0001846576FALSE00018465762023-10-302023-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | |

Date of Report (Date of earliest event reported): October 30, 2023 |

FIGS, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | 001-40448 | 46-2005653 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

2834 Colorado Avenue, Suite 100 | |

Santa Monica, California | | 90404 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | |

Registrant’s Telephone Number, Including Area Code: (424) 300-8330 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | | FIGS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2023, FIGS, Inc. (the “Company”) announced its financial results for the three and nine months ended September 30, 2023. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”).

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 30, 2023, the Board of Directors (the “Board”) of the Company appointed Mario Marte to serve as a member of the Board, effective November 3, 2023 (the “Effective Date”). Mr. Marte will serve as a Class I director with a term expiring at the 2025 annual meeting of stockholders and until his successor is elected and qualified or his earlier death, disqualification, resignation or removal. The Board also appointed Mr. Marte to serve as a member of the Audit Committee of the Board (the (“Audit Committee”) and Jeffrey Wilke, an existing member of the Board, to serve as a member of the Compensation Committee of the Board (the “Compensation Committee”), in each case effective as of the Effective Date. As of the Effective Date, the Audit Committee will consist of Michael Soenen (chair), Kenneth Lin, Mario Marte and Jeffrey Wilke and the Compensation Committee will consist of Michael Soenen (chair), Jeffrey Wilke and J. Martin Willhite.

From September 2018 to July 2023, Mr. Marte served as Chief Financial Officer of Chewy, Inc., the world’s leading online retailer of pet products and services. Before that, from April 2015 until September 2018, Mr. Marte served as Vice President - Finance & Treasurer at Chewy. Mr. Marte previously served as the Vice President—Financial Planning & Analysis for Hilton Worldwide Holdings, Inc., and in various other roles at Hilton, American Airlines Group Inc. and Accenture LLC, a consulting firm. Since January 2021, Mr. Marte has served on the board of directors of Best Buy Co., Inc. and as chair of its audit committee since June 2023. Mr. Marte holds a B.S. in Computer Engineering from the University of South Florida and an M.B.A. from Duke University’s Fuqua School of Business. The Company believes Mr. Marte is qualified to serve as a member of its Board based on his extensive financial expertise, his deep knowledge of eCommerce and consumer businesses, and his leadership experience at private and publicly traded companies.

Upon the Effective Date, Mr. Marte is eligible to participate in the Company’s Non-Employee Director Compensation Program, which provides for (i) an annual cash retainer of (a) $50,000 for serving on the Board and (b) $10,000 for service as a member of the Audit Committee, (ii) an initial grant of restricted stock units (“RSUs”) for the number of shares of the Company’s Class A common stock equal to $150,000, multiplied by a fraction, (a) the numerator of which is the difference between 365 and the number of days from June 7, 2023 through the Effective Date and (b) the denominator of which is 365, divided by the closing price for the Company’s Class A common stock on the Effective Date, and that vests in full on the earlier to occur of (x) the one-year anniversary of the Effective Date and (y) the date of the Company’s next annual meeting of stockholders following the Effective Date, subject to continued service through the applicable vesting date, and (iii) an annual grant, on the date of the Company’s next annual meeting of stockholders, of RSUs for that number of shares of Class A common stock with a value of $150,000, and that vests in full on the earlier to occur of (x) the one-year anniversary of the applicable grant date and (y) the date of Company’s next annual meeting of stockholders following the grant date, subject to continued service through the applicable vesting date.

The Company also expects Mr. Marte to enter into its standard indemnification agreement for directors and officers.

Item 7.01 Regulation FD Disclosure.

On November 2, 2023, the Company posted a financial highlights presentation to the “Investor Relations” portion of its website at ir.wearfigs.com/financials/quarterly-results.

