LSB Industries, Inc. (NYSE: LXU) (“LSB” or the “Company”) today

announced results for the third quarter ended September 30,

2024.

Third Quarter 2024 Results and Recent Highlights

- Net sales of $109.2 million compared to $114.3 million in the

third quarter of 2023

- Net loss of $25.4 million compared to a net loss of $7.7

million in the third quarter of 2023; the third quarter 2024 net

loss included approximately $16.3 million of turnaround costs and

approximately $5.6 million of one-time non-cash charges related to

the write-down of assets taken out of service

- Diluted EPS of $(0.35) compared to $(0.10) for the third

quarter of 2023; the third quarter 2024 diluted EPS included

approximately $(0.24) per share of turnaround costs and one-time

non-cash charges

- Adjusted EBITDA(1) of $17.5 million compared to $9.2 million in

the third quarter of 2023

- Cash Flow from Operations of $17.1 million

- Capital Expenditures of $31.0 million reflect investments in

reliability and expanded UAN capacity at Pryor Facility

- Total cash and debt of approximately $199.4 million and

approximately $487.0 million, respectively, as of September 30,

2024

_____________________________

(1)

This is a Non-GAAP measure. Refer to the

Non-GAAP Reconciliation section.

“I want to first thank my entire team for another injury free

quarter. Our commitment to safety continues to ensure that everyone

goes home safe. We delivered a strong increase in adjusted EBITDA

relative to the third quarter of last year," stated Mark Behrman,

LSB Industries' Chairman, President and CEO. "The year-over-year

improvement was driven by higher ammonia prices coupled with lower

natural gas prices compared to a year ago and an increase in

industrial product production and sales. These favorable dynamics

more than offset the impact of the planned maintenance activities

we conducted during the quarter.”

“Our balance sheet remains strong, providing us with ample

financial flexibility to invest in the growth of our business.

During the third quarter, we completed an injury free and

successful turnaround of our Pryor facility. The investments we

made at Pryor were focused not only on improving its reliability

and daily ammonia production volume, but also included the

debottlenecking of the facility's urea plant. We expect this to

lead to an incremental 75,000 tons per year of UAN production which

we are ramping up over the fourth quarter. We also completed the

construction of an additional 5,000 tons of nitric acid storage at

our El Dorado facility providing us with the ability to capitalize

on incremental sales opportunities not previously available to us.

This should also enable us to further optimize our sales mix to

maximize margins. We continue to deploy capital to improve the

reliability and safety of our facilities with a turnaround at our

Cherokee facility this November and a turnaround of our El Dorado

facility scheduled for the third quarter of 2025. These planned

maintenance and upgrade activities should lead to increased

production volumes and incremental EBITDA and cash flow.”

“We continue to make progress with our two energy transition

projects. We expect to begin producing low carbon products at our

El Dorado facility beginning in 2026 pending the approval by the

EPA of the Class VI permit submitted by our partner, Lapis Energy.

We are working with Lapis and the EPA towards the issuance of our

permit to construct, that will allow us to begin drilling two

injection wells on our site in El Dorado. The permit is the

critical path item for us. Supporting the economics of this

project, earlier this year, we were pleased to announce our first

off-take customer for low carbon ammonium nitrate solution to be

produced at El Dorado.”

“With respect to our Houston Ship Channel project, we have

completed our Pre-FEED study and are working through the results,

engaging with potential customers and preparing to select an

engineering contractor for the FEED study. We expect to start a

full FEED study during the first half of 2025 that should be

completed by mid-2026, after which we anticipate moving on to

FID.”

“We view our low carbon product strategy as a potential

multi-year earnings growth engine that complements our near-term

opportunities to increase our production and sales volumes from our

core manufacturing assets.”

Market Outlook

- Industrial business remains consistent reflecting:

- Stable demand for nitric acid supported by the strength of the

U.S. economy and resilient consumer spending

- Demand for ammonium nitrate (AN) bolstered by U.S. production

and supportive pricing of metals including gold, as well as copper

for data centers and electric vehicles

- Demand for AN is also benefiting from quarrying/aggregate

production for infrastructure upgrade and expansion

- Metals commodity prices are very supportive of maximizing

production

- Declining interest rates could potentially strengthen demand

for industrial products

- Ammonia market is healthy and pricing has been strong driven

by:

- Tight U.S. and West-of-Suez supply-demand dynamics driven by

global supply disruptions

- Geopolitical concerns over conflict in the Middle East, leading

to higher natural gas feedstock costs for European ammonia

producers

- Extended turnarounds, outages and limited spot availability

across the Middle East, North Africa and Trinidad reducing global

inventories

- Ongoing disruptions in the Suez Canal from the Middle East

conflict limiting ammonia imports into Europe from the Middle

East

- Delayed startup of new production capacity in the U.S. Gulf and

export terminal in Russia

- Economic stimulus measures in China could increase demand for

industrial ammonia for use in polyurethane, caprolactam and

acrylonitrile production to pre-COVID levels

- UAN pricing remains solid due to:

- Low inventories in the distribution channel following the

Spring application season and Summer fill program coupled with

historically low imports and strong exports

- Updraft from strong ammonia and urea markets resulting from

global supply constraints

- Potential pent-up demand at retailer and producer level could

lead to favorable order volumes and pricing in the first half of

2025

- Corn futures prices modestly above August lows:

- USDA's recent outlook for U.S. corn is for smaller supplies and

a slight decline in ending stocks

- Increases in U.S. exports and production challenges in

international growing regions potentially supportive of corn

prices

Low Carbon Ammonia Projects Summary

- Houston Ship Channel Blue Ammonia project with INPEX, Air

Liquide and Vopak Exolum Houston

- 1.1 million metric ton per year blue ammonia plant utilizing

blue hydrogen provided by Air Liquide/INPEX (JV)

- Pre-FEED study recently completed

- FEED study expected during 2025; final investment decision by

mid-2026

- El Dorado Carbon Capture and Sequestration (CCS) Project

with Lapis Energy

- Capture and sequester between 400,000 and 500,000 metric tons

of CO2 per year, which would reduce our Scope 1 emissions by 25%,

yielding between 305,000 and 380,000 metric tons per year of low

carbon ammonia

- Awaiting approval of Class VI permit to construct application

by the EPA

- Focused on beginning operations in 2026

- MOU with Amogy to Develop Ammonia as a Marine Fuel

- Collaborating on the evaluation and development of pilot

program that would combine LSB's low-carbon ammonia and Amogy's

ammonia-to-power engine solution

- Amogy successfully completed test of tugboat retrofitted with

power unit using ammonia as a fuel during Q3'24

Third Quarter Results Overview

Three Months Ended September

30,

2024

2023

% Change

Product Sales ($ in Thousands)

(In Thousands)

AN & Nitric Acid

$

47,981

$

46,026

4

%

Urea ammonium nitrate (UAN)

25,303

30,090

(16

)%

Ammonia

28,490

26,823

6

%

Other

7,443

11,348

(34

)%

Total net sales

$

109,217

$

114,287

Comparison of 2024 to 2023 quarterly periods:

- Net sales decreased during the quarter due to lower sales

volumes of ammonia and UAN as a result of the turnaround at the

Pryor facility, partially offset by higher pricing for both

products. Operating loss and net loss were greater than the

operating income and net loss in the third quarter of 2023 due to

Pryor facility turnaround expenses along with non-cash charges for

older assets taken out of service or disposed of during the third

quarter of 2024. Adjusted EBITDA increased during the quarter

driven predominantly by higher ammonia selling prices and lower

natural gas costs.

The following tables provide key sales metrics for our

products:

Three Months Ended September

30,

Key Product Volumes

(short tons sold)

2024

2023

% Change

AN & Nitric Acid

127,139

119,468

6

%

Urea ammonium nitrate (UAN)

95,468

118,135

(19

)%

Ammonia

68,497

88,986

(23

)%

291,104

326,589

(11

)%

Average Selling

Prices (price per short ton) (A)

AN & Nitric Acid

$

308

$

327

(6

)%

Urea ammonium nitrate (UAN)

$

222

$

217

2

%

Ammonia

$

387

$

269

44

%

(A) Average selling prices represent “net back” prices which are

calculated as sales less freight expenses divided by product sales

volume in tons.

Three Months Ended September

30,

2024

2023

% Change

Average Benchmark

Prices (price per ton)

Tampa Ammonia (MT) Benchmark

$

485

$

343

41

%

NOLA UAN

$

204

$

228

(11

)%

Input

Costs

Average natural gas cost/MMBtu in cost of

materials and other

$

2.40

$

3.57

(33

)%

Average natural gas cost/MMBtu used in

production

$

2.17

$

3.61

(40

)%

Conference Call

LSB’s management will host a conference call covering the third

quarter results on Wednesday, October 30, 2024 at 10:00 am ET /

9:00 am CT to discuss these results and recent corporate

developments. Participating in the call will be Chairman, President

& Chief Executive Officer, Mark Behrman, Executive Vice

President & Chief Financial Officer, Cheryl Maguire and

Executive Vice President & Chief Commercial Officer, Damien

Renwick. Interested parties may participate in the call by dialing

(877) 407-6176 / (201) 689-8451. Please call in 10 minutes before

the conference is scheduled to begin and ask for the LSB conference

call.

A webcast of the call, along with a slide presentation that

coincides with management’s prepared remarks, will be available in

the Investors section of LSB’s website, at www.lsbindustries.com. The webcast can be found

under Events & Presentations. If you are unable to listen to

the live call, the conference call webcast will be archived on

LSB’s website.

