0001114483 False 0001114483 2024-01-10 2024-01-10 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2024

_______________________________

INTEGER HOLDINGS CORPORATION

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 1-16137 | 16-1531026 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

5830 Granite Parkway, Suite 1150

Plano, Texas 75024

(Address of Principal Executive Offices) (Zip Code)

(214) 618-5243

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | ITGR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 10, 2024, Integer Holdings Corporation (the “Company”) issued a press release announcing its preliminary unaudited sales for the fourth quarter and year ended December 31, 2023. A copy of the release is furnished with this report as Exhibit 99.1 and is incorporated by reference into this Item 2.02.

The information contained in this report under Items 2.02 and 7.01 and Exhibits 99.1 and 99.2 are being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information contained in this report under Items 2.02 and 7.01 and Exhibits 99.1 and 99.2 shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

As part of the press release attached hereto as Exhibit 99.1, the Company also announced the acquisition of Pulse Technologies, Inc. The full text of the press release is attached hereto as Exhibit 99.1.

In addition, on January 3, 2024, the Company announced that Joseph Dziedzic, President and Chief Executive Officer, would deliver a presentation to analysts and investors at the 42nd Annual J.P. Morgan Healthcare Conference on Wednesday, January 10, 2024, at 4:30 p.m. PT (7:30 p.m. ET). A copy of the presentation slides for this presentation are furnished with this report as Exhibit 99.2 and are incorporated by reference into this Item 7.01, and will also be made available on the Company’s website at www.integer.net, under “Investor Relations - News & Events.”

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | INTEGER HOLDINGS CORPORATION |

| | | |

| | | |

| Date: January 10, 2024 | By: | /s/ McAlister Marshall |

| | | McAlister Marshall |

| | | Senior Vice President, General Counsel and Corporate Secretary |

| | | |

EXHIBIT 99.1

Integer Holdings Corporation Announces Preliminary Unaudited Sales Results and Acquisition of Pulse Technologies

~ Preliminary unaudited full year 2023 sales increase 16% versus 2022 ~

~ Acquisition adds highly differentiated micro machining capability in high growth end markets ~

~ Schedules conference call for fourth quarter and full year 2023 results ~

PLANO, Texas, Jan. 10, 2024 (GLOBE NEWSWIRE) -- Integer Holdings Corporation (NYSE:ITGR), a leading medical device outsource manufacturer, today announced fourth quarter 2023 preliminary unaudited sales are expected to be in the range of $411 million to $413 million, an increase of 10% to 11% compared to fourth quarter 2022. Preliminary unaudited full year 2023 sales are expected to be in the range of $1.595 billion to $1.597 billion, an increase of 16% compared to full year 2022.

The preliminary unaudited sales results for the fourth quarter and full year ended December 31, 2023 are based on information available to management as of the date of this release. These preliminary results are subject to changes, that may be material, in connection with completion of the Company’s standard year-end closing procedures and the completion of our independent registered public accounting firm’s year-end audit.

Pulse Technologies Acquisition

Additionally, Integer announced the acquisition of Pulse Technologies, Inc., a privately-held technology, engineering and contract manufacturing company focused on complex micro machining of medical device components for high growth structural heart, heart pump, electrophysiology, leadless pacing, and neuromodulation markets. Based in Quakertown, Pennsylvania, Pulse Technologies also provides proprietary advanced technologies, including Hierarchical Surface Restructuring (HSR™), Scratch-Free Surface Finishes, and Titanium Nitride Coatings.

Consistent with Integer’s tuck-in acquisition strategy, the acquisition of Pulse Technologies further increases Integer’s end-to-end development capabilities and manufacturing footprint in targeted growth markets and provides customers with expanded capabilities, capacity and resources to accelerate products time to market.

