LMP CAPITAL AND INCOME FUND INC.

|

|

|

| Schedule of investments (unaudited) |

|

August 31, 2023 |

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

| SECURITY |

|

SHARES |

|

|

VALUE |

|

| COMMON STOCKS - 78.2% |

|

|

|

|

|

|

|

|

| COMMUNICATION SERVICES - 1.6% |

|

|

|

|

|

|

|

|

| Entertainment - 1.6% |

|

|

|

|

|

|

|

|

| Activision Blizzard Inc. |

|

|

44,500 |

|

|

$ |

4,093,555 |

(a) |

|

|

|

|

|

|

|

|

|

| CONSUMER STAPLES - 4.6% |

|

|

|

|

|

|

|

|

| Beverages - 2.3% |

|

|

|

|

|

|

|

|

| Coca-Cola Co. |

|

|

99,210 |

|

|

|

5,935,734 |

(a) |

|

|

|

|

|

|

|

|

|

| Household Products - 1.8% |

|

|

|

|

|

|

|

|

| Colgate-Palmolive Co. |

|

|

20,200 |

|

|

|

1,484,094 |

|

| Procter & Gamble Co. |

|

|

19,860 |

|

|

|

3,065,192 |

(a) |

|

|

|

|

|

|

|

|

|

| Total Household Products |

|

|

|

|

|

|

4,549,286 |

|

|

|

|

|

|

|

|

|

|

| Personal Care Products - 0.5% |

|

|

|

|

|

|

|

|

| Kenvue Inc. |

|

|

57,203 |

|

|

|

1,318,520 |

(a) |

|

|

|

|

|

|

|

|

|

| TOTAL CONSUMER STAPLES |

|

|

|

|

|

|

11,803,540 |

|

|

|

|

|

|

|

|

|

|

| ENERGY - 4.1% |

|

|

|

|

|

|

|

|

| Oil, Gas & Consumable Fuels - 4.1% |

|

|

|

|

|

|

|

|

| ConocoPhillips |

|

|

28,400 |

|

|

|

3,380,452 |

|

| DT Midstream Inc. |

|

|

43,000 |

|

|

|

2,248,470 |

|

| Enbridge Inc. |

|

|

41,960 |

|

|

|

1,471,957 |

|

| Williams Cos. Inc. |

|

|

96,740 |

|

|

|

3,340,432 |

(a) |

|

|

|

|

|

|

|

|

|

| TOTAL ENERGY |

|

|

|

|

|

|

10,441,311 |

|

|

|

|

|

|

|

|

|

|

| FINANCIALS - 11.7% |

|

|

|

|

|

|

|

|

| Banks - 2.4% |

|

|

|

|

|

|

|

|

| JPMorgan Chase & Co. |

|

|

41,680 |

|

|

|

6,099,035 |

|

|

|

|

|

|

|

|

|

|

| Capital Markets - 7.6% |

|

|

|

|

|

|

|

|

| Blackstone Inc. |

|

|

92,910 |

|

|

|

9,882,837 |

(a) |

| Blue Owl Capital Inc. |

|

|

394,200 |

|

|

|

4,710,690 |

|

| CME Group Inc. |

|

|

6,680 |

|

|

|

1,353,902 |

|

| Goldman Sachs Group Inc. |

|

|

4,700 |

|

|

|

1,540,237 |

|

| Intercontinental Exchange Inc. |

|

|

9,930 |

|

|

|

1,171,641 |

|

| Trinity Capital Inc. |

|

|

59,691 |

|

|

|

874,473 |

|

|

|

|

|

|

|

|

|

|

| Total Capital Markets |

|

|

|

|

|

|

19,533,780 |

|

|

|

|

|

|

|

|

|

|

| Insurance - 1.7% |

|

|

|

|

|

|

|

|

| Chubb Ltd. |

|

|

22,490 |

|

|

|

4,517,566 |

|

|

|

|

|

|

|

|

|

|

| TOTAL FINANCIALS |

|

|

|

|

|

|

30,150,381 |

|

|

|

|

|

|

|

|

|

|

| HEALTH CARE - 7.7% |

|

|

|

|

|

|

|

|

| Biotechnology - 1.5% |

|

|

|

|

|

|

|

|

| AbbVie Inc. |

|

|

17,200 |

|

|

|

2,527,712 |

|

| Amgen Inc. |

|

|

5,190 |

|

|

|

1,330,404 |

|

|

|

|

|

|

|

|

|

|

| Total Biotechnology |

|

|

|

|

|

|

3,858,116 |

|

|

|

|

|

|

|

|

|

|

See Notes to

Schedule of Investments.

