U.S. Stocks Open Lower Amid Fresh Trade Tensions With China

November 23 2018 - 10:04AM

Dow Jones News

By David Hodari

U.S. stocks opened lower at the end of a holiday-shortened week,

after China shares fell amid fresh trade fears with the U.S.

The Dow Jones Industrial Average shed 170 points, or 0.7%, to

24294 shortly after the opening bell. The S&P 500 fell 0.5% and

the Nasdaq Composite lost 0.5%.

Trading volumes were expected to be thin during an abridged

postholiday trading session, with volumes in Asia-Pacific markets

also thin due to the Japanese public holiday.

Oil-exposed stocks led indexes lower, with TechnipFMC and

Marathon Oil Corp. down 3.9% and 3.7%, respectively, in premarket

trade.

That came as a fall in oil prices accelerated, with Brent crude

oil plumbing depths not seen since 2017, dropping 2.5% to $61 a

barrel as light trading volumes amplified concerns about rising

supply. West Texas Intermediate futures were down 4.4% at $52.51 a

barrel, their lowest price since late October 2017.

The pan-European Stoxx Europe 600 index gained 0.2% in afternoon

trade. Investors were looking to a scheduled meeting between U.K.

and EU lawmakers over the weekend after both announced Thursday

they had made progress in outlining their future relationship.

Still, the deal faces fierce opposition in both the U.K. and

Europe. The British pound fell 0.4% against the U.S. dollar.

Chinese stocks tumbled, with the Shanghai Composite Index down

2.5% and the tech-heavy Shenzhen A-Share dropping 3.7%, after The

Wall Street Journal reported that the U.S. government had attempted

to persuade foreign allies to avoid telecommunications equipment

from China's Huawei Technologies Co. due to what they see as

cybersecurity risks.

That marked the latest attempt by the Trump administration to

tighten restrictions on Chinese telecom firms. The White House

banned U.S. suppliers from selling components to ZTE, a sector-peer

of Huawei, earlier this year. ZTE shares fell 2% Friday.

" Trump asking allies to stop buying equipment from certain

Chinese technology stocks" could have been behind the decline in

Chinese stocks, said Jeroen Blokland, a portfolio manager at Dutch

asset manager Robeco. Slower news flow and lighter volumes may have

also played a role in the size of the move, he said.

The news of Washington's campaign against Huawei followed the

release of a report by U.S. Trade Representative Robert Lighthizer

earlier in the week in which he accused Beijing of failing to

change economic policies that threaten U.S. industry, such as

cybertheft and espionage.

China's commerce ministry responded on Friday, calling

Washington's accusations groundless, according to media

reports.

However, investors have displayed growing optimism of warming

relations between the world's two largest economies, viewing this

week's developments as a part of the U.S.'s negotiating strategy.

President Trump and China's President Xi Jinping are due to meet at

the Group of 20 summit in Buenos Aires later this month.

"There's clearly a good-cop-bad-cop dynamic here with the new

USTR report aimed at keeping pressure on China," said Isabelle

Mateos y Lago, chief multiasset strategist for BlackRock Inc.

"Markets are already pricing in some kind of good outcome from the

meeting and the baseline not yet fully priced in is that further

escalations in U.S. tariffs are put on hold."

The Chinese yuan was down 0.2% against the dollar Friday, while

the country's banking sector was among those weighing on major

bourses.

Global equities have been volatile in recent weeks, but swings

in Chinese benchmarks have been particularly large, with the

country's assets bruised by Beijing's icy trading relations with

Washington and acting as a bellwether for fears over the health of

global economic growth.

U.S. economic figures have also given investors pause this week.

Falling mortgage applications and rising jobless claims "cast more

doubt on how aggressive the Fed can be in raising rates and how

good the growth outlook is for the U.S. given high rates, a strong

dollar, and fading support from fiscal stimulus at a time of trade

protectionism and weaker global growth," according to James

Knightley, the chief international economist at ING.

In commodities, the price of gold was down 0.4% at $1,223.20 a

troy ounce.

Steven Russolillo

contributed to this article.

Write to David Hodari at David.Hodari@dowjones.com

(END) Dow Jones Newswires

November 23, 2018 09:49 ET (14:49 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

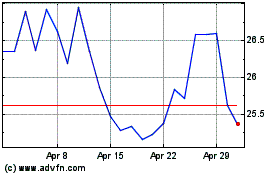

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

TechnipFMC (NYSE:FTI)

Historical Stock Chart

From Apr 2023 to Apr 2024