“The acquisition of Pulse Technologies is directly aligned with Integer’s strategy to expand our capabilities and capacity in targeted growth markets,” said Payman Khales, Integer President, Cardio & Vascular. “We were immediately impressed with Pulse Technologies’ long-standing customer relationships, technical talent, unique technologies, shared values, and capacity for growth. The company shares Integer’s commitment to quality, innovation and enhancing the lives of patients, and we are thrilled to welcome their 250 associates to the Integer team.”

Joe Rosato, Pulse owner, President and CEO, said, “Our founders Bob Walsh and Frank Henofer started Pulse Technologies over 31 years ago with a focus on implantable medical components and assemblies serving high growth sectors of the market. With years of prudent investments in R&D and advanced technology, we have been successful servicing the world’s largest MedTech OEMs. The acquisition by Integer, with their global scale and best-in-class capabilities, will accelerate our growth opportunities and will further enhance our value proposition to our most valued customers.”

Transaction Financial Highlights

- Integer acquired Pulse Technologies for approximately $140 million, subject to customary purchase price adjustments, offset by an expected $15 million NPV tax benefit over 15 years, plus additional consideration contingent on achieving specific revenue growth targets through 2025.

- Pulse Technologies’ estimated full year 2023 sales are approximately $42 million with 2023 adjusted EBITDA(a) expected to be approximately $11 million.

- Integer expects Pulse Technologies’ sales growth and adjusted EBITDA margin to be accretive.

- The transaction closed on January 5, 2024 utilizing borrowings under Integer’s existing revolving credit facility. Integer anticipates it will stay within the 2.5x – 3.5x leverage target following the transaction.

Forward-looking financial information with respect to the transaction will be provided as part of Integer’s fourth quarter earnings release and conference call.

| (a) | Adjusted EBITDA is defined as net income adjusted for the following items: interest expense, depreciation and amortization expense, as well as items affecting comparability, including adjustments to eliminate expenses associated with executive compensation costs and above market lease expense, and add certain expenses to align with Integer’s accounting policies. A GAAP reconciliation of Adjusted EBITDA to anticipated net income has not been included because Pulse Technologies has not yet completed its financial closing procedures for the three months and fiscal year ended December 31, 2023 and such reconciliation could not be produced without unreasonable effort. |

| | |

Fourth Quarter and Full Year 2023 Earnings Release and Conference Call

Integer plans to release financial and operational results for fourth quarter and full year 2023 at 7 a.m. Central Time (CT) / 8 a.m. Eastern Time (ET) on Thursday February 15, 2024. Following the release, Integer management will host a webcast at 8 a.m. CT / 9 a.m ET to discuss these results. Other forward-looking and material information may also be discussed during this call.

Conference call details:

- Date: Thursday, February 15, 2024

- Time: 8 a.m. CT / 9 a.m. ET

- Domestic dial-in number: (888) 330-3567

- International dial-in number: (646) 960-0842

- Conference ID: 9252310

- Webcast Registration: ITGR Q4 2023 Earnings Call

An audio replay will be available for seven days and can be accessed by dialing (800) 770-2030 or (647) 362-9199 and using Conference ID 9252310. The conference call will also be available live or via archived replay on the Investor Relations section of the Integer website at investor.integer.net.

From time to time, the Company posts information that may be of interest to investors on its website at investor.integer.net. To automatically receive Integer financial news by email, please visit investor.integer.net and subscribe to email alerts.

About Integer®

Integer Holdings Corporation (NYSE:ITGR) is one of the largest medical device outsource (MDO) manufacturers in the world serving the cardiac, neuromodulation, vascular, portable medical and orthopedics markets. Integer provides innovative, high-quality medical technologies that enhance the lives of patients worldwide. In addition, the Company develops batteries for high-end niche applications in energy, military, and environmental markets. The Company's brands include Greatbatch Medical®, Lake Region Medical® and Electrochem®. Additional information is available at www.integer.net.

