Form 8-K - Current report

January 25 2024 - 4:05PM

Edgar (US Regulatory)

false

0000039368

0000039368

2024-01-22

2024-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2024

H.B. Fuller Company

(Exact Name of Company as Specified in Charter)

|

Minnesota

|

|

001-09225

|

|

41-0268370

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

1200 Willow Lake Boulevard, P.O. Box 64683, St. Paul, Minnesota

|

|

55164-0683

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Company’s telephone number, including area code: (651) 236-5900

| |

(Former name or former address, if changed since last report)

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $1.00

|

FUL

|

NYSE

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e)(1) On January 24, 2024, the Compensation Committee of H.B. Fuller Company (the “Company”) approved changes to the design of the H.B. Fuller Company Management Short-Term Incentive Plan (the “STIP”) applicable to certain executive officers as attached to this Current Report on Form 8-K as Exhibit 10.1. The changes made include:

| |

(i)

|

Adding EBITDA margin as a metric at a weighting of 25%;

|

| |

(ii)

|

Reducing the weighting of the EBITDA and net revenue metrics from 35% to 25% and the weighting of the Earnings Per Share (“EPS”) metric from 30% to 25%; and

|

| |

(iii)

|

Implementing metric weighting of 35% for EPS, 25% for International Growth Markets EBITDA margin, 20% for International Growth Markets EBITDA, and 20% for International Growth Markets net revenue for the Company’s SVP, International Growth.

|

The changes to the STIP will be effective for any short-term incentive awards related to the Company’s 2024 fiscal year (or portion thereof, as applicable) and thereafter. The STIP provides an annual performance-based cash incentive opportunity for eligible employees. In general, the STIP design is based on financial metrics. The metrics will vary based on position and will generally include (i) EBITDA, (ii) EBITDA margin, (iii) net revenue and (iv) earnings per share. Each metric will have a target level of performance. Threshold and superior levels will be set for each metric. Payout will be determined for each metric based on performance relative to target. The target, threshold and superior levels of performance will be established near the beginning of each fiscal year. The foregoing description is qualified in its entirety by reference to the STIP, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

(e)(2) On January 22, 2024, the Compensation Committee of the Company approved the following increase in compensation for Celeste B. Mastin, President and Chief Executive Officer of the Company after review of market information and in recognition of her performance:

| |

•

|

Annual Base Salary effective February 1, 2024: $1,000,000, an increase of approximately 5%.

|

| |

|

|

| |

•

|

Effective January 26, 2024, the target value of Ms. Mastin’s stock-based awards under the Company’s Long-Term Incentive Plan (the “LTIP”) was increased from 375% of her base salary to 550% of her base salary.

|

| |

|

|

| |

•

|

Ms. Mastin’s incentive opportunity under the STIP increased to a target incentive opportunity of 125% (from 120% in fiscal year 2023) of her base salary with a maximum incentive opportunity of up to 250% of her base salary under the STIP for the Company’s 2024 fiscal year.

|

Item 9.01. Financial Statements and Exhibits.

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 25, 2024

|

|

H.B. FULLER COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Gregory O. Ogunsanya

|

|

|

|

|

Gregory O. Ogunsanya

|

|

|

|

|

Senior Vice President, General Counsel

and Corporate Secretary

|

|

Exhibit 10.1

|

|

Management Short-Term Incentive –

Executive Officers

(STI) Plan

|

| |

|

|

Purpose

|

The STI plan provides an annual performance-based cash bonus opportunity for eligible employees. This is intended to achieve a number of goals including:

|

| |

● |

Emphasizing the Company’s commitment to competitive compensation practices; |

| |

|

|

| |

● |

Driving a high performance culture; |

| |

|

|

| |

● |

Assuring accountability; |

| |

|

|

| |

● |

Focusing on results, not activity; and |

| |

|

|

| |

● |

Reinforcing the importance of measurable and aligned goals and objectives. |

| |

|

|

Eligibility

|

These guidelines apply to Executive Officers.