|

|

|

|

|

|

|

LMP Capital and Income Fund Inc. 2023 Quarterly Report |

|

1 |

LMP CAPITAL AND INCOME FUND INC.

|

|

|

| Schedule of investments (unaudited) (cont’d) |

|

August 31, 2023 |

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

| SECURITY |

|

SHARES |

|

|

VALUE |

|

| Pharmaceuticals - 6.2% |

|

|

|

|

|

|

|

|

| Johnson & Johnson |

|

|

18,201 |

|

|

$ |

2,942,738 |

(a) |

| Merck & Co. Inc. |

|

|

64,600 |

|

|

|

7,040,108 |

(a) |

| Pfizer Inc. |

|

|

171,108 |

|

|

|

6,053,801 |

|

|

|

|

|

|

|

|

|

|

| Total Pharmaceuticals |

|

|

|

|

|

|

16,036,647 |

|

|

|

|

|

|

|

|

|

|

| TOTAL HEALTH CARE |

|

|

|

|

|

|

19,894,763 |

|

|

|

|

|

|

|

|

|

|

| INDUSTRIALS - 8.5% |

|

|

|

|

|

|

|

|

| Aerospace & Defense - 3.3% |

|

|

|

|

|

|

|

|

| L3Harris Technologies Inc. |

|

|

14,700 |

|

|

|

2,617,923 |

|

| Lockheed Martin Corp. |

|

|

9,878 |

|

|

|

4,428,801 |

(a) |

| RTX Corp. |

|

|

17,810 |

|

|

|

1,532,373 |

(a) |

|

|

|

|

|

|

|

|

|

| Total Aerospace & Defense |

|

|

|

|

|

|

8,579,097 |

|

|

|

|

|

|

|

|

|

|

| Air Freight & Logistics - 0.6% |

|

|

|

|

|

|

|

|

| United Parcel Service Inc., Class B Shares |

|

|

8,760 |

|

|

|

1,483,944 |

(a) |

|

|

|

|

|

|

|

|

|

| Electrical Equipment - 0.8% |

|

|

|

|

|

|

|

|

| Emerson Electric Co. |

|

|

20,720 |

|

|

|

2,035,740 |

(a) |

|

|

|

|

|

|

|

|

|

| Ground Transportation - 1.7% |

|

|

|

|

|

|

|

|

| Union Pacific Corp. |

|

|

19,700 |

|

|

|

4,345,229 |

|

|

|

|

|

|

|

|

|

|

| Machinery - 1.8% |

|

|

|

|

|

|

|

|

| Otis Worldwide Corp. |

|

|

54,510 |

|

|

|

4,663,330 |

(a) |

|

|

|

|

|

|

|

|

|

| Professional Services - 0.3% |

|

|

|

|

|

|

|

|

| Paychex Inc. |

|

|

5,570 |

|

|

|

680,821 |

(a) |

|

|

|

|

|

|

|

|

|

| TOTAL INDUSTRIALS |

|

|

|

|

|

|

21,788,161 |

|

|

|

|

|

|

|

|

|

|

| INFORMATION TECHNOLOGY - 23.2% |

|

|

|

|

|

|

|

|

| Communications Equipment - 1.6% |

|

|

|

|

|

|

|

|

| Cisco Systems Inc. |

|

|

71,800 |

|

|

|

4,117,730 |

(a) |

|

|

|

|

|

|

|

|

|

| Electronic Equipment, Instruments & Components - 1.0% |

|

|

|

|

|

|

|

|

| Amphenol Corp., Class A Shares |

|

|

27,500 |

|

|

|

2,430,450 |

|

|

|

|

|

|

|

|

|

|

| Semiconductors & Semiconductor Equipment - 8.0% |

|

|

|

|

|

|

|

|

| Broadcom Inc. |

|

|

14,367 |

|

|

|

13,259,161 |

(a) |

| NXP Semiconductors NV |

|

|

9,440 |

|

|

|

1,941,997 |

|

| QUALCOMM Inc. |

|

|

46,940 |

|

|

|

5,376,038 |

(a) |

|

|

|

|

|

|

|

|

|

| Total Semiconductors & Semiconductor Equipment |

|

|

|

|

|

|

20,577,196 |

|

|

|

|

|

|

|

|

|

|

| Software - 7.8% |

|

|

|

|

|

|

|

|

| Microsoft Corp. |

|

|

47,330 |

|

|

|

15,512,881 |

(a) |

| Oracle Corp. |

|

|

37,690 |

|

|

|

4,537,499 |

(a) |

|

|

|

|

|

|

|

|

|

| Total Software |

|

|

|

|

|

|

20,050,380 |

|

|

|

|

|

|

|

|

|

|

| Technology Hardware, Storage & Peripherals - 4.8% |

|

|

|

|

|

|

|

|

| Apple Inc. |

|

|

65,530 |

|

|

|

12,311,121 |

(a) |

|

|

|

|

|

|

|

|

|

| TOTAL INFORMATION TECHNOLOGY |

|

|

|

|

|

|

59,486,877 |

|

|

|

|

|

|

|

|

|

|

See Notes to

Schedule of Investments.

|

|

|

|

|

|

2 |

|

LMP Capital and Income Fund Inc. 2023 Quarterly Report |

|

|

LMP CAPITAL AND INCOME FUND INC.

