- 1Q19 Net Income Attributable to GEO

of $0.34 per diluted share

- 1Q19 Adjusted Net Income of $0.35

per diluted share

- 1Q19 AFFO of $0.67 per diluted

share

- Updated FY19 guidance for Net Income

Attributable to GEO of $1.42-$1.48 per diluted share and Adjusted

Net Income of $1.44 to $1.50 per diluted share

- Updated FY19 AFFO guidance of

$2.64-$2.70 per diluted share

The GEO Group, Inc. (NYSE: GEO) (“GEO”), a fully

integrated equity real estate investment trust (“REIT”) and a

leading provider of evidence-based offender rehabilitation and

community reentry services around the globe, reported today its

financial results for the first quarter of 2019.

First Quarter 2019 Highlights

- Net Income Attributable to GEO of

$40.7 million or $0.34 per diluted share

- Adjusted Net Income of $0.35 per

diluted share

- Net Operating Income of $161.8

million

- Normalized FFO of $0.50 per diluted

share

- AFFO of $0.67 per diluted

share

GEO reported first quarter 2019 net income attributable to GEO

of $40.7 million, or $0.34 per diluted share, compared to $35.0

million, or $0.29 per diluted share, for the first quarter 2018.

GEO reported total revenues for the first quarter 2019 of $610.7

million up from $564.9 million for the first quarter 2018. First

quarter 2019 results reflect a $1.5 million loss on real estate

assets. Excluding this loss, GEO reported first quarter 2019

Adjusted Net Income of $42.2 million, or $0.35 per diluted

share.

GEO reported first quarter 2019 Normalized Funds From Operations

(“Normalized FFO”) of $60.3 million, or $0.50 per diluted share,

compared to $52.6 million, or $0.43 per diluted share, in the first

quarter 2018. GEO reported first quarter 2019 Adjusted Funds From

Operations (“AFFO”) of $80.3 million, or $0.67 per diluted share,

compared to $69.8 million, or $0.57 per diluted share, in the first

quarter 2018.

George C. Zoley, Chairman and Chief Executive

Officer of GEO, said, “We are pleased with our strong quarterly

financial and operational performance, as well as, our improved

outlook for the balance of the year. We have taken important steps

to reactivate our idle capacity, and we are proud of the continued

success of our GEO Continuum of Care enhanced rehabilitation and

post-release programs. We remain focused on effectively allocating

capital to enhance long-term value for our shareholders, and we

believe we will continue to have access to cost-effective capital

to support the growth and expansion of our high-quality

services.”

Quarterly Dividend

On April 3, 2019, GEO’s Board of Directors declared a quarterly

cash dividend of $0.48 per share. The quarterly cash dividend was

paid on April 22, 2019 to shareholders of record as of the close of

business on April 15, 2019. The declaration of future quarterly

cash dividends is subject to approval by GEO’s Board of Directors

and to meeting the requirements of all applicable laws and

regulations. GEO’s Board of Directors retains the power to modify

its dividend policy as it may deem necessary or appropriate in the

future.

Stock Repurchase Program

GEO did not repurchase any shares of its common stock during the

first quarter of 2019 and currently has approximately $105 million

in available authorization under the $200 million stock repurchase

program approved by GEO’s Board of Directors, which is effective

through October 20, 2020.

The stock repurchase program is intended to be implemented

through purchases made from time to time in the open market or in

privately negotiated transactions, in accordance with applicable

Securities and Exchange Commission requirements. The stock

repurchase program does not obligate GEO to purchase any specific

amount of its common stock and may be suspended or extended at any

time at the discretion of GEO’s Board of Directors.

2019 Financial Guidance

GEO updated its initial financial guidance for the full-year and

issued financial guidance for the second quarter 2019.

GEO expects full-year 2019 total revenue to be approximately

$2.47 billion. GEO expects full-year 2019 Net Income Attributable

to GEO to be in a range of $1.42-$1.48 per diluted share and

Adjusted Net Income to be in a range of $1.44-$1.50 per diluted

share.

GEO expects full-year 2019 AFFO to be in a range of $2.64-$2.70

per diluted share and Adjusted EBITDAre to be in a range of $482.5

million to $489.5 million.