To receive payment under the STI Plan, the participant must be actively employed as of November 30.

|

|

Plan Design

|

The plan design is based on the following financial metrics.

|

| |

● |

EBITDA Dollars |

| |

● |

EBITDA Margin |

| |

● |

Net Revenue |

| |

● |

Earnings Per Share |

| |

|

|

| |

Each participant’s plan design will be based on the participant’s position. Details of the design are as follows: |

| |

|

|

| |

● |

Corporate/Global |

Weighting Per Metric

| EPS |

HBF Net

Revenue

|

HBF

EBITDA

Margin

|

HBF

EBITDA

Dollars

|

| 25% |

25% |

25% |

25% |

Weighting Per Metric

| EPS |

Operating

Segment

Net Revenue

|

Operating

Segment

EBITDA

Margin

|

Operating

Segment

EBITDA

Dollars

|

| 25% |

25% |

25% |

25% |

|

|

Management Short-Term Incentive –

Executive Officers

(STI) Plan

|

| |

|

| |

● |

SVP, International Growth Markets (IGM) |

Weighting Per Metric

| EPS |

IGM Net

Revenue

|

IGM

EBITDA

Margin

|

IGM

EBITDA

Dollars

|

| 35% |

20% |

25% |

20% |

| |

Target

|

| |

● |

Each metric will have a target level of performance. Payout will be determined for each metric based on performance relative to target. The target levels of performance will be established at the beginning of each fiscal year. |

| |

|

| |

Threshold |

| |

● |

Threshold performance levels will be established for each metric as follows: |

| |

|

o |

Net Revenue, EBITDA margin: 85% of target |

| |

|

o |

EBITDA dollars, EPS: 80% of target |

| |

|

|

| |

● |

Payout for net revenue and EBITDA margin will be 25% of the target allocated to that metric. Payout at the threshold level of performance for EBITDA dollars and EPS will be 50% of the target allocated to that metric. |

| |

|

| |

Superior |

| |

● |

Superior performance levels will be established for each metric as follows: |

| |

|

o |

Net Revenue, EBITDA margin: 110% of target |

| |

|

o |

EBITDA dollars, EPS: 120% of target |

| |

|

| |

● |

Payout at the superior level of performance will be 200% of the target allocated to that metric. |

| |

|

| |

See Appendix for payout schedule. |

| |

|

|

Payment

|

Payment will be made in cash, subject to taxes and deductions as applicable.

Payment will be made as close as possible to January 31 following the conclusion of the relevant Plan Year, but will be made no later than March 15th of the calendar year following the Plan Year.

|

|

Participant

Status Changes

|

If a participant begins employment with the company during the Plan Year, bonus potential will be pro-rated for the time the participant was employed during the Plan Year.

If a participant transfers jobs and changes plan design standards, potential bonus will be pro-rated for the time spent in each job.

|

|

Administration

|

Participants may direct questions about the STI Plan to their local management or human resources representatives.

|

|

|

Management Short-Term Incentive –

Executive Officers

(STI) Plan

|

| |

|

| |

The Compensation Committee of the Board of Directors shall make a certification decision with respect to performance of financial metrics and consider extraordinary circumstances that may have positively or negatively impacted the achievement of the objectives. The STI Plan is a discretionary bonus plan and shall not be construed as a contract. The Board or management in their discretion, reserves the right at any time to enhance, diminish or terminate all or any portion of any compensation plan or program, on a collective or individual basis.

Payments under the STI Plan are subject to the Company’s Executive and Key Manager Compensation Recovery Policy and any other compensation recovery policies the Company may adopt in the future to conform to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (or any other applicable law) and any applicable rules and regulations of the Securities and Exchange Commission or applicable stock exchange.

|

|

Relevant Terms

|

Actively Employed - A full-time or part-time employee on the Company payroll. It excludes any employee who has been terminated from employment with the Company – voluntarily or involuntarily –prior to November 30.

Company - H.B. Fuller Company and its wholly owned subsidiaries.

Eligible Earnings – To be determined by region/country.

Payment - The cash reward payable after conclusion of the Plan Year.

