UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☒

Definitive Additional Materials

☐

Soliciting Material under § 240.14a-12

Magellan

Midstream Partners, L.P.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒

No fee required

☐

Fee paid previously with preliminary materials.

☐

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Integration Insights

Watch: Introducing “The Power of AND”

Listen as Pierce Norton and Aaron Milford share why The Power of AND

captures the value of ONEOK and Magellan coming together.

Three Questions With Pierce Norton

Pierce Norton is president and chief executive officer

(CEO) of ONEOK. He joined the company in 2004 and held roles of increasing responsibility before becoming president and CEO of ONE Gas

in 2014 when it was spun off from ONEOK as a stand-alone company. Norton rejoined ONEOK in his current role in 2021 and will serve as

president and CEO of the combined company following the closing of the transaction.

An Alabama native, Norton earned a Bachelor of Science degree in

Mechanical Engineering from the University of Alabama in Tuscaloosa. He also is a graduate of Harvard Business School’s Advanced

Management Program and a past board member of various trade associations, including the Interstate Natural Gas Association of America,

the Texas Pipeline Association and the American Gas Association, where he served as chairman in 2017. He and his wife, Debbie, and dog,

Ali Bama (goes by Ali), reside in Tulsa. They have four adult children and four grandchildren.

Can you give an overview of your career path and why you’re

so passionate about the energy industry?

The overview of my career path can best be described in three phases.

The first 16 years were primarily spent in engineering, construction and operations for three different gathering, processing and natural

gas pipeline companies – Delhi Gas Pipeline, American Oil & Gas and KN Energy. This afforded me the opportunity to work across

the entire state of Texas and parts of Colorado, Nebraska and Kansas. It was not until joining Bear Paw Energy in 1998 that the commercial

phase of my career began. It was with Bear Paw, Northern Border and ONEOK that my commercial roles covered the 18 states in the middle

of the country from the Canadian border to the Gulf Coast. The third and final phase (the past nine years), I have been blessed to be

in the leadership role as President and CEO of both ONE Gas and ONEOK.

Each role has brought with it new challenges and opportunities along

the way. What I have enjoyed most is the people and the ability to build something together that is bigger than any of us alone.

Frankly, this is one of the reasons why I’ve stayed in energy

all these years – I believe in the difference we make together in the quality of people’s day-to-day lives. We work in an

industry with a purpose – one where you wake up every morning and know you are providing vital products and services that impact

the economy and national security and improve people’s lives.

In this newsletter, you introduced the Power of AND and talked about

energy transformation. Can you share why energy transformation is so important and how you see it applying once ONEOK and Magellan combine?

As we shared in the video, the Power of AND captures the value we see

in strengthening our core business AND playing an important role in both the energy needs we have today and the energy transformation

needs taking place for tomorrow.

The future of energy is not about one type of energy or another –

it’s about both the energy we have today and the energy mix we will need tomorrow. To meet the world’s energy

needs, which only continue to grow, it will take all forms of energy – fossil fuels AND renewables AND

nuclear. Each of these forms of energy have their own unique challenges to solve. For fossil fuels, it’s emissions. For renewables,

it’s reliability and storage. For nuclear, it’s affordability and acceptance.

The change of the energy mix needed to meet demands is energy transformation

in motion, and it’s critical to the future of our industry. It’s taking what we have today and using it differently in the

future by solving the most challenging problems or taking advantage of the greatest opportunities. With thoughtful policies and new technologies,

the transformation will take place at the right pace to achieve the right outcomes the world needs – specifically, an energy grid

that is centered on affordability, reliability, resiliency and working toward net sum zero emissions.

I see the combination of ONEOK and Magellan as additive, presenting

even more opportunities to use what we have collectively to be a part of the solution. It increases the role we can play in the industry

as we work together toward the energy mix of the future.

What are you most excited about in the combination of ONEOK and

Magellan? In contrast, what keeps you up at night?

I’m most excited about the potential I see in the combination

of our two talented workforces coming together. Our people give us our greatest competitive advantage, and they are the key to unlocking

the potential of this merger.

This will be a historic change for both companies – one that

allows us to build on the strong foundation established by those who came before us. I feel a great sense of responsibility to those who

have come before us and pride in what has been passed on to us as I think about our combined future – honoring our respective legacies

even as we work toward an integrated future.