|

|

|

| Schedule of investments (unaudited) (cont’d) |

|

August 31, 2023 |

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

| SECURITY |

|

SHARES |

|

|

VALUE |

|

| MATERIALS - 1.6% |

|

|

|

|

|

|

|

|

| Chemicals - 1.6% |

|

|

|

|

|

|

|

|

| Air Products & Chemicals Inc. |

|

|

5,960 |

|

|

$ |

1,761,120 |

|

| Huntsman Corp. |

|

|

83,450 |

|

|

|

2,325,752 |

(a) |

|

|

|

|

|

|

|

|

|

| TOTAL MATERIALS |

|

|

|

|

|

|

4,086,872 |

|

|

|

|

|

|

|

|

|

|

| REAL ESTATE - 10.2% |

|

|

|

|

|

|

|

|

| Health Care REITs - 0.3% |

|

|

|

|

|

|

|

|

| Global Medical REIT Inc. |

|

|

72,500 |

|

|

|

701,800 |

|

|

|

|

|

|

|

|

|

|

| Industrial REITs - 1.8% |

|

|

|

|

|

|

|

|

| Prologis Inc. |

|

|

37,500 |

|

|

|

4,657,500 |

(a) |

|

|

|

|

|

|

|

|

|

| Office REITs - 0.7% |

|

|

|

|

|

|

|

|

| Alexandria Real Estate Equities Inc. |

|

|

15,770 |

|

|

|

1,834,682 |

(a) |

|

|

|

|

|

|

|

|

|

| Residential REITs - 1.0% |

|

|

|

|

|

|

|

|

| American Homes 4 Rent, Class A Shares |

|

|

45,300 |

|

|

|

1,632,612 |

|

| Equity LifeStyle Properties Inc. |

|

|

13,630 |

|

|

|

912,665 |

|

|

|

|

|

|

|

|

|

|

| Total Residential REITs |

|

|

|

|

|

|

2,545,277 |

|

|

|

|

|

|

|

|

|

|

| Specialized REITs - 6.4% |

|

|

|

|

|

|

|

|

| American Tower Corp. |

|

|

8,890 |

|

|

|

1,611,935 |

(a) |

| Digital Realty Trust Inc. |

|

|

33,000 |

|

|

|

4,346,760 |

|

| Equinix Inc. |

|

|

5,410 |

|

|

|

4,227,265 |

(a) |

| Extra Space Storage Inc. |

|

|

21,800 |

|

|

|

2,805,224 |

|

| Gaming and Leisure Properties Inc. |

|

|

74,677 |

|

|

|

3,539,690 |

(a) |

|

|

|

|

|

|

|

|

|

| Total Specialized REITs |

|

|

|

|

|

|

16,530,874 |

|

|

|

|

|

|

|

|

|

|

| TOTAL REAL ESTATE |

|

|

|

|

|

|

26,270,133 |

|

|

|

|

|

|

|

|

|

|

| UTILITIES - 5.0% |

|

|

|

|

|

|

|

|

| Electric Utilities - 1.8% |

|

|

|

|

|

|

|

|

| NextEra Energy Inc. |

|

|

15,480 |

|

|

|

1,034,064 |

|

| PPL Corp. |

|

|

145,100 |

|

|

|

3,615,892 |

|

|

|

|

|

|

|

|

|

|

