Form SD - Specialized disclosure report

September 03 2024 - 10:49AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD SPECIALIZED DISCLOSURE REPORT

IAMGOLD CORPORATION

Ontario, Canada

(State or other jurisdiction of incorporation)

001-31528

(Commission File Number)

Suite 2200 – 150 King Street West

Toronto, ON M5J 1J9

Canada

(Address of principal executive office)

Tim Bradburn

(416) 360-4710

(Name and telephone number, including area code, of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this Form is being submitted, and provide the period to which the information in this Form applies:

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, .

X Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended December 31, 2023.

Section 1 – CONFLICT MINERALS DISCLOSURE

Item 1.01 Conflict Minerals Disclosure and Report

Not applicable

Item 1.02 Exhibit

Not applicable

Section 2 – RESOURCE EXTRACTION ISSUER DISCLOSURE

Item 2.01 Resource Extraction Issuer Disclosure and Report

IAMGOLD Corporation (“IAMGOLD”) is subject to Canada’s Extractive Sector Transparency Measures Act (“ESTMA”). IAMGOLD is relying on the alternative reporting provision of Item 2.01 and providing its ESTMA report for the year ended December 31, 2023, to satisfy the requirements of Item 2.01. IAMGOLD’s ESTMA report is available on IAMGOLD’s website at https://www.iamgold.com/English/investors/regulatory-filings or on the Government of Canada’s website at https://www.natural-resources.canada.ca/estma-data. The payment disclosure required by Form SD is included as Exhibit 2.01 to this Form SD.

Section 3 – EXHIBITS Item 3.01 Exhibits

The following exhibit is filed as part of this report.

| | | | | |

| Exhibit Number | Description |

| 99.1 | Extractive Sector Transparency Measures Act - Annual Report for the year ended December 31, 2023. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

IAMGOLD CORPORATION

By: /s/ Tim Bradburn

_____________________________

Date: September 3, 2024 Tim Bradburn

SVP, General Counsel & Corporate Secretary

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report |

|

|

| Reporting Year | From: | 1/1/2023 | To: | 12/31/2023 | | | | |

| Reporting Entity Name | IAMGOLD Corporation | Currency of the Report | USD | |

Payments by Payee

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Country | Payee Name | Departments, Agency, etc… within Payee that Received Payments | Taxes | Royalties | Fees | Production Entitlements | Bonuses | Dividends | Infrastructure

Improvement

Payments | Total Amount

paid to Payee | Notes |

| Burkina Faso | National Government of Burkina Faso | | 119,660,000 | | 43,570,000 | | 13,990,000 | | — | | — | | 11,680,000 | | — | | 188,900,000 | | Paid in XOF and CAD. |

| Canada | Mattagami First Nation | | — | | — | | 19,550,000 | | — | | — | | — | | — | | 19,550,000 | | Paid in CAD.

Includes payments made by suppliers on behalf of the Company. |

| France | National Government of France | | 7,770,000 | | — | | — | | — | | — | | — | | — | | 7,770,000 | | Paid in EUR. |

| Suriname | National Government of Suriname | | — | | 7,580,000 | | — | | — | | — | | — | | — | | 7,580,000 | | Paid in USD. |

| Canada | Flying Post First Nation | | — | | — | | 6,980,000 | | — | | — | | — | | — | | 6,980,000 | | Paid in CAD.

Includes payments made by suppliers on behalf of the Company. |

| Canada | Provincial Government of Quebec | | 3,630,000 | | — | | 880,000 | | — | | — | | — | | — | | 4,510,000 | | Paid in CAD. |

| Senegal | National Government of Senegal | | 4,100,000 | | — | | 130,000 | | — | | — | | — | | — | | 4,230,000 | | Paid in XOF. |

| Burkina Faso | Municipal Government of Dori | | 600,000 | | — | | — | | — | | — | | — | | — | | 600,000 | | Paid in XOF. |

| Canada | Municipal Government of Preissac | | 370,000 | | — | | — | | — | | — | | — | | — | | 370,000 | | Paid in CAD. |

| Guinea | National Government of Guinea | | — | | — | | 170,000 | | — | | — | | — | | — | | 170,000 | | Paid in GNF. |

| Canada | National Government of Canada | | 160,000 | | — | | — | | — | | — | | — | | — | | 160,000 | | Paid in CAD. |

| Canada | Metis Nation of Ontario | | — | | — | | 80,000 | | — | | — | | — | | — | | 80,000 | | Paid in CAD. |

