LL Flooring’s Board Fails to Accept

Responsibility for Company’s Abysmal Performance and Persistent

Value Destruction

Bogus Attacks and Factual Distortions Appear to

Demonstrate Board’s Efforts to Further Entrench Itself and Avoid

Accountability

Urges Shareholders Vote the GOLD Proxy Card “FOR” F9’s Three Highly

Qualified Director Nominees – Tom Sullivan, Jason Delves, and Jill

Witter – Who Are the Right Individuals to Restore Value to LL

Flooring

F9 Investments, LLC (“F9”), which together with its affiliates

collectively owns approximately 8.85% of LL Flooring Holdings, Inc.

(“LL Flooring” or the “Company”) (NYSE: LL) common stock and is the

Company’s largest shareholder, today mailed a letter to LL

Flooring’s shareholders correcting what it believes are egregious

distortions of the facts and dishonest personal attacks levied

against Tom Sullivan and F9’s other nominees by the Company’s Board

of Directors (the “Board”).

The letter, which highlights the Board’s flimsy attempts to

avoid accountability for its clear strategic failures and

significant erosion of the Company’s value, sets the record

straight regarding what F9 believes are unfounded and distorted

attacks against Mr. Sullivan and F9’s other nominees. The letter

also reiterates the clear intentions of F9’s three highly

qualified, independent director candidates – Thomas D. Sullivan,

Jason Delves, and Jill Witter – to bring much-needed experience,

focus, relevant industry expertise, and proper oversight back to LL

Flooring’s boardroom to restore the long-term value of the Company

for all shareholders.

Mr. Sullivan commented, “It is sad to see this Board so

desperate they have to fabricate bogus nonsense, but I guess when

they can't rely on their performance, they have to resort to lies

and deception."

The full text of the letter is below and available at

www.LLGroove.com.

June 20, 2024

Dear Fellow LL Flooring Shareholders,

As LL Flooring’s largest shareholder owning approximately 8.85%

of the Company’s stock, F9 Investments, LLC and our affiliates

(“F9” or “We”) are disappointed by the Board of Directors’ (the

“Board”) decision to resort to egregious, made-up personal attacks

against Tom Sullivan and our other nominees. Moreover, we believe

LL Flooring has distorted a number of facts in its investor

presentation and letters to shareholders.

We believe the Board’s personal attacks and distortions, coupled

with their stubborn adherence to a failed long-term strategy,

highlight the Board’s utter lack of accountability for its own

failures and further demonstrate that the Board is simply out of

touch with the urgent realities facing LL Flooring. Shareholders

should not be fooled by the Company’s desperate attempts to

distract you from focusing on the dire current reality: the

Board has overseen staggering operational losses and shareholder

value destruction, and by the Company’s own admission there is

substantial concern as to whether LL Flooring will be able to

continue operations at all.

Yet in a profound display of either lack of awareness or

self-denial, LL’s Board continues to insist its plan is working. We

believe shareholders recognize it clearly is not. LL has vastly underperformed its peers in virtually every

metric and over a sustained period. The facts are

irrefutable.

While F9 consistently responds to and refutes the Company’s

mischaracterizations of our nominees’ credentials and plan,

the Board has resorted to peddling

outrageous personal attacks and bogus distortions of the facts

rather than responding directly to F9’s critiques – because they

cannot. The strategic missteps and value erosion that

have occurred under their watch are undeniable, so the Board

continues to promote a false narrative that only further

demonstrates to us the lengths its members will go to entrench

themselves and avoid accountability for their failures.

Accordingly, we would like to set the record straight regarding a

few of the Board’s most egregious claims:

TOM SULLIVAN IS NOT SEEKING TO FORCE A SALE OF THE COMPANY TO

HIMSELF

LL Flooring’s assertion otherwise is patently absurd. If F9 is

successful in this proxy contest, our nominees would constitute

only 1/3 of the Board and would be powerless to “force” anything.

Furthermore, were F9 to make a new offer for the Company, any F9

nominees serving on the Board would recuse themselves from

consideration of the proposed transaction. Most importantly, any

transaction to any buyer would be subject to shareholder

approval.