| Total Electric Utilities |

|

|

|

|

|

|

4,649,956 |

|

|

|

|

|

|

|

|

|

|

| Independent Power and Renewable Electricity Producers - 0.3% |

|

|

|

|

|

|

|

|

| Brookfield Renewable Corp., Class A Shares |

|

|

23,800 |

|

|

|

665,210 |

|

|

|

|

|

|

|

|

|

|

| Multi-Utilities - 2.9% |

|

|

|

|

|

|

|

|

| DTE Energy Co. |

|

|

35,225 |

|

|

|

3,641,561 |

|

| Sempra |

|

|

53,560 |

|

|

|

3,760,983 |

(a) |

|

|

|

|

|

|

|

|

|

| Total Multi-Utilities |

|

|

|

|

|

|

7,402,544 |

|

|

|

|

|

|

|

|

|

|

| TOTAL UTILITIES |

|

|

|

|

|

|

12,717,710 |

|

|

|

|

|

|

|

|

|

|

| TOTAL COMMON STOCKS

(Cost - $132,321,913) |

|

|

|

|

|

|

200,733,303 |

|

|

|

|

|

|

|

|

|

|

See Notes to

Schedule of Investments.

|

|

|

|

|

|

|

LMP Capital and Income Fund Inc. 2023 Quarterly Report |

|

3 |

LMP CAPITAL AND INCOME FUND INC.

|

|

|

| Schedule of investments (unaudited) (cont’d) |

|

August 31, 2023 |

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

| SECURITY |

|

|

|

|

SHARES/UNITS |

|

|

VALUE |

|

| MASTER LIMITED PARTNERSHIPS - 32.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Diversified Energy Infrastructure - 15.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Energy Transfer LP |

|

|

|

|

|

|

1,323,480 |

|

|

$ |

17,827,275 |

(a) |

| Enterprise Products Partners LP |

|

|

|

|

|

|

503,280 |

|

|

|

13,392,281 |

(a) |

| Plains GP Holdings LP, Class A Shares |

|

|

|

|

|

|

463,340 |

|

|

|

7,431,974 |

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Diversified Energy Infrastructure |

|

|

|

|

|

|

|

|

|

|

38,651,530 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Global Infrastructure - 1.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Brookfield Renewable Partners LP |

|

|

|

|

|

|

113,805 |

CAD |

|

|

2,877,130 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liquids Transportation & Storage - 4.7% |

|

|

|

|

|

|

|

|

|

|

|

|

| Magellan Midstream Partners LP |

|

|

|

|

|

|

179,580 |

|

|

|

11,927,704 |

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Oil/Refined Products - 6.7% |