| Peru | National Government of Peru | | — | | — | | 80,000 | | — | | — | | — | | — | | 80,000 | | Paid in PEN. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Additional Notes: | 1. Basis of Accounting The Schedule of Payments by Payee and the Schedule of Payments by Project (collectively, the “Schedules") prepared by IAMGOLD Corporation (the “Company”) for the year ended December 31, 2023 has been prepared in accordance with the financial reporting provisions in Section 9 of the Extractive Sector Transparency Measures Act, Section 2.3 of the Extractive Sector Transparency Measures Act – Technical Reporting Specifications and Section 3 of the Extractor Sector Transparency Measures Act – Guidance (Version 2.1 – July 2018) (collectively the “financial reporting framework"). The Schedules are prepared to provide information to the Board of Directors of IAMGOLD Corporation and the Minister of Natural Resources Canada to assist in meeting the requirements of the Extractive Sector Transparency Measures Act. As a result, the Schedules may not be suitable for another purposes. 2. Basis of Presentation The Schedules have been prepared using the cash basis of accounting, as required by the financial reporting framework, and therefore exclude any accruals related to payments due to governments. The Schedules include all cash payments made, without inclusion of cash inflows from a government. Where the Company makes a payment to a government that is net of credits from that government, the net payment amount has been presented. 3. Reporting currency All payments are reported in U.S. dollars which is the reporting currency of the Company. When the Company has made payments in currencies other than its reporting currency, it translates the payments using the exchange rate as at December 31, 2023, the Company’s financial year end. The following closing exchange rates were used for the 2023 annual report: USD/CAD 1.3205; USD/XOF 593.1100; USD/EUR 0.9042; USD/GNF 8,598.53; USD/PEN 3.7106 4. Rounding All figures have been rounded to the nearest US$10,000. 5. Royalties in-kind In-kind royalty payments are measured at the Company’s cost to produce gold dore. No in-kind royalty payments were reported for 2023. 6. In-kind payments In-kind payments are measured at cost. No in-kind payments were reported for 2023. 7. Control As required by the financial reporting framework, and except for the joint venture discussed below, the Company reports 100% of the payments made by entities controlled by the Company regardless of the Company's percentage of ownership in those entities. The Company has determined whether it controls an entity in accordance with International Financial Reporting Standards. 8. Joint ventures The Côté Gold Project is being developed through an unincorporated joint venture (Côté UJV), where the Company is the operator. Payments made directly by the Côté UJV are included in the Company's ESTMA report at 100%, on behalf of the non-operator member who owns a 39.7% interest in the Côté UJV. The Company has a 40% interest in the Societe d’exploration des Mines d’Or de Yatela S.A joint venture (“Joint Venture”). Payments made directly by the Joint Venture are included in the Company’s ESTMA report at 40%. Payments made by the Company on behalf of the joint venture, are included in the Company’s ESTMA report at 100%. 9. Assets sold Amounts disclosed for payments to the Government of Suriname are for the period until January 31, 2023. The sale of the Rosebel mine was completed on January 31, 2023. Amounts disclosed for payments to the Government of Senegal are for the period until April 25, 2023. The sale of the Boto Gold project was completed on April 25, 2023. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Extractive Sector Transparency Measures Act - Annual Report |

|

|

| Reporting Year | From: | 2023-01-01 | To: | 2023-12-31 | | | | |

| Reporting Entity Name | IAMGOLD Corporation | Currency of the Report | USD | |

Payments by Project

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Country | Project Name | Taxes | Royalties | Fees | Production

Entitlements | Bonuses | Dividends | Infrastructure

Improvement

Payments | Total Amount

paid by Project | Notes |

| Burkina Faso | Essakane | 120,250,000 | | 43,570,000 | | 13,910,000 | | — | | — | | 11,680,000 | | — | | 189,410,000 | | Paid in XOF and CAD. |

| Canada | Cote Gold | — | | — | | 26,660,000 | | — | | — | | — | | — | | 26,660,000 | | Paid in CAD.

Includes payments made by suppliers on behalf of the Company. |

| Suriname | Rosebel | — | | 7,580,000 | | — | | — | | — | | — | | — | | 7,580,000 | | Paid in USD. |

| France | Euro Ressources | 6,160,000 | | — | | — | | — | | — | | — | | — | | 6,160,000 | | Paid in EUR. |

| Canada | Westwood | 4,000,000 | | — | | 850,000 | | — | | — | | — | | — | | 4,850,000 | | Paid in CAD. |

| Senegal | Boto | 4,100,000 | | — | | 190,000 | | — | | — | | — | | — | | 4,290,000 | | Paid in XOF. |

| France | IAMGOLD France | 1,600,000 | | — | | — | | — | | — | | — | | — | | 1,600,000 | | Paid in EUR. |