F9 withdrew its 2023 bid for the Company as LL Flooring’s

financial condition was rapidly deteriorating and it became clear

that the Board’s so-called strategic review and sale process was

disingenuous. Today, we continue to believe that upgrading LL

Flooring’s Board with experienced directors, who bring a track

record of success in the flooring industry, represents the best

path forward to stabilize and grow the Company and restore

long-term value for all shareholders.

OUR NOMINEES’ INTENTIONS ARE SIMPLE: TO HELP

STABILIZE LL FLOORING’S BUSINESS AND POSITION THE COMPANY FOR

LONG-TERM GROWTH, PROFITABILITY, AND SHAREHOLDER VALUE

CREATION

The Board’s claim that F9’s nominees are conflicted due to their

roles at Cabinets to Go has no merit. To be clear, while Cabinets

to Go – a successful cabinets retail chain and F9 portfolio company

– does sell flooring, it is not its primary business and, as

previously disclosed to LL Flooring, flooring sales are relatively

minimal and well below the legal definition of a competitor that

would preclude our nominees from Board service.

In just one example of the Board’s partial recounting of the

history between the Company and F9, its materials reference Mr.

Sullivan’s involvement in litigation between Cabinets to Go and LL

Flooring but fail to mention that the lawsuit ended in a settlement

in which Cabinets to Go was permitted to sell flooring anywhere and

LL Flooring paid F9 Properties, a division of F9 Investments,

$300,000 in damages. Further, the Board’s claim that Ms. Witter

“led the lawsuit” against Cabinets to Go as the Chief Legal Officer

of LL Flooring (then Lumber Liquidators) is completely false. The

litigation was filed in 2019; Ms. Witter left the Company in 2017

and had no involvement whatsoever.

Each of F9’s nominees bring deep knowledge of the flooring space

and related industries, substantial corporate governance

experience, and strong track records of creating value for

companies – all of which we believe will be additive to the Board.

We believe our nominees’ combined skillset is

vitally important and necessary to stabilize the Company and bring

immediate and long-term value to LL Flooring.

SHAMELESS PERSONAL ATTACKS AGAINST MR.

SULLIVAN ARE UNTRUE AND HYPOCRITICAL

In its materials, the Board criticizes the Company’s performance

during Mr. Sullivan’s tenure, yet fails to mention that two of the

three incumbent directors up for re-election this year were also on

the Board during that same period. The Company also refuses to

acknowledge that under the leadership of the current Chair of

the Board, Nancy Taylor, LL Flooring’s stock price has plummeted a

whopping 98.5%.

Since the start of 2024 alone, the Company’s stock has dropped

by 58%, and over the last three years it has fallen by 93%. At the

time of Tom’s departure from the business, LL Flooring had a market

capitalization of approximately $430 million; today, the Company’s

market capitalization is less than $50 million. If the Board

believes Mr. Sullivan’s track record at the Company is “highly

questionable”, how should it characterize its current members’

abysmal performance or their fitness to drive long-term value for

shareholders?

The Board’s other personal attacks against Mr. Sullivan reek of

desperation. Its mudslinging reference to other litigation

involving Mr. Sullivan fails to reflect that the action was

ultimately dismissed, and that Mr. Sullivan was acknowledged as

both a victim and a creditor. Further, the Board’s insinuation that

Mr. Sullivan was ‘timing’ his trades to ‘whipsaw’ other investors

has no basis in reality. As any rational person would, Mr. Sullivan

took profits in 2019, after the first time LL Flooring declined to

meaningfully engage with him regarding a business combination.

IT'S NOT THE ECONOMY – IT’S THE

BOARD

Rather than take responsibility for its own strategic failures,

the Board attempts to blame market conditions for the Company’s

rapidly declining value. However, it fails to reckon honestly with

the Company’s staggering underperformance relative to its peers.

The facts are simple: if you invested $100 in LL Flooring five

years ago, it would be worth just $15 today, while the same

investment in the Company’s proxy peer group would be worth

$196.

