In new independent research reports released early this morning,

Capital Review released its latest key findings for all current

investors, traders, and shareholders of Cypress Semiconductor

Corporation (NASDAQ:CY), OUTFRONT Media Inc. (NYSE:OUT), R1 RCM

Inc. (NASDAQ:RCM), Graham Holdings Company (NYSE:GHC), CVS Health

Corporation (NYSE:CVS), and Tandem Diabetes Care, Inc.

(NASDAQ:TNDM), including updated fundamental summaries,

consolidated fiscal reporting, and fully-qualified certified

analyst research.

Complimentary Access: Research Reports

Full copies of recently published reports are available

to readers at the links below.

CY DOWNLOAD: http://Capital-Review.com/register/?so=CY

OUT DOWNLOAD: http://Capital-Review.com/register/?so=OUT RCM

DOWNLOAD: http://Capital-Review.com/register/?so=RCM GHC DOWNLOAD:

http://Capital-Review.com/register/?so=GHC CVS DOWNLOAD:

http://Capital-Review.com/register/?so=CVS TNDM DOWNLOAD:

http://Capital-Review.com/register/?so=TNDM

(You may have to copy and paste the link into your browser and

hit the [ENTER] key)

The new research reports from Capital Review,

available for free download at the links above, examine Cypress

Semiconductor Corporation (NASDAQ:CY), OUTFRONT Media Inc.

(NYSE:OUT), R1 RCM Inc. (NASDAQ:RCM), Graham Holdings Company

(NYSE:GHC), CVS Health Corporation (NYSE:CVS), and Tandem Diabetes

Care, Inc. (NASDAQ:TNDM) on a fundamental level and outlines the

overall demand for their products and services in addition to an

in-depth review of the business strategy, management discussion,

and overall direction going forward. Several excerpts from the

recently released reports are available to today's readers

below.

-----------------------------------------

Important Notice: the following

excerpts are not designed to be standalone summaries and as such,

important information may be missing from these samples. Please

download the entire research report, free of charge, to ensure you

are reading all relevant material information. All information in

this release was accessed February 27th, 2019. Percentage

calculations are performed after rounding. All amounts in millions

(MM), except per share amounts.

-----------------------------------------

CYPRESS SEMICONDUCTOR CORPORATION (CY) REPORT

OVERVIEW

Cypress Semiconductor's Recent Financial

Performance

For the three months ended December 31st, 2018

vs December 31st, 2017, Cypress Semiconductor reported revenue of

$604.47MM vs $597.55MM (up 1.16%) and analysts estimated basic

earnings per share $0.74 vs -$0.10. For the twelve months ended

December 31st, 2018 vs December 31st, 2017, Cypress Semiconductor

reported revenue of $2,483.84MM vs $2,327.77MM (up 6.70%) and

analysts estimated basic earnings per share $0.99 vs -$0.24.

Analysts expect earnings to be released on April 25th, 2019. The

report will be for the fiscal period ending March 31st, 2019. The

reported EPS for the same quarter last year was $0.23. The

estimated EPS forecast for the next fiscal year is $1.04 and is

expected to report on January 30th, 2020.

To read the full Cypress Semiconductor Corporation (CY) report,

download it here:

http://Capital-Review.com/register/?so=CY

-----------------------------------------

OUTFRONT MEDIA INC. (OUT) REPORT OVERVIEW

OUTFRONT Media's Recent Financial

Performance

For the three months ended September 30th, 2018

vs September 30th, 2017, OUTFRONT Media reported revenue of

$414.20MM vs $392.40MM (up 5.56%) and analysts estimated basic

earnings per share $0.33 vs $0.36 (down 8.33%). For the twelve

months ended December 31st, 2017 vs December 31st, 2016, OUTFRONT

Media reported revenue of $1,520.50MM vs $1,513.90MM (up 0.44%) and

analysts estimated basic earnings per share $0.90 vs $0.66 (up

36.36%). Analysts expect earnings to be released on May 1st, 2019.

The report will be for the fiscal period ending March 31st, 2019.

Reported EPS for the same quarter last year was $0.27. The

estimated EPS forecast for the next fiscal year is $2.31 and is

expected to report on February 25th, 2020.

To read the full OUTFRONT Media Inc. (OUT) report, download it

here:

http://Capital-Review.com/register/?so=OUT

-----------------------------------------

R1 RCM INC. (RCM) REPORT OVERVIEW

R1 RCM's Recent Financial Performance

For the three months ended September 30th, 2018

vs September 30th, 2017, R1 RCM reported revenue of $250.40MM vs

$123.20MM (up 103.25%) and analysts estimated basic earnings per

share -$0.17 vs -$0.08. For the twelve months ended December 31st,

2017 vs December 31st, 2016, R1 RCM reported revenue of $449.80MM

vs $592.60MM (down 24.10%) and analysts estimated basic earnings

per share -$0.75 vs $0.65. Analysts expect earnings to be released

on May 8th, 2019. The report will be for the fiscal period ending

March 31st, 2019. Reported EPS for the same quarter last year was

-$0.14. The estimated EPS forecast for the next fiscal year is

$0.34 and is expected to report on February 28th, 2020.