GEO’s updated full-year 2019 guidance reflects the recently

announced reactivation of GEO’s 1,000-bed South Louisiana ICE

Processing Center during the third quarter of 2019. Full-year 2019

guidance does not assume the reactivation of GEO’s approximately

4,000 remaining idle beds or any additional share repurchases under

GEO’s share repurchase program.

For the second quarter 2019, GEO expects total revenues to be in

a range of $607 million to $612 million. GEO expects second quarter

2019 Net Income Attributable to GEO to be in a range of $0.35 to

$0.37 per diluted share and Adjusted Net Income to be in a range of

$0.36 to $0.38 per diluted share. GEO expects second quarter 2019

AFFO to be in a range of $0.65 to $0.67 per diluted share.

Reconciliation Tables and Supplemental Information

GEO has made available Supplemental Information which contains

reconciliation tables of Net Income Attributable to GEO to Net

Operating Income, Net Income to EBITDAre (EBITDA for real estate)

and Adjusted EBITDAre (Adjusted EBITDA for real estate), and Net

Income Attributable to GEO to FFO, Normalized FFO and AFFO, along

with supplemental financial and operational information on GEO’s

business and other important operating metrics, and in this press

release, Net Income Attributable to GEO to Adjusted Net Income. The

reconciliation tables are also presented herein. Please see the

section below titled “Note to Reconciliation Tables and

Supplemental Disclosure - Important Information on GEO’s Non-GAAP

Financial Measures” for information on how GEO defines these

supplemental Non-GAAP financial measures and reconciles them to the

most directly comparable GAAP measures. GEO’s Reconciliation Tables

can be found herein and in GEO’s Supplemental Information available

on GEO’s investor webpage at investors.geogroup.com.

Conference Call Information

GEO has scheduled a conference call and simultaneous webcast for

today at 11:00 AM (Eastern Time) to discuss GEO’s first quarter

2019 financial results as well as its outlook. The call-in number

for the U.S. is 1-877-250-1553 and the international call-in number

is 1-412-542-4145. In addition, a live audio webcast of the

conference call may be accessed on the Events and Webcasts section

under the News, Events and Reports tab of GEO’s investor relations

webpage at investors.geogroup.com. A replay of the webcast will be

available on the website for one year. A telephonic replay of the

conference call will be available until May 14, 2019 at

1-877-344-7529 (U.S.) and 1-412-317-0088 (International). The

participant passcode for the telephonic replay is 10130411.

About The GEO Group

The GEO Group, Inc. (NYSE: GEO) is the first fully integrated

equity real estate investment trust specializing in the design,

financing, development, and operation of correctional, detention,

and community reentry facilities around the globe. GEO is the

world's leading provider of diversified correctional, detention,

community reentry, and electronic monitoring services to government

agencies worldwide with operations in the United States, Australia,

South Africa, and the United Kingdom. GEO's worldwide operations

include the ownership and/or management of 134 facilities totaling

approximately 95,000 beds, including projects under development,

with a growing workforce of approximately 23,000 professionals.

Note to Reconciliation Tables and Supplemental Disclosure

–Important Information on GEO’s Non-GAAP Financial

Measures

Net Operating Income, EBITDAre, Adjusted EBITDAre, Funds from

Operations, Normalized Funds from Operations, Adjusted Funds from

Operations, and Adjusted Net Income are non-GAAP financial measures

that are presented as supplemental disclosures. GEO has presented

herein certain forward-looking statements about GEO's future

financial performance that include non-GAAP financial measures,

including Adjusted Net Income, FFO, Normalized FFO, and AFFO. The

determination of the amounts that are excluded from these non-GAAP

financial measures is a matter of management judgment and depends

upon, among other factors, the nature of the underlying expense or

income amounts recognized in a given period. While we have provided

a high level reconciliation for the guidance ranges for full year

2019, we are unable to present a more detailed quantitative

reconciliation of the forward-looking non-GAAP financial measures

to their most directly comparable forward-looking GAAP financial

measures because management cannot reliably predict all of the

necessary components of such GAAP measures. The quantitative

reconciliation of the forward-looking non-GAAP financial measures

will be provided for completed annual and quarterly periods, as

applicable, calculated in a consistent manner with the quantitative

reconciliation of non-GAAP financial measures previously reported

for completed annual and quarterly periods.

