ESAB Corporation Announces Upsizing and Pricing of its 6.25% Senior Notes due 2029

March 25 2024 - 5:58PM

Business Wire

ESAB Corporation (“ESAB” or the “Company”) (NYSE: ESAB), a

focused premier industrial compounder, announced today the pricing

of its previously announced offering of $700 million aggregate

principal amount of 6.25% Senior Notes due 2029 (the “Notes”). The

aggregate principal amount of Notes to be issued in the offering

was increased to $700 million from the previously announced amount

of $600 million. ESAB intends to use the net proceeds from the sale

of the Notes to repay the outstanding borrowings under its senior

term loan A-3 facility, with the remainder to be used for general

corporate purposes. The Notes will be guaranteed (the “Guarantees”)

by certain of ESAB’s domestic subsidiaries. The offering is

expected to close on April 9, 2024, subject to customary closing

conditions.

The Notes and the related Guarantees have not been, and will not

be, registered under the Securities Act of 1933, as amended (the

“Securities Act”), or the securities laws of any other

jurisdiction. As a result, the Notes and the related Guarantees may

not be offered or sold within the United States to or for the

account or benefit of any U.S. person unless the offer or sale

would qualify for a registration exemption under the Securities Act

and applicable state securities laws. Accordingly, the Notes and

the related Guarantees are being offered only to a limited number

of U.S. investors that ESAB reasonably believes to be qualified

institutional buyers in accordance with Rule 144A under the

Securities Act, and to certain persons outside the United States in

accordance with Regulation S under the Securities Act.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy any securities, nor shall there be

any sale of the Notes or the related Guarantees in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. This press

release contains information about the pending offering of the

Notes, and there can be no assurance that the offering will be

completed.

About ESAB Corporation

Founded in 1904, ESAB Corporation (NYSE: ESAB) is a focused

premier industrial compounder. The Company’s rich history of

innovative products, workflow solutions and business system ESAB

Business Excellence, enables its purpose of Shaping the World We

ImagineTM. ESAB Corporation is based in North Bethesda, Maryland

and employs approximately 9,000 associates and serves customers in

approximately 150 countries.

CAUTIONARY NOTE CONCERNING FORWARD LOOKING STATEMENTS

This press release includes forward-looking statements,

including forward-looking statements within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements include, but are not limited to,

statements concerning the completion of the offering of the Notes

and the use of the net proceeds therefrom, and other statements

that are not historical or current fact. Forward-looking statements

are based on the Company’s current expectations and involve risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied in such forward-looking

statements, including general risks and uncertainties such as

market conditions, economic conditions, geopolitical events,

changes in laws, regulations or accounting rules, fluctuations in

interest rates, terrorism, wars or conflicts, major health

concerns, natural disasters or other disruptions of expected

business conditions. Factors that could cause the Company’s results

to differ materially from current expectations include, but are not

limited to, risks related to the Company’s ability to operate as a

stand-alone public company; the Company’s ability to achieve the

intended benefits from the Company’s separation from Enovis

Corporation; the impact of the war in Ukraine and escalating

geopolitical tensions; impact of supply chain disruptions; the

impact on creditworthiness and financial viability of customers;

other impacts on the Company’s business and ability to execute

business continuity plans; and the other factors detailed in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023 filed with the U.S. Securities and Exchange Commission

(“SEC”) on February 29, 2024, as well as other risks discussed in

the Company’s filings with the SEC. In addition, these statements

are based on assumptions that are subject to change. This press

release speaks only as of the date hereof. The Company disclaims

any duty to update the information herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240325272182/en/

Investor Relations Contact Mark Barbalato Vice President,

Investor Relations E-mail: investorrelations@esab.com Phone:

1-301-323-9098

Media Contact Tilea Coleman Vice President, Corporate

Communications E-mail: mediarelations@esab.com Phone:

1-301-323-9092

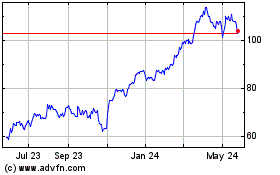

ESAB (NYSE:ESAB)

Historical Stock Chart

From Dec 2024 to Jan 2025

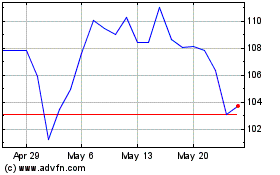

ESAB (NYSE:ESAB)

Historical Stock Chart

From Jan 2024 to Jan 2025