The information in Items 2.02 and 7.01 of this Report (including Exhibit 99.1 attached hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly provided by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1* | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

| |

| * | This exhibit related to Item 2.02 shall be deemed to be furnished, and not filed. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | FIGS, INC. | |

| Date: | November 2, 2023 | By: | /s/ Daniella Turenshine |

| | | Name: | Daniella Turenshine |

| | | Title: | Chief Financial Officer |

FIGS Releases Third Quarter 2023 Financial Results, Raises Full Year Guidance and Adds New Independent Director to Board

Net Revenues Growth of 10.7% YoY, Net Income of $6.1 million, Net Income Margin of 4.2% and Adjusted EBITDA Margin of 17.2%

Finance Executive, Mario Marte, Appointed to Board of Directors

SANTA MONICA, Calif., November 2, 2023 — FIGS, Inc. (NYSE: FIGS) (the “Company”), the direct-to-consumer apparel and lifestyle brand dedicated to the healthcare community, today released its third quarter 2023 financial results and published a financial highlights presentation on its investor relations website at ir.wearfigs.com/financials/quarterly-results.

Third Quarter 2023 Financial Highlights

•Net revenues were $142.4 million, an increase of 10.7% year over year, driven by an increase in orders from existing and new customers and, to a lesser extent, an increase in average order value (“AOV”).

•Gross margin was 68.4%, a decrease of 220 basis points year over year, primarily due to product mix shift and, to a lesser extent, a higher mix of promotional sales and higher duties, partially offset by lower air freight utilization and ocean freight rates.

•Operating expenses were $87.4 million, an increase of 9.8% year over year. As a percentage of net revenues, operating expenses decreased to 61.5% from 61.9% in the prior year period due to lower selling expenses associated with reduced storage costs within fulfillment, and lower marketing expenses as a result of greater efficiency in digital marketing.

•Net income was $6.1 million and diluted earnings per share was $0.03.

•Net income margin(1) was 4.2%, as compared to 3.1% in the same period last year.

•Net income, as adjusted(2) was $6.3 million and diluted earnings per share, as adjusted(2) was $0.03.

•Adjusted EBITDA(2) was $24.4 million, an increase of $3.4 million year over year.

•Adjusted EBITDA margin(1)(2) was 17.2%, as compared to 16.4% in the same period last year.

Key Operating Metrics

•Active customers(3) as of September 30, 2023 increased 19.6% to 2.6 million.

•Net revenues per active customer(3) were $212, a decrease of 6.6% year over year.

•AOV(3) was $114, an increase of 1.8% year over year, primarily driven by an increase in units per transaction and, to a lesser degree, an increase in average unit retail.

“We are pleased with our third quarter performance and to be raising our full year guidance,” said Trina Spear, Chief Executive Officer and Co-founder. “Net revenues growth of 11% and adjusted EBITDA margin expansion to 17.2% exceeded our expectations and led to $46 million in free cash flow(2) generation in the third quarter. Through strong execution of our strategic priorities, we added more new healthcare professionals to our active customer base than in any prior year, delivered record growth in our international and TEAMS businesses and deepened engagement with our community through advocacy. Looking ahead, we see tremendous opportunity to

leverage our brand authenticity, industry leading product innovation, strong balance sheet and scale to capitalize on industry tailwinds and deliver long term growth and profitability.”

Appointment to Board of Directors

FIGS also announced the appointment of Mario Marte, former Chief Financial Officer of Chewy, Inc., to its Board of Directors, effective November 3, 2023. Mr. Marte joins the Board as an independent director and has also been appointed to the Board’s Audit Committee.

Mr. Marte most recently served as Chief Financial Officer of Chewy, Inc., the world’s leading online retailer of pet products and services from September 2018 to July 2023, after serving as the company’s Vice President—Finance & Treasurer from April 2015 until September 2018. During his eight-year tenure at Chewy, Mr. Marte built the Finance organization, helped the company grow from $200 million to over $11 billion in annual sales, and led the company’s IPO in June 2019. Previously, Mr. Marte served as the Vice President of Financial Planning & Analysis for Hilton Worldwide Holdings, Inc., and in various other roles at Hilton, American Airlines Group Inc. and Accenture LLC. Since January 2021, Mr. Marte has served on the board of directors of Best Buy Co., Inc., and as chair of the audit committee since June 2023.