Net Operating Income is defined as revenues less operating

expenses, excluding depreciation and amortization expense, general

and administrative expenses, real estate related operating lease

expense, and start-up expenses, pre-tax. Net Operating Income is

calculated as net income adjusted by subtracting equity in earnings

of affiliates, net of income tax provision, and by adding income

tax (benefit) provision, interest expense, net of interest income,

depreciation and amortization expense, general and administrative

expenses, real estate related operating lease expense, and

gain/loss on real estate assets, pre-tax.

EBITDAre (EBITDA for real estate) is defined as net income

adjusted by adding provisions for income tax, interest expense, net

of interest income, depreciation and amortization, and gain/loss on

real estate assets, pre-tax. Adjusted EBITDAre (Adjusted EBITDA for

real estate) is defined as EBITDAre adjusted for net loss

attributable to non-controlling interests, stock-based compensation

expenses, pre-tax, and certain other adjustments as defined from

time to time. Given the nature of our business as a real estate

owner and operator, we believe that EBITDAre and Adjusted EBITDAre

are helpful to investors as measures of our operational performance

because they provide an indication of our ability to incur and

service debt, to satisfy general operating expenses, to make

capital expenditures and to fund other cash needs or reinvest cash

into our business. We believe that by removing the impact of our

asset base (primarily depreciation and amortization) and excluding

certain non-cash charges, amounts spent on interest and taxes, and

certain other charges that are highly variable from year to year,

EBITDAre and Adjusted EBITDAre provide our investors with

performance measures that reflect the impact to operations from

trends in occupancy rates, per diem rates and operating costs,

providing a perspective not immediately apparent from net income

attributable to GEO.

The adjustments we make to derive the non-GAAP measures of

EBITDAre and Adjusted EBITDAre exclude items which may cause

short-term fluctuations in income from continuing operations and

which we do not consider to be the fundamental attributes or

primary drivers of our business plan and they do not affect our

overall long-term operating performance. EBITDAre and Adjusted

EBITDAre provide disclosure on the same basis as that used by our

management and provide consistency in our financial reporting,

facilitate internal and external comparisons of our historical

operating performance and our business units and provide continuity

to investors for comparability purposes.

Funds From Operations, or FFO, is defined in accordance with

standards established by the National Association of Real Estate

Investment Trusts, or NAREIT, which defines FFO as net income/loss

attributable to common shareholders (computed in accordance with

United States Generally Accepted Accounting Principles), excluding

real estate related depreciation and amortization, excluding gains

and losses from the cumulative effects of accounting changes,

extraordinary items and sales of properties, and including

adjustments for unconsolidated partnerships and joint ventures.

Normalized Funds from Operations, or Normalized FFO, is defined as

FFO adjusted for certain items which by their nature are not

comparable from period to period or that tend to obscure GEO’s

actual operating performance, including for the periods presented

net Tax Cuts and Jobs Act (“TCJA”) impact and tax effect of

adjustments to FFO.

Adjusted Funds From Operations, or AFFO, is defined as

Normalized FFO adjusted by adding non-cash expenses such as

non-real estate related depreciation and amortization, stock based

compensation expense, the amortization of debt issuance costs,

discount and/or premium and other non-cash interest, and by

subtracting recurring consolidated maintenance capital

expenditures.

Adjusted Net Income is defined as Net Income Attributable to GEO

adjusted for certain items which by their nature are not comparable

from period to period or that tend to obscure GEO’s actual

operating performance, including for the periods presented net TCJA

impact, gain/loss on real estate assets, pre-tax, and tax effect of

adjustments to Net Income Attributable to GEO.

Because of the unique design, structure and use of our

correctional facilities, we believe that assessing the performance

of our correctional facilities without the impact of depreciation

or amortization is useful and meaningful to investors. Although

NAREIT has published its definition of FFO, companies often modify

this definition as they seek to provide financial measures that

meaningfully reflect their distinctive operations. We have modified

FFO to derive Normalized FFO and AFFO that meaningfully reflect our

operations.

