Current Report Filing (8-k)

October 24 2022 - 7:26AM

Edgar (US Regulatory)

false000005604700000560472022-10-242022-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): October 24, 2022 |

KIRBY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Nevada |

1-7615 |

74-1884980 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

|

55 Waugh Drive, Suite 1000 |

|

Houston, Texas |

|

77007 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: 713-435-1000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

KEX |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 24, 2022, Kirby Corporation (“Kirby” or the "Company") issued a press release announcing results for the third quarter ended September 30, 2022. A copy of the press release is attached as Exhibit 99.1 to this report.

Adjusted EBITDA, a non-GAAP financial measure, is used in the press release. Kirby defines Adjusted EBITDA as net earnings attributable to Kirby before interest expense, taxes on income, depreciation and amortization, impairment of long-lived assets and impairment of goodwill. Kirby has historically evaluated its operating performance using numerous measures, one of which is Adjusted EBITDA. Adjusted EBITDA is presented because of its wide acceptance as a financial indicator. Adjusted EBITDA is one of the performance measures used in Kirby’s incentive bonus plan. Adjusted EBITDA is also used by rating agencies in determining Kirby’s credit rating and by analysts publishing research reports on Kirby, as well as by investors and investment bankers generally in valuing companies. A quantitative reconciliation of Adjusted EBITDA to net earnings attributable to Kirby for the 2022 and 2021 third quarters and first nine months is included in the press release. Adjusted EBITDA is not a calculation based on generally accepted accounting principles and should not be considered as an alternative to, but should only be considered in conjunction with, Kirby’s GAAP financial information.

The press release also includes non-GAAP financial measures which exclude certain one-time items, including earnings before taxes on income (excluding one-time items), net earnings attributable to Kirby (excluding one-time items), and diluted earnings per share (excluding one-time items). A reconciliation of these measures with GAAP is included in the press release. Management believes that the exclusion of certain one-time items from these financial measures enables it and investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of Kirby’s normal operating results. The press release also includes free cash flow, a non-GAAP financial measure, which Kirby defines as net cash provided by operating activities less capital expenditures. A reconciliation of free cash flow with GAAP is included in the press release. Kirby uses free cash flow to assess and forecast cash flow and to provide additional disclosures on the Company’s liquidity as a result of uncertainty surrounding the COVID-19 pandemic on global and regional market conditions. Free cash flow does not imply the amount of residual cash flow available for discretionary expenditures as it excludes mandatory debt service requirements and other non-discretionary expenditures. These non-GAAP financial measures are not calculations based on generally accepted accounting principles and should not be considered as an alternative to, but should only be considered in conjunction with Kirby’s GAAP financial information.

Item 9.01. Financial Statements and Exhibits

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

KIRBY CORPORATION |

|

|

|

|

Date: |

October 24, 2022 |

By: |

/s/ Raj Kumar |

|

|

|

Raj Kumar

Executive Vice President

and Chief Financial Officer |

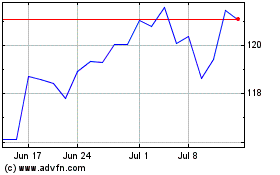

Kirby (NYSE:KEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

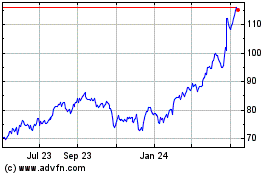

Kirby (NYSE:KEX)

Historical Stock Chart

From Apr 2023 to Apr 2024