|

|

|

|

|

|

|

|

|

|

|

|

| CrossAmerica Partners LP |

|

|

|

|

|

|

151,970 |

|

|

|

2,966,454 |

(a) |

| MPLX LP |

|

|

|

|

|

|

188,500 |

|

|

|

6,576,765 |

(a) |

| Sunoco LP |

|

|

|

|

|

|

165,300 |

|

|

|

7,597,188 |

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Oil/Refined Products |

|

|

|

|

|

|

|

|

|

|

17,140,407 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Petrochemicals - 2.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Westlake Chemical Partners LP |

|

|

|

|

|

|

239,536 |

|

|

|

5,506,933 |

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Power Generation - 1.3% |

|

|

|

|

|

|

|

|

|

|

|

|

| NextEra Energy Partners LP |

|

|

|

|

|

|

66,420 |

|

|

|

3,313,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Propane - 1.1% |

|

|

|

|

|

|

|

|

|

|

|

|

| Suburban Propane Partners LP |

|

|

|

|

|

|

200,000 |

|

|

|

2,904,000 |

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL MASTER LIMITED PARTNERSHIPS

(Cost - $37,616,028) |

|

|

|

|

|

|

|

82,320,734 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

RATE |

|

|

SHARES |

|

|

|

|

| CONVERTIBLE PREFERRED STOCKS - 6.9% |

|

|

|

|

|

|

|

|

|

|

|

|

| COMMUNICATION SERVICES - 0.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| Media - 0.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| Paramount Global, Non Voting Shares |

|

|

5.750 |

% |

|

|

67,964 |

|

|

|

1,504,723 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIALS - 4.4% |

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Markets - 1.8% |

|

|

|

|

|

|

|

|

|

|

|

|

| KKR & Co. Inc., Non Voting Shares |

|

|

6.000 |

% |

|

|

63,700 |

|

|

|

4,664,114 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial Services - 2.6% |

|

|

|

|

|

|

|

|

|

|

|

|

| Apollo Global Management Inc. |

|

|

6.750 |

% |

|

|

121,751 |

|

|

|

6,622,037 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL FINANCIALS |

|

|

|

|

|

|

|

|

|

|

11,286,151 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UTILITIES - 1.9% |

|

|

|

|

|

|

|

|

|

|

|

|

| Electric Utilities - 1.5% |

|

|

|

|

|

|

|

|

|

|

|

|

| NextEra Energy Inc. |

|

|

6.219 |

% |

|

|

84,050 |

|

|

|

3,833,520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Utilities - 0.4% |

|

|

|

|

|

|

|

|

|

|

|

|

| Spire Inc. |

|

|

7.500 |

% |

|

|

23,100 |

|

|

|

1,027,950 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL UTILITIES |

|

|

|

|

|

|

|

|

|

|

4,861,470 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL CONVERTIBLE PREFERRED STOCKS

(Cost - $20,694,389) |

|

|

|

|

|

|

|

17,652,344 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to

Schedule of Investments.

|

|

|

|

|

|

4 |

|

LMP Capital and Income Fund Inc. 2023 Quarterly Report |

|

|

LMP CAPITAL AND INCOME FUND INC.

|

|

|

| Schedule of investments (unaudited) (cont’d) |

|

August 31, 2023 |

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SECURITY |

|

RATE |

|

|

MATURITY

DATE |

|

|

FACE

AMOUNT |

|

|

VALUE |

|

| CORPORATE BONDS & NOTES - 3.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COMMUNICATION SERVICES - 0.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Entertainment - 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Netflix Inc., Senior Notes |

|

|

5.375 |

% |

|

|

11/15/29 |

|

|

$ |

400,000 |

|

|

$ |

398,147 |

(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interactive Media & Services - 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Match Group Holdings II LLC, Senior Notes |

|

|

3.625 |

% |

|

|

10/1/31 |

|

|

|

250,000 |

|

|

|

204,028 |

(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Media - 0.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Charter Communications Operating LLC/Charter Communications Operating Capital Corp., Senior Secured Notes |

|

|

6.384 |

% |

|

|

10/23/35 |

|

|

|

400,000 |

|

|

|

388,250 |

|

| Comcast Corp., Senior Notes |

|

|

4.250 |

% |

|

|

10/15/30 |

|

|

|

400,000 |

|

|

|

380,790 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Media |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