Our assessment of our operations is focused on long-term

sustainability. The adjustments we make to derive the non-GAAP

measures of Normalized FFO and AFFO exclude items which may cause

short-term fluctuations in net income attributable to GEO but have

no impact on our cash flows, or we do not consider them to be

fundamental attributes or the primary drivers of our business plan

and they do not affect our overall long-term operating performance.

We may make adjustments to FFO from time to time for certain other

income and expenses that do not reflect a necessary component of

our operational performance on the basis discussed above, even

though such items may require cash settlement. Because FFO,

Normalized FFO and AFFO exclude depreciation and amortization

unique to real estate as well as non-operational items and certain

other charges that are highly variable from year to year, they

provide our investors with performance measures that reflect the

impact to operations from trends in occupancy rates, per diem

rates, operating costs and interest costs, providing a perspective

not immediately apparent from Net Income Attributable to GEO.

We believe the presentation of FFO, Normalized FFO and AFFO

provide useful information to investors as they provide an

indication of our ability to fund capital expenditures and expand

our business. FFO, Normalized FFO and AFFO provide disclosure on

the same basis as that used by our management and provide

consistency in our financial reporting, facilitate internal and

external comparisons of our historical operating performance and

our business units and provide continuity to investors for

comparability purposes. Additionally, FFO, Normalized FFO and AFFO

are widely recognized measures in our industry as a real estate

investment trust.

Safe-Harbor Statement

This press release contains forward-looking statements regarding

future events and future performance of GEO that involve risks and

uncertainties that could materially affect actual results,

including statements regarding financial guidance for the full year

and second quarter 2019, the assumptions underlying such guidance,

the continued expansion and success of our GEO Continuum of Care,

and statements regarding growth opportunities and allocation of

capital to enhance long-term value for our shareholders. Factors

that could cause actual results to vary from current expectations

and forward-looking statements contained in this press release

include, but are not limited to: (1) GEO’s ability to meet its

financial guidance for 2019 given the various risks to which its

business is exposed; (2) GEO’s ability to implement its stock

repurchase program and the timing and amounts of any future stock

repurchases; (3) GEO’s ability to declare future quarterly cash

dividends and the timing and amount of such future cash dividends;

(4) GEO’s ability to successfully pursue further growth and

continue to create shareholder value; (5) risks associated with

GEO’s ability to control operating costs associated with contract

start-ups; (6) GEO’s ability to timely open facilities as planned,

profitably manage such facilities and successfully integrate such

facilities into GEO’s operations without substantial costs; (7)

GEO’s ability to win management contracts for which it has

submitted proposals and to retain existing management contracts;

(8) GEO’s ability to obtain future financing on acceptable terms;

(9) GEO’s ability to sustain company-wide occupancy rates at its

facilities; (10) GEO’s ability to access the capital markets in the

future on satisfactory terms or at all; (11) the impact of any

future regulations or guidance on the Tax Cuts and Jobs Act; (12)

GEO’s ability to remain qualified as a REIT; (13) the incurrence of

REIT related expenses; and (14) other factors contained in GEO’s

Securities and Exchange Commission periodic filings, including its

Form 10-K, 10-Q and 8-K reports.

First quarter 2019 financial tables to follow:

Condensed

Consolidated Balance Sheets*

(Unaudited)

As of As of March 31, 2019 December

31, 2018 (unaudited) (unaudited)