LSB Industries, Inc.

LSB Industries, Inc., headquartered in Oklahoma City, Oklahoma,

is committed to playing a leadership role in the energy transition

through the production of low and no carbon products that build,

feed and power the world. The LSB team is dedicated to building a

culture of excellence in customer experiences as we currently

deliver essential products across the agricultural, industrial, and

mining end markets and, in the future, the energy markets. The

company manufactures ammonia and ammonia-related products at

facilities in Cherokee, Alabama, El Dorado, Arkansas and Pryor,

Oklahoma and operates a facility for a global chemical company in

Baytown, Texas. Additional information about LSB can be found on

our website at www.lsbindustries.com.

Forward-Looking

Statements

Statements in this release that are not historical are

forward-looking statements within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995. These forward-looking

statements, which are subject to known and unknown risks,

uncertainties and assumptions about us, may include projections of

our future financial performance and anticipated performance based

on our growth and other strategies and anticipated trends in our

business. These statements are only predictions based on our

current expectations and projections about future events. There are

important factors that could cause our actual results, level of

activity, performance or actual achievements to differ materially

from the results, level of activity, performance or anticipated

achievements expressed or implied by the forward-looking

statements. Significant risks and uncertainties may relate to, but

are not limited to, business and market disruptions, market

conditions and price volatility for our products and feedstocks, as

well as global and regional economic downturns that adversely

affect the demand for our end-use products; disruptions in

production at our manufacturing facilities and other financial,

economic, competitive, environmental, political, legal and

regulatory factors. These and other risk factors are discussed in

the Company’s filings with the Securities and Exchange

Commission.

Moreover, we operate in a very competitive and rapidly changing

environment. New risks and uncertainties emerge from time to time,

and it is not possible for our management to predict all risks and

uncertainties, nor can management assess the impact of all factors

on our business or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from

those contained in any forward-looking statements. Although we

believe the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results,

level of activity, performance or achievements. Neither we nor any

other person assumes responsibility for the accuracy or

completeness of any of these forward-looking statements. You should

not rely upon forward-looking statements as predictions of future

events. Unless otherwise required by applicable laws, we undertake

no obligation to update or revise any forward-looking statements,

whether because of new information or future developments.

See Accompanying Tables

LSB Industries, Inc.

Consolidated Statements of

Operations

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In Thousands, Except Per Share

Amounts)

Net sales

$

109,217

$

114,287

$

387,494

$

461,096

Cost of sales

117,162

117,673

345,746

386,845

Gross (loss) profit

(7,945)

(3,386)

41,748

74,251

Selling, general and administrative

expense

10,042

8,512

31,883

27,815

Other expense (income), net

6,436

(2,399)

8,625

(2,096)

Operating (loss) income

(24,423)

(9,499)

1,240

48,532

Interest expense, net

8,115

7,165

26,229

31,213

Gain on extinguishment of debt

—

—

(3,013)

(8,644)

Non-operating other income, net

(2,674)

(3,689)

(9,143)

(10,929)

(Loss) income before provision for income

taxes

(29,864)

(12,975)

(12,833)

36,892

(Benefit) provision for income taxes

(4,482)

(5,249)

(2,629)

3,622

Net (loss) income

$

(25,382)

$

(7,726)

$

(10,204)

$

33,270

(Loss) income per common share:

Basic:

Net (loss) income

$

(0.35)

$

(0.10)

$

(0.14)

$

0.44

Diluted:

Net (loss) income

$

(0.35)

$

(0.10)

$

(0.14)

$

0.44

LSB Industries, Inc.

Consolidated Balance

Sheets

September 30, 2024

December 31, 2023

(In Thousands)

Assets

Current assets:

Cash and cash equivalents

$

42,283

$

98,500

Restricted cash

—

2,532

Short-term investments

157,060

207,434

Accounts receivable

44,601

40,749

Allowance for doubtful accounts

(326)

(364)

Accounts receivable, net

44,275

40,385

Inventories:

Finished goods

19,259

26,329

Raw materials

2,127

1,799

Total inventories

21,386

28,128

Supplies, prepaid items and other:

Prepaid insurance

2,014

14,846

Precious metals

11,675

12,094

Supplies

31,421

30,486

Other

4,123

2,337

Total supplies, prepaid items and

other

49,233

59,763

Total current assets

314,237

436,742

Property, plant and equipment, net

842,863

835,298

Other assets:

Operating lease assets

24,377

24,852

Intangible and other assets, net

1,456

1,292

25,833

26,144

$

1,182,933

$

1,298,184

LSB Industries, Inc.