769,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Wireless Telecommunication Services - 0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| T-Mobile USA Inc., Senior Notes |

|

|

3.875 |

% |

|

|

4/15/30 |

|

|

|

500,000 |

|

|

|

456,551 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL COMMUNICATION SERVICES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,827,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSUMER DISCRETIONARY - 0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Automobiles - 0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ford Motor Co., Senior Notes |

|

|

3.250 |

% |

|

|

2/12/32 |

|

|

|

550,000 |

|

|

|

429,830 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSUMER STAPLES - 0.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Food Products - 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lamb Weston Holdings Inc., Senior Notes |

|

|

4.375 |

% |

|

|

1/31/32 |

|

|

|

400,000 |

|

|

|

347,530 |

(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Personal Care Products - 0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Kenvue Inc., Senior Notes |

|

|

4.900 |

% |

|

|

3/22/33 |

|

|

|

400,000 |

|

|

|

398,071 |

(b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL CONSUMER STAPLES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

745,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIALS - 1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Banks - 0.8% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bank of America Corp., Senior Notes

(5.015% to 7/22/32 then SOFR + 2.160%) |

|

|

5.015 |

% |

|

|

7/22/33 |

|

|

|

400,000 |

|

|

|

385,153 |

(c) |

| Citigroup Inc., Subordinated Notes

(6.174% to 5/25/33 then SOFR + 2.661%) |

|

|

6.174 |

% |

|

|

5/25/34 |

|

|

|

700,000 |

|

|

|

697,947 |

(c) |

| JPMorgan Chase & Co., Subordinated Notes

(5.717% to 9/14/32 then SOFR + 2.580%) |

|

|

5.717 |

% |

|

|

9/14/33 |

|

|

|

700,000 |

|

|

|

699,913 |

(c) |

| Wells Fargo & Co., Senior Notes

(4.897% to 7/25/32 then SOFR + 2.100%) |

|

|

4.897 |

% |

|

|

7/25/33 |

|

|

|

500,000 |

|

|

|

470,676 |

(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Banks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,253,689 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer Finance - 0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| American Express Co., Senior Notes

(5.043% to 5/1/33 then SOFR + 1.835%) |

|

|

5.043 |

% |

|

|

5/1/34 |

|

|

|

500,000 |

|

|

|

480,687 |

(c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL FINANCIALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,734,376 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to

Schedule of Investments.

|

|

|

|

|

|

|

LMP Capital and Income Fund Inc. 2023 Quarterly Report |

|

5 |

LMP CAPITAL AND INCOME FUND INC.

|

|

|

| Schedule of investments (unaudited) (cont’d) |

|

August 31, 2023 |

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SECURITY |

|

RATE |

|

|

MATURITY

DATE |

|

|

FACE

AMOUNT |

|

|

VALUE |

|

| HEALTH CARE - 0.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Biotechnology - 0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amgen Inc., Senior Notes |

|

|

5.250 |

% |

|

|

3/2/33 |

|

|

$ |

400,000 |

|

|

$ |

398,088 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Health Care Providers & Services - 0.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Centene Corp., Senior Notes |

|

|

3.000 |

% |

|

|

10/15/30 |

|

|

|

600,000 |

|

|

|

499,635 |

|

| CVS Health Corp., Senior Notes |

|

|

3.750 |

% |

|

|

4/1/30 |

|

|

|

600,000 |

|

|

|

546,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Health Care Providers & Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,045,792 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pharmaceuticals - 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pfizer Investment Enterprises Pte Ltd., Senior Notes |

|

|

4.750 |

% |

|

|

5/19/33 |

|

|

|

400,000 |

|

|

|

393,825 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL HEALTH CARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,837,705 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INDUSTRIALS - 0.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aerospace & Defense - 0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Northrop Grumman Corp., Senior Notes |

|

|

4.750 |

% |

|

|

6/1/43 |

|

|

|

500,000 |

|

|

|

454,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Trading Companies & Distributors - 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United Rentals North America Inc., Senior Notes |

|

|

3.750 |

% |

|

|

1/15/32 |

|

|

|

350,000 |

|

|

|

294,649 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL INDUSTRIALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