“We are delighted to welcome Mario, a seasoned finance executive, to our Board,” said Heather Hasson, Executive Chair. “Since our IPO, we have added new independent directors with strong and varied expertise, and the appointment of Mario further expands the skillset of our Board. We look forward to benefiting from Mario’s extensive background in finance, strategy and operations across industry leading companies. His experience and strategic mindset will be invaluable as we continue to execute on our long term growth strategy and serve our healthcare community.”

Financial Outlook

Raises full-year 2023 outlook:

| | | | | |

| Net Revenues Growth as Compared to 2022 | ~ 8.5% |

| |

Adjusted EBITDA Margin(1)(2)(4) | ~ 14% |

Daniella Turenshine, Chief Financial Officer, commented, “Our third quarter performance reflects strong execution of our strategic priorities. We have an incredibly healthy balance sheet with ample cash and no debt and our business model generates strong cash flow. We are in the early stages of growth and intend to make the investments that we believe will drive accelerated growth as we move past near term macro challenges.”

(1) “Net income margin” and “adjusted EBITDA margin” are calculated by dividing net income and adjusted EBITDA by net revenues, respectively.

(2) “Net income, as adjusted,” “diluted earnings per share, as adjusted,” “adjusted EBITDA,” “adjusted EBITDA margin” and “free cash flow” are non-GAAP financial measures. Please see the sections titled “Non-GAAP Financial Measures and Key Operating Metrics” and “Reconciliations of GAAP to Non-GAAP Measures” below for more information regarding the Company’s use of non-GAAP financial measures and reconciliations to the most directly comparable GAAP measures.

(3) “Active customers,” “net revenues per active customer” and “average order value” are key operational and business metrics that are important to understanding the Company’s performance. Please see the sections titled “Non-GAAP Financial Measures and Key Operating Metrics” and “Key Operating Metrics” below for information regarding how the Company calculates its key operational and business metrics and for comparisons of active customers, net revenues per active customer and average order value to the prior year period.

(4) The Company has not provided a quantitative reconciliation of its adjusted EBITDA margin outlook to a GAAP net income margin outlook because it is unable, without making unreasonable efforts, to project certain reconciling items. These items include, but are not limited to, future stock-based compensation expense, income taxes, expenses related to non-ordinary course disputes and transaction costs. These items are inherently variable and uncertain and depend on various factors, some of which are outside of the Company’s control or ability to predict. For more information regarding the Company’s use of non-GAAP financial measures, please see the section titled “Non-GAAP Financial Measures and Key Operating Metrics.”

Conference Call Details

FIGS management will host a conference call and webcast today at 2:00 p.m. PT / 5:00 p.m. ET to discuss the Company’s financial and business results and outlook. To participate, please dial 1-833-470-1428 (US) or 1-404-975-4839 (International) and the conference ID 315705. The call is also accessible via webcast at ir.wearfigs.com. A recording will be available shortly after the conclusion of the call until 11:59 p.m. ET on November 9, 2023. To access the replay, please dial 1-866-813-9403 (US) or +1-929-458-6194 (International) and the conference ID 658204. An archive of the webcast will be available on FIGS’ investor relations website at ir.wearfigs.com.

