UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2021

Commission File Number: 001-31528

IAMGOLD Corporation

(Translation of registrant's name into English)

401 Bay Street Suite 3200, PO Box 153

Toronto, Ontario, Canada M5H 2Y4

Tel: (416) 360-4710

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [ x ]

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

IAMGOLD CORPORATION |

| |

(Registrant) |

| |

|

|

| Date: May 31, 2021 |

By: |

/s/ Tim Bradburn |

| |

|

Tim Bradburn |

| |

Title: |

Senior Vice President, General Counsel and Corporate Secretary |

IAMGOLD ANNOUNCES FILING OF EARLY WARNING REPORT IN CONNECTION WITH DUNDEE PRECIOUS METALS' PROPOSED ACQUISITION OF INV METALS

Toronto, Ontario, May 31, 2021 - IAMGOLD Corporation ("IAMGOLD" or the "Company") announces that it has entered into a voting and support agreement (the "Support Agreement") with Dundee Precious Metals Inc. ("DPM") pursuant to which IAMGOLD has agreed, subject to the terms and conditions thereof, to vote all of its common shares (the "Common Shares") of INV Metals Inc. ("INV") in favour of the proposed acquisition of INV by DPM by way of a plan of arrangement (the "Transaction"). Under the terms of the arrangement agreement dated May 31, 2021 (the "Arrangement Agreement"), holders of Common Shares will receive 0.0910 common shares of DPM in exchange for each Common Share. IAMGOLD beneficially owns and has control or direction over 53,331,158 Common Shares, representing approximately 35.5% of the total issued and outstanding Common Shares.

The Support Agreement may be terminated by the mutual agreement in writing of DPM and IAMGOLD. The Support Agreement will also terminate and be of no further force or effect in certain circumstances, including in the event that the Arrangement Agreement is terminated by INV in order to accept a superior proposal.

If the Transaction does not proceed and/or the Support Agreement is terminated, depending on market conditions, general economic and industry conditions, trading prices of INV's securities, INV's business, financial condition and prospects and/or other relevant factors, IAMGOLD may from time to time acquire additional Common Shares, dispose of some or all of its Common Shares or continue to hold Common Shares or other securities of INV.

An early warning report in respect of the Transaction will be filed under INV's profile on SEDAR at www.sedar.com, and may also be obtained by contacting the persons named below. IAMGOLD's head office is located at 401 Bay Street, Suite 3200, PO Box 153, Toronto, Ontario, M5H 2Y4. INV's head office is located at 55 University Avenue, Suite 700, Toronto, Ontario, M5J 2H7.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements. All statements, other than of historical fact, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements are generally identifiable by, but not limited to, the use of the words "may", "will", "should", "continue", "expect", "planned", "budget", "forecast", "schedule", "de-risking", "anticipate", "target", "estimate", "believe", "prospective", "significant", "potential", "significant potential", "substantial", "transformative", "intend", "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results to differ materially from those discussed in the forward-looking statements. Examples of forward-looking statements in this press release include, but are not limited to, the number of DPM common shares that will be issued in exchange for each INV Common Share and the Company's plans and future intentions in the event that the Transaction does not proceed and/or the Support Agreement is terminated. Factors that could cause actual results or events to differ materially from current expectations include, among other things, without limitation, the non-completion of the Transaction, the acceptance by INV of a superior proposal, the failure to meet expected, estimated or planned gold production, or to accurately estimate mineral resources or mineral reserves, differences in the mineral content within the material identified as mineral resources or mineral reserves from that predicted, unexpected increases in all-in sustaining costs or other costs, unexpected increases in capital expenditures, operating expenditures and exploration expenditures, changes in development or mining plans due to changes in logistical, technical or other factors, the possibility that future exploration results will not be consistent with the Company's expectations, changes in world gold markets and other risks disclosed in IAMGOLD's most recent Form 40-F/ Annual Information Form on file with the United States Securities and Exchange Commission at https://www.sec.gov/edgar.shtml and Canadian securities regulatory authorities at www.sedar.com, which are incorporated herein. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as required by applicable law.

About IAMGOLD

IAMGOLD is a mid-tier gold mining company operating in three regions globally: North America, South America and West Africa. Within these regions the Company is developing high potential mining districts that encompass operating mines, construction, development, and exploration projects. The Company's operating mines include Westwood in Canada, Rosebel (including Saramacca) in Suriname and Essakane in Burkina Faso. A solid base of strategic assets is complemented by the Côté Gold construction project in Canada, the Boto Gold development project in Senegal, as well as greenfield and brownfield exploration projects in various countries located in the Americas and West Africa.

IAMGOLD employs approximately 5,000 people. IAMGOLD is committed to maintaining its culture of accountable mining through high standards of Environmental, Social and Governance practices, including its commitment to Zero Harm®, in every aspect of its business. IAMGOLD (www.iamgold.com) is listed on the New York Stock Exchange (NYSE:IAG) and the Toronto Stock Exchange (TSX:IMG) and is one of the companies on the JSI index1.

1 Jantzi Social Index ("JSI"). The JSI is a socially screened market capitalization-weighted common stock index modeled on the S&P/TSX 60. It consists of companies which pass a set of broadly based environmental, social and governance rating criteria.

For further information please contact:

Indi Gopinathan, VP, Investor Relations & Corporate Communications, IAMGOLD Corporation

Tel: (416) 360-4743 Mobile: (416) 388-6883

Philip Rabenok, Senior Analyst, Investor Relations, IAMGOLD Corporation

Tel: (416) 933-5783 Mobile: (647) 967-9942

Toll-free: 1-888-464-9999 info@iamgold.com

Please note:

This entire news release may be accessed via fax, e-mail, IAMGOLD's website at www.iamgold.com and through Newsfile's website at www.newsfilecorp.com. All material information on IAMGOLD can be found at www.sedar.com or at www.sec.gov.

Si vous désirez obtenir la version française de ce communiqué, veuillez consulter le https://www.iamgold.com/French/accueil/default.aspx.

This regulatory filing also includes additional resources:

exhibit99-1.pdf

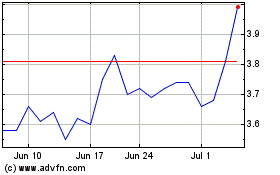

Iamgold (NYSE:IAG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Iamgold (NYSE:IAG)

Historical Stock Chart

From Sep 2023 to Sep 2024