749,471 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MATERIALS - 0.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Containers & Packaging - 0.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ball Corp., Senior Notes |

|

|

3.125 |

% |

|

|

9/15/31 |

|

|

|

400,000 |

|

|

|

324,207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Metals & Mining - 0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Freeport-McMoRan Inc., Senior Notes |

|

|

5.450 |

% |

|

|

3/15/43 |

|

|

|

500,000 |

|

|

|

449,222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL MATERIALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

773,429 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL CORPORATE BONDS & NOTES

(Cost - $9,250,463) |

|

|

|

|

|

|

|

|

|

|

|

9,098,178 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

SHARES |

|

|

|

|

| INVESTMENTS IN UNDERLYING FUNDS - 2.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ares Capital Corp.

(Cost - $5,260,817) |

|

|

|

|

|

|

|

|

|

|

286,890 |

|

|

|

5,591,486 |

(a)(d) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GOVERNMENT & AGENCY OBLIGATIONS - 0.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. Treasury Notes

(Cost - $637,639) |

|

|

1.500 |

% |

|

|

2/29/24 |

|

|

|

650,000 |

|

|

|

637,625 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENTS

(Cost - $205,781,249) |

|

|

|

316,033,670 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to

Schedule of Investments.

|

|

|

|

|

|

6 |

|

LMP Capital and Income Fund Inc. 2023 Quarterly Report |

|

|

LMP CAPITAL AND INCOME FUND INC.

|

|

|

| Schedule of investments (unaudited) (cont’d) |

|

August 31, 2023 |

(Percentages shown based on Fund net assets)

|

|

|

|

|

|

|

|

|

|

|

|

|

| SECURITY |

|

RATE |

|

|

SHARES |

|

|

VALUE |

|

| SHORT-TERM INVESTMENTS - 0.5% |

|

|

|

|

|

|

|

|

|

|

|

|

| Dreyfus Government Cash Management, Institutional Shares |

|

|

5.215 |

% |

|

|

27,902 |

|

|

$ |

27,902 |

(e) |

| JPMorgan 100% U.S. Treasury Securities Money Market Fund, Institutional Class |

|

|

5.165 |

% |

|

|

1,375,412 |

|

|

|

1,375,412 |

(e) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL SHORT-TERM INVESTMENTS

(Cost - $1,403,314) |

|

|

|

|

|

|

|

1,403,314 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL INVESTMENTS - 123.6%

(Cost - $207,184,563) |

|

|

|

|

|

|

|

317,436,984 |

|

| Liabilities in Excess of Other Assets - (23.6)% |

|

|

|

|

|

|

|

|

|

|

(60,651,601 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL NET ASSETS - 100.0% |

|

|

|

|

|

|

|

|

|

$ |

256,785,383 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Non-income producing security. |

| (a) |

All or a portion of this security is pledged as collateral pursuant to the loan agreement.

|

| (b) |

Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold

in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors. |

| (c) |

Variable rate security. Interest rate disclosed is as of the most recent information available. Certain

variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description

above. |

| (d) |

Security is a business development company. |

| (e) |

Rate shown is one-day yield as of the end of the reporting period.

|

Abbreviation(s) used in this schedule:

|

|

|

| CAD |

|

— Canadian Dollar |

| REIT |

|

— Real Estate Investment Trust |

| SOFR |

|

— Secured Overnight Financing Rate |

This Schedule of Investments is unaudited and is intended to provide information about the Fund’s investments as of the

date of the schedule. Other information regarding the Fund is available in the Fund’s most recent annual or semi-annual shareholder report.

See Notes to

Schedule of Investments.

|

|

|

|

|

|

|

LMP Capital and Income Fund Inc. 2023 Quarterly Report |

|

7 |

Notes to Schedule of Investments (unaudited)

1. Organization and significant accounting policies

LMP Capital and Income Fund Inc. (the “Fund”) was incorporated in Maryland on November 12, 2003 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors authorized

100 million shares of $0.001 par value common stock. The Fund’s investment objective is total return with an emphasis on income.