| Investor Relations: | Media Relations: |

| Andrew Senn | Kelly Butler |

| andrew.senn@integer.net | kelly.butler@integer.net |

| 763.951.8312 | 214.618.4216 |

Forward-Looking Statements

Some of the statements contained in this press release are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding fourth quarter 2023 preliminary unaudited sales and preliminary unaudited full year 2023 sales; statements regarding Integer’s ability to stay within its 2.5x-3.5x leverage target following the acquisition of Pulse Technologies; statements regarding estimated full year 2023 sales and adjusted EBITDA of Pulse Technologies; expectations regarding the accretive nature of Pulse Technologies’ sales growth and adjusted EBITDA margin and the benefits of the acquisition; and other events, conditions or developments that will or may occur in the future. You can identify forward-looking statements by terminology such as “outlook,” “projected,” “may,” “will,” “should,” “could,” “expect,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “project,” or “continue” or variations or the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially from those stated or implied by these forward-looking statements. In evaluating these statements and our prospects, you should carefully consider the factors set forth below.

Although it is not possible to create a comprehensive list of all factors that may cause actual results to differ from the results expressed or implied by our forward-looking statements or that may affect our future results, some of these factors and other risks and uncertainties that arise from time to time are described in Item 1A “Risk Factors” of our Annual Report on Form 10-K and in our other periodic filings with the SEC and include the following:

- operational risks, such as the duration, scope and impact of global supply chain issues and the military conflicts between Russia and Ukraine and between Israel and Hamas, including the evolving economic, social and governmental environments and their effects on our associates, suppliers and customers as well as the global economy; our dependence upon a limited number of customers; pricing pressures that we face from customers; our reliance on third party suppliers for raw materials, key products and subcomponents; the competitive labor market and our ability to attract, train and retain a sufficient number of qualified associates; the potential for harm to our reputation caused by quality problems related to our products; the dependence of our energy market-related revenues on the conditions in the oil and natural gas industry; interruptions in our manufacturing operations; our dependence upon our information technology systems and our ability to prevent cyber-attacks and other failures; and our dependence upon our senior management team and technical personnel;

- strategic risks, such as the intense competition we face and our ability to successfully market our products; our ability to respond to changes in technology; our ability to develop new products and expand into new geographic and product markets; and our ability to successfully identify, make and integrate acquisitions to expand and develop our business in accordance with expectations, including our ability to successfully integrate Pulse Technologies into our business and risks inherent with the acquisition of Pulse Technologies in the achievement of expected results, including whether the acquisition will be accretive and within the expected time frame;

- financial risks, such as our significant amount of outstanding indebtedness and our ability to remain in compliance with financial and other covenants under our senior secured credit facilities; economic and credit market uncertainties that could interrupt our access to capital markets, borrowings or financial transactions; financial and market risks related to our international operations and sales; our complex international tax profile; and our ability to realize the full value of our intangible assets; and

- legal and compliance risks, such as regulatory issues resulting from product complaints, recalls or regulatory audits; the potential of becoming subject to product liability or intellectual property claims; our ability to protect our intellectual property and proprietary rights; our ability and the cost to comply with environmental regulations; our ability to comply with customer-driven policies and third party standards or certification requirements; our ability to obtain necessary licenses for new technologies; legal and regulatory risks from our international operations, including trade regulation; and the fact that the healthcare industry is highly regulated and subject to various regulatory changes.

Except as may be required by law, we assume no obligation to update forward-looking statements in this press release whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial conditions or prospects, or otherwise.

Exhibit 99.2

ITGR: JPM Conference / January 10, 2024 / Page 1 42 nd Annual JP Morgan Healthcare Conference January 10, 2024