As for what keeps me up at night – when I would get asked this

question in my previous role, I would always say, “It’s what I don’t know.” My answer has expanded with my own

question: “What can I do that would put my mind at ease about what I don’t know?”

If every employee is looking out for the right things – potential

hazards, impacts, consequences and opportunities – and knows how to engage based on our company values, then there is no question

about how to act. That puts my mind at ease. It’s also each of our responsibility to ask the right questions – back to the

Power of AND where A stands for “Ask” – to make sure that we’re operating in a manner that is safe, reliable and

environmentally responsible.

Magellan’s Proud History

Magellan’s history began on July 17, 1930, with the creation

of Great Lakes Pipe Line Company. As the demand for automobiles and refined petroleum products increased in the 1930s, Great Lakes was

one of America’s first companies to transport gasoline and diesel fuel long distances via pipeline. The pipeline system originally

connected Mid-Continent refineries to terminals in five states, which were previously served by rail car deliveries.

Initially, terminals were established in Kansas City, Kansas; Des Moines,

Iowa; Chicago, Illinois; Omaha, Nebraska; and Minneapolis, Minnesota, with a sixth planned for Coralville (Iowa City), Iowa. The original

owners of the company were Continental Oil Company, Barnsdall Oil Corporation, Mid-Continent Petroleum Corporation, The Pure Oil Company

and Phillips Petroleum Company, each of which had a refinery in Oklahoma; and Skelly Oil Company, which had a refinery in Kansas. In 1933,

two new owners bought into Great Lakes – The Texas Company and Sinclair Refining Company. In 1938, Cities Service Oil Company joined

the mix as an owner-shipper, while that same year Barnsdall sold its remaining stock. For several decades, Great Lakes grew significantly

by expanding its pipeline system, upgrading pipeline infrastructure and transporting an increased amount of fuel blends.

In March 1966, Great Lakes was acquired by Williams Brothers Pipeline

Company, the predecessor to Williams Companies. While part of Williams, the company established itself as a major provider of transportation

and storage services. Growth continued to be a focal point of the Williams business model until 2001, when it became a stand-alone company

with petroleum, ammonia and terminal assets in 21 states under the name of Williams Energy Partners. In 2003, the company was sold by

Williams, and this was the birth of Magellan Midstream Partners, trading under the stock ticker MMP.

Over the past two decades, the company has undergone substantial growth,

significantly expanding its operations, both organically through construction projects as well as through the purchase of assets. In 2003,

Magellan acquired more than 2,000 miles of refined petroleum product pipelines from Shell. In 2009, the company purchased the Longhorn

Pipeline, which runs 700 miles to El Paso, Texas, from Houston, Texas. The reversal and repurposing of the Longhorn Pipeline played a

key role in one of Magellan’s first steps into the crude oil business.

In 2010, Magellan purchased another 100 miles of pipeline and 7.8 million

barrels of storage from BP. In 2013, the company acquired approximately 800 miles of refined petroleum products pipelines, four terminals

and 1.7 million barrels of storage from Plains All American Pipeline, adding assets in Colorado, New Mexico, South Dakota and Wyoming.

Magellan’s approximately 1,650 employees are critical to our

growth and success, and the safe operation of our assets. Today, Magellan owns and operates the nation’s longest refined products

pipeline system, which is 9,800 miles. The system includes 54 connected terminals and two marine storage terminals (one of which is owned

through a joint venture). In addition, Magellan owns approximately 2,200 miles of crude oil pipelines, a condensate splitter and storage

facilities with an aggregate storage capacity of about 39 million barrels, of which 29 million are used for contract storage. Approximately

1,000 miles of these pipelines, the condensate splitter and 31 million barrels of this storage capacity (including 25 million barrels

used for contract storage) are wholly owned, and the remainder is owned through joint ventures.

ONEOK’s history will be shared in the next volume of Integration

Insights.

Updates from the Integration Management Office (IMO)

Our integration planning teams have been hard at work learning more

about our businesses and each other and planning for our future as a combined organization.

| An

essential objective guiding the integration planning process is to ensure that we can continue to safely and reliably serve all our stakeholders

throughout the process. To do this, we are taking a phased approach as we combine our people, processes and technology. The phases are:

stabilize, integrate and transform. |

|

STABILIZE

Starting with the first phase aimed at stabilizing the newly combined

organization upon closing of the transaction, we have largely completed the evaluation of current-state processes across both organizations.