ASSETS Cash and

cash equivalents $ 67,728 $ 31,255 Restricted cash and cash

equivalents 53,749 51,678 Accounts receivable, less allowance for

doubtful accounts 423,596 445,526 Contract receivable, current

portion 16,005 15,535 Prepaid expenses and other current assets

43,535 57,768

Total current assets $

604,613 $

601,762 Restricted Cash and Investments 27,282

22,431

Property and Equipment, Net 2,150,627 2,158,610

Contract Receivable 368,698 368,178

Operating Lease

Right-of-Use Assets, Net 133,365 -

Assets Held for Sale

4,607 2,634

Deferred Income Tax Assets 29,924 29,924

Intangible Assets, Net (including goodwill) 1,003,143

1,008,719

Other Non-Current Assets 61,807 65,860

Total Assets $ 4,384,066 $

4,258,118 LIABILITIES AND SHAREHOLDERS' EQUITY

Accounts payable $ 93,458 $ 93,032 Accrued payroll and

related taxes 58,079 76,009 Accrued expenses and other current

liabilities 189,174 204,170 Operating lease liabilities, current

portion 35,210 - Current portion of finance lease obligations,

long-term debt, and non-recourse debt 332,864 332,027

Total

current liabilities $

708,785 $ 705,238

Deferred Income Tax Liabilities 13,681 13,681

Other Non-Current Liabilities 79,734 82,481

Operating

Lease Liabilities 102,238 -

Finance Lease Liabilities

4,179 4,570

Long-Term Debt 2,433,433 2,397,227

Non-Recourse Debt 15,112 15,017

Total Shareholders'

Equity 1,026,904 1,039,904

Total Liabilities

and Shareholders' Equity $ 4,384,066 $

4,258,118 * all figures in '000s

Condensed

Consolidated Statements of Operations*

(Unaudited)

Q1 2019 Q1 2018 (unaudited) (unaudited)

Revenues $ 610,667 $ 564,917

Operating

expenses 456,997 426,709

Depreciation and amortization

32,469 31,926

General and administrative expenses 46,424

41,832

Operating income 74,777

64,450 Interest income 8,396 9,099

Interest

expense (40,280 ) (35,869 )

Income before income

taxes and equity in earnings of affiliates 42,893

37,680 Provision for income taxes 4,840 4,755

Equity in earnings of affiliates, net of income tax

provision 2,596 1,995

Net income

40,649 34,920 Less: Net loss attributable

to noncontrolling interests 56 67

Net income

attributable to The GEO Group, Inc. $

40,705 $

34,987 Weighted Average Common

Shares Outstanding: Basic 118,774 121,768 Diluted 119,496

122,304

Net income per Common Share Attributable to The

GEO Group, Inc. : Basic: Net income per share —

basic $

0.34 $

0.29

Diluted: Net income per share — diluted $

0.34

$

0.29 Regular Dividends Declared per Common

Share $

0.48 $

0.47 * all

figures in '000s, except per share data

Reconciliation of

Net Income Attributable to GEO to Adjusted Net

Income

(In thousands, except per share

data)(Unaudited)

Q1 2019 Q1 2018 Net

Income attributable to GEO $ 40,705 $ 34,987 Add: Net

Tax Cuts and Jobs Act Impact - 304 Gain/Loss on real estate assets,

pre-tax 1,497 (98 ) Tax effect of adjustments to Net Income

attributable to GEO (45 ) -

Adjusted

Net Income $ 42,157 $ 35,193

Weighted average common shares outstanding - Diluted

119,496 122,304

Adjusted Net Income Per Diluted Share

$ 0.35 $ 0.29

Reconciliation of

Net Income Attributable to GEO to FFO, Normalized FFO, and

AFFO*

(Unaudited)

Q1 2019 Q1 2018 (unaudited) (unaudited)

Net Income attributable to GEO $ 40,705 $ 34,987 Add

(Subtract): Real Estate Related Depreciation and Amortization

18,103 17,388 Gain/Loss on real estate assets 1,497 (98)

Equals: NAREIT defined FFO $

60,305 $

52,277 Add (Subtract): Net Tax Cuts and Jobs

Act Impact - 304 Tax Effect of adjustments to Funds From Operations

** (45) -

Equals: FFO, normalized $

60,260 $

52,581 Add (Subtract): Non-Real

Estate Related Depreciation & Amortization 14,366 14,538

Consolidated Maintenance Capital Expenditures (3,634) (5,323) Stock

Based Compensation Expenses 6,727 5,827 Amortization of debt

issuance costs, discount and/or premium and other non-cash interest

2,563 2,138

Equals: AFFO $

80,282 $

69,761 Weighted average common shares

outstanding - Diluted 119,496 122,304

FFO/AFFO per Share

- Diluted Normalized FFO Per Diluted Share $

0.50 $

0.43 AFFO Per Diluted Share $

0.67 $

0.57 Regular Common Stock

Dividends per common share $

0.48 $

0.47 *

all figures in '000s, except per share data ** tax adjustments

related to Gain/Loss on real estate assets

Reconciliation of

Net Income Attributable to GEO to Net Operating Income, EBITDAre

and Adjusted EBITDAre*

(Unaudited)