ITGR: JPM Conference / January 10, 2024 / Page 2 Presentation of Financial Information & Forward - Looking Statements Important Information This presentation contains summarized information concerning Integer Holdings Corporation (the “Company”) and its business, operations, financial performance and trends. The historical financial and operating data contained herein reflect the consolid ated results of the Company for the periods indicated. No representation is made that the information in this presentation is comple te. For additional financial and business - related information, as well as information regarding business and product line trends, see th e Company’s most recent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well other reports filed with the SEC from time - to - time. Such reports are or will be availab le in the investor relations section of our corporate website ( investor.integer.net ) and the SEC’s website ( www.sec.gov ). Non - GAAP Financial Measures . This presentation includes financial information prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) as well as other financial measures referred to as non - GAAP. These non - GAAP financial measures are not calculated in accordance with GAAP and are not meant to be considered in isolation from or as a substitute for the information prepared in accordance with GAAP. Forward Looking Statements. Some of the statements contained in this presentation whether written or oral may be “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securiti es Exchange Act of 1934, as amended, including statements relating to future sales, expenses, and profitability; future developm ent and expected growth of our business and industry; our ability to execute our business model and our business strategy, including completion and integration of current or future acquisition targets; having available sufficient cash and borrowing capacity to meet working capital, debt service and capital expenditure requirements for the next twelve months; projected capital spending; an d o ther events, conditions or developments that will or may occur in the future. You can identify forward - looking statements by terminol ogy such as “may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “po tential,” “projects,” “sustain,” or “continue” or variations or the negative of these terms or other comparable terminology. These stat eme nts are based on the Company’s current expectations and speak only as of date of this presentation. The Company’s actual results could differ materially from those stated or implied by such forward - looking statements. Except as required by law, the Company assum es no obligation to update forward - looking information, including information in this presentation, to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial conditions or prospects or otherwise.

ITGR: JPM Conference / January 10, 2024 / Page 3 Integer is one of the largest medical device outsource manufacturers in the world 17 mfg. sites & 9 R&D centers worldwide 500+ R&D Associates ~ 7 0% of sales under LTA ~ 700 patents 11,000 + associates Our vision is to enhance the lives of patients worldwide by being our customers’ partner of choice for innovative technologies and services Integer Snapshot ~$1.6 Billion Medical Sales (97%) % Sales by End Markets ( 1 ) Non - Medical (3%) Portable Medical & AS&O 5 2 % 39 % Cardio & CRM & Vascular Neuromod 6 % 3% Electrochem (1) End market sales based on 202 3 sales 2023 Sales Outlook at Midpoint Differentiated Global Footprint

ITGR: JPM Conference / January 10, 2024 / Page 4 Integer Investment Thesis Resilient Business Model x Sustainable mid - single - digit growth industry x Breadth of product portfolio x Proprietary technology, long development cycle, high switching costs & regulatory x ~70% sales under multi - year agreements x Favorable outsourcing trends x World - class research & development capabilities x Leadership capability: – Selection, development, evaluation, succession x Performance excellence: – Engagement, assessment, organization effectiveness x Diversity & Inclusion x Track record of delivering sustainable profitable growth x Strong cash generation x Disciplined capital allocation Compelling Strategy for Growth Performance Culture Financial Strength • Sales growth 200 basis points above market • Operating profit 2x sales growth rate • Debt leverage 2.5x – 3.5x 1 2 3 1 Strategy Financial Objectives

ITGR: JPM Conference / January 10, 2024 / Page 5 Integer’s Strategy Journey 2017 2018 2019 2020 2021 2022 Portfolio Strategy Launched Divested AS&O Additional Operational Strategies Launched Manufacturing Excellence Launched Growth Teams Formed Acquisitions: Strategy Developed Executing strategy to deliver sustained outperformance Product Line Strategies Launched Margin Expansio n Capability & Capacity Expansion Initiated Partial Portable Medical Exit Portfolio Strategy Operational Strategy Product Line Strategies Portfolio Strategy Galway Dominican Republic New Ross 2023 COVID Impact and Macro Challenges Margin Expansio n