Consolidated Balance Sheets

(continued)

September 30, 2024

December 31, 2023

(In Thousands)

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable

$

75,734

$

68,323

Short-term financing

1,528

13,398

Accrued and other liabilities

36,107

30,961

Current portion of long-term debt

10,979

5,847

Total current liabilities

124,348

118,529

Long-term debt, net

475,991

575,874

Noncurrent operating lease liabilities

17,137

16,074

Other noncurrent accrued and other

liabilities

523

523

Deferred income taxes

65,973

68,853

Commitments and contingencies

Stockholders' equity:

Common stock, $.10 par value; 150 million

shares authorized, 91.2 million shares issued

9,117

9,117

Capital in excess of par value

502,972

501,026

Retained earnings

216,811

227,015

728,900

737,158

Less treasury stock, at cost:

Common stock, 19.5 million shares (18.1

million shares at December 31, 2023)

229,939

218,827

Total stockholders' equity

498,961

518,331

$

1,182,933

$

1,298,184

Non-GAAP Reconciliations

This news release includes certain “non-GAAP financial measures”

under the rules of the Securities and Exchange Commission,

including Regulation G. These non-GAAP measures are calculated

using GAAP amounts in our consolidated financial statements.

EBITDA and Adjusted EBITDA

Reconciliation

EBITDA is defined as net income (loss) plus interest expense and

interest income, net, less gain on extinguishment of debt, plus

depreciation and amortization (D&A) (which includes D&A of

property, plant and equipment and amortization of intangible and

other assets), plus provision (benefit) for income taxes. Adjusted

EBITDA is reported to show the impact of non-cash stock-based

compensation, one time/non-cash or non-operating items-such as,

one-time income or fees, loss (gain) on sale of a business and/or

other property and equipment, certain fair market value (FMV)

adjustments, and consulting costs associated with reliability and

purchasing initiatives (Initiatives). We historically have

performed turnaround activities on an annual basis; however, we

have moved towards extending turnarounds to a two or three-year

cycle. Rather than being capitalized and amortized over the period

of benefit, our accounting policy is to recognize the costs as

incurred. Given these turnarounds are essentially investments that

provide benefits over multiple years, they are not reflective of

our operating performance in a given year.

We believe that certain investors consider EBITDA a useful means

of measuring our ability to meet our debt service obligations and

evaluating our financial performance. In addition, we believe that

certain investors consider adjusted EBITDA as more meaningful to

further assess our performance. We believe that the inclusion of

supplementary adjustments to EBITDA is appropriate to provide

additional information to investors about certain items.

EBITDA and adjusted EBITDA have limitations and should not be

considered in isolation or as a substitute for net income,

operating income, cash flow from operations or other consolidated

income or cash flow data prepared in accordance with GAAP. Because

not all companies use identical calculations, this presentation of

EBITDA and adjusted EBITDA may not be comparable to a similarly

titled measure of other companies. The following table provides a

reconciliation of net income (loss) to EBITDA and adjusted EBITDA

for the periods indicated.

Non-GAAP Reconciliations

(continued)

LSB Consolidated

($ In Thousands)

Three Months Ended September

30,

2024

2023

Net loss

$

(25,382)

$

(7,726)

Plus:

Interest expense and interest income,

net

5,401

3,467

Depreciation and amortization

16,693

15,548

Benefit for income taxes

(4,482)

(5,249)

EBITDA

$

(7,770)

$

6,040

Stock-based compensation

1,550

1,318

Legal Fees & Settlements - Specific

Matters

1,385

111

Loss (gain) on disposal and impairment of

assets

5,639

(11)

Turnaround costs

16,284

1,741

Growth Initiatives

376

-

Adjusted EBITDA

$

17,464

$

9,199

Ammonia, AN, Nitric Acid, UAN Sales

Price Reconciliation

The following table provides a reconciliation of total

identified net sales as reported under GAAP in our consolidated

financial statements reconciled to netback sales which is

calculated as net sales less freight and other non-netback costs.

We believe this provides a relevant industry comparison among our

peer group.

Three Months Ended September

30,

2024

2023

(In Thousands)

Ammonia, AN, Nitric Acid, UAN net

sales

$

101,774

$

102,938

Less freight and other

14,943

14,236

Ammonia, AN, Nitric Acid, UAN netback

sales

$

86,831

$

88,702

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029195060/en/

Cheryl Maguire, Executive Vice President & CFO (405)

510-3524

Fred Buonocore, CFA, Vice President of Investor Relations (405)

510-3550 fbuonocore@lsbindustries.com

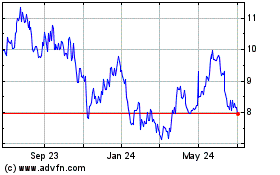

LSB Industries (NYSE:LXU)

Historical Stock Chart

From Nov 2024 to Dec 2024

LSB Industries (NYSE:LXU)

Historical Stock Chart

From Dec 2023 to Dec 2024