The Board notes that its strategic plan in part relies on

waiting to “capitalize on improving market conditions” and

“anticipated industry tailwinds”. Meanwhile, in the near term the

Company plans to enter into a sale-leaseback commitment for its

primary asset – LL Flooring’s Sandston, VA distribution center – in

a shortsighted attempt to generate cash that will likely increase

expenses and destroy value for shareholders in the long run. The

Board’s misguided decision to simply wait out macroeconomic

conditions shows a disturbing lack of urgency, vision, and

confidence in the Company’s value proposition, and reflects the

dire need for change at the Board level to protect what remains of

LL Flooring’s value.

UNEVEN, SHAM STRATEGIC REVIEW PROCESS HAS

RESULTED IN PLUMMETING OFFERS

LL Flooring’s Board claims it has been conducting a “thorough

review’ of strategic alternatives to maximize shareholder value.

However, despite receiving fully financed offers from F9 to buy LL

Flooring at premium valuations far exceeding the Company’s current

value and during a period of declining operating performance, the

Company refused to engage constructively with F9 and created a

deeply uneven playing field for F9 versus other bidders.

In 2023, F9 offered several times to enter into an NDA, but the

Company refused to consider F9’s proposed standstill provisions

that the Company later publicly disclosed it provided to at least

one other bidder. In fact, the Board sought to have F9 sign an NDA

which would have prevented F9 from making an offer for the Company

during the standstill period that may have been in the best

interests of all of the shareholders while granting the Company the

right to terminate the NDA or refuse to provide due diligence.

Indeed, the Board’s disingenuous “strategic review” and sale

process have been characterized by a disturbing pattern of premium

bids rejected, falling bid prices, limited transparency, and an

uneven playing field for bidders – all despite the Board’s

insistence that the bids received “significantly undervalued” the

Company.

Time is short. All LL Flooring shareholders

must protect the value of their investment.

VOTE ON THE GOLD PROXY CARD TODAY “FOR” F9’S NOMINEES TOM

SULLIVAN, JASON DELVES, AND JILL WITTER AND “WITHHOLD” ON ALL LL

FLOORING NOMINEES AND JERALD HAMMANN

Shareholders must act decisively to safeguard their investment.

YOUR VOTE MATTERS, NO MATTER HOW MANY SHARES YOU OWN. We

urge all shareholders to protect the value of their investment by

voting for F9’s nominees today using the GOLD proxy card.

You can cast your vote online at www.ProxyVote.com or by

completing, signing and dating the GOLD proxy card or GOLD voting

instruction form and mailing it in the postage paid envelope

provided.

If you have not received the GOLD proxy card from F9 and have

only received a WHITE proxy card sent to you by the Company, you

can still support F9’s nominees using the WHITE proxy card. You can

do so by checking the “WITHHOLD” boxes on all of the Company

nominees and Jerald Hammann and checking the “FOR” boxes for all F9

nominees – Tom Sullivan, Jason Delves, and Jill Witter.

If you have any questions about how to vote your shares, please

contact our proxy solicitor, Campaign Management, by telephone

1-(855) 264-1527 (shareholders) or (212) 632-8422 (banks &

brokerages) or by email at info@campaign-mgmt.com.

For more information about F9 and detailed voting instructions,

visit our website at www.LLGroove.com.

With your vote, we will be one step closer to ensuring LL

Flooring is on a better path to creating lasting shareholder value

and getting the Company back in the groove.

We thank you for your support.

Sincerely,

Tom Sullivan Jason Delves Jill Witter

Solomon Partners Securities, LLC is serving as F9’s financial

advisor and Dentons US LLP is serving as its legal advisor.

DISCLAIMER

Except as otherwise set forth in this press release, the views

expressed in this press release reflect the opinions of F9

Investments, LLC and its affiliates (“F9”) and are based on

publicly available information with respect to LL Flooring

Holdings, Inc. (“LL” or the “Company”). F9 recognizes that there

may be confidential information in the possession of the Company

that could lead it or others to disagree with F9’s conclusions. F9

reserves the right to change any of its opinions expressed herein

at any time as it deems appropriate and disclaims any obligation to

notify the market or any other party of any such change, except as

required by law. F9 disclaims any obligation to update the

information or opinions contained in this press release, except as

required by law. For the avoidance of doubt, this press release is

not affiliated with or endorsed by LL.