Non-GAAP Financial Measures and Key Operating Metrics

In addition to the GAAP financial measures set forth in this press release, the Company has included non-GAAP financial measures within the meaning of Regulation G and Item 10(e) of Regulation S-K. The Company uses “net income, as adjusted,” “diluted earnings per share, as adjusted,” “adjusted EBITDA” and “adjusted EBITDA margin” to provide useful supplemental measures that assist in evaluating its ability to generate earnings, provide consistency and comparability with its past financial performance and facilitate period-to-period comparisons of its core operating results as well as the results of its peer companies. The Company uses “free cash flow” as a useful supplemental measure of liquidity and as an additional basis for assessing its ability to generate cash. The Company calculates “net income, as adjusted,” as net income adjusted to exclude transaction costs, expenses related to non-ordinary course disputes, other than temporary impairment of held-to-maturity investments, stock-based compensation, including expense related to award modifications, accelerated performance awards and associated payroll taxes and costs, ambassador grants in connection with its initial public offering, and expense resulting from the retirement of the Company’s previous CFO, and the income tax impact of these adjustments. The Company calculates “diluted earnings per share, as adjusted” as net income, as adjusted divided by diluted shares outstanding. The Company calculates “adjusted EBITDA” as net income adjusted to exclude: other income (loss), net; gain/loss on disposal of assets; provision for income taxes; depreciation and amortization expense; stock-based compensation and related expense; transaction costs; and expenses related to non-ordinary course disputes. The Company calculates “adjusted EBITDA margin” by dividing adjusted EBITDA by net revenues. The Company calculates “free cash flow” as net cash (used in) provided by operating activities reduced by capital expenditures, including purchases of property and equipment and capitalized software development costs.

Reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures are included below under the heading “Reconciliations of GAAP to Non-GAAP Measures.”

The Company has also included herein “active customers,” “net revenues per active customer” and “average order value,” which are key operational and business metrics that are important to understanding Company performance. The number of active customers is an important indicator of growth as it reflects the reach of the Company’s digital platform, brand awareness and overall value proposition. The Company defines an active customer as a unique customer account that has made at least one purchase in the preceding 12-month period. In any particular period, the Company determines the number of active customers by counting the total number of customers who have made at least one purchase in the preceding 12-month period, measured from the last date of such period. The Company believes measuring net revenues per active customer is important to understanding engagement and retention of customers, and as such, the value proposition for its customer base. The Company defines net revenues per active customer as the sum of total net revenues in the preceding 12-month period divided by the current period active customers. The Company defines average order value as the sum of the total net revenues in a given period divided by the total orders placed in that period. Total orders are the summation of all completed individual purchase transactions in a given period. The Company believes its relatively high average order value demonstrates the premium nature of its products. As the Company expands into and increases its presence in additional product categories, price points and international markets, average order value may fluctuate.

Active customers as of September 30, 2023 and 2022, respectively, net revenues per active customer as of September 30, 2023 and 2022, respectively, and average order value for the three and nine months ended September 30, 2023 and 2022, respectively, are presented below under the heading “Key Operating Metrics.”

About FIGS

FIGS is a founder-led, direct-to-consumer healthcare apparel and lifestyle brand that seeks to celebrate, empower and serve current and future generations of healthcare professionals. We create technically advanced apparel and products that feature an unmatched combination of comfort, durability, function and style. We share stories about healthcare professionals’ experiences in ways that inspire them. We create meaningful connections within the healthcare community that we created. Above all, we seek to make an impact for our community, including by advocating for them and always having their backs.

We serve healthcare professionals in numerous countries in North America, Europe, the Asia Pacific region and the Middle East. We also serve healthcare institutions through our TEAMS platform.