This involved more than 15 functional teams consisting of employees from ONEOK, Magellan and KPMG (ONEOK’s integration partner).

The teams are currently conducting workshops where they are focused

on designing the future-state processes while placing a particular emphasis on what is required to occur upon closing (“Day 1”

plans) and what can be deferred to after closing. On Day 1, we want you to continue to operate the businesses just like we do today

– safely, environmentally responsibly and customer-focused. If there are changes after Day 1 in the stabilizing and integration

phases, they will come through your direct supervisor or functional operational leader.

INTEGRATE

Following closing and after ensuring that our operations have remained

stable, we will continue to more fully integrate our combined company. In this phase, we will begin implementing plans advancing us toward

our future state based on our Mission, Vision and Core Values. This will involve things like process and technology changes. We will be

intentional, disciplined and focused on our combined future as we implement changes.

TRANSFORM

The last phase, transform, is where we will identify improvement areas

across the combined company. Some of these potential opportunities have been identified as we have moved through our integration planning

process, but many others will be identified by our innovative employees as we begin operating as ONE company.

The Stabilize

à Integrate à

Transform process will take time, and we remain committed to a consistent communication

process as we build our combined future. As before, we ask that you remain focused on delivering safe and reliable day-to-day operations

for our respective businesses.

DECISIONS TAKEN

One decision that was recently made is:

| ● | The parent company name will remain ONEOK, Inc. In the future,

we will determine if and how we may continue to use the Magellan brand – as we sometimes do with other ONEOK assets – and

will share more information as more decisions in this area are made. |

We appreciate your ongoing feedback and look forward to future communications,

including the next volume of Integration Insights where we’ll share more about ONEOK’s proud history and ONEOK’s

and Magellan’s values.

Sincerely,

Kevin Burdick and Jeff Holman

Your Questions

Please continue to reach out through ONEOK’s and Magellan’s

integration inboxes with any questions or feedback. Check out the latest Integration FAQ, available alongside other Integration-related

resources, on ONEOK’s and Magellan’s respective intranets.

The updated FAQ now features more information on the recent definitive

proxy, benefits of the transaction, job impacts and more.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical fact, included in this communication that address activities, events or developments

that ONEOK or Magellan expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as

“estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,”

“potential,” “create,” “intend,” “could,” “would,” “may,” “plan,”

“will,” “guidance,” “look,” “goal,” “future,” “build,” “focus,”

“continue,” “strive,” “allow” or the negative of such terms or other variations thereof and words

and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements.

However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include,

but are not limited to, statements regarding the proposed transaction between ONEOK and Magellan (the “proposed transaction”),

the expected closing of the proposed transaction and the timing thereof and as adjusted descriptions of the post-transaction company and

its operations, strategies and plans, integration, debt levels and leverage ratio, capital expenditures, cash flows and anticipated uses

thereof, synergies, opportunities and anticipated future performance, including maintaining current ONEOK management, enhancements to

investment-grade credit profile, an expected accretion to earnings and free cash flow, dividend payments and potential share repurchases,

increase in value of tax attributes and expected impact on EBITDA. Information adjusted for the proposed transaction should not be considered

a forecast of future results. There are a number of risks and uncertainties that could cause actual results to differ materially from

the forward-looking statements included in this communication. These include the risk that ONEOK’s and Magellan’s businesses

will not be integrated successfully; the risk that cost savings, synergies and growth from the proposed transaction may not be fully realized

or may take longer to realize than expected; the risk that the credit ratings of the combined company or its subsidiaries may be different

from what the companies expect; the possibility that shareholders of ONEOK may not approve the issuance of new shares of ONEOK common

stock in the proposed transaction or that unitholders of Magellan may not approve the proposed transaction; the risk that a condition

to closing of the proposed transaction may not be satisfied, that either party may terminate the merger agreement relating to the proposed

transaction or that the closing of the proposed transaction might be delayed or not occur at all; potential adverse reactions or changes

to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; the

occurrence of any other event, change or other circumstances that could give rise to the termination of the merger agreement relating

to the proposed transaction; the risk that changes in ONEOK’s capital structure and governance could have adverse effects on the

market value of its securities; the ability of ONEOK and Magellan to retain customers and retain and hire key personnel and maintain relationships