| Guinea | Karita | — | | — | | 170,000 | | — | | — | | — | | — | | 170,000 | | Paid in GNF. |

| Canada | IMG Corp | 160,000 | | — | | — | | — | | — | | — | | — | | 160,000 | | Paid in CAD, USD, TRY and EUR. |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Additional Notes: | 1. Basis of Accounting The Schedule of Payments by Payee and the Schedule of Payments by Project (collectively, the “Schedules") prepared by IAMGOLD Corporation (the “Company”) for the year ended December 31, 2023 has been prepared in accordance with the financial reporting provisions in Section 9 of the Extractive Sector Transparency Measures Act, Section 2.3 of the Extractive Sector Transparency Measures Act – Technical Reporting Specifications and Section 3 of the Extractor Sector Transparency Measures Act – Guidance (Version 2.1 – July 2018) (collectively the “financial reporting framework"). The Schedules are prepared to provide information to the Board of Directors of IAMGOLD Corporation and the Minister of Natural Resources Canada to assist in meeting the requirements of the Extractive Sector Transparency Measures Act. As a result, the Schedules may not be suitable for another purposes. 2. Basis of Presentation The Schedules have been prepared using the cash basis of accounting, as required by the financial reporting framework, and therefore exclude any accruals related to payments due to governments. The Schedules include all cash payments made, without inclusion of cash inflows from a government. Where the Company makes a payment to a government that is net of credits from that government, the net payment amount has been presented. 3. Reporting currency All payments are reported in U.S. dollars which is the reporting currency of the Company. When the Company has made payments in currencies other than its reporting currency, it translates the payments using the exchange rate as at December 31, 2023, the Company’s financial year end. The following closing exchange rates were used for the 2023 annual report: USD/CAD 1.3205; USD/XOF 593.1100; USD/EUR 0.9042; USD/GNF 8,598.5300; USD/TRY 29.5280 4. Rounding All figures have been rounded to the nearest US$10,000. 5. Royalties in-kind In-kind royalty payments are measured at the Company’s cost to produce gold dore. No in-kind royalty payments were reported for 2023. 6. In-kind payments In-kind payments are measured at cost. No in-kind payments were reported for 2023. 7. Control As required by the financial reporting framework, and except for the joint venture discussed below, the Company reports 100% of the payments made by entities controlled by the Company regardless of the Company's percentage of ownership in those entities. The Company has determined whether it controls an entity in accordance with International Financial Reporting Standards. 8. Joint ventures The Côté Gold Project is being developed through an unincorporated joint venture (Côté UJV), where the Company is the operator. Payments made directly by the Côté UJV are included in the Company's ESTMA report at 100%, on behalf of the non-operator member who owns a 39.7% interest in the Côté UJV. The Company has a 40% interest in the Societe d’exploration des Mines d’Or de Yatela S.A joint venture (“Joint Venture”). Payments made directly by the Joint Venture are included in the Company’s ESTMA report at 40%. Payments made by the Company on behalf of the joint venture, are included in the Company’s ESTMA report at 100%. 9. Assets sold Amounts disclosed for payments to the Government of Suriname are for the period until January 31, 2023. The sale of the Rosebel mine was completed on January 31, 2023. Amounts disclosed for payments to the Government of Senegal are for the period until April 25, 2023. The sale of the Boto Gold project was completed on April 25, 2023. |

| | | | | | | | | | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe three character ISO 4217 code for the currency used for reporting purposes. Example: 'USD'.

| Name: |

dei_EntityReportingCurrencyISOCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:currencyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

Payments, by Category - USD ($)

$ in Thousands |

Taxes |

Royalties |

Fees |

Dividends |

Total Payments |

| Total |

[1] |

$ 136,290

|

$ 51,150

|

$ 41,860

|

$ 11,680

|

$ 240,980

|

|

|

v3.24.2.u1

Payments, by Project - 12 months ended Dec. 31, 2023 - USD ($)