Plan Year – The relevant Company fiscal year.

Short Term Incentive (STI) Plan - The program described herein. May also be referred to as “STIP” or “STI Plan”.

|

|

|

Management Short-Term Incentive –

Executive Officers

(STI) Plan

|

| |

|

|

Appendix

|

|

| |

|

| |

● |

Payout is calculated for each incremental increase in performance (straight line interpolation). |

|

|

Management Short-Term Incentive –

Executive Officers

(STI) Plan

|

| |

|

| Calculation Guidelines |

|

| |

|

| |

Total Company Metrics

Company EPS

The adjusted EPS as disclosed in the Company’s earnings release.

|

| |

|

| |

HBF Net Revenue |

| |

●

|

Net revenue as disclosed in the Company’s earnings release.

|

| |

|

|

| |

● |

Basis of targets is US dollars. Actual results are adjusted to conform with budgeted exchange rates. |

| |

|

|

| |

● |

Unbudgeted acquisitions and divestitures are excluded from the calculation. |

| |

|

|

| |

HBF EBITDA Dollars (Consolidated) |

| |

● |

Adjusted Net Income plus adjusted Income Tax Expense plus Interest Expense, net, plus Depreciation Expense plus Amortization Expense. |

| |

|

|

| |

● |

Basis of targets is US dollars. Actual results are adjusted to conform with budgeted exchange rates |

| |

|

|

| |

● |

Unbudgeted acquisitions and divestitures are excluded from the calculation. |

| |

|

|

| |

HBF EBITDA Margin (Consolidated) |

| |

● |

HBF EBITDA Dollars (Consolidated)/HBF Net Revenue |

| |

|

|

| |

Operating Segment Metrics

Net Revenue

|

| |

● |

Net revenue of the operating segment as disclosed in the Company’s earnings release. |

| |

|

|

| |

● |

Basis of targets is US dollars. Actual results are adjusted to conform with budgeted exchange rates. |

| |

|

|

| |

● |

Unbudgeted acquisitions and divestitures are excluded from the calculation. |

| |

|

|

| |

Segment EBITDA Dollars |

| |

● |

Segment Operating Income plus Depreciation Expense plus Amortization Expense, plus Non-Operating Pension Expense or Income, plus Reported Sekisui Fuller Joint Venture Equity Earnings as reported on the consolidated Company P&L (if applicable), as reported in the Company’s earnings release |

|

|

Management Short-Term Incentive –

Executive Officers

(STI) Plan

|

| |

|

| |

●

|

Basis of targets is US dollars. Actual results are adjusted to conform with budgeted exchange rates.

|

| |

|

|

| |

● |

Unbudgeted acquisitions and divestitures are excluded from the calculation. |

| |

Segment EBITDA Margin |

| |

●

|

Segment EBITDA Dollars/Segment Net Revenue

|

v3.23.4

Document And Entity Information

|

Jan. 22, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

H.B. Fuller Company

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 22, 2024

|

| Entity, Incorporation, State or Country Code |

MN

|

| Entity, File Number |

001-09225

|

| Entity, Tax Identification Number |

41-0268370

|

| Entity, Address, Address Line One |

1200 Willow Lake Boulevard, P.O. Box 64683

|

| Entity, Address, City or Town |

St. Paul

|

| Entity, Address, State or Province |

MN

|

| Entity, Address, Postal Zip Code |

55164-0683

|

| City Area Code |

651

|

| Local Phone Number |

236-5900

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

FUL

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000039368

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

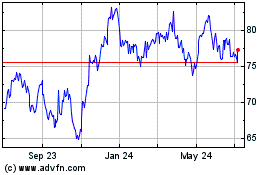

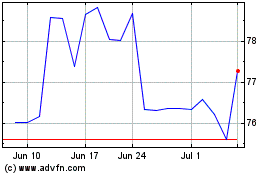

H B Fuller (NYSE:FUL)

Historical Stock Chart

From Apr 2024 to May 2024

H B Fuller (NYSE:FUL)

Historical Stock Chart

From May 2023 to May 2024