ITGR: JPM Conference / January 10, 2024 / Page 6 Product Development 2 – 3 years Clinical / Regulatory 0.5 – 1 year Market Intro. ~1 year Begin Manufacturing Ramp Integer is uniquely positioned to serve customers and generate revenue across the entire development cycle New 510k Products (Class II) Developed w/ Customers Product Development 3 – 5 years Clinical / Regulatory 1 – 3 years Market Intro. ~1 year Begin Manufacturing Ramp Process Dev 1 – 2 years Reg 0 – 6 months Begin Manufacturing Ramp Existing Product Transfers New Revenue Generation Cycle Times 1 – 2+ Years 3 – 5+ Years New PMA Products (Class III) Developed w/ Customers Time to Manufacturing Ramp 5 – 9+ Years Integer Revenue Profile Across Cycle Development Clinical Manufacturing Ramp

ITGR: JPM Conference / January 10, 2024 / Page 7 C&V Targeted Market Strategy to Drive Sustained Growth Technology Maturity Low High Interventional Cardiology Renal Denervation Pulsed Field Ablation Structural Heart Electro - physiology Neurovascular Peripheral Vascular Integer Investment Focus Growth Curve Heart Pumps Structural Heart $11.6 billion 2024 Market, 14% ’24 – ’28E CAGR Transcatheter Delivery Systems & Implants Electrophysiology $ 8.0 billion 2024 Market, 7% ’24 – ’28E CAGR Ablation Catheters Advanced Diagnostics Neurovascular $ 3.7 billion 2024 Market, 8 % ’24 – ‘28E CAGR Aspiration Catheters Thrombectomy Devices Target Growth Markets

ITGR: JPM Conference / January 10, 2024 / Page 8 Integer Investment Focus Pain Mgmt. (SCS) Cochlear Epilepsy Sleep Apnea Pain Mgmt. (Emerging) Parkinson's Incontinence Neuromodulation Single - Chamber Leadless CRM Ventricular Assist Cardiac Monitoring Dual - Chamber Leadless CRM CRM Conventional CRM Technology Maturity Low High Growth Curve Traditional Pacing Leadless Pacemaker & ICM $1.6 billion 2022 Market 13% ’24 – ’28E CAGR Leadless Pacemakers Neuromodulation $7.9 billion 2022 Market 9% ’24 – ’28E CAGR Implantable Leads Implantable Pulse Generators Target Growth Markets Implantable Cardiac Monitors CRM&N Targeted Market Strategy to Drive Sustained Growth

ITGR: JPM Conference / January 10, 2024 / Page 9 Growth Starts with Product Development 3 – 5+ Years Strategy delivering mix shift to high - growth markets Product development sales +230% since strategy launch Emerging / Growth Mature 2017 202 3 2021 Development Sales Strategy focused on being designed into our customers’ products in high growth markets 2017 2021 2023 ~20% ~20% ~ 8 0% ~2 8 % ~ 5 0% ~ 5 0%

ITGR: JPM Conference / January 10, 2024 / Page 10 Capacity & Capability to Continue Acquisition Strategy $250 - $300 million of annual acquisition capacity … maintaining 2.5x - 3.5x leverage Annual Acquisition Capacity $250 - $300 Organic growth and acquired EBITDA Annual Free Cash Flow Funding Sources Acquisition Criteria + ($ in millions) Differentiated Capabilities Growth Market Focus High Medical Concentration Accretive Margin Profile Revenue Growth Scalable Team & Infrastructure

ITGR: JPM Conference / January 10, 2024 / Page 11 Executing Targeted Inorganic Growth Strategy Four Acquisitions in last 25 Months Generating ~$170 million of annualized sales with accretive margins Jan 2024 Oct 2023 Apr 2022 Dec 2021 ▪ Leadless pacing ▪ Neuromodulation ▪ Heart pumps ▪ Electrophysiology ▪ Structural heart ▪ Peripheral vascular ▪ Aspiration catheters ▪ Thrombectomy delivery catheters ▪ Steerable microcatheters ▪ Balloon guide catheters ▪ Radial access catheters ▪ Structural heart ▪ Neurovascular ▪ Peripheral vascular ▪ Endovascular ▪ Electrophysiology ▪ Neuromodulation ▪ Peripheral vascular ▪ Structural heart