$ in Thousands |

Taxes |

Royalties |

Fees |

Dividends |

Total Payments |

| Total |

[1] |

$ 136,290

|

$ 51,150

|

$ 41,860

|

$ 11,680

|

$ 240,980

|

| Essakane [Member] |

|

|

|

|

|

|

| Total |

[2],[3] |

120,250

|

43,570

|

13,910

|

$ 11,680

|

189,410

|

| Cote Gold [Member] |

|

|

|

|

|

|

| Total |

[2],[4] |

|

|

26,660

|

|

26,660

|

| Rosebel [Member] |

|

|

|

|

|

|

| Total |

[2],[5] |

|

$ 7,580

|

|

|

7,580

|

| Euro Ressources [Member] |

|

|

|

|

|

|

| Total |

[2],[6] |

6,160

|

|

|

|

6,160

|

| Westwood [Member] |

|

|

|

|

|

|

| Total |

[2],[7] |

4,000

|

|

850

|

|

4,850

|

| Boto [Member] |

|

|

|

|

|

|

| Total |

[2],[8] |

4,100

|

|

190

|

|

4,290

|

| IAMGOLD France [Member] |

|

|

|

|

|

|

| Total |

[2],[6] |

1,600

|

|

|

|

1,600

|

| Karita [Member] |

|

|

|

|

|

|

| Total |

[2],[9] |

|

|

$ 170

|

|

170

|

| IMG Corp [Member] |

|

|

|

|

|

|

| Total |

[2],[10] |

$ 160

|

|

|

|

$ 160

|

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=iag_EssakaneMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=iag_CoteGoldMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=iag_RosebelMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=iag_EuroRessourcesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=iag_WestwoodMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=iag_BotoMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=iag_IAMGOLDFranceMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=iag_KaritaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_ProjectAxis=iag_IMGCorpMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.2.u1

Payments, by Government - 12 months ended Dec. 31, 2023 - USD ($)

$ in Thousands |

Taxes |

Royalties |

Fees |

Dividends |

Total Payments |

| Total |

[1] |

$ 136,290

|

$ 51,150

|

$ 41,860

|

$ 11,680

|

$ 240,980

|

| BURKINA FASO | National Government of Burkina Faso [Member] |

|

|

|

|

|

|

| Total |

[2],[3] |

119,660

|

43,570

|

13,990

|

$ 11,680

|

188,900

|

| BURKINA FASO | Municipal Government of Dori [Member] |

|

|

|

|

|

|

| Total |

[2],[4] |

600

|

|

|

|

600

|

| CANADA | Mattagami First Nation [Member] |

|

|

|

|

|

|

| Total |

[2],[5] |

|

|

19,550

|

|

19,550

|

| CANADA | Flying Post First Nation [Member] |

|

|

|

|

|

|

| Total |

[2],[5] |

|

|

6,980

|

|

6,980

|

| CANADA | Provincial Government of Quebec [Member] |

|

|

|

|

|

|

| Total |

[2],[6] |

3,630

|

|

880

|

|

4,510

|

| CANADA | Municipal Government of Preissac [Member] |

|

|

|

|

|

|

| Total |

[2],[6] |

370

|

|

|

|

370

|

| CANADA | National Government of Canada [Member] |

|

|

|

|

|

|

| Total |

[2],[6] |

160

|

|

|

|

160

|

| CANADA | Metis Nation of Ontario [Member] |

|

|

|

|

|

|

| Total |

[2],[6] |

|

|

80

|

|

80

|

| FRANCE | National Government of France [Member] |

|

|

|

|

|

|

| Total |

[2],[7] |

7,770

|

|

|

|

7,770

|

| SURINAME | National Government of Suriname [Member] |

|

|

|

|

|

|

| Total |

[2],[8] |

|

$ 7,580

|

|

|

7,580

|

| SENEGAL | National Government of Senegal [Member] |

|

|

|

|

|

|

| Total |

[2],[4] |

$ 4,100

|

|

130

|

|

4,230

|

| GUINEA | National Government of Guinea [Member] |

|

|

|

|

|

|

| Total |

[2],[9] |

|

|

170

|

|

170

|

| PERU | National Government of Peru [Member] |

|

|

|

|

|

|

| Total |

[2],[10] |

|

|

$ 80

|

|

$ 80

|

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_BF |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_NationalGovernmentOfBurkinaFasoMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_MunicipalGovernmentOfDoriMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_CA |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_MattagamiFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_FlyingPostFirstNationMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_ProvincialGovernmentOfQuebecMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_MunicipalGovernmentOfPreissacMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_NationalGovernmentOfCanadaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_MetisNationOfOntarioMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_FR |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_NationalGovernmentOfFranceMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_SR |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_NationalGovernmentOfSurinameMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_SN |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_NationalGovernmentOfSenegalMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_GN |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_NationalGovernmentOfGuineaMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_PE |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=iag_NationalGovernmentOfPeruMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

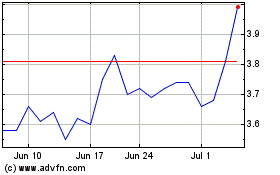

Iamgold (NYSE:IAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Iamgold (NYSE:IAG)

Historical Stock Chart

From Dec 2023 to Dec 2024