Under normal

market conditions, the Fund seeks to maximize total return by investing at least 80% of its Managed Assets in a broad range of equity and fixed income securities of both U.S. and foreign issuers. The Fund will vary its allocation between equity and

fixed income securities depending on ClearBridge’s view of economic, market or political conditions, fiscal and monetary policy and security valuation.

The Fund follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946,

Financial Services – Investment Companies (“ASC 946”). The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles

(“GAAP”), including, but not limited to, ASC 946.

(a) Investment valuation. Equity securities for which market quotations are available

are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal,

mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer

quotations or a variety of valuation techniques and methodologies. The independent third party pricing services typically use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads,

default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. When the Fund holds securities or

other assets that are denominated in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if

the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value

has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the

security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Directors.

Notes to Schedule of Investments (unaudited) (continued)

Pursuant to policies adopted by the Board of Directors, the Fund’s manager has been

designated as the valuation designee and is responsible for the oversight of the daily valuation process. The Fund’s manager is assisted by the Global Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee is

responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Fund’s manager and the Board of Directors. When determining the reliability of third party pricing

information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible

methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or

fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the

issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions;

information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable

companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the

policies adopted by the Board of Directors, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are

reported to the Board of Directors quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach

and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income

approach uses valuation techniques to discount estimated future cash flows to present value.

Notes to Schedule of Investments (unaudited) (continued)

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation

techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| |

• |

|

Level 1 – unadjusted quoted prices in active markets for identical investments |

| |

• |

|

Level 2 – other significant observable inputs (including quoted prices for similar investments,

interest rates, prepayment speeds, credit risk, etc.) |

| |

• |

|

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the

fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk

associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

| DESCRIPTION |

|

QUOTED PRICES

(LEVEL 1) |

|

|

OTHER SIGNIFICANT

OBSERVABLE INPUTS

(LEVEL 2) |

|

|

SIGNIFICANT

UNOBSERVABLE

INPUTS

(LEVEL 3) |

|

|

TOTAL |

|

| Long-Term Investments†: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stocks |

|

$ |

200,733,303 |

|

|

|

— |

|

|

|

— |

|

|

$ |

200,733,303 |

|

| Master Limited Partnerships |

|

|

82,320,734 |

|

|

|

— |

|

|

|

— |

|

|

|

82,320,734 |

|

| Convertible Preferred Stocks |

|

|

17,652,344 |

|

|

|

— |

|

|

|

— |

|

|

|

17,652,344 |

|

| Corporate Bonds & Notes |

|

|

— |

|

|

$ |

9,098,178 |

|

|

|

— |

|

|

|

9,098,178 |

|

| Investments in Underlying Funds |

|

|

5,591,486 |

|

|

|

— |

|

|

|

— |

|

|

|

5,591,486 |

|

| U.S. government & agency obligations |

|

|

— |

|

|

|

637,625 |

|

|

|

— |

|

|

|

637,625 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Long-Term Investments |

|

|

306,297,867 |

|

|

|

9,735,803 |

|

|

|

— |

|

|

|

316,033,670 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Short-Term Investments† |

|

|

1,403,314 |

|

|

|

— |

|

|

|

— |

|

|

|

1,403,314 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments |

|

$ |

307,701,181 |

|

|

$ |

9,735,803 |

|

|

|

— |

|

|

$ |

317,436,984 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| † |

See Schedule of Investments for additional detailed categorizations. |

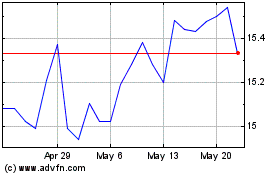

LMP Capital and Income (NYSE:SCD)

Historical Stock Chart

From Apr 2024 to May 2024

LMP Capital and Income (NYSE:SCD)

Historical Stock Chart

From May 2023 to May 2024