Forward Looking Statements

This press release contains various forward-looking statements about the Company within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, that are based on current management expectations, and which involve substantial risks and uncertainties that could cause actual results to differ materially from the results expressed in, or implied by, such forward-looking statements. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking. These forward-looking statements generally are identified by the words “anticipate”, “believe”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “future”, “intend”, “may”, “might”, “opportunity”, “outlook”, “plan”, “possible”, “potential”, “predict”, “project,” “should”, “strategy”, “strive”, “target”, “will” or “would”, the negative of these words or other similar terms or expressions. The absence of these words does not mean that a statement is not forward-looking. These forward-looking statements address various matters, including the Company’s opportunity to leverage its brand authenticity, industry leading product innovation, strong balance sheet and scale to capitalize on industry tailwinds and deliver long term growth and profitability; the Company’s stage of growth; the Company’s intention to make the investments that it believes will drive accelerated growth as it moves past near term macro challenges; and the Company’s outlook as to net revenues growth and adjusted EBITDA margin for the full year ending December 31, 2023; all of which reflect the Company’s expectations based upon currently available information and data. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, the Company’s actual results, performance or achievements may differ materially from those expressed or implied by the forward-looking statements, and you are cautioned not to place undue reliance on these forward-looking statements. The following important factors and uncertainties, among others, could cause actual results, performance or achievements to differ materially from those described in these forward-looking statements: the Company’s ability to maintain its recent rapid growth and effectively manage its growth; the Company’s ability to maintain profitability; the Company’s ability to maintain the value and reputation of its brand; the Company’s ability to attract new customers, retain existing customers, and to maintain or increase sales to those customers; the success of the Company’s marketing efforts; the Company’s ability to maintain a strong community of engaged customers and Ambassadors; negative publicity related to the Company’s marketing efforts or use of social media; the Company’s ability to successfully develop and introduce new, innovative and updated products; the competitiveness of the market for healthcare apparel; the Company’s ability to maintain its key employees; the Company’s ability to attract and retain highly skilled team members; risks associated with expansion into, and conducting business in, international markets; changes in, or disruptions to, the Company’s shipping arrangements; the successful operation of the Company’s distribution and warehouse management systems; the Company’s ability to accurately forecast customer demand, manage its inventory, and plan for future expenses; the impact of changes in consumer confidence, shopping behavior and consumer spending on demand for the Company’s products; the impact of COVID-19 and macroeconomic trends on the Company’s operations; the Company’s reliance on a limited number of third-party suppliers; the fluctuating costs of raw materials; the Company’s failure to protect its intellectual property rights; the fact that the operations of many of the Company’s suppliers and vendors are subject to additional risks that are beyond its control; and other risks, uncertainties and factors discussed in the “Risk Factors” section of the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 to be filed with the Securities and Exchange Commission (“SEC”), the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on February 28, 2023, and the Company’s other periodic filings with the SEC. The forward-looking statements in this press release

speak only as of the time made and the Company does not undertake to update or revise them to reflect future events or circumstances.

FIGS, INC.

BALANCE SHEETS

(In thousands, except share and per share data)

| | | | | | | | | | | |

| As of |

| September 30,

2023 | | December 31,

2022 |

| Assets | (Unaudited) | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 182,951 | | | $ | 159,775 | |

| Short-term investments | 49,148 | | | — | |

| Accounts receivable | 6,316 | | | 6,866 | |

| Inventory, net | 143,183 | | | 177,976 | |

| Prepaid expenses and other current assets | 13,446 | | | 11,883 | |

| Total current assets | 395,044 | | | 356,500 | |

| Non-current assets | | | |

| Property and equipment, net | 16,306 | | | 11,024 | |

| Operating lease right-of-use assets | 16,380 | | | 15,312 | |

| Deferred tax assets | 12,812 | | | 10,971 | |

| Other assets | 1,239 | | | 1,257 | |

| Total non-current assets | 46,737 | | | 38,564 | |

| Total assets | $ | 441,781 | | | $ | 395,064 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 15,014 | | | $ | 20,906 | |

| Operating lease liabilities | 3,997 | | | 3,408 | |

| Accrued expenses | 16,145 | | | 26,164 | |

| Accrued compensation and benefits | 6,681 | | | 3,415 | |

| Sales tax payable | 4,048 | | | 3,374 | |

| Gift card liability | 8,689 | | | 7,882 | |

| Deferred revenue | 3,337 | | | 2,786 | |

| Returns reserve | 2,640 | | | 3,458 | |

| Income tax payable | 9,670 | | | — | |

| Total current liabilities | 70,221 | | | 71,393 | |

| Non-current liabilities | | | |

| Operating lease liabilities, non-current | 16,190 | | | 15,756 | |

| Other non-current liabilities | 176 | | | 176 | |

| Total liabilities | $ | 86,587 | | | $ | 87,325 | |

| Commitments and contingencies | | | |

| Stockholders’ equity | | | |

| Class A Common stock — par value $0.0001 per share, 1,000,000,000 shares authorized as of September 30, 2023 and December 31, 2022; 161,020,834 and 159,351,307 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 16 | | | 16 | |