Q1 2019 Q1 2018 (unaudited) (unaudited)

Net Income attributable to GEO $ 40,705 $ 34,987 Less Net

loss attributable to noncontrolling interests 56 67

Net

Income $ 40,649 $ 34,920 Add

(Subtract): Equity in earnings of affiliates, net of income tax

provision (2,596) (1,995) Income tax provision 4,840 4,755 Interest

expense, net of interest income 31,884 26,770 Depreciation and

amortization 32,469 31,926 General and administrative expenses

46,424 41,832

Net Operating Income, net of operating lease

obligations $ 153,670 $ 138,208

Add: Operating lease expense, real estate 6,608 7,781

Gain/Loss on real estate assets, pre-tax 1,497 (98)

Net

Operating Income (NOI) $ 161,775 $

145,891 Q1 2019 Q1 2018

(unaudited) (unaudited)

Net Income $

40,649 $

34,920 Add (Subtract): Income tax provision ** 5,199 5,461

Interest expense, net of interest income 31,884 26,770 Depreciation

and amortization 32,469 31,926 Gain/Loss on real estate assets,

pre-tax 1,497 (98)

EBITDAre $

111,698 $ 98,979 Add (Subtract): Net loss

attributable to noncontrolling interests 56 67 Stock based

compensation expenses, pre-tax 6,727 5,827

Adjusted EBITDAre $ 118,481 $

104,873 * all figures in '000s ** including income

tax provision on equity in earnings of affiliates

2019

Outlook/Reconciliation

(In thousands, except per share data)

(Unaudited)

FY 2019 Net Income Attributable to

GEO $ 169,000 to $ 176,000

Real Estate Related Depreciation

and Amortization 75,500 75,500

Loss on Real Estate

Assets 1,500 1,500

Funds from Operations (FFO) $

246,000 to

$ 253,000

Start-Up Expenses 1,500 1,500

Normalized Funds from

Operations $ 247,500 to

$

254,500 Non-Real Estate Related

Depreciation and Amortization 61,500 61,500

Consolidated

Maintenance Capex (28,000 ) (28,000 )

Non-Cash Stock Based

Compensation 23,500 23,500

Non-Cash Interest Expense

11,500 11,500

Adjusted Funds From Operations (AFFO) $

316,000 to

$ 323,000

Net Interest Expense 128,500 128,500

Non-Cash Interest

Expense (11,500 ) (11,500 )

Consolidated Maintenance

Capex 28,000 28,000

Income Taxes (including income tax

provision on equity in earnings of affiliates) 21,500 21,500

Adjusted EBITDAre $ 482,500 to

$

489,500 G&A Expenses 184,000

184,000

Non-Cash Stock Based Compensation (23,500 ) (23,500

)

Equity in Earnings of Affiliates (9,000 ) (9,000 )

Real

Estate Related Operating Lease Expense 26,500 26,500

Net

Operating Income $ 660,500 to

$

667,500 Adjusted Net Income Per Diluted

Share $ 1.44 to

$ 1.50

AFFO Per Diluted Share $ 2.64 to

$ 2.70 Weighted Average Common Shares

Outstanding-Diluted 119,700 to 119,700

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190430005245/en/

Pablo E. Paez(866) 301 4436Executive Vice President, Corporate

Relations

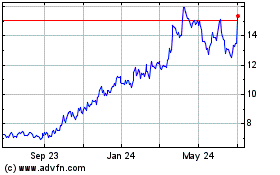

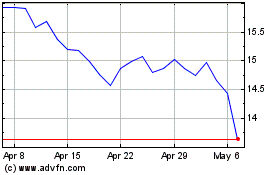

Geo (NYSE:GEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Geo (NYSE:GEO)

Historical Stock Chart

From Apr 2023 to Apr 2024