Additional Proxy Soliciting Materials (definitive) (defa14a)

April 23 2021 - 4:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY

STATEMENT

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange

Act of 1934 (Amendment No. )

Filed by

the Registrant

Filed by

a Party other than the Registrant

Check the appropriate box

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☒

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Pursuant to § 240.14a-12

|

General Dynamics Corporation

(Name of registrant as specified

in its charter)

(Name of person(s) filing proxy

statement, if other than the registrant)

Payment of

Filing Fee (Check the appropriate box):

|

|

|

No fee required.

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4)

and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

SUPPLEMENT

DATED APRIL 23, 2021

TO THE PROXY STATEMENT FOR THE

ANNUAL MEETING OF GENERAL DYNAMICS CORPORATION

TO BE HELD MAY 5, 2021

Explanatory Note

This supplement to

the Proxy Statement dated March 25, 2021 (the “Original Proxy Statement”) of General Dynamics Corporation (the “Company”)

updates the Original Proxy Statement as follows:

|

|

-

|

Updates and replaces each statement

from the Original Proxy Statement set forth below that includes “net debt.”

|

|

|

-

|

Adds a footnote to each such statement

to refer to Appendix A.

|

|

|

-

|

Updates “Appendix A: Use of Non-GAAP

Financial Measures” to include the information set forth below.

|

The Company’s

Original Proxy Statement inadvertently omitted: the most directly comparable GAAP metric in places where “net debt” was referenced;

footnotes referring to the reconciliation of net debt to the most directly comparable GAAP metric; and the corresponding information

in Appendix A.

References to “Net

Debt” in the Original Proxy Statement

Each of the sentences

or other references set forth below, as included on the respective pages of the Original Proxy Statement, is revised and replaced as

follows:

|

|

-

|

Page 1: “Our total debt at the

end of 2020 was $13 billion compared with $11.9 billion at year-end 2019, while our net debt*

at the end of 2020 was $10.2 billion compared with $11 billion at year-end 2019. Although

our total debt increased by $1.1 billion, our $1.9 billion increase in cash and equivalents

resulted in a reduction to net debt* of $854 million. In addition, we increased our dividend

by 8%, marking the 23rd consecutive year of annual increases.”

|

cash

and equivalents increase

$1.9 billion

offsetting

total debt increase

$1.1 billion

reduction

in net debt*

$854 million

|

|

-

|

Page 56: “Ended 2020 with total

debt of $13 billion and cash and equivalents of $2.8 billion, compared with total debt of

$11.9 billion and cash and equivalents of $902 million at year-end 2019, to achieve an $854

million reduction in net debt*.”

|

|

|

-

|

Page 59: “Ended 2020 with total

debt of $13 billion and cash and equivalents of $2.8 billion, compared with total debt of

$11.9 billion and cash and equivalents of $902 million at year-end 2019, to achieve an $854

million reduction in net debt* to approximately $10 billion at year-end.”

|

* See Appendix A for a discussion of

this non-GAAP measure.

Appendix

A: Use of Non-GAAP Financial Measures

Net Debt. We

define net debt as short- and long-term debt (total debt) less cash and equivalents. We believe net debt is a useful measure for investors

because it reflects the borrowings that support our operations and capital deployment strategy. We use net debt as an important indicator

of liquidity and financial position. The following table reconciles net debt with total debt:

|

Year Ended December 31

|

2020

|

|

2019

|

|

Total debt

|

$

|

12,998

|

|

|

$

|

11,930

|

|

|

Less cash and equivalents

|

|

2,824

|

|

|

|

902

|

|

|

Net debt

|

$

|

10,174

|

|

|

$

|

11,028

|

|

|

|

|

|

|

|

|

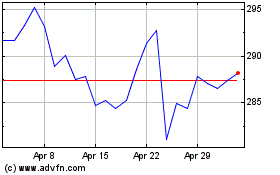

General Dynamics (NYSE:GD)

Historical Stock Chart

From Mar 2024 to Apr 2024

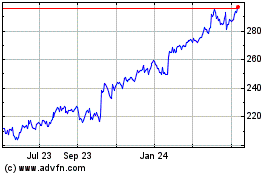

General Dynamics (NYSE:GD)

Historical Stock Chart

From Apr 2023 to Apr 2024