| Class B Common stock — par value $0.0001 per share, 150,000,000 shares authorized as of September 30, 2023 and December 31, 2022; 8,016,338 and 7,210,795 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | — | | | — | |

| Preferred stock — par value $0.0001 per share, 100,000,000 shares authorized as of September 30, 2023 and December 31, 2022; zero shares issued and outstanding as of September 30, 2023 and December 31, 2022 | — | | | — | |

| Additional paid-in capital | 303,428 | | | 268,606 | |

| Accumulated other comprehensive loss | (4) | | | — | |

| Retained earnings | 51,754 | | | 39,117 | |

| Total stockholders’ equity | 355,194 | | | 307,739 | |

| Total liabilities and stockholders’ equity | $ | 441,781 | | | $ | 395,064 | |

FIGS, INC.

STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net revenues | $ | 142,364 | | | $ | 128,589 | | | $ | 400,728 | | | $ | 360,937 | |

| Cost of goods sold | 44,971 | | | 37,756 | | | 121,625 | | | 105,325 | |

| Gross profit | 97,393 | | | 90,833 | | | 279,103 | | | 255,612 | |

| Operating expenses | | | | | | | |

| Selling | 32,195 | | | 31,940 | | | 97,092 | | | 80,801 | |

| Marketing | 19,012 | | | 20,031 | | | 56,965 | | | 56,263 | |

| General and administrative | 36,232 | | | 27,652 | | | 105,229 | | | 84,142 | |

| Total operating expenses | 87,439 | | | 79,623 | | | 259,286 | | | 221,206 | |

| Net income from operations | 9,954 | | | 11,210 | | | 19,817 | | | 34,406 | |

| Other income, net | | | | | | | |

| Interest income | 1,901 | | | 604 | | | 4,494 | | | 683 | |

| Other income (expense) | (6) | | | 1 | | | (11) | | | — | |

| Total other income, net | 1,895 | | | 605 | | | 4,483 | | | 683 | |

| Net income before provision for income taxes | 11,849 | | | 11,815 | | | 24,300 | | | 35,089 | |

| Provision for income taxes | 5,703 | | | 7,771 | | | 11,663 | | | 17,294 | |

| Net income | $ | 6,146 | | | $ | 4,044 | | | $ | 12,637 | | | $ | 17,795 | |

| Earnings attributable to Class A and Class B common stockholders | | | | | | | |

| Basic earnings per share | $ | 0.04 | | | $ | 0.02 | | | $ | 0.08 | | | $ | 0.11 | |

| Diluted earnings per share | $ | 0.03 | | | $ | 0.02 | | | $ | 0.07 | | | $ | 0.09 | |

| Weighted-average shares outstanding—basic | 168,668,844 | | | 165,543,067 | | | 167,628,888 | | | 164,960,561 | |

| Weighted-average shares outstanding—diluted | 181,429,745 | | | 186,991,769 | | | 182,545,627 | | | 189,762,364 | |

FIGS, INC.

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Nine months ended

September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 12,637 | | | $ | 17,795 | |

| Adjustments to reconcile net income to net cash (used in) provided by operating activities: | | | |

| Depreciation and amortization expense | 2,128 | | | 1,287 | |

| Deferred income taxes | (1,841) | | | (976) | |

| Non-cash operating lease cost | 2,138 | | | 1,719 | |

| Stock-based compensation | 34,305 | | | 26,288 | |

| Accretion of discount on available-for-sale securities | (897) | | | — | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 550 | | | (5,927) | |