This press release is provided merely as information and is not

intended to be, nor should it be construed as, an offer to sell or

a solicitation of an offer to buy any security nor as a

recommendation to purchase or sell any security. Certain of the

Participants (as defined below) currently beneficially own shares

of the Company. The Participants and their affiliates may from time

to time sell all or a portion of their holdings of the Company in

open market transactions or otherwise, buy additional shares (in

open market or privately negotiated transactions or otherwise), or

trade in options, puts, calls, swaps or other derivative

instruments relating to such shares.

Some of the materials in this press release contain

forward-looking statements. All statements contained herein that

are not clearly historical in nature or that necessarily depend on

future events are forward-looking, and the words “anticipate,”

“believe,” “expect,” “potential,” “could,” “opportunity,”

“estimate,” “plan,” “once again,” “achieve,” and similar

expressions are generally intended to identify forward-looking

statements. The projected results and statements contained herein

that are not historical facts are based on current expectations,

speak only as of the date of these materials and involve risks,

uncertainties and other factors that may cause actual results,

performances or achievements to be materially different from any

future results, performances or achievements expressed or implied

by such projected results and statements. Assumptions relating to

the foregoing involve judgments with respect to, among other

things, future economic competitive and market conditions and

future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond the control of

F9.

The estimates, projections and potential impact of the

opportunities identified by F9 herein are based on assumptions that

F9 believes to be reasonable as of the date of this press release,

but there can be no assurance or guarantee (i) that any of the

proposed actions set forth in this press release will be completed,

(ii) that the actual results or performance of the Company will not

differ, and such differences may be material, or (iii) that any of

the assumptions provided in this press release are accurate.

F9 has neither sought nor obtained the consent from any third

party to use any statements or information contained herein that

have been obtained or derived from statements made or published by

such third parties, nor has it paid for any such statements. Any

such statements or information should not be viewed as indicating

the support of such third parties for the views expressed herein.

F9 does not endorse third-party estimates or research which are

used herein solely for illustrative purposes.

Important Information

F9 Investments, LLC, Thomas D. Sullivan, John Jason Delves and

Jill Witter (collectively, the “Participants”) filed a definitive

proxy statement and accompanying form of gold proxy card (as

supplemented and amended, the “Definitive Proxy Statement”) with

the Securities and Exchange Commission (the "SEC”) on May 31, 2024

to be used in connection with the 2024 annual meeting of

stockholders of the Company.

THE PARTICIPANTS STRONGLY ADVISE ALL STOCKHOLDERS OF THE COMPANY

TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER PROXY MATERIALS

BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV AND

F9’S WEBSITE AT WWW.LLGROOVE.COM. THE DEFINITIVE PROXY STATEMENT

AND ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE

COMPANY’S STOCKHOLDERS. STOCKHOLDERS MAY ALSO DIRECT A REQUEST TO

F9’S PROXY SOLICITOR, CAMPAIGN MANAGEMENT, 15 WEST 38TH STREET,

SUITE #747, NEW YORK, NY 10018 (STOCKHOLDERS CAN E-MAIL

INFO@CAMPAIGNMANAGEMENT.COM OR CALL TOLL-FREE: (855) 264-1527.

Information about the Participants and a description of their

direct or indirect interests by security holdings or otherwise can

be found in the Definitive Proxy Statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240620325755/en/

INVESTOR AND MEDIA CONTACTS Investors: Michael Fein

Campaign Management (212) 632-8422 michael.fein@campaign-mgmt.com

Media: Jonathan Gasthalter/Nathaniel Garnick Gasthalter & Co.

(212) 257-4170 F9Investments@gasthalter.com

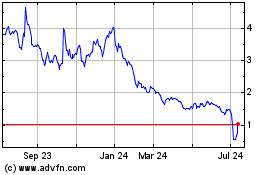

LL Flooring (NYSE:LL)

Historical Stock Chart

From May 2024 to Jun 2024

LL Flooring (NYSE:LL)

Historical Stock Chart

From Jun 2023 to Jun 2024