To read the full R1 RCM Inc. (RCM) report, download it here:

http://Capital-Review.com/register/?so=RCM

-----------------------------------------

GRAHAM HOLDINGS COMPANY (GHC) REPORT

OVERVIEW

Graham's Recent Financial Performance

For the three months ended September 30th, 2018

vs September 30th, 2017, Graham reported revenue of $674.77MM vs

$657.23MM (up 2.67%) and basic earnings per share $23.43 vs $4.45

(up 426.52%). For the twelve months ended December 31st, 2017 vs

December 31st, 2016, Graham reported revenue of $2,591.85MM vs

$2,481.89MM (up 4.43%) and analysts estimated basic earnings per

share $54.24 vs $29.95 (up 81.10%). Analysts expect earnings to be

released on May 1st, 2019. The report will be for the fiscal period

ending March 31st, 2019.

To read the full Graham Holdings Company (GHC) report, download

it here:

http://Capital-Review.com/register/?so=GHC

-----------------------------------------

CVS HEALTH CORPORATION (CVS) REPORT

OVERVIEW

CVS Health's Recent Financial Performance

For the three months ended December 31st, 2018

vs December 31st, 2017, CVS Health reported revenue of $54,424.00MM

vs $48,385.00MM (up 12.48%) and analysts estimated basic earnings

per share -$0.37 vs $3.22. For the twelve months ended December

31st, 2018 vs December 31st, 2017, CVS Health reported revenue of

$194,579.00MM vs $184,765.00MM (up 5.31%) and analysts estimated

basic earnings per share -$0.57 vs $6.47. Analysts expect earnings

to be released on May 1st, 2019. The report will be for the fiscal

period ending March 31st, 2019. The reported EPS for the same

quarter last year was $1.48. The estimated EPS forecast for the

next fiscal year is $7.70 and is expected to report on February

19th, 2020.

To read the full CVS Health Corporation (CVS) report, download

it here:

http://Capital-Review.com/register/?so=CVS

-----------------------------------------

TANDEM DIABETES CARE, INC. (TNDM) REPORT

OVERVIEW

Tandem Diabetes Care's Recent Financial

Performance

For the three months ended September 30th, 2018

vs September 30th, 2017, Tandem Diabetes Care reported revenue of

$46.26MM vs $27.00MM (up 71.33%) and analysts estimated basic

earnings per share -$0.62 vs -$3.09. For the twelve months ended

December 31st, 2017 vs December 31st, 2016, Tandem Diabetes Care

reported revenue of $107.60MM vs $84.25MM (up 27.72%) and analysts

estimated basic earnings per share -$12.87 vs -$27.30. Analysts

expect earnings to be released on April 25th, 2019. The report will

be for the fiscal period ending March 31st, 2019. The reported EPS

for the same quarter last year was -$1.03. The estimated EPS

forecast for the next fiscal year is -$0.48 and is expected to

report on February 25th, 2020.

To read the full Tandem Diabetes Care, Inc. (TNDM) report,

download it here:

http://Capital-Review.com/register/?so=TNDM

-----------------------------------------

ABOUT CAPITAL REVIEW

Capital Review is a nationally recognized

publisher of financial analysis, research reports, and exclusive

market reporting. Institutional investors, registered brokers,

professional traders, and personal investment advisers rely on

Capital Review to quantify public company valuations, discover

opportunity across asset classes, stay informed about market-moving

events, and read exclusive analysis of important material

developments. With 14 offices worldwide, Capital Review staffs and

manages certified and registered financial professionals, including

Chartered Financial Analyst® (CFA®) designation holders and FINRA®

BrokerCheck® certified individuals with current and valid CRD®

number designations, to enable continuous coverage of topics

relevant to its regular active reader base.

REGISTERED MEMBER STATUS

Capital Review's oversight and audit staff are

registered analysts, brokers, and/or financial advisers

("Registered Members") working within Equity Research, Media, and

Compliance departments. Capital Review's roster includes qualified

CFA® charterholders, licensed securities attorneys, and registered

FINRA® members holding duly issued CRD® numbers. Current licensed

status of several Registered Members at Capital Review have been

independently verified by an outside audit firm, including policy

and audit records duly executed by Registered Members. Complaints,

concerns, questions, or inquiries regarding this release should be

directed to Capital Review's Compliance department by Phone, at +1

(410) 280-7496, or by E-mail at compliance@Capital-Review.com.

LEGAL NOTICES

Information contained herein is not an offer or

solicitation to buy, hold, or sell any security. Capital Review,

Capital Review members, and/or Capital Review affiliates are not

responsible for any gains or losses that result from the opinions

expressed. Capital Review makes no representations as to the

completeness, accuracy, or timeliness of the material provided and

all materials are subject to change without notice. Capital Review

has not been compensated for the publication of this press release

by any of the above mentioned companies. Capital Review is not a

financial advisory firm, investment adviser, or broker-dealer, and

does not undertake any activities that would require such

registration. For our full disclaimer, disclosure, and terms of

service please visit our website.

Media Contact: Nicole Garrens, Media Department

Office: +1 (410) 280-7496 E-mail: media@Capital-Review.com

© 2019 Capital Review. All Rights Reserved. For

republishing permissions, please contact a partner network manager

at partnership@Capital-Review.com.

CFA® and Chartered Financial Analyst® are registered

trademarks owned by CFA Institute.

FINRA®, BrokerCheck®, and CRD® are registered trademarks

owned by Financial Industry Regulatory Authority, Inc.

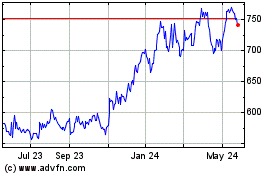

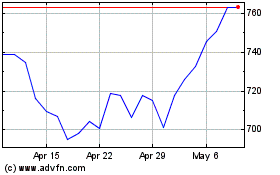

Graham (NYSE:GHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Graham (NYSE:GHC)

Historical Stock Chart

From Apr 2023 to Apr 2024