| | | |

| Inventory | 34,793 | | | (82,020) | |

| Prepaid expenses and other current assets | (1,563) | | | (6,470) | |

| Other assets | 18 | | | (678) | |

| Accounts payable | (4,092) | | | 6,421 | |

| Accrued expenses | (9,496) | | | 7,584 | |

| Accrued compensation and benefits | 3,266 | | | (1,248) | |

| Sales tax payable | 674 | | | (25) | |

| Gift card liability | 807 | | | 403 | |

| Deferred revenue | 551 | | | 640 | |

| Returns reserve | (818) | | | 663 | |

| Income tax payable | 9,670 | | | (3,973) | |

| Operating lease liabilities | (2,183) | | | (1,336) | |

| Other non-current liabilities | — | | | (28) | |

| Net cash (used in) provided by operating activities | 80,647 | | | (39,881) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (9,733) | | | (4,256) | |

| Purchases of available-for-sale securities | (65,805) | | | — | |

| Maturities of available-for-sale securities | 17,550 | | | — | |

| Purchases of held-to-maturity securities | — | | | (500) | |

| Net cash used in investing activities | (57,988) | | | (4,756) | |

| Cash flows from financing activities: | | | |

| Proceeds from stock option exercises and employee stock purchases | 763 | | | 2,310 | |

| Tax payments related to net share settlements on restricted stock units | (246) | | | — | |

| Capital contributions | — | | | 479 | |

| Net cash provided by financing activities | 517 | | | 2,789 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 23,176 | | | (41,848) | |

| Cash, cash equivalents, and restricted cash, beginning of period | 159,775 | | | 197,430 | |

| Cash and cash equivalents, end of period | $ | 182,951 | | | $ | 155,582 | |

| | | |

| | | |

| | | |

| | | |

FIGS, INC.

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

(Unaudited)

The following table presents a reconciliation of net income, as adjusted to net income, which is the most directly comparable financial measure calculated in accordance with GAAP, and presents diluted earnings per share (“EPS”), as adjusted with diluted earnings per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

September 30, | | | Nine months ended

September 30, |

| | 2023 | | 2022 | | | 2023 | | 2022 |

| | | | | | | | |

| | (in thousands, except share and per share amounts) |

| Net income | $ | 6,146 | | | $ | 4,044 | | | | $ | 12,637 | | | $ | 17,795 | |

| Add (deduct): | | | | | | | | |

| Transaction costs | — | | | — | | | | — | | | 145 | |

Expenses related to non-ordinary course disputes(1) | — | | | 254 | | | | 1,256 | | | 5,458 | |

Stock-based compensation expense in connection with the IPO and other(2) | 290 | | | — | | | | 290 | | | — | |

| Income tax impacts of items above | (140) | | | (167) | | | | (847) | | | (2,458) | |

| Net income, as adjusted | $ | 6,296 | | | $ | 4,131 | | | | $ | 13,336 | | | $ | 20,940 | |

| Diluted EPS | $ | 0.03 | | | $ | 0.02 | | | | $ | 0.07 | | | $ | 0.11 | |

| Diluted EPS, as adjusted | $ | 0.03 | | | $ | 0.02 | | | | $ | 0.07 | | | $ | 0.11 | |

| Weighted-average shares used to compute Diluted EPS and Diluted EPS, as adjusted | 181,429,745 | | | 186,991,769 | | | | 182,545,627 | | | 189,762,364 | |

| | | | | | | | |

| | | | | | | | |

(1) Exclusively represents attorney’s fees, costs and expenses incurred by the Company in connection with the Company’s now-concluded litigation against Strategic Partners, Inc.

(2) Includes certain stock-based compensation expense in connection with the IPO, including expense related to accelerated performance awards and associated payroll taxes and costs.