ITGR: JPM Conference / January 10, 2024 / Page 12 , a Leader in Precision Micro Machining • Stock purchase closed on January 5, 2024 • ~250 associates located in Quakertown, Pennsylvania • Estimated 2023 sales of ~$42 million and 2023 adjusted EBITDA (1) of ~$11 million Financials • ~$140 million purchase price plus additional consideration contingent on achieving specific revenue growth through 2025, offset by ~$15 million NPV cash tax benefit • Anticipate staying within 2.5x – 3.5x leverage target • Expect accretive sales growth and adjusted EBITDA margin • Brings differentiated complex machining and manufacturing capabilities as well as proprietary technologies • Revenue concentrated in high growth structural heart, heart pump, electrophysiology, leadless pacing, and neuromodulation products • Long standing relationships with the leading MedTech OEMs as well as emerging innovators Transaction Profile Strategic Fit (1) Adjusted EBITDA is a non - GAAP financial measure; refer to “Non - GAAP Financial Measures” on Page 17 of this presentation

ITGR: JPM Conference / January 10, 2024 / Page 13 Brings Differentiated Expertise and Capabilities Areas of Focus CRM & Neuromodulation: x Leadless pacing x Ventricular assist x Deep brain stimulation x Pain management x Traditional pacing Cardio & Vascular: x Heart pumps x Electrophysiology (incl. PFA) x Structural heart x Peripheral vascular x Interventional cardiology

ITGR: JPM Conference / January 10, 2024 / Page 14 Executing Organic and Inorganic Sales Growth Strategy … … to deliver high single digit / low double - digit sales growth 2016 2019 13% 15% 2022 2023 Future Integer Sales Growth at Market Rate Sustained Above Market Growth

ITGR: JPM Conference / January 10, 2024 / Page 15 Integer Investment Thesis Resilient Business Model x Sustainable mid - single - digit growth industry x Breadth of product portfolio x Proprietary technology, long development cycle, high switching costs & regulatory x ~70% sales under multi - year agreements x Favorable outsourcing trends x World - class research & development capabilities x Leadership capability: – Selection, development, evaluation, succession x Performance excellence: – Engagement, assessment, organization effectiveness x Diversity & Inclusion x Track record of delivering sustainable profitable growth x Strong cash generation x Disciplined capital allocation Compelling Strategy for Growth Performance Culture Financial Strength • Sales growth 200 basis points above market • Operating profit 2x sales growth rate • Debt leverage 2.5x – 3.5x 1 2 3 1 Strategy Financial Objectives

ITGR: JPM Conference / January 10, 2024 / Page 16 Questions?

ITGR: JPM Conference / January 10, 2024 / Page 17 Non - GAAP Financial Measures This presentation may contain the non - GAAP financial measures defined in the table below. A GAAP reconciliation of Adjusted EBIT DA to anticipated net income has not been included because Pulse Technologies has not yet completed its financial closing procedures for the three months and fis cal year ended December 31, 2023 and such reconciliation could not be produced without unreasonable effort. Non - GAAP Financial Measure Definitions for Pulse Technologies: Adjusted EBITDA is defined as net income adjusted for the following items: interest expense, depreciation and amortization ex pen se, as well as items affecting comparability, including adjustments to eliminate expenses associated with executive compensation costs and above m ark et lease expense, and add certain expenses to align with Integer’s accounting policies. Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”)

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

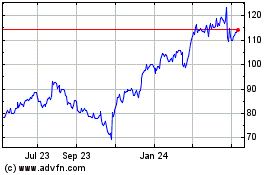

Integer (NYSE:ITGR)

Historical Stock Chart

From Apr 2024 to May 2024

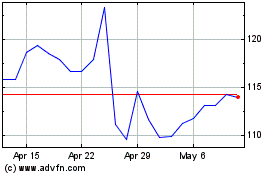

Integer (NYSE:ITGR)

Historical Stock Chart

From May 2023 to May 2024