasons, to permit execution and delivery of the Note, the Company entered into a Second Amended and Restated Credit

Agreement (“Credit Agreement”) with Sprott Private Resource Lending II (Collector), LP as administrative agent (“Agent”)

and lender and Evanachan (collectively with Agent, the “Lenders”). The Credit Agreement amends the credit facility and related

agreement in the amount of $50 million previously executed June 25, 2020 (the “Original Credit Agreement”). The Credit

Agreement is filed with this report as Exhibit 10.2.

The loan represented by

the Credit Agreement continues to bear interest at the rate of 9.75% per year with interest payments due monthly in arrears. The maturity

date of the loan has been extended from August 31, 2023 under the Original Credit Agreement to March 31, 2025 under the Credit

Agreement. In addition to extension of the maturity date and allowance of the execution and delivery of the Note, the Credit Agreement

contains the following modifications from the provisions of the Original Credit Agreement:

| • | Monthly principal payments in the amount of $2 million each are due beginning August 31, 2023, extended from August 31,

2022 under the Original Credit Agreement; |

| • | The loan can be prepaid in full or in part at any time prior to the maturity date (i) where the prepayment is received prior

to March 31, 2023, upon payment of accrued interest plus a prepayment fee linked to the amount of the prepayment and the remaining

life of the Loan, and (ii) at any time after March 31, 2023, upon payment of a prepayment fee equal to 3% of the prepaid principal

plus any accrued interest; |

| • | The consolidated working capital which the Company is required to maintain in the future was reduced to $5 million at June 30,

2022 and for each quarter thereafter until March 31, 2023, increasing to $7 million at June 30, 2023 and $10 million at September 30,

2023 and each quarter thereafter until the loan is paid; |

| • | McEwen Copper Inc. and its predecessors are eliminated as guarantors of the loan and the assets of McEwen Copper are removed as security

for the loan; and |

| • | The Company agreed to issue to the Agent 588,235 shares of its common stock in consideration for the maintenance and continuation

of the loan, the relaxation and amendment of certain covenants, and the extension of the maturity date. |

Remaining provisions of the Original Credit

Agreement remain substantially unchanged.

The shares issued to

the Agent were valued at a total of one percent of the principal amount of the loan, or $500,000, and the number of shares issued to

the Lenders was determined based on the closing price of the Company’s common stock on the New York Stock Exchange, the

Company’s principal Exchange, on the five days preceding the execution of the Credit Agreement. The shares were issued

pursuant to exemptions from the registration requirements of the Securities Act of 1933, as amended (the “Act”), and

from the prospectus delivery requirements under Canadian securities law.

The Credit Agreement contains

representations and warranties, affirmative and negative covenants customary for financings of this type, including, but not limited to,

limitations on additional borrowings, additional investments and asset sales. Until the loan is repaid, the Company continues to

be restricted from paying distributions to its shareholders.

The Credit Agreement is

not intended to provide any factual information about the Company. The representations, warranties, and covenants contained in the Credit

Agreement were made only for purposes of the Credit Agreement, including the allocation of risk between the parties, and as of specific

dates, were solely for the benefit of the parties to the Credit Agreement, and may be subject to limitations agreed upon by the contracting

parties, including being qualified by confidential disclosures exchanged between the parties in connection with the execution of the Credit

Agreement.

The preceding summaries

of the Note and the Credit Agreement are qualified in their entirety by reference to the full text of the documents, copies of which are

filed with this report.

Item

1.02 Termination of a Material Definitive Agreement

The information under Item 1.01

above is incorporated into this Item 1.02 by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant

The information under

Item 1.01 above is incorporated into this Item 2.03 by reference.

Item 3.02 Unregistered Sales of Equity

Securities

The disclosure contained

in Item 1.01 above is hereby incorporated into this Item 3.02 by reference. The common stock issued to the Agent was not registered under

the Act in reliance on the exemption provided by Rule 903 of Regulation S promulgated under the Act. The issuance of the common

stock was made in an offshore transaction, was not offered or sold to a “U.S. Person” within the meaning of Regulation S and

offering restrictions were implemented.

Item 7.01 Regulation FD Disclosure.

On April 5, 2022, the

Company issued a press release announcing execution of the Credit Agreement. A copy of the press release is attached to this report as

Exhibit 99.1

The information furnished

under this Item 7.01, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall

be expressly set forth by reference to such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are filed or furnished with this report:

| 104 | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document (contained

in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of Section 13

or 15(d) of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| |

McEWEN MINING INC. |

| |

|

| |

|

|

| Date: April 6, 2022 |

By: |

/s/ Carmen Diges |

| |

|

Carmen Diges, General Counsel |

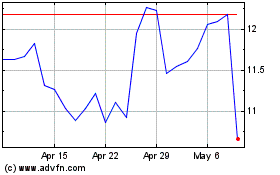

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

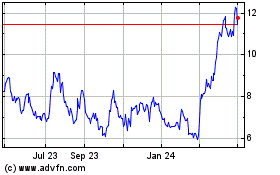

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Apr 2023 to Apr 2024