with their suppliers and customers and on ONEOK’s and Magellan’s operating results and business generally; the risk the proposed

transaction could distract management from ongoing business operations or cause ONEOK and/or Magellan to incur substantial costs; the

risk of any litigation relating to the proposed transaction; the risk that ONEOK may be unable to reduce expenses or access financing

or liquidity; the impact of a pandemic, any related economic downturn and any related substantial decline in commodity prices; the risk

of changes in governmental regulations or enforcement practices, especially with respect to environmental, health and safety matters;

and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult

to predict and are beyond ONEOK’s or Magellan’s control, including those detailed in the joint proxy statement/prospectus

(as defined below). All forward-looking statements are based on assumptions that ONEOK and Magellan believe to be reasonable but that

may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and neither ONEOK

nor Magellan undertakes any obligation to correct or update any forward-looking statement, whether as a result of new information, future

events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer

to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or

approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means

of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Important Additional Information and Where to Find It

In connection with the proposed transaction, ONEOK has filed with the

Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “Registration Statement”)

to register the shares of ONEOK’s common stock to be issued in connection with the proposed transaction. The Registration Statement

includes a document that serves as a prospectus of ONEOK and joint proxy statement of ONEOK and Magellan (the “joint proxy statement/prospectus”),

and each party will file other documents regarding the proposed transaction with the SEC. The Registration Statement was declared effective

by the SEC on July 24, 2023. ONEOK and Magellan each filed with the SEC the definitive joint proxy statement/prospectus on July 25, 2023.

Each of ONEOK and Magellan commenced mailing copies of the joint proxy statement/prospectus to shareholders of ONEOK and unitholders of

Magellan, respectively, on or about July 25, 2023. This report is not a substitute for the joint proxy statement/prospectus or for any

other document that ONEOK or Magellan has filed or may file in the future with the SEC in connection with the merger. INVESTORS AND SECURITY

HOLDERS OF ONEOK AND MAGELLAN ARE URGED TO CAREFULLY AND THOROUGHLY READ THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ALL AMENDMENTS

AND SUPPLEMENTS THERETO, AND OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED BY ONEOK AND MAGELLAN WITH THE SEC BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT ONEOK AND MAGELLAN, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS. Investors

can obtain free copies of the joint proxy statement/prospectus and other relevant documents filed by ONEOK and Magellan with the SEC through

the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by ONEOK, including the joint proxy statement/prospectus,

are available free of charge from ONEOK’s website at www.ONEOK.com under the “Investors” tab. Copies of documents filed

with the SEC by Magellan, including the joint proxy statement/prospectus, are available free of charge from Magellan’s website at

www.magellanlp.com under the “Investors” tab.

Participants in the Solicitation

ONEOK and certain of its directors, executive officers and other members

of management and employees, Magellan, and certain of the directors, executive officers and other members of management and employees

of Magellan GP, LLC, which manages the business and affairs of Magellan, may be deemed to be participants in the solicitation of proxies

from ONEOK’s shareholders and the solicitation of proxies from Magellan’s unitholders, in each case with respect to the proposed

transaction. Information about ONEOK’s directors and executive officers is available in ONEOK’s Annual Report on Form 10-K

for the 2022 fiscal year filed with the SEC on February 28, 2023 and its definitive proxy statement for the 2023 annual meeting of stockholders

filed with the SEC on April 5, 2023, and in the joint proxy statement/prospectus. Information about Magellan’s directors and executive

officers is available in its Annual Report on Form 10-K for the 2022 fiscal year and its definitive proxy statement for the 2023 annual

meeting of unitholders, each filed with the SEC on February 21, 2023, and the joint proxy statement/prospectus. Other information regarding

the participants in the solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will

be contained in the Registration Statement, the joint proxy statement/prospectus and other relevant materials to be filed with the SEC

regarding the proposed transaction when they become available. Shareholders of ONEOK, unitholders of Magellan, potential investors and

other readers should read the joint proxy statement/prospectus carefully before making any voting or investment decisions.

5

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

From Apr 2024 to May 2024

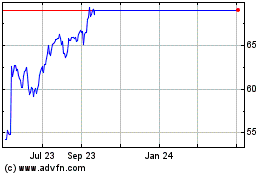

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

From May 2023 to May 2024