The following table presents a reconciliation of adjusted EBITDA to net income, which is the most directly comparable financial measure calculated in accordance with GAAP, and presents adjusted EBITDA margin with net income margin, which is the most directly comparable financial measure calculated in accordance with GAAP:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

September 30, | | | Nine months ended

September 30, |

| 2023 | | 2022 | | | 2023 | | 2022 |

| (in thousands, except margin) |

| Net income | $ | 6,146 | | | $ | 4,044 | | | | $ | 12,637 | | | $ | 17,795 | |

| Add (deduct): | | | | | | | | |

| Other income, net | (1,895) | | | (605) | | | | (4,483) | | | (683) | |

| Provision for income taxes | 5,703 | | | 7,771 | | | | 11,663 | | | 17,294 | |

Depreciation and amortization expense(1) | 756 | | | 479 | | | | 2,128 | | | 1,287 | |

Stock-based compensation and related expense(2) | 13,713 | | | 9,082 | | | | 36,195 | | | 26,335 | |

Expenses related to non-ordinary course disputes(3) | — | | | 254 | | | | 1,256 | | | 5,458 | |

| Adjusted EBITDA | $ | 24,423 | | | $ | 21,025 | | | | $ | 59,396 | | | $ | 67,486 | |

| | | | | | | | |

| Net revenues | $ | 142,364 | | | $ | 128,589 | | | | $ | 400,728 | | | $ | 360,937 | |

Net income margin(4) | 4.2 | % | | 3.1 | % | | | 3.1 | % | | 4.9 | % |

| Adjusted EBITDA margin | 17.2 | % | | 16.4 | % | | | 14.8 | % | | 18.7 | % |

(1) Excludes amortization of debt issuance costs included in “Other income, net.”

(2) Includes stock-based compensation expense, payroll taxes and costs related to equity award activity.

(3) Exclusively represents attorney’s fees, costs and expenses incurred by the Company in connection with the Company’s now-concluded litigation against Strategic Partners, Inc.

(4) Net income margin represents net income as a percentage of net revenues.

The following table presents a reconciliation of free cash flow to net cash (used in) provided by operating activities, which is the most directly comparable financial measure calculated in accordance with GAAP:

| | | | | | | | | | | |

| Nine months ended

September 30, |

| 2023 | | 2022 |

| (in thousands) |

| Net cash (used in) provided by operating activities | $ | 80,647 | | | $ | (39,881) | |

| Less: capital expenditures | (9,733) | | | (4,256) | |

| Free cash flow | $ | 70,914 | | | $ | (44,137) | |

FIGS, INC.

KEY OPERATING METRICS

(Unaudited)

Active customers as of September 30, 2023 and 2022, respectively, net revenues per active customer as of September 30, 2023 and 2022, respectively, and average order value for the three and nine months ended September 30, 2023 and 2022, respectively, are presented in the following tables:

| | | | | | | | | | | | | | |

| As of September 30, |

| 2023 | | | 2022 |

| (in thousands) |

| Active customers | 2,576 | | | 2,154 |

| | | | | | | | | | | |

| As of September 30, |

| 2023 | | 2022 |

| Net revenues per active customer | $ | 212 | | | $ | 227 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

September 30, | | Nine months ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Average order value | $ | 114 | | | $ | 112 | | | $ | 114 | | | $ | 112 | |

Contacts

Investors:

Jean Fontana

IR@wearfigs.com

Media:

Todd Maron

press@wearfigs.com

v3.23.3

Cover Page

|

Oct. 30, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 30, 2023

|

| Entity Registrant Name |

FIGS, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40448

|

| Entity Tax Identification Number |

46-2005653

|

| Entity Address, Address Line One |

2834 Colorado Avenue

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Santa Monica

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90404

|

| City Area Code |

(424)

|

| Local Phone Number |

300-8330

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

FIGS

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001846576

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

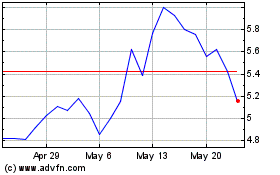

FIGS (NYSE:FIGS)

Historical Stock Chart

From Nov 2024 to Dec 2024

FIGS (NYSE:FIGS)

Historical Stock Chart

From Dec 2023 to Dec 2024